A Traditional IRA Rollover pertains to the movement of funds from one retirement savings account, such as a 401(k) or another IRA, into a Traditional IRA. With this mechanism, individuals can consolidate their retirement assets, often for simplification, better investment choices, or both. A rollover transaction is usually initiated by the account holder but executed by the financial institutions holding the accounts. Yet, it's not just a matter of shuffling funds. Several guidelines, particularly those stipulated by the IRS, govern the manner and frequency of such rollovers. Being unaware can result in unexpected tax liabilities or penalties, turning a simple decision into a complicated financial quagmire. Understanding tax implications is crucial for Traditional IRA holders. While these accounts provide notable tax benefits, their complexity can lead to costly mistakes. Proper knowledge helps savers navigate potential pitfalls and secure their financial future.

Traditional IRAs and Roth IRAs are siblings in the retirement savings family, but with contrasting tax features. Traditional IRA contributions can provide tax deductions in the year of contribution, meaning taxes are deferred until withdrawals during retirement. Conversely, Roth IRAs, funded with after-tax dollars, allow for tax-free distributions, granted certain conditions are met. This fundamental difference also extends to rollovers. Rolling funds from a Traditional IRA to another similar account typically involves no immediate tax, but converting a Traditional IRA to a Roth IRA creates a taxable event. Understanding these nuances is paramount when considering any movement of funds. One of the initial aspects to understand is the difference between a direct and indirect rollover. In a direct rollover, money moves directly between financial institutions, never touching the hands of the account holder. This method generally doesn't trigger taxes. An indirect rollover, however, involves the account holder taking temporary possession of the funds. This method comes with a tighter set of rules and potential tax implications, especially if the funds aren’t deposited into the new account promptly. Rolling over funds from one Traditional IRA to another is usually straightforward, and if done correctly, incurs no immediate tax. This process essentially lets you consolidate your IRAs, perhaps for better management or investment choices. If executed directly between financial institutions, it becomes a seamless transfer with zero tax hitches. However, like any financial move, precision matters. Ensure that the receiving institution knows it’s a rollover, and not a fresh contribution, which could lead to issues like exceeding annual contribution limits. Fancy a brief loan from your IRA? Well, it's risky business, but it's feasible, courtesy of the 60-day rollover rule. If you take money out of your Traditional IRA, you have 60 days to put it back or roll it into another IRA to avoid taxes and penalties. It's like a short-term loan, but failure to redeposit the funds in time spells tax trouble. And there’s an added caveat: this can only be done once in a 12-month period across all IRAs. Converting a Traditional IRA to a Roth IRA is often termed a "backdoor" way to fund a Roth when income limits prevent direct contributions. But this backdoor isn't without its tolls. Since Roth IRAs are funded with after-tax dollars and Traditional IRAs are typically funded with pre-tax dollars, converting means paying tax on the amount you move. It's a present-day tax hit for potential future tax-free withdrawals. However, the allure of tax-free Roth distributions, especially in a scenario where one expects higher future tax rates, can make this conversion an enticing strategy. Still, one must evaluate the immediate tax impact before jumping in. Is Roth conversion the golden ticket? Not always. Several factors can influence this decision. The foremost is the tax bracket—both current and anticipated future ones. I f you believe you're in a lower tax bracket now than you'll be in retirement, conversion could be beneficial. Other elements include your investment time horizon, estate planning goals, and current financial situation. It's a jigsaw puzzle where all the pieces need to fit perfectly. When transitioning from a workplace 401(k) to a Traditional IRA, the rollover route you select holds profound tax consequences. As with IRAs, direct rollovers—where funds move from institution to institution—are smoother and typically tax-free. However, opt for an indirect rollover, and you might stumble upon mandatory withholding rules. This could see 20% of your money held back for taxes, a chunk you'll need to replace from other sources if you wish to avoid taxes on the distribution. That 20% withholding during an indirect rollover from a 401(k) isn’t a final tax, but more of an IRS insurance policy. If you complete the rollover within 60 days, the withheld amount can be reclaimed when you file your taxes. However, fail to redeposit the full amount, including the withheld 20%, into the new IRA, and it becomes a taxable distribution. Plus, if you're under 59.5 years old, you might also face a 10% early withdrawal penalty. Time is money, and in the world of IRA rollovers, this adage rings particularly true. Observing rollover deadlines isn't just a best practice—it's an essential one. The 60-day rule for rollovers, if flouted, can trigger a myriad of penalties and taxes. Not only does the distribution become taxable, but you might also be slapped with a 10% early withdrawal penalty if you're under age 59.5. Rollovers aren't an everyday event, and their infrequent nature makes it even more crucial to get them right. Keeping an eagle eye on the calendar ensures that your retirement savings continue to enjoy their tax-advantaged status. Woe befalls those who miss the IRA rollover deadline. What was intended as a simple account transfer or temporary loan becomes a taxable event. But it doesn't end there. On top of taxes on the distribution, there are potential penalties. If you're younger than 59.5, brace for an additional 10% early distribution penalty. This duo of tax and penalty can substantially erode your retirement savings. Moreover, if the missed rollover was intended to consolidate accounts, you’re left with multiple accounts, diluting your ability to streamline investments and account management. The IRS isn't one for ambiguity. Its penalties for missed rollovers are well-defined. Beyond the tax on the distribution amount, there's the 10% early distribution penalty if you're under 59.5. However, remember that not all is lost. Certain exceptions might save you from this penalty, such as if the distribution was used for specific medical expenses or a first-time home purchase. Yet, relying on these exceptions isn’t a strategy; it's a salvage operation. Records are your compass in the retirement savings journey. Proper documentation provides a clear path through the labyrinth of tax rules and stipulations. Keeping track of contribution dates, amounts, and any distributions or rollovers can make tax time a breeze. This practice isn't just for IRS purposes. It also equips you with a snapshot of your retirement savings health, guiding future decisions. Inaccurate or lost records can lead to issues like double taxation or missed deduction opportunities. The solution? Cultivate a habit of meticulous record-keeping. It's a small investment of time with potentially significant returns. Like speed limits on a highway, IRA contribution limits ensure you don’t go overboard. Each year, the IRS stipulates how much you can contribute to IRAs. Exceeding these limits, either accidentally or through misinformed enthusiasm, can lead to penalties. It's not just about being aware of the limits, but also monitoring your contributions diligently. As time progresses, the IRS may adjust these limits. Such changes underline the importance of staying updated on retirement savings rules. It's a dynamic landscape, and navigation requires up-to-date maps. The world of rollovers and conversions isn’t a minefield, but it does have its traps. Proper execution is the bridge between a successful rollover and an expensive tax mishap. Direct rollovers, where funds transfer from institution to institution, are the safest bet. However, if handling an indirect rollover, ensure funds are redeposited into the new account within 60 days. Conversions, especially to Roth IRAs, come with their tax considerations. Before executing one, it's wise to weigh the tax implications against the potential future benefits of tax-free Roth distributions. Tax laws are like shifting sands, evolving with legislative changes and economic conditions. For the retirement saver, staying updated isn’t just beneficial—it's essential. Periodic reviews of tax laws, especially those affecting retirement accounts, ensure you're always playing by the current rules. Such reviews don't mean you have to become a tax expert. However, a basic understanding, coupled with resources or professionals for deeper insights, can be instrumental in optimal retirement planning. Sometimes, the best tool in your retirement planning arsenal is expert advice. Tax professionals, armed with up-to-date knowledge and experience, can guide you through complex decisions. Whether it’s a rollover, conversion, or just annual tax planning, their insights can be invaluable. Yet, a professional's advice is most effective when coupled with personal knowledge. Understanding the basics ensures you can ask the right questions and make informed decisions based on their guidance. The digital age offers myriad tools to simplify retirement planning. Financial calculators can predict potential future account values, tax implications of conversions, or even the impact of early withdrawals. These tools, while not a substitute for professional advice, offer a snapshot of potential outcomes. Before making any significant moves with your IRA, such as rollovers or conversions, it's wise to run the numbers. The digital playground offers numerous resources—using them can be a step towards a more secure financial future. Navigating the intricacies of Traditional IRA rollovers requires astute knowledge of tax implications. A Traditional IRA Rollover facilitates the movement of funds between retirement accounts, often streamlining assets for improved management or diversified investment options. However, the process is bound by stringent IRS regulations. Missteps, such as missing the 60-day redeposit window, can lead to substantial tax liabilities and penalties. The distinction between Traditional and Roth IRAs plays a pivotal role, especially when considering tax repercussions. Direct rollovers, involving a straightforward transfer between institutions, are generally tax-free, while indirect rollovers come with potential tax complications. Furthermore, converting a Traditional IRA to a Roth IRA incurs taxes, given the differing tax structures. Therefore, understanding these nuances is essential to avoid pitfalls. Employing the expertise of tax professionals, maintaining meticulous records, and leveraging financial tools can assist account holders in making informed decisions, ensuring a robust and tax-efficient retirement planning strategy.What Is a Traditional IRA Rollover?

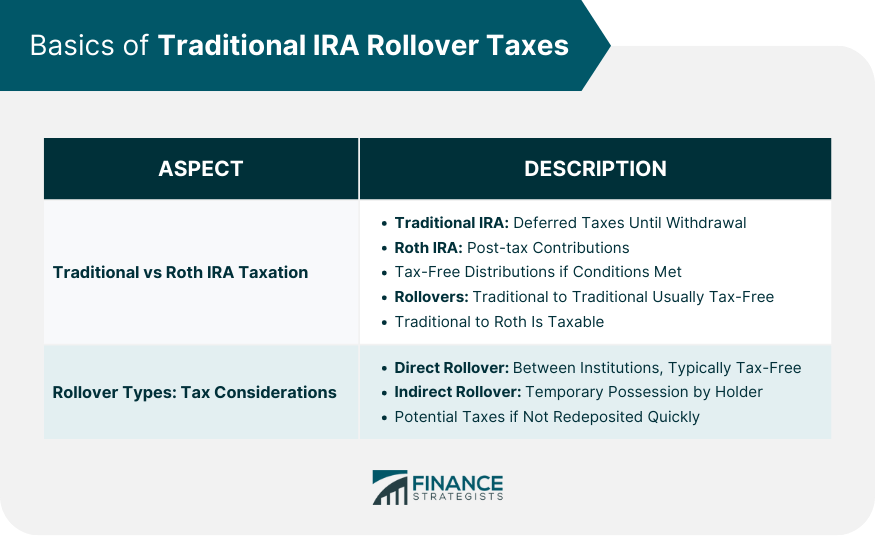

Basics of Traditional IRA Rollover Taxes

Difference Between Traditional IRA and Roth IRA Taxation

Rollover Process: Key Tax Considerations

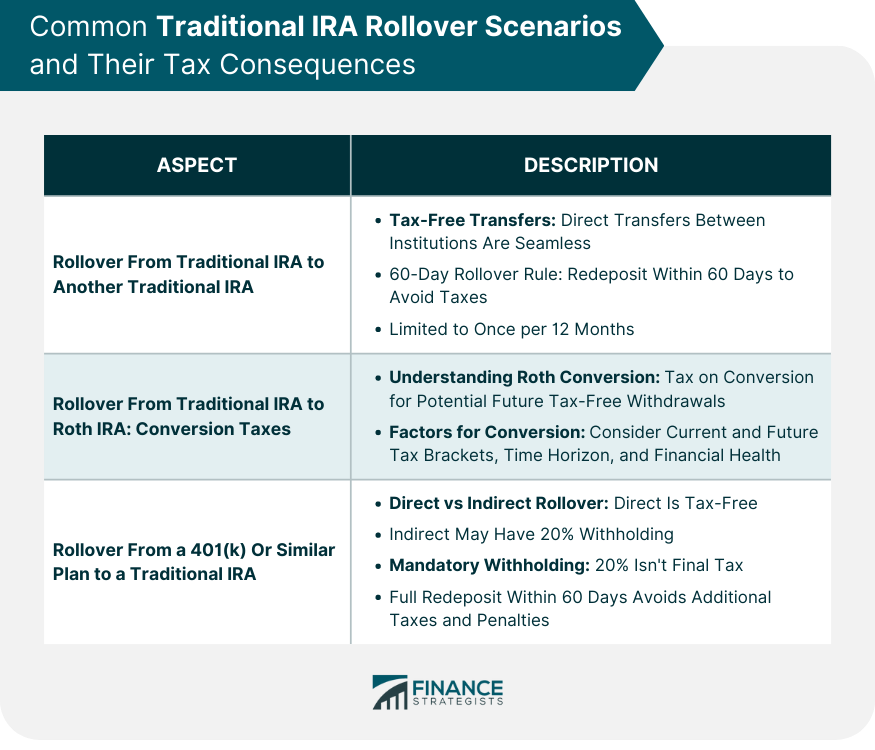

Common Traditional IRA Rollover Scenarios and Their Tax Consequences

Rollover From Traditional IRA to Another Traditional IRA

Tax-Free Transfers

60-Day Rollover Rule

Rollover From Traditional IRA to Roth IRA: Conversion Taxes

Understanding Roth Conversion Taxes

Factors Impacting the Conversion Decision

Rollover From a 401(k) or Similar Plan to a Traditional IRA

Direct vs Indirect Rollover Differences

Mandatory Withholding and Tax Implications

Consequences of Missed Rollover Deadlines and Potential Penalties

Importance of Observing Rollover Deadlines

Tax and Financial Consequences of Missing Deadlines

Overview of Penalties and Their Calculations

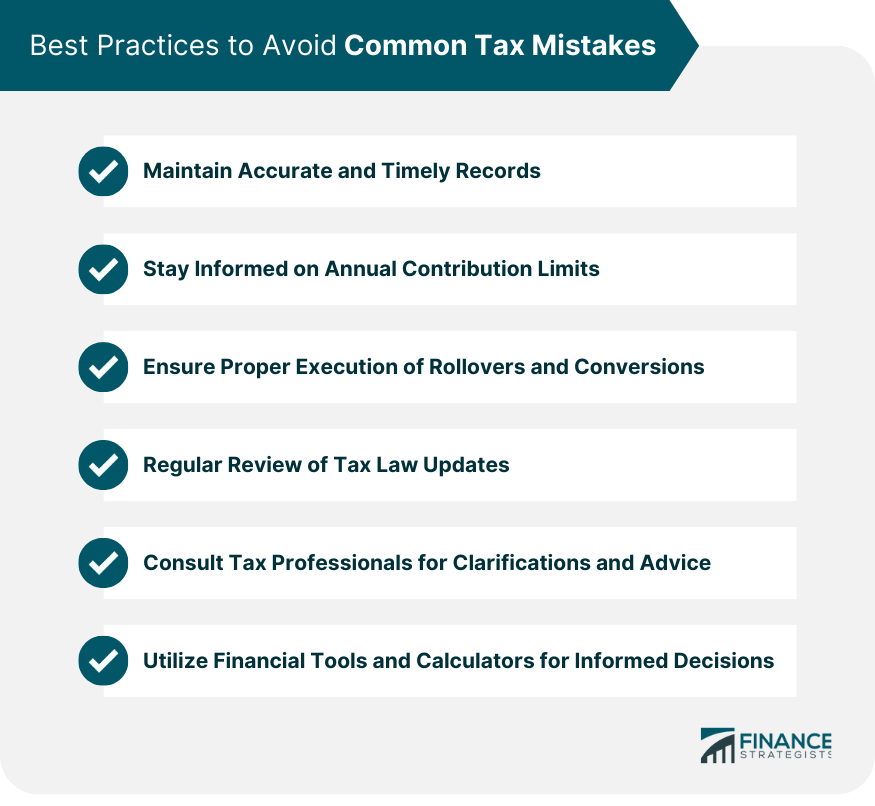

Best Practices to Avoid Common Tax Mistakes

Maintain Accurate and Timely Records

Stay Informed on Annual Contribution Limits

Ensure Proper Execution of Rollovers and Conversions

Regular Review of Tax Law Updates

Consult Tax Professionals for Clarifications and Advice

Utilize Financial Tools and Calculators for Informed Decisions

Bottom Line

Tax Consequences for Common Traditional IRA Rollover FAQs

A Traditional IRA rollover is the transfer of funds from one retirement account to a Traditional IRA, which can be used to consolidate retirement assets.

Traditional IRA contributions may be tax-deductible with taxes deferred until withdrawal, while Roth IRAs are funded post-tax and allow tax-free distributions.

Taxes can arise if rollovers aren't executed properly. Direct transfers between financial institutions are usually tax-free, while indirect rollovers have specific guidelines.

Missed deadlines can result in taxable distributions and potential penalties, especially if you're under 59.5 years old.

Tax professionals provide expert advice, ensuring you optimize your savings and adhere to evolving tax laws related to retirement accounts.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.