A 401(k) is an employer-sponsored retirement savings plan named after a section of the U.S. Internal Revenue Code. It permits employees to allocate a portion of their pre-tax paycheck towards retirement savings. Taxes on these contributions are deferred until the funds are withdrawn. In the face of declining pension plans and the potential instability of Social Security, self-directed retirement plans such as 401(k)s have become vital to secure financial stability in retirement. These plans offer tax advantages that accelerate the growth of individual savings. Younger individuals can harness the power of compound interest over a longer time frame, thus allowing their savings to grow exponentially. As individuals age, the investment strategy often transitions from wealth accumulation to wealth preservation. Therefore, the average 401(k) balance typically increases with age, mirroring the accumulation of contributions over an individual's working years.

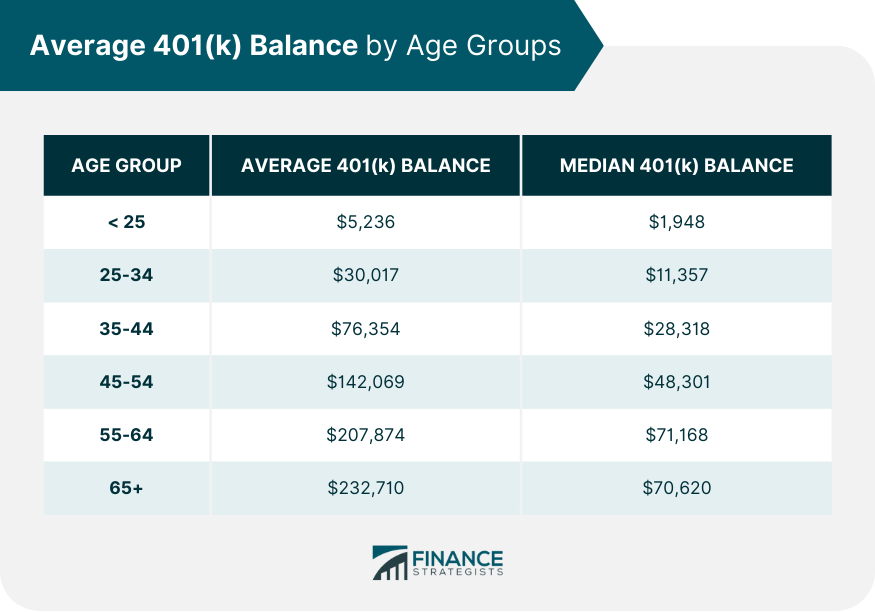

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Understanding the average 401(k) balance by age is crucial for benchmarking your retirement savings. Generally, younger workers should aim for a balance that is at least half their annual salary by age 30, and by age 50, strive for six times their salary. To enhance your 401(k) balance, maximize employer contributions, diversify your investments, and regularly review your portfolio. Ready to secure your financial future? Start optimizing your 401(k) strategy today for a comfortable retirement. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation 401(k) balances typically increase with age, reflecting both increased earnings (and, therefore, contributions) and the growth of investments over time. Younger employees are likely to have lower balances due to lower salaries and fewer years of contributions, while older employees tend to have higher balances. Factors influencing the size of 401(k) balances include the individual's income, their saving rate, the rate of return on invested funds, and the length of time the funds have been invested. External factors, such as the general state of the economy and financial market performance, can also impact the size of 401(k) balances. According to Vanguard's 2023 data, the median balance for individuals starting their careers is $1,948, with an average balance of $5,236. These balances are lower due to less time in the workforce and lower initial salaries. During this age range, the average 401(k) balance increases to $30,017, with a median balance of $11,357. This increase is due to rising incomes and a greater emphasis on saving for retirement. By this age, individuals face multiple financial obligations, including mortgage payments and raising a family. Despite these responsibilities, the average 401(k) balance from Vanguard's 2023 data jumps to $76,354, and the median balance rises to $28,318, indicating that many continue prioritizing retirement savings. In this decade, individuals often earn larger paychecks than ever before. The average 401(k) balance further increases to $142,069, with a median balance of $48,301, suggesting that many can maximize their 401(k) contributions. For those nearing retirement, diversification in assets becomes increasingly critical. The average 401(k) balance peaks at $207,874, with a median balance of $71,168 according to Vanguard's 2023 data. For those in the retirement age bracket, the average balance remains substantial at $232,710, with a median balance of $70,620 according to Vanguard's 2023 data. Apart from age and personal financial behaviors, various external factors can influence 401(k) balances. Understanding these factors can help individuals better plan their retirement strategies. The state of the economy can significantly impact the performance of investments within a 401(k). During a thriving economy, the stock market typically performs well, which can boost 401(k) balances. Conversely, during a recession, the stock market may perform poorly, which can result in decreased 401(k) balances. Fluctuations in the financial market can affect the value of investments within a 401(k). Periods of high market volatility can lead to significant gains or losses in a short period, impacting the overall balance of the account. The rate of inflation can also impact the purchasing power of money saved in a 401(k). Higher inflation rates can decrease the future purchasing power of the current savings, making it necessary to save more to maintain a similar lifestyle in retirement. Changes in tax laws or retirement savings regulations can affect 401(k) balances. For instance, changes to contribution limits, withdrawal rules, or tax advantages associated with 401(k)s can influence how much individuals can save and, ultimately, the size of their retirement nest egg. Increasing your 401(k) balance isn't just about saving—it's also about implementing strategies that take advantage of employer contributions, tax rules, and market trends. Here are four strategies that can help maximize your 401(k) balance: One of the most effective strategies for maximizing a 401(k) balance is making regular contributions. Contributing consistently, regardless of market conditions, allows you to take advantage of dollar-cost averaging. This technique involves buying more shares when prices are low and fewer when prices are high, potentially lowering the average cost per share over time. Many employers offer a matching contribution up to a certain percentage of the employee's salary. For example, if your employer offers a 100% match on the first 3% of your salary that you contribute to your 401(k), and you're not contributing at least 3%, you're essentially leaving free money on the table. Always aim to contribute at least enough to get the full employer match. Putting all your eggs in one basket is generally a risky strategy. Diversification, or spreading your investments among a variety of asset classes (stocks, bonds, cash equivalents, etc.), can help manage risk and potentially increase returns over time. Always remember to review your portfolio regularly and rebalance as needed to maintain your desired asset allocation. If you're aged 50 or over, the IRS allows you to make additional "catch-up" contributions to your 401(k) beyond the standard limit. For 2024, the standard limit is $23,000, but those aged 50 and older can contribute an additional $7,500 for a total of $30,500. Maximizing these catch-up contributions can significantly boost your 401(k) balance. The average 401(k) balance generally increases with age, reflecting a combination of higher earnings, increased years of contributions, and the growth of investments over time. Balances range from an average of $5,236 for individuals aged 25 and younger to over $232,710 for those aged 65 and older. Age plays a significant role in 401(k) balances. Younger individuals have the benefit of time, allowing compound interest to work in their favor. As individuals age, the focus often shifts towards wealth preservation, with strategies pivoting accordingly. Planning for retirement is a lifelong process that involves regular saving, smart investing, and frequent reassessment of goals and strategies. By understanding how factors such as age and market conditions affect your 401(k) balance, you can make informed decisions to ensure a comfortable retirement.Overview of 401(k) Retirement Savings

Learn From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Understanding the Average 401(k) Balance by Age

Brief Explanation of How 401(k) Balances Vary by Age

Overview of Factors Influencing 401(k) Balances

Breakdown of Average 401(k) Balance by Age Groups

Average 401(k) Balance for Individuals Aged 25 and Younger

Average 401(k) Balance for Individuals Aged 25-34

Average 401(k) Balance for Individuals Aged 35-44

Average 401(k) Balance for Individuals Aged 45-54

Average 401(k) Balance for Individuals Aged 55-64

Average 401(k) Balance for Individuals Aged 65 and Older

External Factors Affecting 401(k) Balances

Economic Conditions

Market Volatility

Inflation Rate

Legislative Changes

Strategies for Maximizing 401(k) Balances

Regular Contributions

Maximize Employer Match

Diversify Investments

Take Advantage of Catch-up Contributions

The Bottom Line

Understanding the Average 401(k) Balance by Age FAQs

The average 401(k) balance varies by age, with younger individuals typically having smaller balances due to less time in the workforce. Balances generally increase with age, reflecting higher earnings and increased years of contributions.

Age impacts the 401(k) balance as it reflects the accumulation of contributions and investment returns over time. Older individuals typically have higher balances due to longer periods of saving and investing.

Economic conditions, market volatility, inflation rates, and legislative changes are external factors that can significantly impact 401(k) balances.

Regular contributions, maximizing employer match, diversifying investments, and making catch-up contributions (if eligible) are effective strategies to maximize a 401(k) balance.

Yes, the average 401(k) balance is typically higher than the median because it is skewed by high earners. The median, representing the middle point of a data set, is often a more accurate reflection of what most individuals have saved.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.