Peer-to-Peer (P2P) lending is a groundbreaking financial practice that enables individuals or businesses to lend or borrow money directly, bypassing traditional financial intermediaries like banks. This is facilitated through online platforms that match lenders with borrowers, a process that has been greatly enhanced by technology. The rise of user-friendly interfaces, mobile apps, and the adoption of blockchain technology have made P2P lending more efficient, transparent, and secure. The main advantages of P2P lending include lower interest rates and flexible terms for borrowers, and higher returns and portfolio diversification for lenders. However, there are also risks to consider. Borrowers with a poor credit rating could face higher interest rates, while lenders must contend with the possibility of borrower default. Despite these challenges, P2P lending continues to revolutionize the financial industry, offering a compelling alternative to traditional lending models. At its core, P2P lending operates by facilitating a connection between those needing to borrow money and those willing to lend it. Prospective borrowers apply online, and if approved, their loan is listed on the platform where investors can choose to fund part or all of the requested loan. Technology has played a crucial role in the success of P2P lending, with platforms like LendingClub, Prosper, and Funding Circle leading the way. These platforms offer user-friendly interfaces and mobile apps that simplify the lending process, making it more accessible and convenient. Blockchain and cryptocurrencies have the potential to revolutionize P2P lending by offering secure, transparent, and decentralized platforms. Companies like SALT and Ethlend already leverage blockchain technology to offer crypto-backed P2P loans, removing geographical constraints and lowering transaction costs. With the rise of digital platforms comes the challenge of data security and privacy. P2P lending platforms must ensure robust cybersecurity measures to protect sensitive user data and maintain trust. One of the most significant advantages of P2P lending is that it often offers lower interest rates for borrowers compared to conventional banks. This is mainly due to the absence of overhead costs associated with traditional banking infrastructures. P2P lending also provides flexible loan terms, offering a variety of loan amounts and repayment periods to cater to diverse financial needs. It's known for faster loan approval and funding, thanks to the streamlined online processes. For lenders, P2P platforms offer potentially higher returns than traditional saving mechanisms. These platforms also provide opportunities for portfolio diversification, as lenders can invest in a variety of loans with different risk profiles. The primary risk for borrowers is the potential for higher interest rates if they have a poor credit rating. For lenders, the risk lies in the possibility of borrowers defaulting on their loans. Also, P2P lending platforms are not covered by the Federal Deposit Insurance Corporation (FDIC), making investments riskier than traditional bank deposits. Despite its benefits, P2P lending also presents some challenges. Borrowers with poor credit ratings may face higher interest rates compared to those offered by traditional banks. Unlike traditional lending, P2P lending eliminates the need for a financial institution as a middleman. The process is often faster, as everything is conducted online, and loans can be approved and funded within days. P2P lending provides a more personalized and transparent lending experience. Lenders can choose the loans they fund, and borrowers can often find better rates than with traditional banks. While P2P lending has many advantages, it also faces several challenges. The lack of a physical presence can deter some potential users, and the risk of platform insolvency can be a concern. In many countries, P2P lending platforms are required to comply with the same regulations as traditional financial institutions. They must ensure anti-money laundering (AML) procedures are in place, adhere to consumer protection laws, and abide by credit laws and regulations. Regulations can both facilitate and limit the growth of P2P lending. On one hand, clear and fair regulations can boost consumer trust in these platforms. On the other hand, overly stringent or unclear regulations can stifle innovation and growth. One of the main regulatory challenges is the balancing act between consumer protection and fostering innovation. Striking the right balance is key to maintaining a healthy, competitive P2P lending industry. The future of peer-to-peer lending is shaped by several trends. Technological innovations, like AI and blockchain, are enabling more efficient risk assessment and transactions. Regulatory developments are also crucial, providing a legal framework for this sector's growth. Additionally, the increased need for diversification in investment portfolios and the search for high-yield alternatives amid a low-interest-rate environment are driving the influx of investors. Lastly, a growing cultural shift towards more inclusive financial services, which P2P lending inherently supports, is further fueling this sector's expansion. In the coming decade, we can expect P2P lending to become more mainstream, with further integration into the broader financial system. The use of AI and machine learning for credit scoring and risk management will likely become more prevalent, and may see more innovation around loan products. Innovation and technology will continue to be key drivers of the P2P lending industry. Likely see advancements in AI for credit assessments, blockchain for secure and transparent transactions, and more sophisticated platforms to enhance the user experience. Peer-to-Peer (P2P) lending signifies a shift in the financial industry, allowing individuals or businesses to lend or borrow money directly through online platforms, bypassing the traditional financial intermediaries. As technology continues to evolve, its role in P2P lending becomes more pronounced. Platforms offer user-friendly interfaces and innovative features to ensure a smooth and transparent lending process. Blockchain technology is also contributing to the industry by providing secure, transparent, and decentralized lending platforms. While P2P lending presents several advantages such as lower interest rates and flexible terms for borrowers, and higher returns and portfolio diversification for lenders, it also comes with its set of challenges. These include potentially higher rates for borrowers with poor credit, and the risk of default for lenders. Move forward, a balanced understanding of these advantages and risks will be crucial for the continued growth and innovation in the P2P lending industry.Definition of Peer-To-Peer Lending

Mechanism of Peer-To-Peer Lending

Role of Technology in Peer-to-Peer Lending

Technology Platforms and Apps for Peer-To-Peer Lending

Impact of Blockchain and Cryptocurrencies on Peer-To-Peer Lending

Data Security and Privacy in Peer-To-Peer Lending

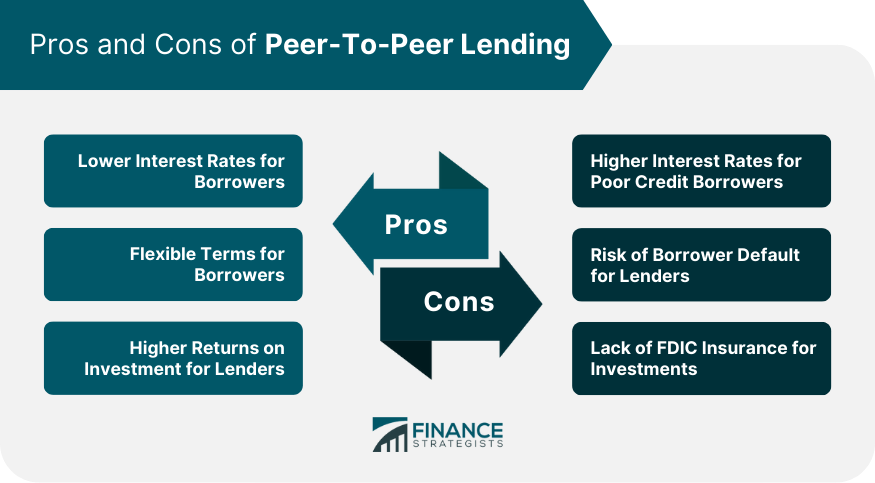

Advantages and Disadvantages of Peer-To-Peer Lending

Advantages of Peer-To-Peer Lending

Disadvantages of Peer-To-Peer Lending

Peer-To-Peer Lending vs Traditional Lending

How Peer-To-Peer Lending Differs From Traditional Lending

Benefits of Peer-To-Peer Lending Over Traditional Lending

Challenges Peer-To-Peer Lending Faces Compared to Traditional Lending

Regulatory Environment of Peer-To-Peer Lending

Overview of Regulations Governing Peer-To-Peer Lending

Impact of Regulations on the Growth of Peer-To-Peer Lending

Regulatory Challenges in Peer-To-Peer Lending

The Future of Peer-To-Peer Lending

Trends Influencing the Future of Peer-To-Peer Lending

Predictions for Peer-To-Peer Lending in the Next Decade

Role of Innovation and Technology in the Future of Peer-To-Peer Lending

Conclusion

Peer-to-Peer Lending FAQs

Peer-to-Peer (P2P) lending is a method of lending money to individuals or businesses through online services that directly match lenders with borrowers, effectively bypassing traditional financial institutions like banks.

In P2P lending, prospective borrowers apply for loans through an online platform. If approved, their loan is listed on the platform where investors can choose to fund part or all of the loan. These platforms leverage technology to facilitate and streamline the lending process.

The advantages of P2P lending include lower interest rates and more flexible terms for borrowers, as well as higher returns and portfolio diversification for lenders. However, risks include potentially higher rates for borrowers with poor credit and the possibility of borrower default for lenders. Also, unlike traditional bank deposits, P2P loans are not FDIC insured.

P2P lending differs from traditional lending in that it eliminates the financial institution as a middleman. This can make the lending process faster and more transparent. However, the lack of a physical presence can deter some potential users, and P2P platforms face regulatory challenges and risks of insolvency.

The future of P2P lending looks promising with increasing digitization, the rise of blockchain technology, and growing demand for personalized financial services. It's expected that P2P lending will become more mainstream, integrate more deeply into the financial system, and leverage AI and machine learning for credit scoring and risk management.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.