A 457(b) plan, typically available to state and local public employees and certain non-profit employees, is a type of deferred-compensation retirement plan. The term "rollover" denotes the transfer of funds from this plan into an Individual Retirement Account (IRA). With such a transfer, you're essentially moving your retirement savings from the employer-sponsored 457(b) plan to a privately managed IRA without immediate tax implications. The beauty of this strategy lies in its ability to pave the way for a broader range of investment options. Moreover, the rollover keeps the tax-deferred status of the funds intact, ensuring that they continue to grow without the burden of yearly tax payments. A 457(b) to IRA rollover offers increased flexibility and a broader range of investment options compared to a standard 457(b) plan. This rollover also streamlines financial planning by consolidating assets, especially during job changes or as retirement approaches.

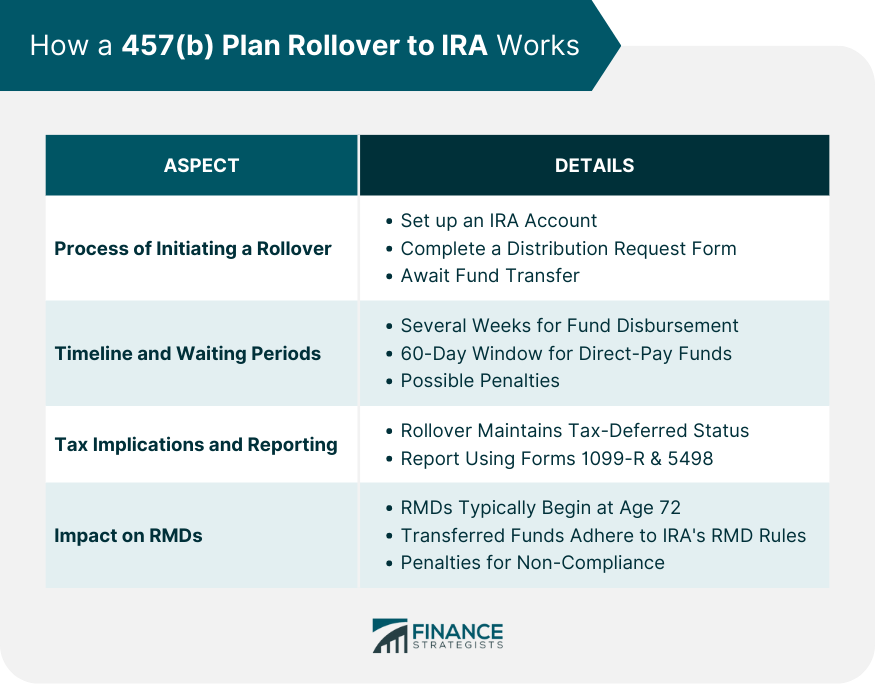

Set up an IRA Account: Before you can initiate a rollover, you need to have an IRA account ready to receive the funds. You can set up this account through various financial institutions based on your preference and investment goals. Complete a Distribution Request Form: This form is obtained from your 457(b) plan administrator. Filling it out will officially request the transfer of funds from the 457(b) plan to your newly established IRA account. Await Fund Transfer: Once your request is processed, the administrator will issue a check to you for your IRA—ensure you deposit this promptly, or directly transfer funds to your IRA, a recommended method to avoid potential tax complications. Rolling over retirement funds isn't instantaneous. After submitting the distribution request form, it might take several weeks for the funds to be disbursed. The exact timeline largely depends on the 457(b) plan's procedures. When you receive the funds, there's a crucial window to consider. If the money is directly payable to you, the IRS grants a 60-day period to deposit it into the IRA. Failing this, it's treated as a distribution, and taxes, perhaps penalties, may apply. A significant advantage of rolling over from a 457(b) plan to an IRA is the tax-deferred status retention. When executed correctly, no immediate taxes are due. This is particularly beneficial since it allows the entire amount to continue growing tax-free. However, it's essential to report the rollover to the IRS. While the transaction might be tax-free, it isn't report-free. Using Form 1099-R, the distribution will be documented, and by Form 5498, the IRA contribution will be recorded. RMDs are minimum amounts that a retirement plan account owner must withdraw annually, typically starting at age 72. With a 457(b), RMDs are obligatory. When you roll these funds into an IRA, they become subject to the RMD rules governing IRAs. It's essential to be aware of these RMD rules since they dictate the amount you must withdraw annually once you reach the specified age. Non-compliance carries hefty penalties, making it crucial to plan withdrawals accordingly. One of the most compelling reasons individuals opt for a rollover is the allure of broader investment options. A typical 457(b) plan may have a restricted list of investment choices. An IRA, however, often opens the door to a wide array of stocks, bonds, mutual funds, and other investment vehicles. This expanded universe can allow for a more diversified portfolio. Diversification, as any financial planner will tell you, is key to mitigating risk. With more options, one can craft a retirement strategy that's tailored to individual goals and risk tolerance. Having multiple retirement accounts can be cumbersome. Tracking performance, managing allocations, and understanding the aggregate value can become complex tasks. By rolling over a 457(b) plan into an existing IRA, you can consolidate assets, making management more straightforward. The value of consolidation extends beyond mere convenience. It offers a holistic view of retirement assets, allowing for more informed decisions about asset allocation, risk management, and retirement planning. Management fees, though they might seem small, can erode savings over time. Some 457(b) plans might have higher administrative and management fees than available IRAs in the market. By rolling over, individuals might find opportunities to reduce these costs. Moreover, with an IRA, there's the potential to receive more personalized advice. The world of finance is intricate, and having expert guidance tailored to individual needs can be invaluable in navigating the retirement landscape. IRA withdrawal rules can offer more flexibility than those of a 457(b) plan. For instance, there are exceptions in an IRA allowing for penalty-free withdrawals for first-time home purchases or qualified education expenses. Understanding these nuances can provide strategic advantages. As life unfolds, having the ability to access retirement savings for significant life events without penalties can be a financial boon. 457(b) plans carry a unique advantage: there's no early withdrawal penalty, even before age 59½. This offers unparalleled flexibility, especially for those considering early retirement or facing financial hardships. When funds are rolled over to an IRA, this specific advantage is lost. Losing this flexibility can be consequential. For someone eyeing early retirement, or for those who might need to tap into their funds before 59½, preserving the 457(b) might be a wiser choice. Financial transactions often come with fees. Initiating a rollover isn't always free. Some 457(b) plans may charge a processing or distribution fee. While these fees aren't usually exorbitant, they can still eat into retirement savings. Furthermore, if the rollover isn't executed correctly, it can inadvertently become a taxable distribution. This can lead to both taxes and potential penalties, negating some of the rollover's benefits. Not all investments within a 457(b) plan can be rolled over into an IRA. Certain proprietary funds or unique investment structures might not be transferrable. Before initiating a rollover, it's imperative to understand which assets can move and which can't. This limitation can sometimes disrupt a well-laid investment strategy. If specific assets have been integral to an individual's retirement plan, losing them during a rollover might necessitate a strategy reevaluation. While consolidating retirement accounts can simplify things, the rollover itself might introduce temporary complexity. If the 457(b) isn't fully liquidated, or if multiple IRAs are maintained, juggling these accounts can become challenging. Each account has its statements, tax documents, and RMDs. For those unaccustomed to managing multiple accounts, the added responsibility might be overwhelming. A 401(k) is another prevalent employer-sponsored retirement plan. At a glance, it seems similar to a 457(b). However, their rollover dynamics differ. 457(b) plans have the distinct advantage of no early withdrawal penalty. When rolling a 401(k) into an IRA, the rules governing early withdrawals remain the same. Moreover, 401(k) plans might offer loan provisions, allowing participants to borrow against their savings. This feature isn't universal to 457(b) plans, making the 401(k) to IRA rollover decision somewhat distinct. 403(b) plans, often found in non-profit sectors, share several features with 457(b) plans. However, their rollover dynamics carry nuanced differences. For one, 457(b) funds rolled over to an IRA can be accessed without penalty after separation from an employer, even before age 59½. This isn't necessarily the case for 403(b) funds. Understanding these subtleties is crucial. The decision to rollover should consider the unique features of the originating account and how they'll evolve post-transfer. Choosing to rollover is just the start. The more significant decision lies in the type of IRA to select. Traditional IRAs offer tax-deferred growth, mirroring the benefits of a 457(b). Meanwhile, Roth IRAs provide tax-free withdrawals in retirement, offering an entirely different tax strategy. Considering individual tax situations is vital. Predicting future tax brackets, weighing immediate tax benefits against future tax-free withdrawals, and contemplating current financial needs are all factors in this decision matrix. Tax efficiency is the art of managing financial affairs to reduce tax liability. When contemplating a rollover, timing becomes a vital component. For instance, executing a rollover in a year with lower income might place an individual in a more favorable tax bracket. The calendar isn't the only timing consideration. Life events, such as job changes or significant financial shifts, can also influence the most tax-efficient rollover timing. After a rollover, the world of investment choices expands dramatically. The question becomes: how should assets be allocated? Diversification remains a golden rule. Spreading investments across various asset classes mitigates risk. However, one size doesn't fit all. An individual's age, risk tolerance, financial goals, and market conditions should all inform post-rollover asset allocation. A Roth conversion is the process of moving funds from a traditional IRA (or, in this case, a 457(b) rollover to a traditional IRA) to a Roth IRA. This move incurs taxes on the transferred amount, but the payoff is tax-free growth and withdrawals in the future. It's a strategy worth considering, especially for those predicting higher tax rates in retirement. However, the immediate tax hit requires careful planning and potentially strategic timing. Beyond mere asset allocation, post-rollover is an opportune time to consider broader portfolio diversification. This might mean exploring sectors previously unavailable in the 457(b) or considering alternative investments. The aim remains the same: risk mitigation. A well-diversified portfolio weathers market volatility more gracefully, potentially preserving hard-earned retirement savings. The financial landscape is dynamic. Market fluctuations, life changes, and evolving financial goals mean that decisions made yesterday might not be optimal today. Post-rollover, it's crucial to adopt a habit of regular portfolio reviews. This doesn't mean impulsive reactions to market dips or spikes. Rather, it's a call for thoughtful reflection on whether the current strategy aligns with overarching retirement goals. Periodic re-evaluation ensures alignment, fostering confidence in future financial stability. The decision to rollover a 457(b) plan into an IRA provides individuals with several advantages and potential drawbacks. Such a move allows for broader investment opportunities, asset consolidation, possible savings on account management fees, and increased withdrawal flexibility. However, this transfer isn't without its caveats. By opting for a rollover, individuals might lose the unique 457(b) early withdrawal benefits, face rollover-associated fees, and confront limitations on specific asset types. Furthermore, a rollover might add complexities if not all assets are transferred or if multiple accounts are retained. Key to a successful transition is understanding the mechanics of the rollover process, tax implications, and subsequent strategies to maximize rollover benefits. Periodic re-evaluation of one's financial strategy ensures alignment with retirement goals, while tax-efficient decisions and diversification stand paramount. Making informed choices in the complex financial landscape will set the groundwork for a secure retirement future.Understanding 457(b) Plan Rollover to IRA

How a 457(b) Plan Rollover to IRA Works

Process of Initiating a Rollover

Timeline and Waiting Periods

Tax Implications and Reporting

Impact on Required Minimum Distributions (RMDs)

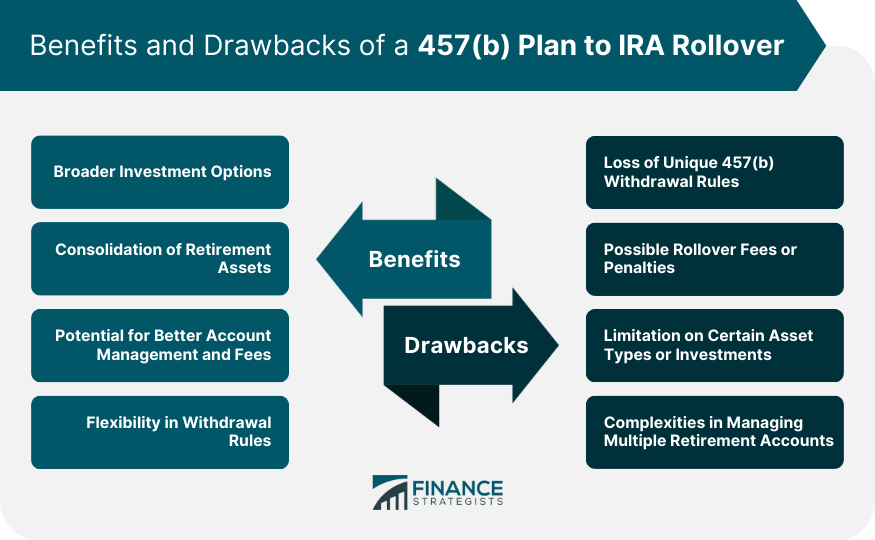

Benefits of a 457(b) Plan Rollover to IRA

Broader Investment Options

Consolidation of Retirement Assets

Potential for Better Account Management and Fees

Flexibility in Withdrawal Rules

Drawbacks of a 457(b) Plan Rollover to IRA

Loss of Unique 457(b) Withdrawal Rules

Possible Rollover Fees or Penalties

Limitation on Certain Asset Types or Investments

Complexities in Managing Multiple Retirement Accounts

Comparing 457(b) to Other Retirement Account Rollovers

457(b) vs 401(k) Rollovers

457(b) vs 403(b) Rollovers

Considerations in Choosing the Right Rollover Strategy

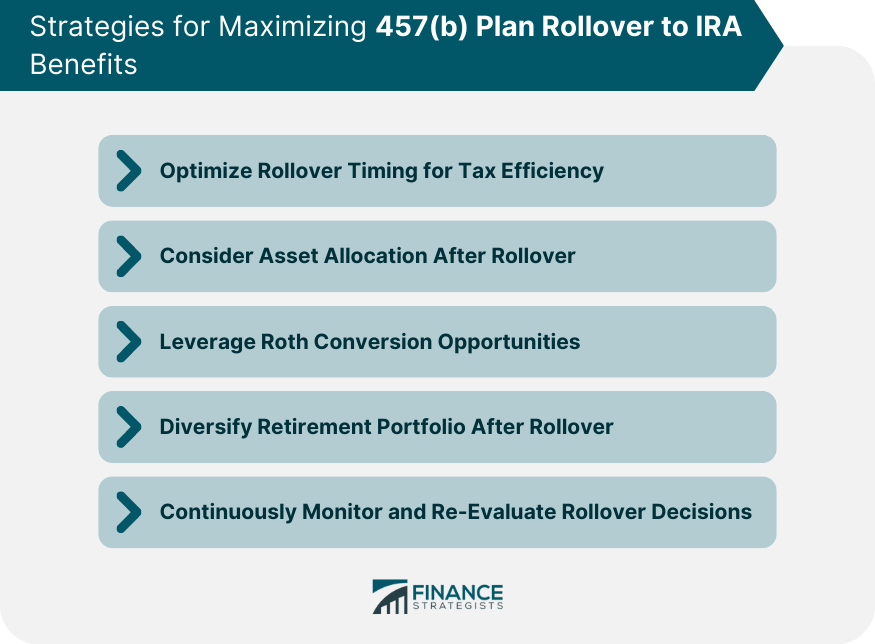

Strategies for Maximizing 457(b) Plan Rollover to IRA Benefits

Optimize Rollover Timing for Tax Efficiency

Consider Asset Allocation After Rollover

Leverage Roth Conversion Opportunities

Diversify Retirement Portfolio After Rollover

Continuously Monitor and Re-Evaluate Rollover Decisions

Bottom Line

457(b) Plan Rollover to IRA FAQs

It's the transfer of funds from a 457(b) plan, typically for public employees, into an Individual Retirement Account (IRA) without immediate tax implications.

It offers broader investment options, consolidated retirement assets, better account management, and increased withdrawal flexibility.

Yes, including the loss of unique 457(b) withdrawal rules, potential rollover fees, certain asset transfer limitations, and complexities in managing multiple accounts.

While similar in some ways, 457(b) rollovers have unique features compared to 401(k) or 403(b) rollovers, like specific withdrawal rules and tax implications.

Timing for tax efficiency, post-rollover asset allocation, leveraging Roth conversions, diversifying the retirement portfolio, and regular re-evaluation are all key strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.