Life insurance is a contractual agreement between an individual (the insured) and an insurance company. In exchange for regular premium payments, the insurance company agrees to provide a death benefit to the designated beneficiaries upon the insured person's death. The purpose of life insurance is to offer financial protection, ensuring that loved ones are financially supported and provided for in the event of the insured's passing. While the primary objective of life insurance is to provide for beneficiaries after the insured person's death, there are ways to leverage life insurance policies while alive. Using life insurance while alive involves accessing the policy's cash value or utilizing additional living benefits riders. These features provide policyholders with the opportunity to access funds or receive benefits to address various financial needs, such as emergencies, investments, healthcare expenses, or retirement income. Certain types of life insurance policies, such as whole or universal life insurance, have a cash value component that accumulates over time. This cash value can serve as a type of living benefit by allowing you to borrow against it as a loan. These loans can be used for a wide variety of purposes, including covering unexpected expenses, funding education, or supplementing retirement income. However, it's crucial to keep in mind that any unpaid loans may decrease the death benefit. Accelerated death benefits are a feature in some life insurance policies that permit policyholders to access a portion of the death benefit while they're still alive. This feature is typically activated when the policyholder is diagnosed with a terminal illness or requires long-term care. It's a powerful tool to cover medical costs or provide a steady stream of income if the policyholder is unable to work. If a policyholder no longer needs the insurance policy or finds it difficult to keep up with the premiums, they can opt to surrender the policy for its cash value, effectively terminating the policy. The surrendering of the policy could provide a lump sum that can be used for various purposes. However, it's important to remember that surrendering a policy often comes with penalties and potential tax implications. Life settlements provide an option for older policyholders to sell their life insurance policy to a third party. The selling price is usually more than the policy's cash value but less than its death benefit. While this gives a lump sum of money to the policyholder, they lose control over the policy, and the death benefit goes to the new owner. Some life insurance policies include a waiver of premium benefits. This feature waives the policy premiums in case of a severe disability or illness that prevents the policyholder from working but still keeps the policy in force. This ensures that the policyholder can still maintain their coverage even during financially difficult times. Using life insurance while you're alive can provide substantial benefits under the right circumstances. When considering using life insurance while you're alive, the first thing you should evaluate is your financial needs and goals. Life insurance can provide funds for a variety of purposes, such as covering unexpected expenses, supplementing income, or funding education. However, using your policy in this way may reduce the death benefit, which could impact your family's financial security after your death. The type of life insurance policy you have and its features significantly impact how you can use it during your lifetime. For example, term life insurance doesn't typically offer living benefits, while whole life and universal life policies do through their cash value component. Similarly, policies with features like accelerated death benefits or waivers of premiums provide additional avenues to access benefits while still alive. Understanding your policy's features is critical when considering how to use your life insurance. Your health status can also affect your decision to use life insurance while you're alive. If you're diagnosed with a terminal illness or require long-term care, you might be able to use an accelerated death benefit to cover medical costs. Alternatively, if a severe disability or illness prevents you from working, a waiver of premium can ensure your policy stays in effect even if you can't pay the premiums. It's essential to consider the potential tax implications of using life insurance while you're alive. Borrowing against the cash value of your policy is generally tax-free as long as the policy remains in force. However, surrendering your policy or selling it in a life settlement might have tax consequences. Consult with a tax advisor to understand the implications fully. Consider how using your life insurance while you're alive will affect the policy's death benefit. Using your policy's cash value, surrendering the policy, or utilizing the accelerated death benefit can reduce the amount your beneficiaries receive upon your death. If providing financial security for your loved ones after your death is a primary goal, you'll need to weigh this against the potential benefits of using your policy during your lifetime. Before deciding to utilize life insurance while alive, it's important to thoroughly understand the rules and restrictions that come with your policy. For instance, certain types of life insurance policies may have specific requirements for accessing cash value. There might be surrender charges if you choose to terminate your policy early, minimum cash value requirements that must be met, or waiting periods that must be endured before accessing certain benefits. Neglecting to understand these stipulations can result in unintended financial consequences. Life insurance, while primarily providing a financial safeguard for beneficiaries after the policyholder's death, can also be utilized while the insured is still alive. Accessing the policy's cash value or leveraging living benefits riders can help meet financial needs like emergencies, investments, or healthcare expenses. These benefits can be accessed by borrowing against the policy's cash value, surrendering the policy, activating accelerated death benefits, or using the waiver of premium benefits. The benefits accessible depend on the type of policy, its features, and the policyholder's health. However, using life insurance this way requires understanding the potential impact on the death benefit, the potential tax implications, and the policy's rules. Consultation with financial professionals is advised to navigate these complexities and align decisions with the individual's broader financial strategy.Overview of Life Insurance

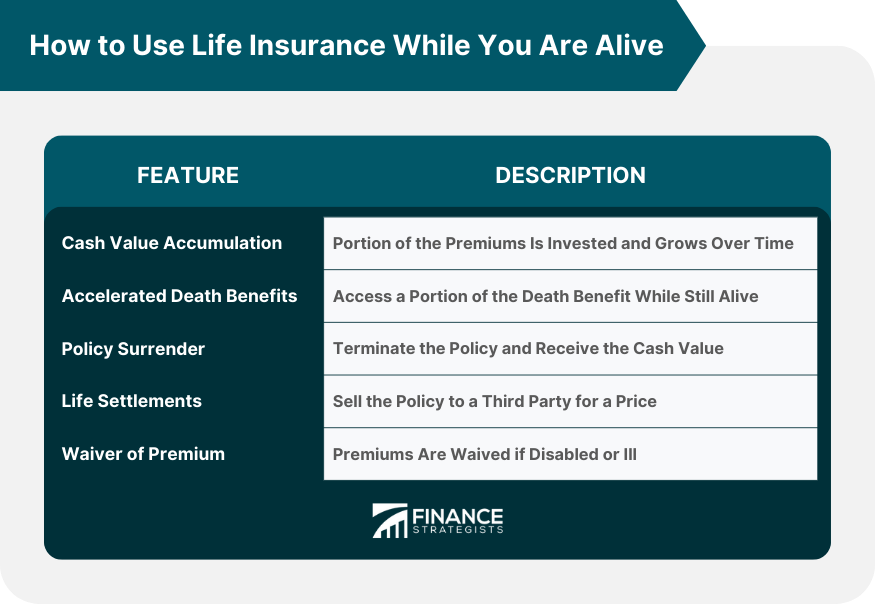

How to Use Life Insurance While You Are Alive

Cash Value Accumulation

Accelerated Death Benefits

Policy Surrender

Life Settlements

Waiver of Premium

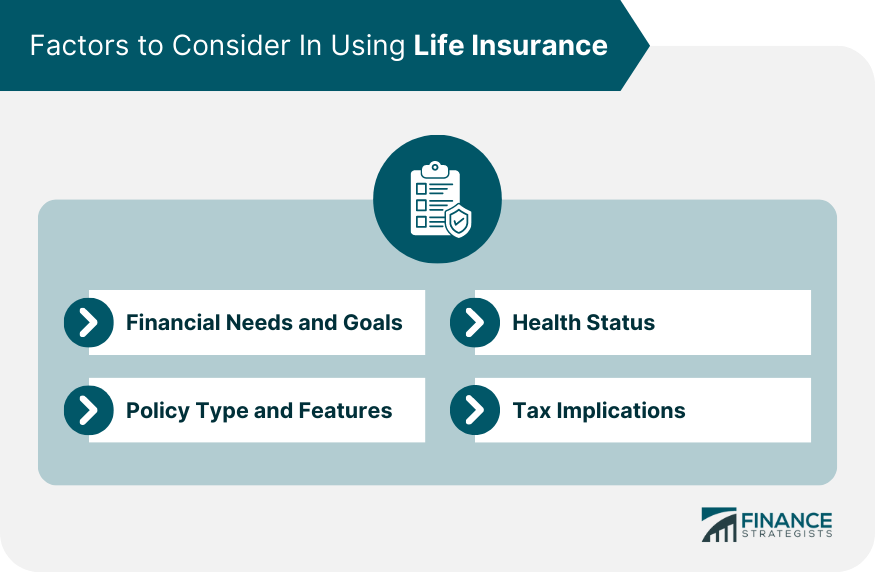

Factors to Consider in Using Life Insurance While You Are Alive

Financial Needs and Goals

Policy Type and Features

Health Status

Tax Implications

Impact on Death Benefit

Understand the Rules and Restrictions

Conclusion

How to Use Life Insurance While You Are Alive FAQs

Certain types of life insurance policies, such as cash value or permanent life insurance, allow you to accumulate savings over time that can be accessed while you are alive.

Using life insurance while you are alive can provide financial benefits such as supplementing your retirement income, paying for medical expenses, funding education, or serving as a source of emergency funds.

Depending on the policy, you may be able to access the funds through policy loans, withdrawals, or partial surrenders. It's important to review your policy and understand the specific terms and conditions for accessing the funds.

Yes, some life insurance policies offer long-term care riders or accelerated death benefits that can be used to cover expenses related to long-term care if you become chronically ill or unable to perform daily activities.

If you don't use the funds while you are alive, they will typically be paid out to your beneficiaries upon your death. It's essential to review your policy to understand the specific terms and options for distributing the proceeds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.