The Individual Retirement Account (IRA) is marked by its variety, allowing individuals to tailor their retirement savings to fit their unique financial situations and goals. There are two prominent types: the Rollover IRA and the Traditional IRA. A Rollover IRA is primarily designed for individuals who have funds in an employer-sponsored retirement plan, such as a 401(k) or a 403(b) and wish to move those funds into an IRA without incurring immediate taxation or penalties. This mechanism provides flexibility to those who change jobs or wish to consolidate retirement assets, ensuring the continuation of tax-advantaged growth. On the other hand, a Traditional IRA is a tax-deferred retirement savings account that individuals can establish using their personal income. Contributions to a Traditional IRA might be tax-deductible, depending on the contributor's income, tax-filing status, and other factors. While the Rollover IRA is mainly about preserving the tax status of transferred assets, the Traditional IRA focuses on offering individuals a tax-efficient way to save for retirement from scratch. Both accounts play vital roles in comprehensive retirement planning, but their utilization and advantages are tailored to different scenarios and needs.

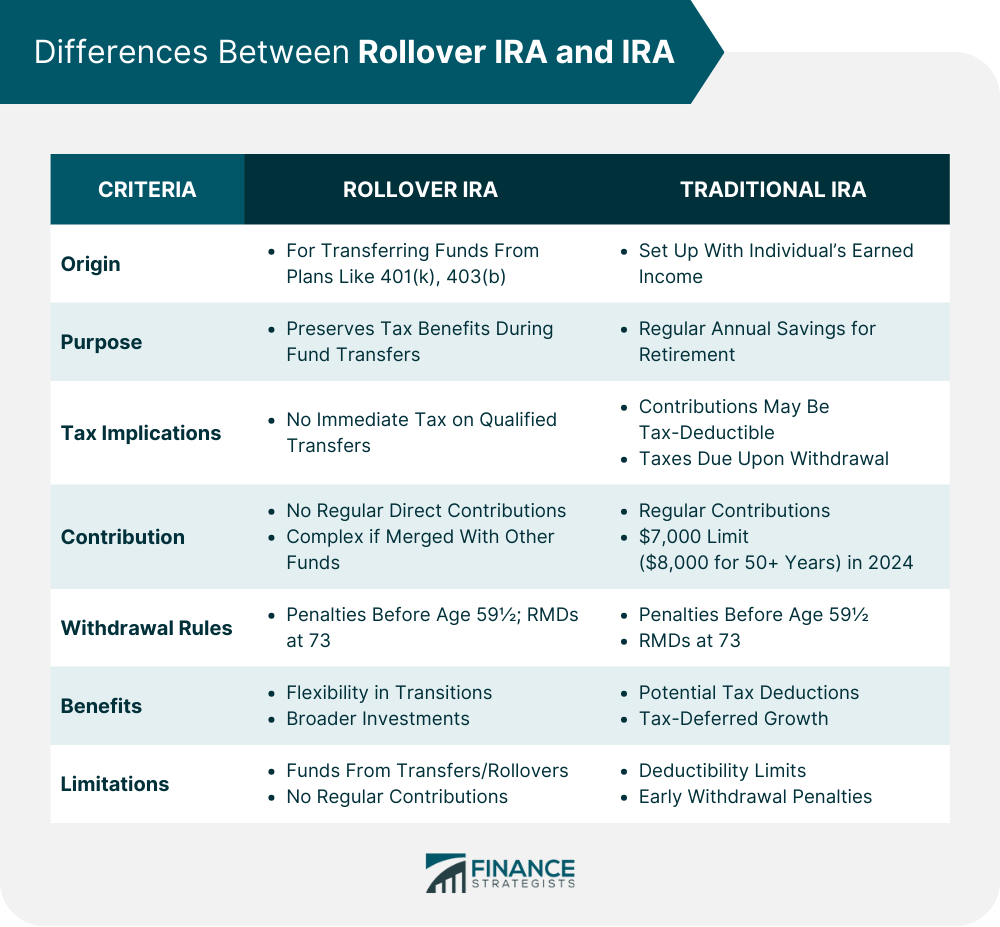

A Rollover IRA is specifically designed for individuals moving funds from another retirement plan, often a 401(k) or 403(b). This shift typically happens after significant career events, such as job changes or retirements. The intent behind the Rollover IRA is to preserve the tax-advantaged status of these funds during the transition. Conversely, a Traditional IRA is established directly by individuals using their earned income. There's no requirement for previous retirement account funds. Instead, contributions are made periodically based on personal savings decisions. The Rollover IRA's main purpose is to facilitate the seamless transfer of retirement funds between different accounts or plans. By doing so, it ensures the continuity of tax benefits associated with these funds. The Rollover IRA serves as a bridge for those who change jobs or want to centralize their retirement assets. The Traditional IRA, on the other hand, provides a consistent space for annual savings toward retirement. It is initiated and maintained through personal contributions. Its framework is built to offer tax efficiencies for these contributions and the ensuing investment growth. For those opting for a Rollover IRA, immediate taxation is typically avoided when funds are shifted from a qualified plan, ensuring the protection of assets. This absence of immediate tax is contingent on adhering to specific transfer protocols. In contrast, the Traditional IRA has its unique tax implications. Contributions to this account can be tax-deductible, but this depends on several factors like income, tax-filing status, and other retirement plan coverages. The investments within a Traditional IRA grow tax-deferred. This means taxes are due only upon withdrawal, potentially at a lower retirement income rate. When discussing contributions, the Rollover IRA doesn't usually see direct, new inputs. Instead, it accumulates funds mainly from transfers or rollovers from other qualified accounts. It's a one-time or occasional infusion based on career transitions. Meanwhile, the Traditional IRA functions on regular contributions. As of 2024, the maximum annual contribution limit is $7,000, or $8,000, for individuals 50 years and older. These contributions are made directly, reflecting an individual's saving decisions and capacity. Rollover IRA and Traditional IRA share similarities in their withdrawal norms. For both, early withdrawals, specifically, those made before age 59½, might attract penalties, although some exceptions exist. Furthermore, both necessitate the initiation of Required Minimum Distributions (RMDs) once the account holder reaches age 73. These RMDs ensure that tax-deferred assets don't remain untouched indefinitely. The amounts for these distributions are calculated based on life expectancy charts provided by the IRS. Proper planning is essential to optimize withdrawal strategies and minimize potential tax impacts. The Rollover IRA stands out for its flexibility in asset transition, especially during job shifts. It successfully sidesteps immediate taxation on qualified transfers and often allows access to a broader investment landscape compared to employer-based plans. Additionally, it's an excellent tool for consolidating various retirement assets. The Traditional IRA offers its set of advantages. Tax-deductible contributions, subject to eligibility, can reduce current taxable income. Moreover, the tax-deferred growth potential means that investments can compound without annual tax drag, maximizing growth. The Rollover IRA isn't without restrictions. One notable limitation is the inability to make regular, direct contributions, as seen in other IRA types. Additionally, merging rollover funds with other contributions can complicate future transfers, especially back into employer plans. The Traditional IRA's limitations hinge on contribution deductibility, which can be reduced or eliminated based on income levels and participation in workplace retirement plans. There's also the deterrent of penalties for early withdrawals. In any decision involving retirement planning, it's always prudent to consult with a financial advisor or tax services professional to ensure you're making choices aligned with your long-term goals and current situation. If you already have retirement funds in an employer-sponsored plan and are leaving your job or wish to consolidate, a Rollover IRA might be the ideal choice. It's specifically designed to accept funds from such accounts without immediate tax implications. On the contrary, if you're starting fresh with your savings, a Traditional IRA would be more appropriate. While Rollover IRAs are chiefly about maintaining the tax-advantaged status of rolled-over funds, Traditional IRAs offer potential tax deductions on contributions, depending on your income and participation in other retirement plans. Consider your current tax situation and future tax expectations when deciding. If you're looking for a retirement account into which you can consistently contribute year after year, the Traditional IRA is the way to go. However, if you're solely focused on moving existing retirement assets, especially from employer-sponsored plans, then the Rollover IRA stands out. Often, Rollover IRAs, especially those provided by brokerage firms, might offer a broader range of investment choices compared to many employer-sponsored plans. If you're seeking diverse investment opportunities or specific types of assets not offered in your current plan, rolling over to an IRA might provide those options. If you anticipate multiple transitions in your career, it might be beneficial to establish a Rollover IRA as a central hub for retirement assets from various employer-sponsored plans. This approach can simplify management and ensure that assets from different sources maintain their tax-advantaged status. The comparison between Rollover IRA and Traditional IRA underscores the considerations in retirement planning. The Rollover IRA serves as a conduit for seamless asset transfer, safeguarding tax advantages during career shifts and asset consolidations. Its focus is on maintaining the tax-deferred status of transferred funds. Conversely, the Traditional IRA provides a foundation for consistent annual savings, with potential tax deductions on contributions, and tax-deferred growth on investments, making it a versatile choice for those starting anew. Understanding the divergence in taxation, contribution dynamics, and investment opportunities is pivotal. Factors such as existing retirement assets, taxation expectations, contribution patterns, investment preferences, and career changes should guide the selection process. Collaborating with financial advisors or tax professionals can ensure that the chosen IRA aligns with individual aspirations, providing a secure path toward a well-prepared retirement future.Rollover IRA vs IRA Overview

Differences Between Rollover IRA and IRA

Origin

Purpose

Tax Implications

Contribution

Withdrawal Rules

Benefits

Limitations

Considerations for Choosing Between Rollover IRA and IRA

Current Retirement Assets

Taxation and Deductibility

Contribution Flexibility

Investment Options

Future Employment Changes

Conclusion

Difference Between a Rollover IRA and an IRA FAQs

A Rollover IRA is designed for transferring funds from employer-sponsored plans, while a Traditional IRA is established with personal income for retirement savings.

A Rollover IRA usually accumulates funds from transfers, while a Traditional IRA involves regular contributions from earned income.

A Rollover IRA preserves tax benefits on transferred funds, avoiding immediate taxation. In contrast, contributions to a Traditional IRA might be tax-deductible, and investment growth is tax-deferred.

A Rollover IRA facilitates seamless transfers of retirement funds during job changes, aiming to maintain tax advantages. A Traditional IRA provides a consistent avenue for personal retirement savings with potential tax deductions.

Consider your existing retirement assets – a Rollover IRA suits funds from employer plans, while a Traditional IRA is ideal for fresh savings. Also, factor in your taxation preferences, contribution habits, investment choices, and potential career transitions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.