When delving into the intricacies of retirement accounts, the Simplified Employee Pension (SEP) IRA and Roth IRA emerge as two major players. The SEP IRA offers an advantageous vehicle for business owners and self-employed professionals to stash away significant retirement savings. On the other hand, Roth IRAs are more democratized, offering benefits to a wider range of earners, albeit with some limitations. Both these instruments, each with its own merit, hold unique opportunities for future retirees. While the SEP IRA provides considerable tax benefits at the time of contribution, the Roth IRA shines in its tax-free withdrawals during retirement. Knowing the distinct facets of both can help determine whether a rollover could be a prudent move.

The path from SEP IRA to Roth isn’t strewn with countless obstacles, but it does have rules. Most notably, you can execute a direct rollover, converting your SEP IRA assets into a Roth IRA. This transfer, despite its seeming simplicity, comes with considerations, especially pertaining to taxes. However, this direct transfer isn't the only avenue. Another common method involves rolling over SEP IRA funds first to a Traditional IRA, and subsequently converting those to a Roth IRA. While this might sound roundabout, sometimes this two-step process can have its benefits, especially when strategically planning around taxes. When converting a SEP IRA to a Roth IRA, you'll need to pay income taxes on the amount being transferred. This is because SEP IRA contributions are tax-deferred, meaning you haven’t yet paid taxes on those funds. In stark contrast, Roth IRAs operate on post-tax contributions. Paying taxes upfront might sound daunting. But, consider the flip side: all future qualified distributions from Roth will be tax-free. This forward-thinking strategy is often why many consider the rollover, even if the upfront tax payment feels heavy. Contrary to popular belief, there's no specific deadline for rolling over a SEP IRA to a Roth IRA. However, it's wise to note that timing can affect the tax implications of the rollover. For instance, if you're expecting a higher income year, it might be prudent to delay the rollover to avoid a hefty tax bite. Moreover, if you're inching closer to retirement, consider how the rollover might affect your immediate future. Rolling over just before retirement could mean drawing from a smaller pool if taxes take a considerable chunk from the rollover amount. Understanding where you stand financially is the cornerstone of any major monetary decision. Ask yourself: Why do you want to roll over? Is it for better tax management, or are you eyeing the benefits of Roth's tax-free distributions? Once you nail down the 'why,' inspect your financial health. Your current income, expected retirement age, future financial commitments, and even possible inheritance scenarios all play a part. Evaluating your present state and aligning it with your future goals will provide clarity. Remember, this isn’t just about retirement; it's about the legacy you might want to leave behind. Financial waters can be tricky to navigate alone. An experienced tax or financial advisor, armed with the nuances of tax laws and retirement strategies, can be a beacon. They can offer insights tailored to your specific situation. While it's tempting to DIY our finances in an age of digital information, certain decisions—like a significant rollover—benefit from professional guidance. An advisor doesn't just bring expertise; they bring personalized strategies that align with your financial blueprint. We've touched upon this, but it's crucial enough to merit repetition. Ascertain the immediate tax consequences of the rollover. Simultaneously, don't lose sight of the long-term tax-free benefits of Roth. Weigh these potential benefits against the immediate tax hit. For many, the allure of tax-free distributions in retirement and the possibility of a growing tax-free nest egg for heirs prove irresistible. However, your personal financial scenario is key in determining if these benefits will outweigh the initial tax costs. Once your decision is firm, the technical part begins. The financial institution where your SEP IRA resides is your starting point. Typically, they'll have a rollover form to kickstart the process. If you're moving to a different institution for your Roth, they'll also have their own set of paperwork. While it might seem cumbersome, most institutions streamline the process for client convenience. However, always be vigilant. Ensure all forms are duly filled and no erroneous data jeopardizes the process. Withholding taxes can be a sneaky surprise if you're not prepared. When you execute a rollover, the IRS may insist on withholding a percentage for taxes. This isn't your actual tax obligation but an estimate. If the withheld amount is more than what you owe, you'll get a refund. However, there's a catch. If you don't make up the withheld amount when completing the rollover, it's considered a distribution. Also, distributions can attract penalties if done prematurely. So, if 20% is withheld and you only roll over 80% of your SEP IRA, that 20% might be subject to both taxes and penalties. The penultimate step—keeping a watchful eye. After initiating the rollover, ensure the funds move seamlessly from your SEP IRA to the Roth. Any discrepancies can lead to avoidable complications. Once completed, your financial institution should furnish you with a confirmation. It’s more than just a receipt; it's a testament to your proactive approach towards potentially reaping better retirement benefits. Roth IRAs are like the golden geese of retirement savings, chiefly due to their tax-free withdrawals. Imagine a retirement where your distributions aren’t nibbled at by taxes. With a Roth, once you've paid your dues during the rollover, the growth and distributions are yours to command, sans the tax bite. This doesn't just impact your retirement. It also defines the legacy you might leave behind. Heirs inheriting Roth IRAs can also benefit from tax-free distributions, making it a gift that retains its full value. Traditional and SEP IRAs come with a string attached: the Required Minimum Distributions (RMDs). These mandatory distributions start at age 72, ensuring that the government gets its share of taxes on your savings. Roth IRAs, however, dance to a different tune. Without the yoke of RMDs, Roth IRA owners have flexibility. There's no compulsion to withdraw, allowing the account to grow, potentially benefiting both the retiree and their heirs. Compound Interest is the magic potion of finance. And when this compounding happens tax-free, as in a Roth IRA, the growth potential amplifies. With no taxes hindering the growth or mandating withdrawals, your savings have the space to burgeon. Over time, especially if you've made the shift to Roth early, this can lead to a significantly larger nest egg. It's not just about the amount but the potential quality of life it can assure during retirement. Unlike its counterparts that come saddled with RMDs, Roth IRAs offer delightful flexibility in withdrawal timings. Whether you wish to withdraw at 60 or 80, the decision lies with you. There’s no looming deadline forcing distributions. This flexibility can be instrumental in devising retirement strategies, especially if you have multiple income streams or significant assets. It lets you dictate the pace, ensuring your financial security isn't compromised. The Roth IRA isn't just a retirement vehicle—it's also an estate planning tool. Since Roth IRAs don’t have RMDs and offer tax-free distributions, they become prime assets to bequeath. Your beneficiaries can stretch out Roth IRA distributions over their lifetime, enjoying the tax-free benefits. Moreover, the absence of RMDs means that if you don’t need the money, your Roth IRA can continue to grow undisturbed, potentially providing a more substantial inheritance for your loved ones. The immediate tax liabilities arising from a rollover can't be understated. SEP IRA contributions are pre-tax, meaning the IRS hasn’t taken its cut yet. When transitioning to a Roth, this tax bill comes due. Depending on the size of your SEP IRA, this can be a significant amount. It's imperative to have the funds to cover this tax bill outside of your IRA. Tapping into the IRA for the taxes can dilute the benefits of the rollover and might even incur penalties. A sizable rollover can push you into a higher tax bracket for the year. Let's say your rollover amount, when added to your regular income, catapults you into the next tax bracket. This doesn’t just affect the taxes on the rollover but potentially your entire income. Before making the move, it's essential to estimate the tax implications. In some cases, it might even be worth considering a multi-year approach, rolling over parts of your SEP IRA over several years to manage the tax bite. The funds used to pay the conversion tax are an opportunity cost. If left invested, they might have yielded returns. By paying a large tax bill now, you're essentially betting on the future benefits of the Roth IRA outweighing this immediate cost. It's a calculation that hinges on several factors: expected tax rates during retirement, anticipated investment returns, and the time horizon until you start distributions. All these variables determine whether the opportunity cost of the immediate tax is justified. Tax laws aren’t set in stone. While the current rules surrounding Roth IRAs are appealing, there's always a chance they might change. Banking solely on the future tax-free benefits of Roth IRAs carries the risk of legislative changes. While it's impossible to predict with certainty, it's wise to stay informed. A diversified retirement strategy can also mitigate the potential risks arising from such unforeseen changes. The rollover process, while straightforward on paper, has nuances. Errors, especially regarding withholding taxes and the 60-day rollover rule, can attract penalties. If a rollover isn't completed within 60 days, the amount might be treated as a distribution. Distributions before the age of 59.5 generally incur a 10% penalty on top of applicable taxes. Hence, ensuring a smooth, error-free rollover becomes paramount. Both the SEP IRA and Roth IRA come with contribution limits, but they differ considerably. SEP IRAs, designed primarily for self-employed individuals and small business owners, allow for more substantial contributions, often a percentage of the individual's income or a fixed annual amount, whichever is lesser. On the contrary, Roth IRAs have more modest contribution limits. These limits are also influenced by the individual's income, with high earners potentially being phased out from contributing directly to a Roth IRA. When considering a rollover, it’s essential to understand these limits as they shape your future contribution strategy. The fundamental difference between these two IRAs lies in their tax treatment. SEP IRAs are tax-deferred. Contributions reduce your taxable income now, but distributions during retirement are taxed. In contrast, Roth IRAs operate on post-tax money. While contributions don’t reduce current taxable income, future distributions are typically tax-free. This distinction forms the crux of the rollover decision. While SEP IRAs provide immediate tax relief, Roth IRAs promise future tax benefits, a choice between immediate gratification and future gains. SEP IRAs and Roth IRAs have distinct age-related rules. While Roth IRAs have no age restrictions on contributions (as long as you have earned income), SEP IRAs come with a cut-off. Furthermore, Roth IRAs don’t have RMDs, while SEP IRAs mandate distributions starting at age 72. For those planning an early retirement or wishing to continue contributing post the traditional retirement age, these age-related nuances can significantly influence the rollover decision. Both SEP and Roth IRAs generally offer a wide range of investment options, including stocks, bonds, mutual funds, and ETFs. However, the specifics can vary based on the custodian. Some institutions might offer a broader range of alternative investments, while others stick to traditional options. It's essential to ensure that the investment options align with your financial goals and risk tolerance. A rollover isn't just about tax implications but also about optimizing your investment strategy for retirement. Lastly, both IRAs have implications for estate planning. Roth IRAs, with their lack of RMDs and tax-free distributions, can be a more attractive asset to pass on. However, SEP IRAs might offer larger balances due to their higher contribution limits. The decision isn't merely financial but also deeply personal, hinging on your wishes for your beneficiaries. Both IRAs offer a legacy, but the nature of that legacy differs, warranting careful consideration. Rollover decisions from a SEP IRA to a Roth IRA require thorough analysis, given their distinct features and tax implications. SEP IRAs primarily cater to business owners and self-employed professionals, offering sizable contributions with tax benefits upon contribution. In contrast, Roth IRAs, accessible to a broader range of earners, promise tax-free withdrawals in retirement. While the rollover process is not overly complex, it mandates due consideration, particularly regarding immediate tax implications. Undertaking this transfer might initially be tax-intensive, as SEP contributions are pre-taxed, yet the allure of Roth's future tax-free distributions for both retirees and their heirs is undeniable. However, potential pitfalls such as a rise in one's tax bracket or the possibility of legislative changes to tax laws should not be overlooked. It's crucial to consult financial experts, understand one's financial position, and meticulously execute the rollover to maximize benefits while circumventing possible pitfalls.Overview of SEP IRA and Roth IRA

Can You Rollover SEP IRA to Roth?

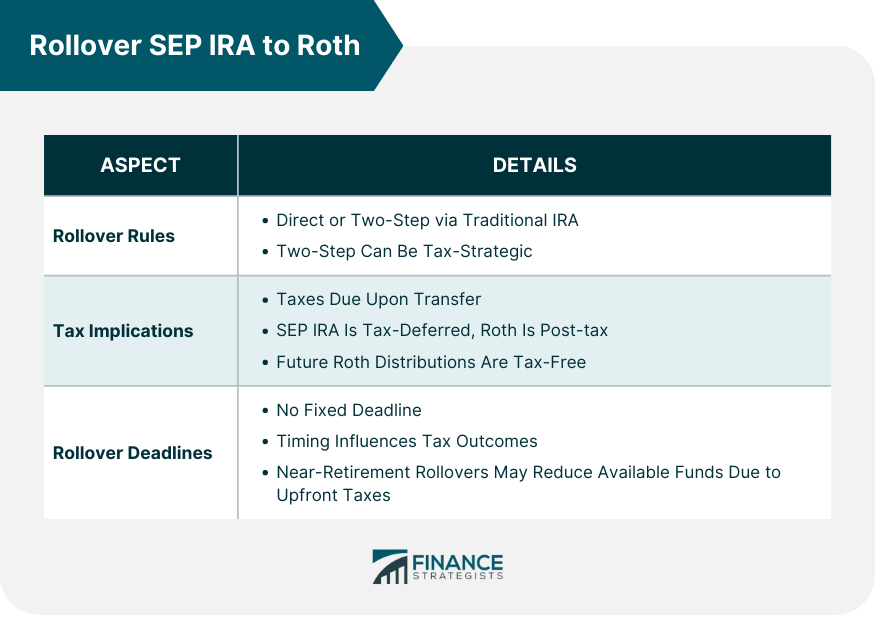

Rollover Rules

Tax Implications

Rollover Deadlines

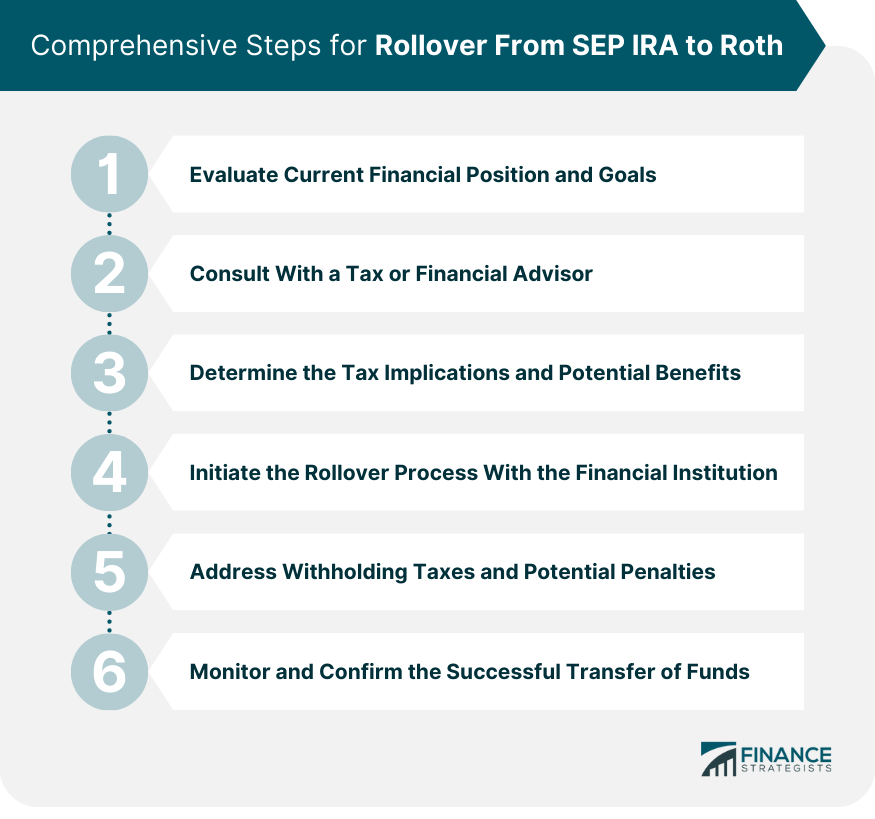

Comprehensive Steps for Rollover From SEP IRA to Roth

Evaluate Current Financial Position and Goals

Consult With a Tax or Financial Advisor

Determine the Tax Implications and Potential Benefits

Initiate the Rollover Process With the Financial Institution

Address Withholding Taxes and Potential Penalties

Monitor and Confirm the Successful Transfer of Funds

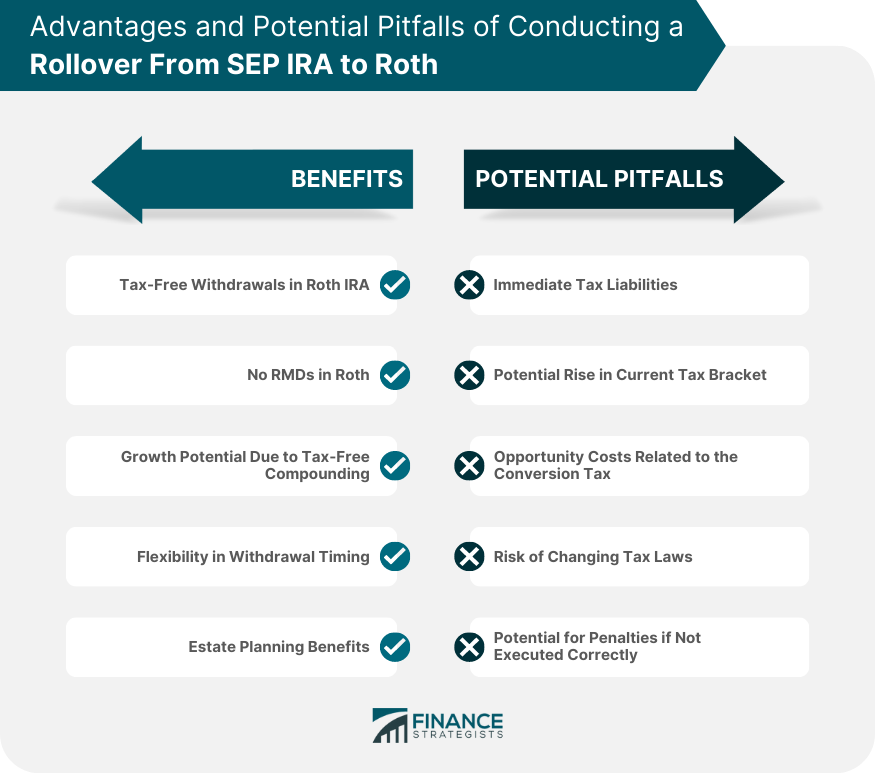

Advantages of Conducting a Rollover From SEP IRA to Roth

Tax-Free Withdrawals in Roth IRA

No Required Minimum Distributions in Roth

Growth Potential Due to Tax-Free Compounding

Flexibility in Withdrawal Timing

Estate Planning Benefits

Potential Pitfalls and Concerns of Rollover From SEP IRA to Roth

Immediate Tax Liabilities

Potential Rise in Current Tax Bracket

Opportunity Costs Related to the Conversion Tax

Risk of Changing Tax Laws

Potential for Penalties if Not Executed Correctly

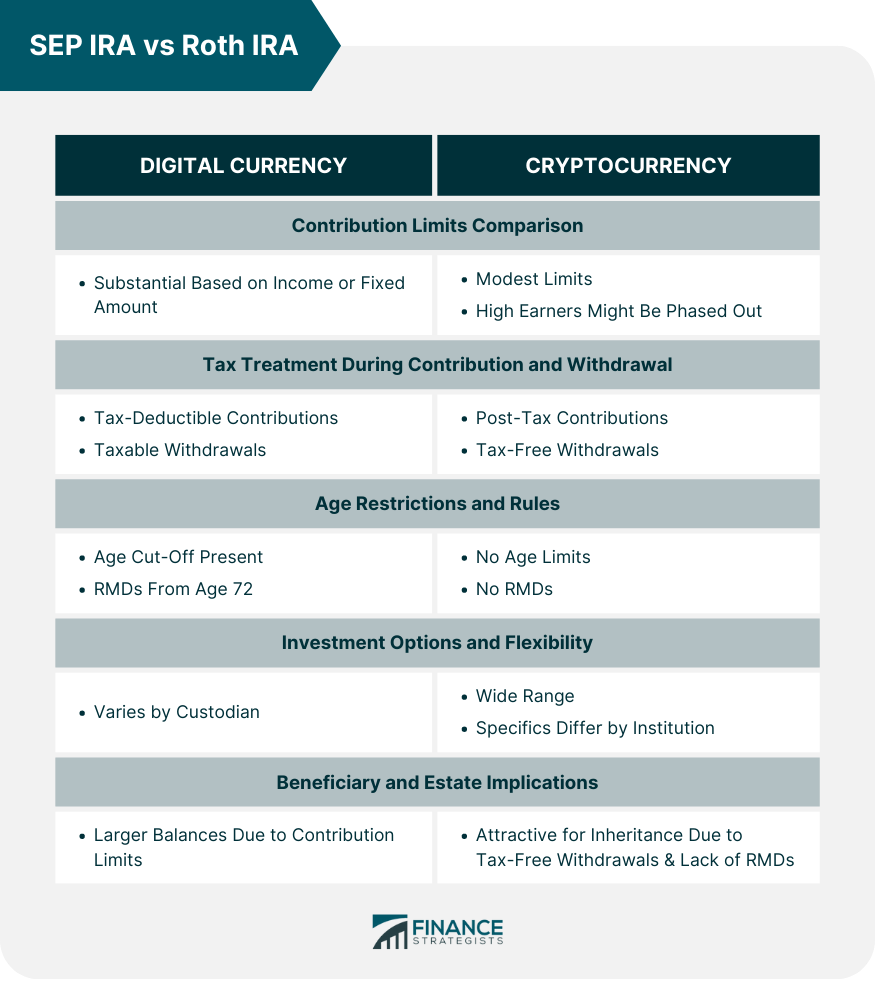

SEP IRA vs Roth IRA

Contribution Limits Comparison

Tax Treatment During Contribution and Withdrawal

Age Restrictions and Rules

Investment Options and Flexibility

Beneficiary and Estate Implications

Bottom Line

Rollover SEP IRA to Roth FAQs

Yes, you can rollover a SEP IRA to a Roth, but it's essential to be aware of the tax implications and deadlines involved.

The benefits include tax-free withdrawals, no required minimum distributions, tax-free compounding growth, flexible withdrawal timing, and estate planning advantages.

Yes, concerns include immediate tax liabilities, a potential rise in your current tax bracket, conversion tax opportunity costs, risks of changing tax laws, and penalties if not executed correctly.

SEP IRAs allow more substantial contributions based on income, while Roth IRAs have modest limits influenced by an individual's earnings.

SEP IRA distributions are taxed during retirement, whereas Roth IRA distributions are typically tax-free if certain conditions are met.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.