A 401(k) plan is a retirement savings account that allows employees to invest a portion of their paycheck before taxes are taken out. These plans, named for the section of the Internal Revenue Code that defines them, are offered by employers as a benefit to their employees. Funds in a 401(k) grow tax-free until they are withdrawn, typically during retirement. At the point of withdrawal, they are taxed as ordinary income. In addition to employee contributions, employers often match a certain percentage of the employee's contributions, further enhancing the potential for savings growth. There are penalties for withdrawing funds from a 401(k) before reaching a certain age, typically 59½, unless specific conditions are met. Unlike traditional pension plans that guarantee a fixed income in retirement, 401(k) plans shift the responsibility to the individual. The amount available during retirement depends on contributions made, investment choices, and market performance. This includes any employment contracts, hiring paperwork, or benefits documentation you received when you started your job. These records often detail the benefits provided by the employer, including retirement plans. If you have kept copies of your pay stubs, these can also be a good indication; look for deductions labeled as 401(k) contributions. Another effective method is reviewing your past financial statements. Old bank statements may show deposits from 401(k) disbursements or transfers. Similarly, if you've ever rolled over a 401(k) into an IRA or another account, there would be records of these transactions in your financial documents. If you're unsure about past 401(k) accounts from previous jobs, it's a good idea to reach out to those employers. The HR or benefits department would typically have records of any 401(k) plans set up during your employment. When contacting, ensure you provide them with the dates of your employment and any other relevant details to help locate your records. There are several prominent retirement plan providers that many employers use for 401(k) services. Companies like Fidelity, Vanguard, and Charles Schwab might have records if your employer used their platforms. Contacting these providers directly and providing them with your personal details can help in tracing any old or forgotten accounts. The National Registry of Unclaimed Retirement Benefits is a free service that helps individuals locate potential unclaimed retirement benefits. By entering your Social Security Number, you can search to see if there are any matches for forgotten or unclaimed 401(k) accounts. The Social Security Administration (SSA) sends out statements that detail your reported earnings and the estimated benefits you can expect to receive. Occasionally, these statements may also include information about potential 401(k) or pension plans from past employers. By reviewing these statements or engaging with the SSA, you might uncover details about old retirement accounts. Financial advisors or retirement planning professionals can be invaluable in helping trace lost or forgotten 401(k) plans. They often have access to resources, databases, and contacts that can expedite the process. Furthermore, once the accounts are located, they can provide advice on how to manage or consolidate them for maximum benefit. Several online databases and platforms help individuals trace their retirement accounts. Websites such as the Pension Benefit Guaranty Corporation or the Employee Benefits Security Administration offer tools and resources to assist in tracking down 401(k) accounts. Additionally, doing a general online search with your details and past employers might yield results or lead you to platforms that can assist in your search. One of the primary advantages is that contributions are made with pre-tax dollars, which means that the amount you contribute to your 401(k) plan reduces your taxable income for that year. This deferred taxation system not only helps reduce your current taxable income but also allows your investments to grow tax-free until you decide to withdraw during retirement. At that time, distributions are generally taxed at a potentially lower rate, especially if you're in a lower tax bracket upon retirement. Arguably, one of the most attractive features of a 401(k) plan is employer matching. Many employers offer a matching contribution up to a certain percentage of the employee's salary. This is essentially "free money" added to your retirement savings. By contributing enough to take full advantage of your employer's match, you can significantly boost the growth of your retirement fund. The exact match ratio varies by employer, but a common setup might be a dollar-for-dollar match up to 3% of an employee's salary, for example. Over the long term, the compounding effect of the quarterly returns on a 401(k) account can be quite powerful. By continually reinvesting earnings, employees can potentially earn returns on both their principal and the interest that has previously been added to it. Additionally, 401(k) plans often provide a range of investment options, such as mutual funds, stocks, bonds, and more. This diversification allows participants to tailor their portfolios based on their risk tolerance and investment goals, potentially maximizing returns over the course of decades. While 401(k) plans often offer a selection of investment options, the choices can sometimes be limited compared to other investment platforms. Unlike a personal brokerage account, where you might have access to a vast array of stocks, bonds, and other securities, a 401(k) might only offer a curated selection of mutual funds and other assets. This limitation can be restrictive for seasoned investors looking to diversify their portfolios in specific ways. Dipping into your 401(k) before you reach the age of 59½ is not advisable due to hefty penalties. Early withdrawals are subject to a 10% penalty on top of the regular income tax that must be paid on the distribution. This can significantly erode the value of the investment. There are certain exceptions, such as hardship withdrawals, but even these can come with financial consequences. While 401(k) plans offer many benefits, they aren't always free. Many plans come with administrative fees that can eat into your returns over time. These fees might cover the costs of record-keeping, legal services, and other administrative duties related to the management of the plan. Over the course of many years, even seemingly small fees can add up and affect the overall growth of your retirement savings. A 401(k) plan is a retirement savings account allowing pre-tax contributions, often matched by employers. The process to find your plan involves checking employment records, reviewing financial statements, contacting past employers, consulting retirement providers, using the National Registry of Unclaimed Retirement Benefits. It is also recommended to engage with the Social Security Administration. Seeking professional advice and employing online resources are also valuable strategies. The advantages of a 401(k) plan encompass tax benefits, deferred contributions, employer matching, and investment growth opportunities. However, potential disadvantages include limited investment choices, early withdrawal penalties, and potential administrative fees. While 401(k) plans offer tax advantages and employer contributions, careful consideration of the limitations and potential drawbacks is crucial for making informed decisions about your retirement savings strategy.Definition of a 401(k) Plan

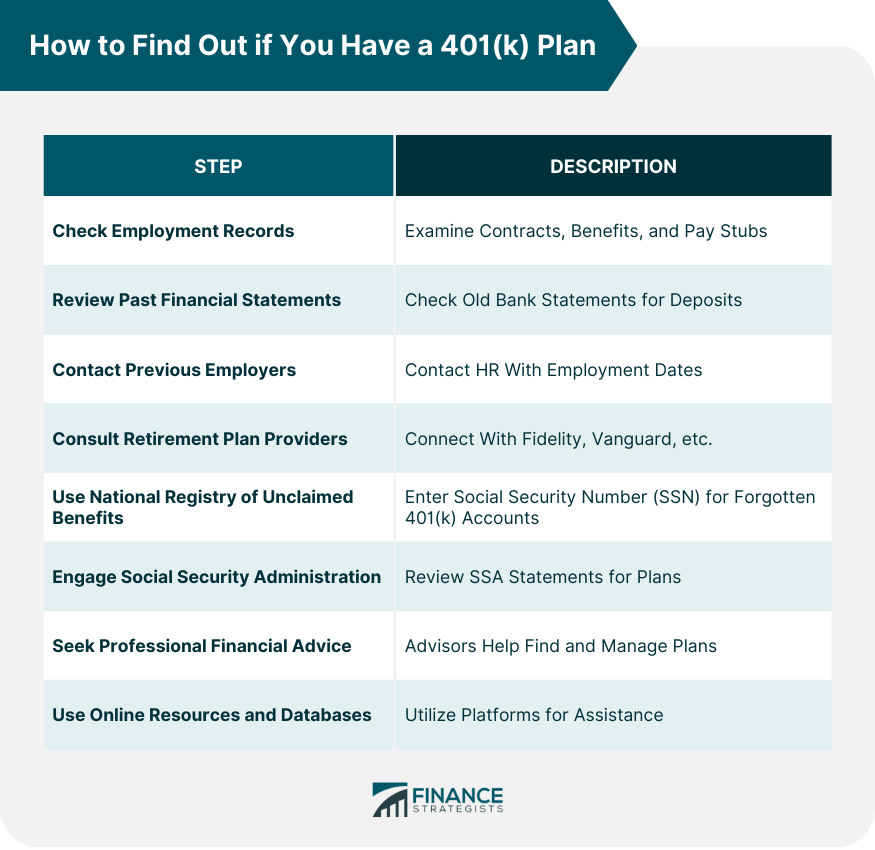

How to Find Out if You Have a 401(k) Plan

Check Employment Records

Review Past Financial Statements

Contact Previous Employers

Consult With Retirement Plan Providers

Utilize the National Registry of Unclaimed Retirement Benefits

Engage With the Social Security Administration

Seek Professional Financial Advice

Employ Online Resources and Databases

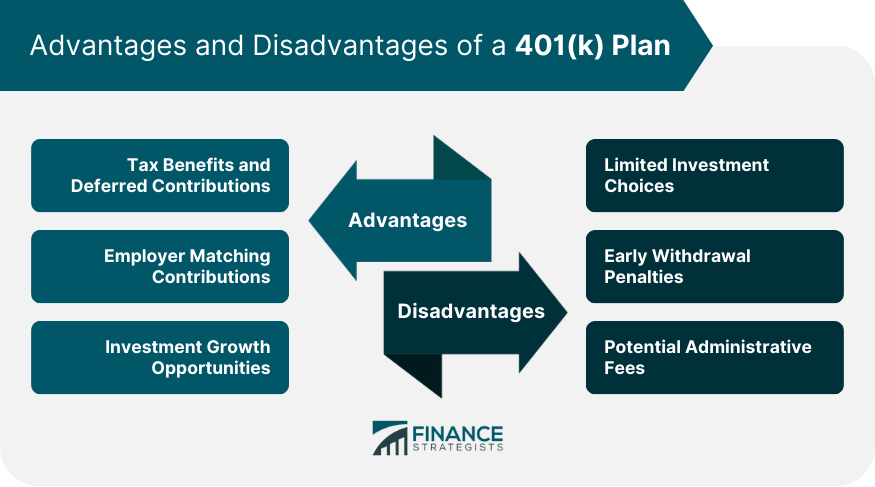

Advantages of a 401(k) Plan

Tax Benefits and Deferred Contributions

Employer Matching Contributions

Investment Growth Opportunities

Disadvantages of a 401(k) Plan

Limited Investment Choices

Early Withdrawal Penalties

Potential Administrative Fees

Conclusion

How to Find Out if You Have a 401(k) Plan FAQs

For 2023, the contribution limit for employees is $22,500 annually. Those aged 50 and over can make an additional catch-up contribution of $7,500, bringing their total allowable contribution to $30,000.

You can start withdrawing from your 401(k) without incurring the 10% early withdrawal penalty once you reach the age of 59½.

No, not all employers offer a matching contribution. The specifics of the match, if one is offered, vary from one employer to another. Always check with your HR department about the specifics of your company's 401(k) plan.

If you change jobs, you generally have several options: You can leave the money in your previous employer's plan, roll it over into a new employer's 401(k), roll it into an Individual Retirement Account (IRA), or cash out. Cashing out can lead to penalties and tax consequences.

Many 401(k) plans allow participants to take loans against their accounts. However, there are often restrictions, and the loan typically needs to be paid back with interest. If you fail to repay the loan, it may be treated as a distribution and subject to taxes and penalties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.