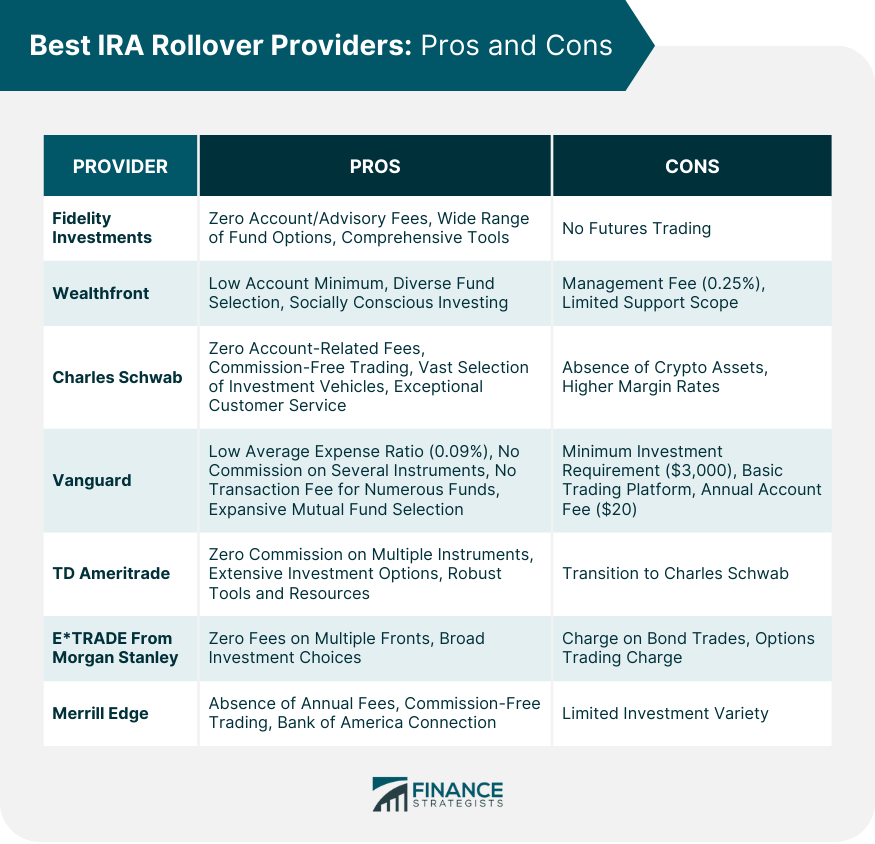

An Individual Retirement Account (IRA) rollover occurs when funds are distributed from a retirement account and then deposited into another retirement account within a 60-day period. This maneuver is more than just a shuffle of funds; it represents an individual's strategic move to take advantage of better account terms, a broader selection of investments, or even just to consolidate multiple accounts. While the term “rollover” may sound casual, its execution in the financial realm requires adherence to specific rules to ensure that one doesn't incur any tax liabilities. Successfully conducting an IRA rollover can offer vast benefits, which will be highlighted in subsequent sections. IRA rollovers handle life savings meant for retirement. Thus, informed choices are essential. Decisions made today affect future financial security. Mistakes or poor choices can risk retirement aspirations, making a thorough understanding of IRA rollovers crucial. In the realm of retirement planning, Fidelity Investments stands as a colossus. Their reputation has been built on a foundation of reliability, diverse investment options, and customer-centric services. Whether you're a novice investor or a seasoned professional, Fidelity offers tools and resources tailored to fit your needs. Moreover, Fidelity has consistently pioneered various financial products, giving investors the edge in terms of innovative solutions for wealth accumulation. Their approach to IRA rollovers is no exception, ensuring a seamless transition of funds while maximizing growth potential. Zero Account or Advisory Fees: One of the prime benefits of Fidelity Investments is the elimination of any account or advisory fees, enabling individuals to manage their finances without incurring extra charges. Wide Range of Fund Options: Fidelity provides access to over 10,000 fund options, a vast pool of opportunities for diversification and investment. Particularly notable are their no-expense-ratio index funds which allow for investment growth with minimal cost drag. Comprehensive Tools: Fidelity stands out with its suite of planning tools, calculators, and reporting features. These tools empower investors to make informed decisions, track their investments, and plan for future financial scenarios. No Futures Trading: A significant drawback for some investors is Fidelity's absence of futures trading options. For traders looking to diversify their portfolio with futures or hedge against market movements, this limitation might be a constraining factor. In the digital age, robo-advisors have risen to prominence, and Wealthfront is among the leaders in this domain. Leveraging sophisticated algorithms, Wealthfront offers personalized investment strategies that cater to an individual's unique financial situation and goals. The allure of Wealthfront lies in its simplicity, allowing even beginners to navigate the complex world of investments with ease. However, simplicity doesn't mean a lack of depth. Wealthfront's platform is backed by rigorous financial science, ensuring that your funds are optimized for growth. Their low fees combined with automated strategies make them a favorable choice for those considering an IRA rollover. Low Account Minimum: Wealthfront's low account minimum threshold makes it accessible for a broader range of investors, including beginners and those who are initially looking to invest smaller amounts. Diverse Fund Selection: Offering hundreds of funds, including options that expose investors to cryptocurrency, Wealthfront offers a spectrum of investment avenues. This allows individuals to tap into various market segments and growth opportunities. Socially Conscious Investing: For investors keen on aligning their financial decisions with their values, Wealthfront's portfolios designed for socially conscious investing are a significant draw. This lets one invest in a manner that's both profitable and principled. Management Fee: While they offer a host of benefits, Wealthfront does charge a 0.25% management fee. This ongoing fee can accumulate over time and erode potential earnings, especially when compared to platforms that may charge lower fees. Limited Support Scope: Wealthfront falls short when it comes to offering investment or financial planning advice. For those who seek personalized investment insights or have intricate financial situations, this limitation might be a point of contention. Few names in finance evoke as much trust and respect as Charles Schwab. With a legacy spanning decades, they have been instrumental in democratizing investments for the average individual. Schwab offers a broad range of services, from brokerage accounts to a vast array of retirement products, making them a top contender for IRA rollovers. Delving deeper into Schwab's offerings, the Schwab Intelligent Portfolios® deserves a special mention. This robo-advisory platform harnesses the power of technology to offer automated investment management. While it caters to the tech-savvy investor, it doesn't forsake the human touch, ensuring that customers always have a helpline to address any concerns. Zero Account-Related Fees: Charles Schwab’s lack of account opening or maintenance fees is a notable advantage, ensuring investors don’t face unnecessary charges that eat into their returns. Commission-Free Trading: Offering $0 commission on stock, options, and ETF trades, Charles Schwab makes trading more affordable, allowing for more flexibility and higher potential profits. Vast Selection of Investment Vehicles: With over 2,000 ETFs and 7,000 mutual funds available, investors are presented with a rich array of investment options to diversify their portfolios and align with their financial goals. Exceptional Customer Service: Recognized for its award-winning 24/7 customer service support, Charles Schwab provides investors with reliable and immediate assistance, fostering a sense of security and trust. Absence of Crypto Assets: In the era of digital currency, Charles Schwab’s lack of crypto investment options can be a downside for those wanting to diversify their portfolios with cryptocurrency assets. Higher Margin Rates: For investors who borrow money for buying stocks, Charles Schwab’s higher margin rates could increase the cost of trading, potentially affecting the overall return on investment. Vanguard's philosophy has always centered around the investor. As one of the world's largest investment management companies, they offer a diverse range of investment options, low costs, and an unwavering focus on long-term growth. Individuals looking to roll over their IRAs would find a robust platform in Vanguard, with a track record that speaks for itself. Amidst Vanguard's many offerings, the Vanguard Digital Advisor stands out. This service combines the best of both worlds: the precision of algorithms and the expertise of human advisors. Designed for those who prefer a more hands-off investment approach, the Digital Advisor offers personalized advice, automatic rebalancing, and an intuitive platform, making IRA rollovers a breeze. Low Average Expense Ratio: At just 0.09%, Vanguard boasts one of the industry's lowest average expense ratios. This translates to fewer costs for investors, leading to potentially larger returns over the long term. No Commission on Several Instruments: Vanguard offers $0 commission on stocks, ETFs, and its own mutual funds, providing cost-saving opportunities for its users. No Transaction Fee for Numerous Funds: Out of its impressive array of mutual funds, 160 of Vanguard's offerings come with no transaction fee. This is yet another avenue for investors to save on costs. Expansive Mutual Fund Selection: With over 3,000 mutual funds available, investors have a plethora of choices to diversify their portfolio and tailor their investments according to their preferences and goals. Minimum Investment Requirement: A major sticking point for some might be the requirement for most Vanguard mutual funds, which necessitates a minimum investment of $3,000. This could be prohibitive for newcomers or those wishing to start with smaller amounts. Basic Trading Platform: Vanguard's trading platform is often cited for its simplicity, lacking the advanced tools and interactive features that many traders have come to expect in the digital age. Annual Account Fee: The $20 annual fee could be an additional cost to consider. However, it's worth noting that this can be waived if users opt for e-delivery of their account updates, which could be a convenient alternative for the digitally inclined. As a stalwart in the brokerage industry, TD Ameritrade offers a comprehensive suite of financial services tailored to individual needs. From educational resources to state-of-the-art trading platforms, they cater to both the beginner and the experienced investor. Their commitment to transparency, coupled with competitive pricing, makes them a prime choice for those considering an IRA rollover. TD Ameritrade has always emphasized the importance of informed decision-making. Hence, clients are equipped with research, data, and tools to make the best choices for their retirement savings. The firm's dedication to innovation ensures that clients always have access to the latest and most efficient investment strategies. Zero Commission on Multiple Instruments: TD Ameritrade stands out with its $0 commission offering on ETFs, stocks, and mutual funds. This pricing model can lead to significant savings for investors, especially those who trade frequently. Extensive Investment Options: With a staggering variety of over 13,000 mutual funds available, TD Ameritrade ensures that investors have ample opportunities to diversify and tailor their portfolios according to their investment goals. Robust Tools and Resources: TD Ameritrade excels in offering a suite of interactive tools, third-party research resources, and personalized reporting and analysis. These enable both novice and experienced investors to make informed decision-making. Transition to Charles Schwab: All accounts will eventually transition to Charles Schwab's platform, which might mean changes in user experience, platform familiarity, and possibly even fee structures. ETRADE, now a part of Morgan Stanley, has been synonymous with online trading since its inception. Their platform is intuitive, offering a seamless experience for users looking to rollover their IRAs. With a vast array of investment choices, research tools, and educational resources, ETRADE ensures that clients are never left in the dark. The acquisition by Morgan Stanley has only added to ETRADE's prowess. Combining the legacy and expertise of Morgan Stanley with ETRADE's innovative platforms promises clients a holistic financial experience. Those mulling over an IRA rollover can expect top-notch service, a blend of technology, and human expertise. Zero Fees on Multiple Fronts: E*TRADE stands out with its no account fees policy, paired with the absence of commissions on stocks, ETFs, or mutual funds. This ensures cost-effectiveness and maximizes the potential returns for investors. Broad Investment Choices: E*TRADE provides access to over 6,500 mutual funds, and a staggering 50,000+ bond and CD offerings. This diversity enables investors to diversify their portfolios across a wide range of asset classes and instruments. Charge on Bond Trades: For those looking to trade bonds on the secondary market online, E*TRADE levies a charge of $1 per bond with a minimum fee of $10. This can add up for investors who engage in frequent bond trading or make sizable trades. Options Trading Charge: Those delving into options trading need to factor in a per-contract charge ranging from $0.50 to $0.65. For active options traders, these charges can accumulate, influencing the overall trading strategy and profitability. Merrill Edge, a subsidiary of Bank of America, offers a seamless blend of the online trading world and personalized financial advice. Clients benefit from the robust research of BofA Global Research and the convenience of the Merrill Edge Self-Directed platform. With a suite of tools and resources, the platform caters to both DIY investors and those seeking guided advice. The strategic advantage of being backed by Bank of America means clients have a unified view of their financial picture. This integrated approach, coupled with a focus on educating clients, makes Merrill Edge a compelling choice for an IRA rollover. The firm's dedication to individual growth ensures that retirement goals are not just met but exceeded. Absence of Annual Fees: One of Merrill Edge's highlights is the lack of annual account fees, ensuring that users aren't burdened with unnecessary charges that could reduce their investment returns. Commission-Free Trading: Investors benefit from no commissions on stock, ETF, or options trades. This affordability can lead to more trading flexibility and increased potential for profit. Bank of America Connection: A distinguishing feature of Merrill Edge is the ability for users to connect to a linked Bank of America account. This integration provides streamlined banking and investment operations, enhancing convenience and efficiency. Limited Investment Variety: Merrill Edge doesn't provide as extensive a variety of investment options when compared to some other brokerages. Investors seeking a wider array of choices might find this aspect restrictive. The Traditional IRA stands as one of the most popular retirement account types. Contributions to this account may be tax-deductible, depending on one's income and participation in employer-sponsored plans. The primary allure of the Traditional IRA is the tax-deferred growth, allowing investments to compound without the drag of annual taxes. However, it's essential to note that withdrawals in retirement are taxed as regular income. This deferred tax structure makes the Traditional IRA particularly appealing to those who anticipate being in a lower tax bracket during their retirement years. As such, it remains a stalwart choice for many looking to roll over their retirement savings. The Roth IRA flips the script on the Traditional IRA's tax structure. Contributions to a Roth IRA are made with post-tax dollars, meaning there's no upfront tax break. However, the magic unfolds in retirement, where qualified withdrawals are entirely tax-free. This structure can be incredibly advantageous for those who anticipate being in a higher tax bracket in their golden years. While the Roth IRA offers undeniable tax advantages, it's essential to consider eligibility criteria. Not everyone can contribute to a Roth IRA, as there are income limits in place. For those who are eligible and are playing the long game, a Roth IRA can offer substantial tax savings, making it a prime choice for a rollover. Designed for small businesses, the Savings Incentive Match Plan for Employees (SIMPLE) IRA offers a straightforward retirement solution for employers and employees alike. Employers are required to make contributions, which can either match employee contributions up to a certain percentage or be a fixed percentage of an employee's compensation. While the SIMPLE IRA offers the allure of employer contributions, it comes with a catch. Early withdrawals, especially within the first two years of participation, can lead to hefty penalties. For those considering a rollover from a SIMPLE IRA, it's vital to understand the nuances to avoid any financial pitfalls. The Simplified Employee Pension (SEP) IRA is tailored for self-employed individuals and small business owners. It offers higher contribution limits compared to Traditional or Roth IRAs, allowing for more substantial tax-deductible contributions. The flexibility in annual contributions, depending on the business's profitability, makes the SEP IRA highly attractive for entrepreneurs. However, while the SEP IRA offers significant benefits, there are considerations to bear in mind, especially regarding employee inclusion criteria. Rolling over from a SEP IRA requires a keen understanding of its unique structure to ensure optimal financial outcomes. The variety of investment choices a provider offers can be crucial. Some IRA providers might only offer a limited selection of mutual funds, while others provide a broader array of options, including individual stocks, bonds, ETFs, and alternative investments. A diverse range allows you to tailor your portfolio according to your risk tolerance and financial objectives. One of the main reasons individuals consider an IRA rollover is to reduce costs. Be wary of providers that charge high account maintenance fees, transaction charges, or hefty expense ratios on their proprietary funds. Even small differences in fees can make a significant impact over the long term due to the power of compounding. The provider's reputation in the industry can speak volumes about its reliability. Look for providers with a strong track record, positive customer reviews, and a history of sound financial management. Trust is paramount when it's about safeguarding your retirement savings. In today's digital age, having a robust online platform and mobile application can be vital. Check if the provider offers user-friendly tools for tracking and managing your investments, real-time updates, and the ability to execute trades or rebalance your portfolio on the go. Exceptional customer support can be invaluable, especially if you're new to IRA rollovers or investing in general. Providers that offer multiple avenues for support—be it through phone, email, or live chat—demonstrate their commitment to their clients. Additionally, the availability of financial advisors or specialists to guide you can be a significant advantage. For those who prefer to be hands-on with their investments or are keen on learning, the availability of educational resources can be a determining factor. Look for providers that offer webinars, articles, tutorials, and tools that help you make informed decisions about your retirement savings. Each provider will have its set of terms and conditions related to account minimums, withdrawal policies, loan options, or early termination. It's vital to choose a provider whose terms align with your financial situation and future plans. Retirement accounts aren't just about the account holder; they're often part of a broader estate planning strategy. Ensure that the provider offers flexible beneficiary designation options, allowing for changes as personal circumstances evolve. The ease and efficiency with which a provider can handle the rollover process can be indicative of their overall operational prowess. Providers that offer a streamlined, hassle-free process with dedicated support can make the transition smoother. Beyond the basic IRA services, some providers offer additional features like tax optimization strategies, automatic rebalancing, or even robo-advisory services. Depending on your needs, these extras can offer added value and make one provider stand out over another. Tax implications are a constant companion in the financial realm, and IRA rollovers are rife with potential tax traps. One of the most common pitfalls involves indirect rollovers and the withholding tax. If the entire distributed amount, including the withheld tax, isn't deposited into the new account, the shortfall can be considered a taxable distribution. Avoiding this trap requires foresight. Being aware of the withholding and ensuring you have the means to deposit the full amount can stave off unwanted tax consequences. Moreover, being meticulous about timelines, especially the 60-day rule for indirect rollovers, can ensure that the transfer remains tax-free. Retirement accounts can be a mix of pre-tax and post-tax contributions. During a rollover, it's imperative to ensure that these funds don't get intermingled inadvertently. Mixing these funds can complicate tax calculations during withdrawals and potentially lead to unintended tax consequences. To sidestep this pitfall, it's advisable to keep a clear record of pre-tax and post-tax contributions. When executing the rollover, ensuring that these funds are transferred to corresponding accounts can maintain clarity and simplicity. The IRS imposes limits on how frequently one can conduct IRA rollovers. As of my last update in 2021, the rule stipulates that an individual can only perform one indirect IRA-to-IRA rollover in any 12-month period. This rule is irrespective of the number of IRAs an individual might have. Being cognizant of this rule is paramount to avoid unwanted penalties or jeopardizing the tax-advantaged status of the funds. For those looking to conduct multiple transfers, considering direct rollovers, which aren't bound by this limitation, might be a prudent move. An often overlooked aspect of IRA rollovers is the beneficiary information. When transferring funds to a new account or provider, the beneficiary designations from the old account don't automatically carry over. Failing to update this information can lead to unintended consequences, especially in the event of the account holder's demise. Ensuring that beneficiary information is up-to-date and aligns with one's wishes is crucial. Regularly reviewing and updating this information, especially after significant life events like marriages, births, or divorces, can ensure that retirement savings are disbursed as intended. In navigating the complexities of Individual Retirement Account (IRA) rollovers, it's essential to recognize the significant advantages while being wary of potential pitfalls. Rollover IRAs offer individuals a strategic opportunity to optimize their retirement savings, consolidate accounts, and access better investment options. With providers like Fidelity, Wealthfront, Charles Schwab, Vanguard, TD Ameritrade, E*TRADE, and Merrill Edge, investors are spoiled for choice. However, these choices come with varied offerings, pros, and cons. While zero fees and diverse investment options are coveted, factors like technological infrastructure, customer service, and educational resources are equally critical. But, it's not just about choosing the right provider; it's about executing the rollover correctly. Tax implications, especially around withholding taxes and the crucial 60-day rule, can't be ignored. Mixing pre-tax and post-tax funds, overlooking rollover limits, and neglecting beneficiary updates can derail one's retirement aspirations.Overview of an IRA Rollover

Best IRA Rollover Providers: An Overview

Fidelity Investments

Pros

Cons

Wealthfront

Pros

Cons

Charles Schwab

Pros

Cons

Vanguard

Pros

Cons

TD Ameritrade

Pros

Cons

E*TRADE From Morgan Stanley

Pros

Cons

Merrill Edge

Pros

Cons

Different Types of IRAs to Consider for Rollover

Traditional IRA

Roth IRA

SIMPLE IRA

SEP IRA

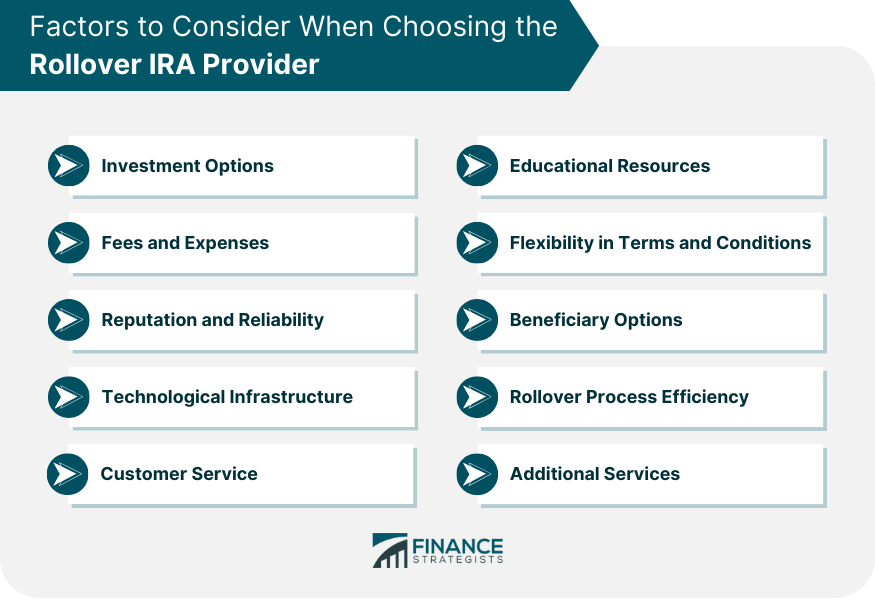

Factors to Consider When Choosing the Rollover IRA Provider

Investment Options

Fees and Expenses

Reputation and Reliability

Technological Infrastructure

Customer Service

Educational Resources

Flexibility in Terms and Conditions

Beneficiary Options

Rollover Process Efficiency

Additional Services

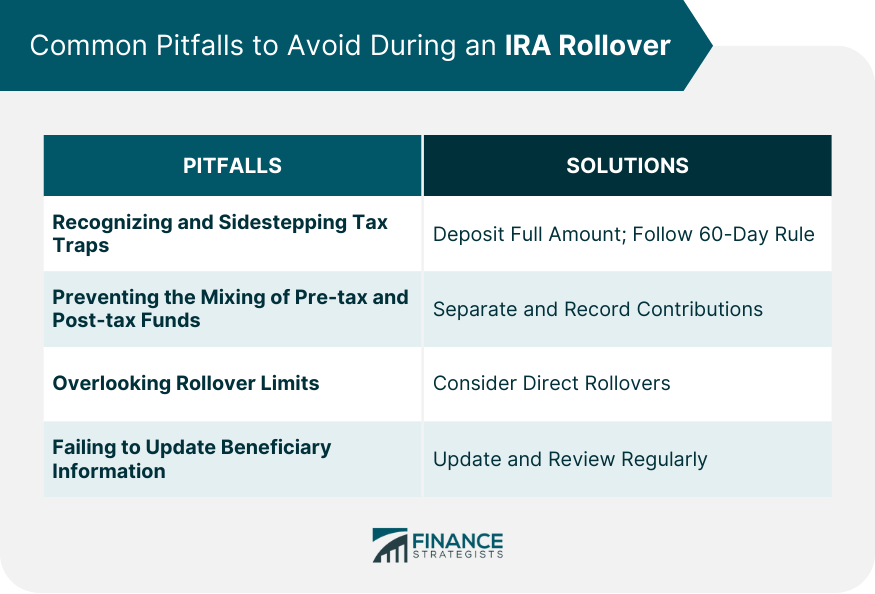

Common Pitfalls to Avoid During an IRA Rollover

Recognizing and Sidestepping Tax Traps

Preventing the Mixing of Pre-tax and Post-tax Funds

Overlooking Rollover Limits

Failing to Update Beneficiary Information

Bottom Line

Best IRA Rollover Providers FAQs

An IRA rollover is the transfer of funds from one retirement account to another within a 60-day period, often for better terms or account consolidation.

Top providers include Fidelity Investments, Wealthfront, Charles Schwab, Vanguard, TD Ameritrade, E*TRADE, and Merrill Edge.

Pitfalls include tax traps with indirect rollovers, mixing pre-tax and post-tax funds, overlooking rollover limits, and not updating beneficiary information.

The right provider offers beneficial investment options, reasonable fees, good customer service, and tools that directly impact future financial security.

Avoid tax issues by understanding withholding tax for indirect rollovers, adhering to the 60-day rule, and segregating pre-tax and post-tax funds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.