A 401(k) profit-sharing plan is a retirement savings plan that allows employers to share profits with their employees. It is an employer-sponsored savings account that allows a certain portion of the company’s profits to be allocated to employees’ retirement accounts. Employees can contribute their own money on a pre-tax basis, reducing their overall taxable income, and employers can make matching contributions on behalf of their employees. The key features distinguishing it from other retirement savings plans are its customizable contribution caps based on individual performance, tax benefits for employers and employees, and flexibility in how contributions are made and distributed. A 401(k) profit-sharing plan operates by allowing employers to set aside a portion of their profits to be allocated to their employees’ retirement accounts. Employers can make matching contributions on behalf of their employees based on individual performance. The maximum contribution cap is set at 100% of an employee’s salary up to a predetermined limit. Employees can contribute their own money pre-tax, reducing their overall taxable income. Contributions are taken from employees’ paychecks before taxes and placed into the 401(k) plan account. The contribution limit for a 401(k) profit-sharing plan is set each year by the Internal Revenue Service (IRS) and is currently $23,000 per employee per year for 2024. A 401(k) profit-sharing plan provides many benefits to employers and employees. It can be an effective tool for helping individuals meet their financial goals now and in the future. The tax benefits of a 401(k) profit-sharing plan are one of its main draws. Employer contributions to the plan are tax-deductible as a business expense. Employees can defer taxes that would otherwise be levied on salary deferral contributions until they withdraw funds in retirement. The plan allows individuals to save more money each year through pre-tax contributions, giving them greater potential to meet their retirement goals. Employers can also offer matching contributions and other incentives, which can improve employee morale and retention. By participating in a 401(k) profit-sharing plan, employers have the opportunity to offer their employees additional retirement benefits while also obtaining significant tax deductions. This type of plan also helps employers attract and retain talented employees by providing them with extra retirement savings options. Additionally, they can help businesses attract and retain skilled workers by providing competitive benefits packages that include retirement savings options. Employees can also benefit from a 401(k) profit-sharing plan. By contributing funds to the plan, they can now take advantage of tax benefits and build up their retirement savings for later use. Additionally, employer contributions are provided on top of employee salary deferral contributions and are generally vested immediately. Employees who leave before vesting requirements are met will still receive employer contributions. This provides employees with an added incentive to stay with the same employer. The 401(k) profit-sharing plan is a popular retirement savings option for many employees, but as with any financial product, it is important to understand its drawbacks and limitations. One potential drawback to a 401(k) profit-sharing plan is the unpredictability of how much can be contributed each year, as it is based on the company's profits. Companies may not always be able to contribute the same or any amount at all, depending on their financial situation. This could lead to employees having a lower retirement income than anticipated or thought they were saving for. Another potential drawback of a 401(k) profit-sharing plan is that it may be subject to lower contribution limits than regular 401(k) plans. As these plans are based on company profits, employers may have to limit how much money can be put into the plan to ensure their financial goals and objectives are met. This could lead employees to save less for retirement than if they had chosen another type of plan. If you are considering a retirement savings plan, deciding between a profit-sharing plan and a traditional 401(k) can be difficult. While these plans are similar in many ways, some key differences should be considered before making a choice. A profit-sharing plan is an employer-sponsored retirement savings plan that sets aside a percentage of profits to share among employees. Each employee’s share of the profits depends on their salary or other criteria set by the employer. This kind of plan is not the same as a 401(k), which is a defined contribution plan in which employees make contributions from their paychecks into individual accounts. Profit-sharing plans also allow employers to give discretionary contributions that do not need to be based on profits. The main advantage of a profit-sharing plan is that employers may choose when and how much money will be available for investment. Those decisions are not tied to the success of investments in the market. The downside, however, is that because funds come from profits, they may not always be dependable from year to year. With a traditional 401(k) plan, on the other hand, contributions are steady since they come directly from employee paychecks, and employers may match contributions. However, with this type of plan, there may be restrictions regarding investment options and withdrawals before retirement age (usually 59 ½). Regardless of which type of retirement savings plan you choose, both have potential tax advantages associated with them if contributions are made on a pre-tax basis. Ultimately, each option has its own merits and corresponding advantages/disadvantages depending on individual goals and circumstances. Consulting your financial advisor is the best way to determine what works best for you. A 401(k) profit-sharing plan is an employer-sponsored retirement savings plan that allows employers to set aside a portion of their profits to share with employees. In this type of plan, each employee’s share of the profits depends on salary or other criteria set by the employer. The major advantage of a profit-sharing plan is that it gives employers flexibility in how they choose to invest and when they want to make contributions – making it a popular choice among small businesses. However, there are some potential drawbacks associated with this kind of plan. The funds for investment come from profits, so the amount available for contribution may not always be dependable from year to year. Additionally, depending on the company’s circumstances and profit margin, the total amount available may be lower than what you would get if you were to invest in a traditional 401(k) plan, where contribution comes directly from employee paychecks and may also be supplemented by employer-matching. That said, both 401(k) profit-sharing plans and traditional 401(k) plans offer tax breaks, meaning contributions are made from pre-tax income, which decreases your taxable income and therefore lowers your taxes due. When deciding between these two types of plans, it is important to consider your individual needs and discuss options with a financial advisor before making any decisions.What Is a 401(k) Profit-Sharing Plan?

How a 401(k) Profit-Sharing Plan Works

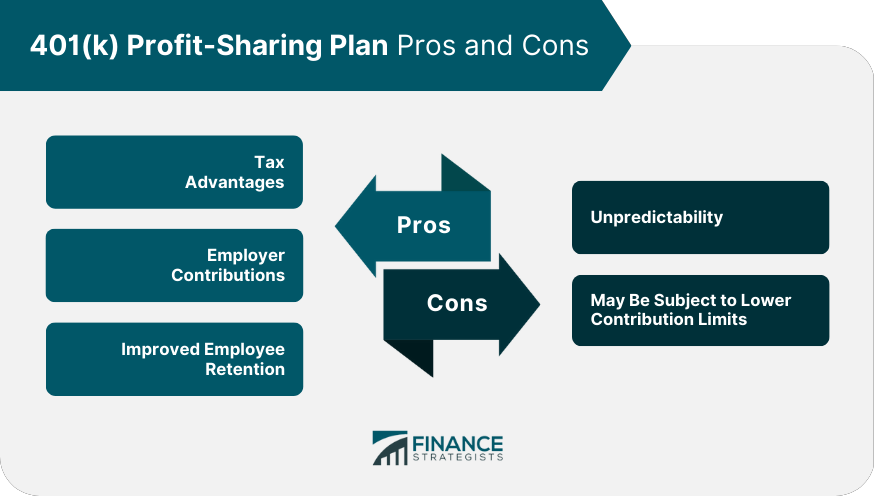

Benefits of a 401(k) Profit-Sharing Plan

Tax Advantages

Employer Contributions

Improved Employee Retention

Drawbacks of a 401(k) Profit-Sharing Plan

Unpredictability

May Be Subject to Lower Contribution Limits

401(k) Profit-Sharing Plan vs Traditional 401(k)

Final Thoughts

401(k) Profit-Sharing Plan FAQs

A 401(k) profit-sharing plan is an employer-sponsored retirement savings plan that helps employees save for retirement. The employer contributes a predetermined amount of money to the employee's account, and the employee may also contribute from their own payroll. This type of plan allows employers to set up automatic and discretionary contributions based on profits.

A 401(k) profit-sharing plan works by setting aside a percentage of profits for employees in an individual retirement savings account. The employer determines how much will be contributed per employee and how that contribution will be allocated among them (based on salary or other criteria). Both employer and employee contributions are typically pre-tax income and can provide tax benefits if utilized properly. Though certain exceptions exist, employees are usually eligible to withdraw funds when they reach 59 ½ years old.

Benefits of this type of retirement savings plan include potential tax advantages related to employer and employee contributions, more flexibility than traditionally defined contribution plans like a 401(k), and the potential for employers to attract and retain talent more easily with these incentives.

Yes, any non-elective contributions made by an employer through a profit-sharing plan count towards an employee's total annual contribution limits for all types of defined contribution plans, such as 403b, 457, SIMPLE IRA, etc.

While both types of plans offer tax advantages related to retirement savings, they have different structures which affect how investments are made and when funds can be withdrawn. A 401(k) plan is a defined contribution plan in which employees make contributions from their paychecks into individual accounts. Meanwhile, profit sharing is an employer-sponsored program in which employers can choose when and how much money will be available for investment each year, regardless of market performance.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.