Value investing is an investment strategy that aims to identify undervalued stocks and assets in the market. It is based on the principle that markets can sometimes misprice securities, leading to opportunities for investors to buy them at a discount and profit from their subsequent increase in value. The concept of value investing dates back to the 1920s and 1930s when Benjamin Graham, widely regarded as the father of value investing, introduced the idea of "investing in a dollar for fifty cents." Since then, value investing has become a popular investment approach, with notable practitioners like Warren Buffett and Seth Klarman achieving great success with their value-based strategies. Have questions about Value Investing? Click here. The principles of value investing are centered on identifying undervalued stocks and assets and investing in them with a margin of safety. The following are the key principles of value investing: Value investing is about finding securities trading below their intrinsic value. This requires investors to conduct fundamental analysis and valuation to determine the true worth of a company's assets, earnings, and future prospects. The goal is to find companies trading at a discount to their intrinsic value, which could be due to temporary market dislocations, unfavorable news or industry trends, or simply because investors overlook them. To determine a company's intrinsic value, value investors use fundamental analysis and valuation techniques that look at a company's financial statements, earnings, dividends, cash flows, and other key indicators. This helps them to assess the company's financial health, growth potential, competitive advantages, and other factors that may affect its future performance. Some common valuation techniques used in value investing include the price-to-earnings (P/E) ratio, price-to-book (P/B) ratio, and discounted cash flow (DCF) analysis. One of the key tenets of value investing is to invest with a margin of safety. This means buying securities at a discount to their intrinsic value, so even if the market misprices them further, investors are still protected against significant losses. In addition, value investors focus on risk management by diversifying their portfolios and avoiding speculative or high-risk investments. Value investing is a long-term investment approach that requires patience and discipline. Value investors are willing to wait for their investments to appreciate over time and avoid the temptation to chase short-term market trends. This helps them avoid the market's volatility and uncertainty and focus on the fundamentals of the companies they invest in. Value investing is also about being contrarian and avoiding the market herd mentality. Value investors look for opportunities where others may not see them and are willing to invest in companies that may be out of favor with the market or are experiencing temporary setbacks. This helps them to buy low and sell high rather than follow the crowd and buy high and sell low. Several key figures have shaped the development of value investing over the years. These include Benjamin Graham, Warren Buffett, and other notable value investors who have achieved great success with their value-based strategies. Benjamin Graham is widely regarded as the father of value investing and is known for his influential book "The Intelligent Investor." He introduced the "margin of safety" concept and emphasized the importance of fundamental analysis and valuation in investing. Graham's approach was based on buying undervalued stocks and assets and holding them long-term, regardless of short-term market fluctuations. Warren Buffett is one of the most successful investors of all time and is often called the Oracle of Omaha. He is a disciple of Graham's value-based approach and has applied it greatly in his investment portfolio. Buffett is known for focusing on buying high-quality companies at a reasonable price and holding them long-term. He has also emphasized the importance of a solid corporate culture and management team in his investment decisions. Other notable value investors include Seth Klarman, Joel Greenblatt, and Howard Marks. Klarman is the founder of Baupost Group, a hedge fund known for its value-based approach, and is known for his disciplined and patient investment style. Greenblatt is the founder of Gotham Capital and the author of "The Little Book That Beats the Market," which outlines his value-based investment strategy. Marks is the founder of Oaktree Capital and is known for emphasizing risk management and downside protection. Value investing encompasses a range of investment strategies that aim to identify undervalued stocks and assets in the market. Some key value investing strategies include: Deep value investing involves investing in stocks that are trading at a deep discount to their intrinsic value, often due to temporary market dislocations or unfavorable industry trends. This strategy requires investors to conduct extensive fundamental analysis and valuation and to be patient and disciplined in their investment decisions. Dividend investing involves investing in stocks that pay high dividends relative to their market price. This strategy is popular among income-oriented investors looking for steady and reliable returns. Dividend investing also provides a margin of safety by providing a steady stream of income that can help offset market fluctuations. Growth at a Reasonable Price (GARP) investing involves investing in stocks with strong growth potential but trading at a reasonable price relative to their earnings growth rate. This strategy combines value and growth investing elements and seeks to identify companies with a sustainable competitive advantage well-positioned for long-term growth. Contrarian investing involves investing in stocks that are out of favor with the market or experiencing temporary setbacks. This strategy requires investors to be patient and disciplined in their investment decisions and to have a contrarian mindset that looks for opportunities where others may not see them. Value investing is one of several investment approaches available to investors, each with its strengths and weaknesses. The following are some key differences between value investing and other investment approaches: Value investing focuses on buying stocks trading at a discount to their intrinsic value, while growth investing focuses on buying stocks with strong growth potential. Value investing tends to be more defensive and risk-averse, while growth investing tends to be more aggressive and speculative. Value investing involves actively selecting individual stocks that are undervalued, while index investing involves investing in a diversified portfolio of stocks that track a specific index, such as the S&P 500. Value investing requires more research and analysis, while index investing is more passive and low-cost. Value investing focuses on buying stocks trading at a discount to their intrinsic value. Meanwhile, momentum investing focuses on buying stocks with strong price momentum likely to continue performing well in the short term. Value investing tends to be more long-term focused, while momentum investing tends to be more short-term. Value investing offers several potential benefits and risks that investors should consider: Potential for Higher Returns. Value investing can generate higher returns than other investment approaches, as it focuses on buying undervalued stocks and assets that have the potential to appreciate over time. Lower Risk Compared to Other Investment Approaches. Value investing offers a margin of safety by buying stocks at a discount to their intrinsic value, which provides some protection against market fluctuations and downside risks. Requires Discipline and Patience. Value investing requires a long-term perspective, as it may take time for undervalued stocks and assets to appreciate. This approach requires investors to have discipline and avoid chasing short-term market trends. Possibility of Value Traps and Prolonged Periods of Underperformance. Value investing is not without its risks, such as the possibility of investing in a "value trap," where a stock or asset appears undervalued but fails to appreciate. Value investing can also experience prolonged periods of underperformance, as undervalued stocks may take time to appreciate. Getting started with value investing requires developing a value investing mindset and philosophy, conducting fundamental analysis and valuation, and creating a diversified value investing portfolio. The following are some critical steps to get started with value investing: 1. Develop a Value Investing Mindset and Philosophy. Value investing requires discipline, patience, and a contrarian mindset. Value investing is an approach used successfully by many notable investors over the years. It involves identifying undervalued stocks and assets and investing in them with a margin of safety. Value investing requires discipline, patience, and a contrarian mindset, and it offers the potential for higher returns and lower risk compared to other investment approaches. To get started with value investing, investors should focus on developing a value investing mindset and philosophy, conducting fundamental analysis and valuation, and creating a diversified value investing portfolio. If you want to start with value investing, it is important to understand the principles and strategies involved. However, it can be overwhelming to navigate the complexities of the market on your own. That is why it is important to consider hiring a financial advisor who specializes in wealth management to help you develop a value investing portfolio.An Overview of Value Investing

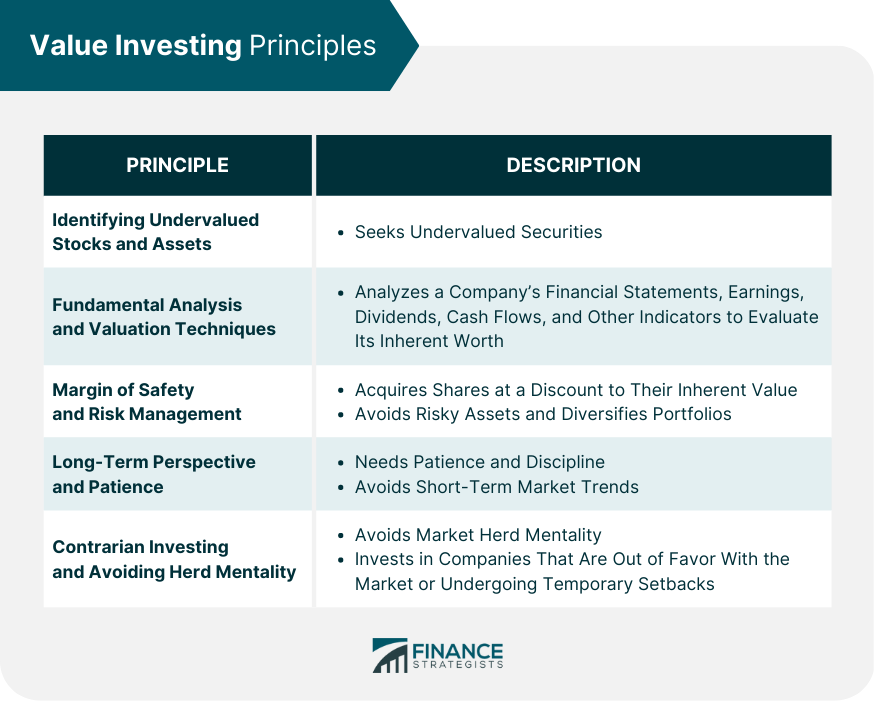

Principles of Value Investing

Identifying Undervalued Stocks and Assets

Fundamental Analysis and Valuation Techniques

Margin of Safety and Risk Management

Long-Term Perspective and Patience

Contrarian Investing and Avoiding Herd Mentality

Key Figures in Value Investing

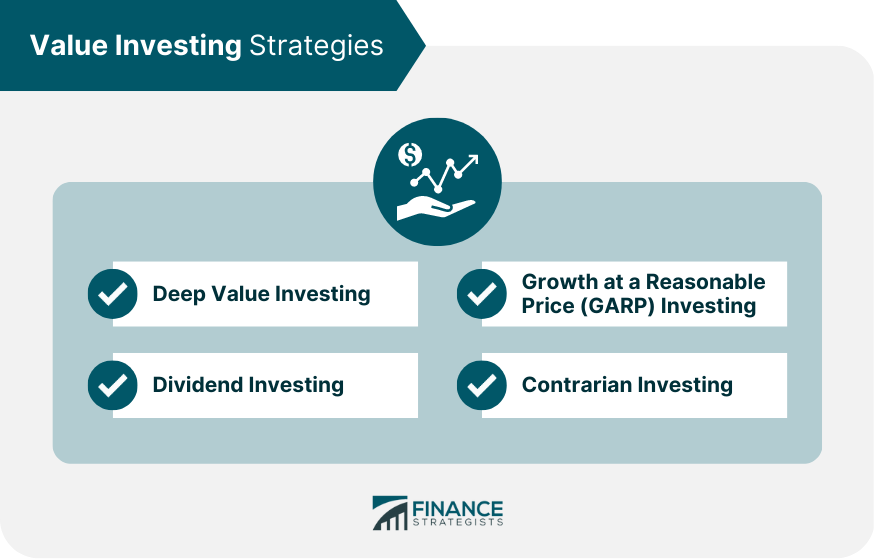

Value Investing Strategies

Deep Value Investing

Dividend Investing

Growth at a Reasonable Price (GARP) Investing

Contrarian Investing

Value Investing vs Other Investment Approaches

Value Investing vs Growth Investing

Value Investing vs Index Investing

Value Investing vs Momentum Investing

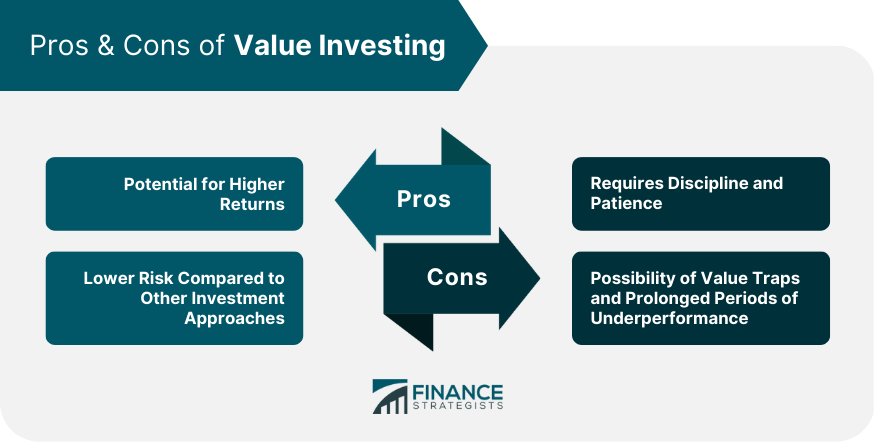

Benefits and Risks of Value Investing

How to Get Started With Value Investing

Investors should focus on buying undervalued stocks and assets with a margin of safety and avoiding speculative or high-risk investments.

2. Conduct Fundamental Analysis and Valuation. Investors should conduct fundamental analysis and valuation to identify undervalued stocks and assets.

This involves looking at a company's financial statements, earnings, dividends, cash flows, and other key indicators to determine its intrinsic value.

3. Create a Diversified Value Investing Portfolio. To minimize risk and maximize returns, investors should create a diversified value investing portfolio with undervalued stocks and assets across different industries and sectors.

Conclusion

Value Investing FAQs

Value investing is an investment strategy that involves identifying undervalued stocks and assets and investing in them with a margin of safety. It differs from other investment strategies, such as growth investing and momentum investing, which focus on buying stocks with strong growth potential or price momentum.

Some key figures in value investing include Benjamin Graham, Warren Buffett, Seth Klarman, Joel Greenblatt, and Howard Marks. They have all made significant contributions to value investing through their investment strategies, books, and teachings.

Some potential benefits of value investing include the potential for higher returns, lower risk compared to other investment approaches, and a focus on long-term value creation. However, value investing also carries risks, such as the possibility of investing in value traps and experiencing prolonged periods of underperformance.

To get started with value investing, investors should focus on developing a value investing mindset and philosophy, conducting fundamental analysis and valuation, and creating a diversified value investing portfolio. This involves researching companies, analyzing financial statements, and developing a disciplined and patient investment approach.

Yes, investors interested in value investing may benefit from working with a financial advisor who can provide personalized guidance and advice. A financial advisor can help investors navigate the complexities of the market, develop a value investing strategy that aligns with their investment goals and risk tolerance, and make informed investment decisions.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.