A profit sharing plan rollover to a 401(k) refers to the process of transferring funds from a profit sharing plan into a 401(k) retirement account. A profit sharing plan is an employer-sponsored retirement plan that allows employers to contribute a portion of the company's profits to employees' retirement savings. On the other hand, a 401(k) retirement plan is a tax-advantaged retirement savings plan offered by employers, where employees can contribute a portion of their salary towards their retirement savings. Profit sharing plans are often added to traditional 401(k) plans rather than used exclusively. The difference is that employees can not contribute to a profit sharing plan, but by combining it with a 401(k), both employees and employers can contribute. It is possible to roll over a profit sharing 401(k) into an individual retirement account, just as it can be done with a traditional 401(k). Need help with a Profit Sharing Plan Rollover? Click here.

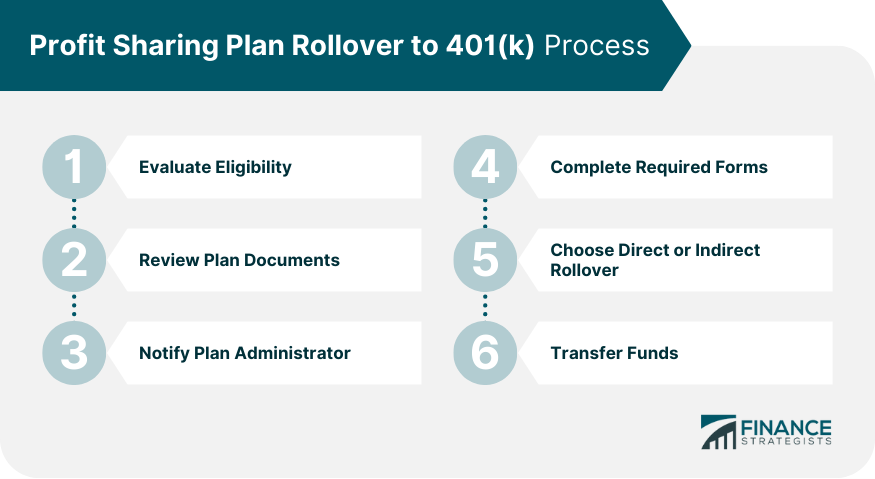

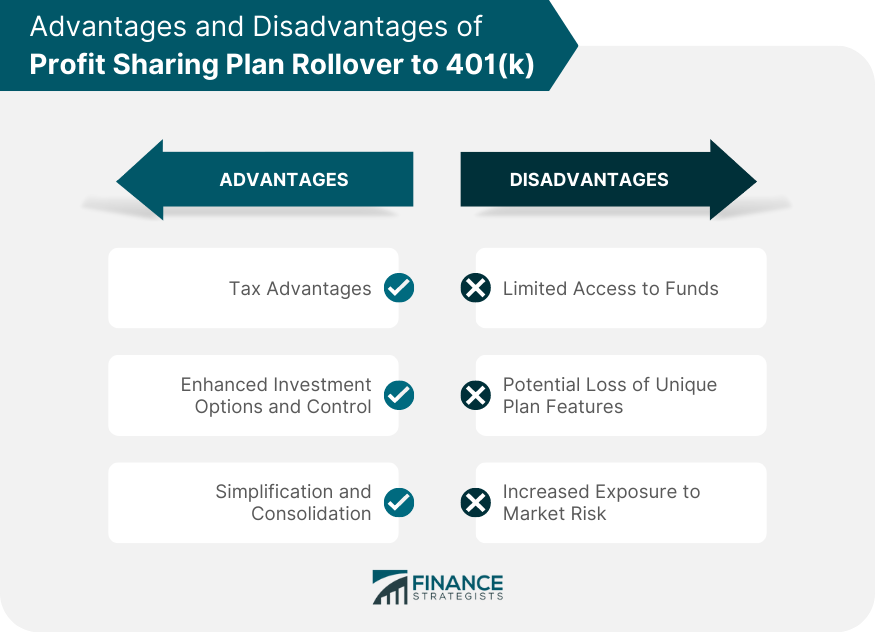

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Rolling over a Profit Sharing Plan into a 401(k) smartly consolidates retirement savings, potentially simplifying management and broadening investment choices. This move can offer tax-deferred growth and possibly lower fees, enhancing your nest egg's potential. Consider exploring this strategy further to make your retirement savings work harder for you. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation A Profit Sharing Plan Rollover to a 401(k) involves the process of transferring funds from a profit sharing plan into a 401(k) retirement account. Here is a step-by-step explanation of how it typically works: Determine if you are eligible to perform a rollover. Typically, eligibility requirements depend on the terms of your profit sharing plan and the rules of the 401(k) plan. Obtain and review the plan documents for both the profit sharing plan and the 401(k) plan. These documents provide specific details about the rules, requirements, and restrictions related to rollovers. Inform the administrator of your profit sharing plan about your intention to rollover the funds into a 401(k) account. They will guide you through the necessary steps and provide the required paperwork. Obtain and complete the necessary forms for initiating the rollover process. This may include a distribution request form from the profit sharing plan and a rollover contribution form from the 401(k) plan. Decide whether you want to perform a direct rollover or an indirect rollover. A direct rollover involves transferring the funds directly from the profit sharing plan to the 401(k) plan. While an indirect rollover involves receiving the distribution as a check and then depositing it into the 401(k) plan within 60 days. If you opt for a direct rollover, provide the required information to the profit sharing plan administrator and instruct them to transfer the funds directly to the 401(k) plan. If you choose an indirect rollover, ensure that the distribution check is made payable to the 401(k) plan custodian or trustee. By rolling over funds from a profit sharing plan to a 401(k), individuals can benefit from tax-deferred growth, allowing their investments to potentially compound over time without being subject to immediate taxes. Additionally, contributions made to a 401(k) account may be tax-deductible, reducing current taxable income and potentially lowering overall tax liability. Furthermore, individuals have the option to convert rollover funds to a Roth 401(k), which can provide tax-free withdrawals in retirement, as qualified distributions from Roth accounts are not subject to income tax. Unlike profit sharing plans, 401(k) plans typically offer a broader range of investment choices, including various mutual funds, stocks, bonds, and target-date funds. This allows individuals to diversify their retirement portfolio and tailor their investments based on their risk tolerance and retirement goals. Additionally, some employers may provide matching contributions specifically to 401(k) accounts, further increasing the total savings and potential growth of the rollover funds. This combination of investment flexibility and potential employer contributions can significantly enhance long-term retirement savings. By consolidating funds from a profit sharing plan into a 401(k), individuals can streamline their retirement savings strategy, reducing the number of separate accounts and paperwork to manage. This consolidation also makes it easier to track and monitor investment performance, as all retirement funds are housed in a single 401(k) account. Additionally, rolling over to a 401(k) may offer the potential for lower fees compared to some profit sharing plans, resulting in cost savings and potentially higher investment returns. When funds are rolled over from a profit sharing plan to a 401(k), they become subject to the rules and restrictions of the 401(k) plan. This means that individuals may face limitations on accessing their funds until they reach retirement age or meet specific criteria, such as financial hardship or separation from the employer. Therefore, if individuals anticipate needing to access their retirement savings before reaching retirement age, a Profit Sharing Plan Rollover to a 401(k) may not be the most suitable option. Profit sharing plans can have unique features that differ from 401(k) plans, such as more flexible contribution limits, higher employer contributions, or early retirement provisions. By rolling over funds to a 401(k), individuals may lose access to these specific plan features, potentially impacting their retirement strategy. It is crucial to carefully evaluate the specific advantages of the profit sharing plan before deciding to roll over funds to a 401(k). The investment performance of funds within a 401(k) account is subject to market fluctuations and risks. By rolling over funds from a profit sharing plan to a 401(k), individuals assume a potentially higher level of investment risk, particularly if the profit sharing plan offered more conservative or stable investment options. It is important to evaluate the investment options available within the 401(k) plan and consider one's risk tolerance and long-term investment strategy before proceeding with a rollover. Determining the appropriate time to perform a Profit Sharing Plan Rollover to a 401(k) depends on various factors and individual circumstances. Here are some situations when it may be advantageous to consider a rollover: If you are changing jobs or transitioning to a new employer, it is often a suitable time to consider a rollover. Rolling over funds from a profit sharing plan to a 401(k) can consolidate your retirement savings into a single account, making it easier to manage and track your investments. If you are nearing retirement or have reached the age of 59½, it may be beneficial to evaluate the rollover option. Rolling over funds to a 401(k) can provide access to a wider range of investment options and potentially simplify your retirement savings strategy. If you anticipate being in a lower tax bracket during the rollover year or expect higher taxes in the future, it might be advantageous to perform a rollover. However, it is crucial to consult with a tax professional to assess the tax implications and determine the most appropriate timing for your specific tax situation. The process of a Profit Sharing Plan Rollover to a 401(k) involves transferring funds from a profit sharing plan to a 401(k) retirement account. This enables individuals to benefit from tax advantages, enhanced investment options and control, and simplification and consolidation of their retirement savings. However, it's important to consider potential disadvantages, such as limited access to funds, potential loss of unique plan features, and increased exposure to market risk. The decision of when to perform a rollover depends on individual circumstances, including employment changes, retirement planning, and tax considerations. Consulting with professionals and thoroughly understanding the implications can help individuals make informed decisions regarding their Profit Sharing Plan Rollover to a 401(k).What Is a Profit Sharing Plan Rollover to 401(k)?

Learn From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Profit Sharing Plan Rollover to 401(k) Process

Step 1: Evaluate Eligibility

Step 2: Review Plan Documents

Step 3: Notify Plan Administrator

Step 4: Complete Required Forms

Step 5: Choose Direct or Indirect Rollover

Step 6: Transfer Funds

Advantages of Profit Sharing Plan Rollover to 401(k)

Tax Advantages

Enhanced Investment Options and Control

Simplification and Consolidation

Disadvantages of Profit Sharing Plan Rollover to 401(k)

Limited Access to Funds

Potential Loss of Unique Plan Features

Increased Exposure to Market Risk

Timing the Profit Sharing Plan Rollover to 401(k)

Employment Change

Retirement Planning

Tax Planning

The Bottom Line

Profit Sharing Plan Rollover to 401(k) FAQs

A 401(k) plan is a retirement plan offered by an employer designed to help employees save for retirement.

Profit sharing plans are often added to traditional 401(k) plans rather than used exclusively. It is possible to roll over a profit sharing 401(k) into an individual retirement account, just as it can be done with a traditional 401(k).

Generally, any employee who participates in a company's profit sharing plan and has at least five years of service with the organization will be eligible for a Profit Sharing Plan Rollover to 401(k).

Yes, the transfer of assets from a profit sharing plan to a 401(k) plan is treated as taxable income for both federal and state taxes in the year that it occurs. The company may also be required to pay applicable employer withholding taxes on the rollover.

Yes, Profit Sharing Plan Rollovers must be completed by December 31st of the calendar year in order for employees to take advantage of the tax-deferred growth opportunities offered by this type of arrangement.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.