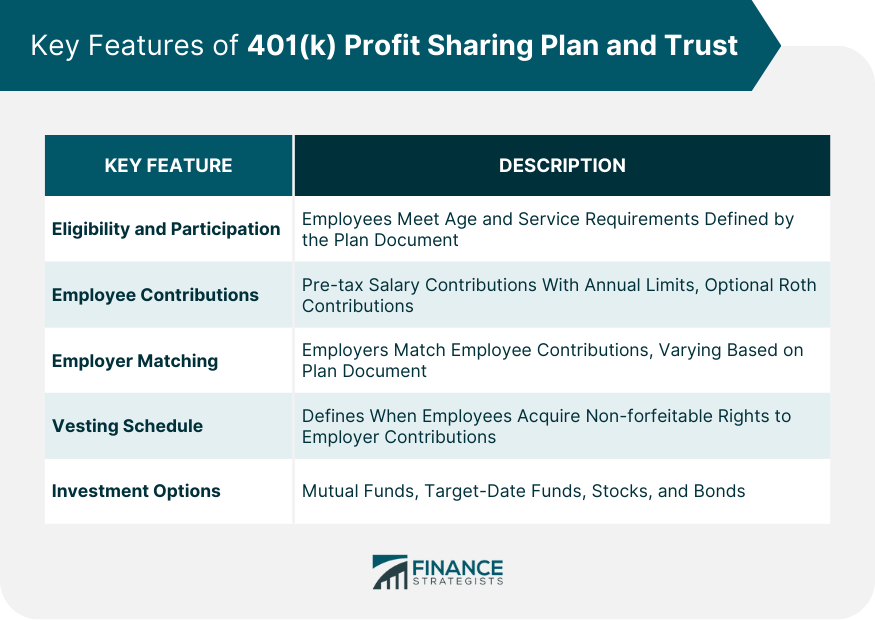

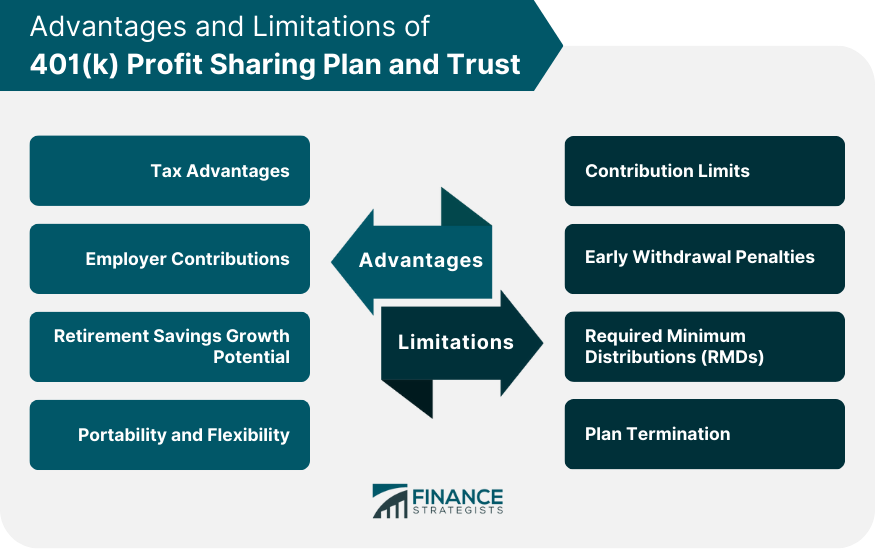

A 401(k) profit sharing plan combines the features of a traditional 401(k) plan with a profit sharing component, offering a retirement saving solution that's potentially beneficial for both employees and employers. Trust, in this context, refers to the legal entity that holds the plan's assets. The 401(k) profit sharing plan and trust allows employers to contribute to employees' retirement funds based on company profits, fostering a vested interest in the company's success. Many 401(k) profit sharing plans still use a trust, who may also be the administrator, to oversee the assets in the plan. The purpose of the trust is to handle the managerial aspects of the plan. The trust has a fiduciary responsibility to act in the best interests of the participants. Typically, employees are eligible to participate if they meet the age and service requirements outlined in the plan document. The employer, however, has discretion in defining these requirements, offering some flexibility in aligning the plan with the company's specific goals and employee demographics. Contributions made by employees are one of the essential facets of any 401(k) plan. Participants can contribute a portion of their pre-tax salary, up to an annual limit set by the IRS. Additionally, some plans offer the option of making Roth contributions, which are made with after-tax dollars and allow for tax-free withdrawals in retirement. A characteristic feature of many 401(k) profit sharing plans is employer matching contributions. In this scenario, the employer matches a portion of the employee's contributions, essentially providing free money towards the employee's retirement savings. The matching formula, however, can vary from one plan to another and is generally outlined in the plan document. The vesting schedule defines when employees acquire non-forfeitable rights to employer contributions made to their 401(k) accounts. Vesting can be immediate or gradual over a number of years, depending on the vesting schedule implemented by the employer. The last, but certainly not least, key feature of a 401(k) profit sharing plan is the variety of investment options. Employees can typically choose from a range of investment options, including mutual funds, target-date funds, and individual stocks and bonds. The selection of investments plays a crucial role in the potential growth of retirement savings. Employee contributions are made pre-tax, reducing the participant's taxable income for the year. Additionally, the contributions grow tax-deferred until they are distributed, allowing the savings to compound over time without being eroded by taxes. The profit sharing aspect of this plan introduces an added advantage – employer contributions. These contributions, which are tied to the company's profits, have the potential to significantly augment an employee's retirement savings. Moreover, they engender a sense of shared success, linking the employees' financial wellness to the company's prosperity. One of the main draws of a 401(k) profit sharing plan is the potential for substantial retirement savings growth. Through a combination of employee contributions, employer contributions, and tax-deferred compounding, retirement savings can grow significantly over the long term. If employees change jobs, they can typically roll over their savings into a new employer's plan or into an Individual Retirement Account (IRA). This feature provides employees with continued control over their retirement savings, regardless of their employment situation. The IRS sets an annual limit on the amount an employee can contribute. Additionally, there's a limit on the total contributions (including both employee and employer contributions) that can be made to a participant's account each year. If participants withdraw funds from the plan before reaching age 59 ½, they may be subject to a 10% early withdrawal penalty, in addition to paying income taxes on the amount withdrawn. This penalty is designed to discourage participants from dipping into their retirement savings prematurely. As participants age, they must start taking Required Minimum Distributions (RMDs) from their 401(k) accounts. These distributions, which must begin by April 1 following the year the participant reaches age 73 (or 72 if they reached that age before January 1, 2023), can have tax implications and limit the potential for continued tax-deferred growth. In the unfortunate event of a plan termination, participants may face a sudden and mandatory distribution of their plan assets. Such a scenario can have tax implications and disrupt the participant's retirement planning strategy. However, in most cases, participants can roll over the distributed assets into an IRA or another employer's plan to preserve the tax advantages. Running a 401(k) profit sharing plan and trust requires a significant amount of work and responsibility. The plan administrators are responsible for the day-to-day operation of the plan, which includes maintaining the plan document, administering benefits, and ensuring compliance with regulations. The trustee, on the other hand, has the responsibility for managing the plan's investments. This includes selecting the investment options offered under the plan, monitoring the performance of these investments, and making changes when necessary. It's a role that demands financial acumen and a thorough understanding of fiduciary duties. An often overlooked, but vital role of plan administrators and trustees is employee communication and education. They're responsible for informing employees about the plan's features, benefits, and risks, and providing them with the information needed to make informed decisions about participation and investment choices. The 401(k) profit sharing plan and trust provides employees with the opportunity to save for retirement on a pre-tax basis and benefit from employer contributions tied to the company's profits. It's a unique blend of self-directed saving and shared success that aligns the financial interests of the company and its employees. The key features of a 401(k) profit sharing plan and trust, including eligibility requirements, contribution options, employer matching, vesting schedules, and investment options, offer flexibility and potential for growth. While the 401(k) profit sharing plan offers several advantages, including tax benefits, employer contributions, growth potential, and portability, it's not without its limitations. Contribution limits, early withdrawal penalties, required minimum distributions, and the possibility of plan termination present challenges that need careful consideration. What Is a 401(k) Profit Sharing Plan and Trust?

Key Features of 401(k) Profit Sharing Plan and Trust

Eligibility and Participation Requirements

Employee Contribution Options

Employer Matching Contributions

Vesting Schedule

Investment Options

Advantages of 401(k) Profit Sharing Plan and Trust

Tax Advantages

Employer Contributions

Retirement Savings Growth Potential

Portability and Flexibility

Limitations of 401(k) Profit Sharing Plan and Trust

Contribution Limits

Early Withdrawal Penalties

Required Minimum Distributions (RMDs)

Plan Termination

Role of Plan Administrators and Trustees

Duties and Responsibilities

Investment Oversight

Employee Communication and Education

Final Thoughts

401(k) Profit Sharing Plan and Trust FAQs

A 401(k) Profit Sharing Plan and Trust is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their salaries for retirement. The employer can also choose to match employee contributions, add discretionary profit-sharing contributions, or both.

Employees who are age 21 or older, have worked for the company for at least one year, and are not part of a collective bargaining agreement may be eligible to contribute to the plan. Additionally, employers must provide equal participation rights regardless of job classification or length of service.

Employees can contribute pre-tax money from their salary to the plan, and the employer may choose to match contributions or add discretionary profit-sharing contributions. These funds are invested and grow tax-deferred until withdrawal at retirement age (59 ½). Withdrawals before that age are subject to income taxes and a 10% penalty.

The primary benefit of this type of plan is that it allows employees to save for retirement in a tax-advantaged way. Additionally, employers who offer a matching contribution program can attract and retain employees, and any employer contributions are tax-deductible.

Yes, distributions from a 401(K) Profit Sharing Plan and Trust before age 59 ½ may be subject to income taxes and a 10% penalty. Additionally, plan participants may be required to take minimum distributions once they reach the age of 70 ½.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.