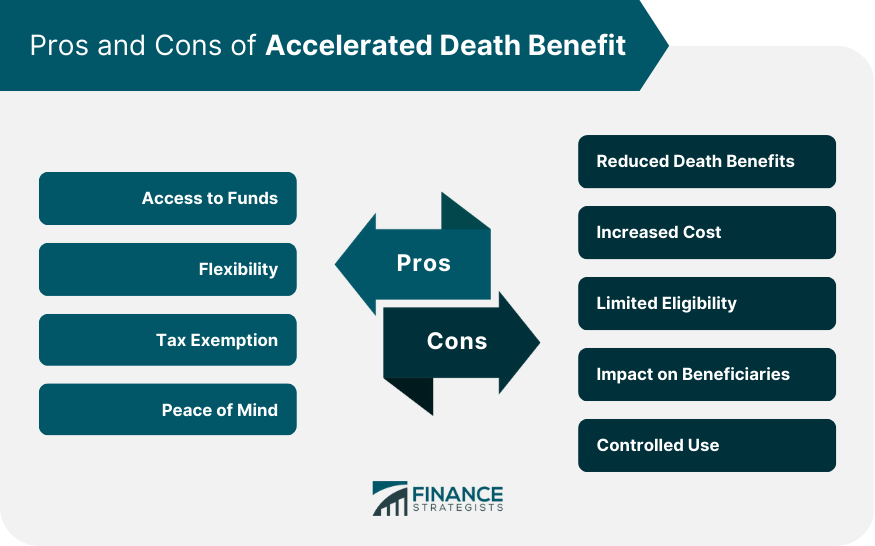

An accelerated death benefit is a provision that allows individuals to receive a portion of their life insurance policy's death benefit before they pass away. The payout amount is determined based on the policy's death benefit. The funds received from the accelerated death benefit can be used to cover medical expenses, hospice care, and other end-of-life costs. Having accelerated death benefit provides individuals with potential access to funds they can use to alleviate some of the financial burdens on themselves and their loved ones during a challenging time. This provision works by allowing individuals who meet specific eligibility requirements to access a portion of their life insurance policy's death benefit before they die. Typically, individuals must have a life insurance policy in force and have been paying premiums regularly. They must also have been diagnosed with a terminal illness with a life expectancy of fewer than 12 to 24 months, depending on the policy's terms. Other criteria will vary depending on the insurance company. Once an individual meets these eligibility requirements, they can submit a request to their insurance provider to access the accelerated death benefit. The provider will review the claim and determine the payout amount, ranging from a percentage of the policy's death benefit to the entire amount. The funds received from the accelerated death benefit are typically tax-free. During a difficult period, these funds can be utilized to alleviate the financial burden on the individual and their loved ones by covering medical expenses, hospice care, and other costs related to end-of-life care. It is essential to note that accessing the accelerated death benefit will reduce the policy's death benefit, which means less money will be paid out to beneficiaries upon the individual's death. Additionally, policyholders may need to pay a processing fee to access the funds, which can further reduce the payout. The advantages revolve around access to funds, flexibility, tax exemptions, and peace of mind. The most significant benefit of accelerated death benefit is that it provides individuals with access to funds when they need them most. When an individual is diagnosed with a terminal illness, they may face significant medical expenses and other end-of-life costs. The accelerated death benefit can help cover these expenses, alleviating some of the financial burdens on the individual and their loved ones. In some cases, individuals may need to access their policy's death benefit before they pass away for reasons other than medical expenses. For example, they may need to pay off debts, pay for a child's education, or cover other unexpected expenses. In these situations, accelerated death benefits can provide individuals with the money they need without surrendering their policy. The payout from accelerated death benefit is typically excludable from taxable income, which means the funds received can be used in their entirety. It can be particularly helpful for individuals who may not have adequate health insurance or who are facing significant expenses related to their medical treatment. Knowing that there is an accelerated death benefit provision in place can provide individuals with peace of mind. It can help them feel more prepared and secure during a terminal illness, which can be a significant source of comfort during such a challenging time. While accelerated death benefit can provide several benefits, there are also drawbacks that individuals should consider before adding the benefit to their life insurance policy. It means less money will be paid out to beneficiaries upon the individual's death. This reduction can be significant, depending on the amount of the payout and the policy's original death benefit. Adding an accelerated death benefit rider to a life insurance policy may result in an additional premium, which can increase the overall cost of the policy. Individuals should carefully consider whether the benefit is necessary and how it fits into their comprehensive financial plan before adding it to their policy. To qualify for accelerated death benefit, individuals must meet specific eligibility requirements set by their insurance provider. Typically, these requirements include a diagnosis of a terminal illness with a life expectancy of fewer than 12 to 24 months. If an individual does not meet these requirements, they may be unable to access the benefit. Accessing the accelerated death benefit may impact beneficiaries' financial well-being, as they will receive less money upon the individual's death. Individuals should consider these consequences on their beneficiaries and how they plan to use the funds before accessing the benefit. The accelerated death benefit can only be used for specific purposes, such as medical expenses, hospice care, and other end-of-life costs. Individuals should consider whether they have other financial resources to cover these expenses before accessing the benefit. Accelerated death benefit is a valuable provision that can provide you with access to funds when you need them most. It can help cover medical expenses, hospice care, and other end-of-life costs, mitigating some of the financial burdens on you and your loved ones. However, before adding the benefit to a life insurance policy or accessing the funds, you should carefully consider the pros and cons and how it fits into your overall financial plan. An accelerated death benefit may provide additional financial security in the face of terminal illness. However, it will reduce the death benefit that will be received by the beneficiaries Consult a qualified financial advisor or insurance broker for further guidance on accelerated death benefits. These professionals can help you make an informed decision and ensure you and your loved ones are adequately prepared for the future. What Is an Accelerated Death Benefit?

How Accelerated Death Benefit Works

Accessing Accelerated Death Benefit Funds

Pros of Accelerated Death Benefit

Access to Funds

Flexibility

Tax Exemption

Peace of Mind

Cons of Accelerated Death Benefit

Reduced Death Benefit

Increased Cost

Limited Eligibility

Impact on Beneficiaries

Controlled Use

Final Thoughts

Accelerated Death Benefit FAQs

The accelerated death benefit is a provision that allows individuals to receive a portion of their life insurance policy's death benefit before they pass away. The benefit is typically available to individuals who have been diagnosed with a terminal illness with a life expectancy of fewer than 12 to 24 months.

To access the accelerated death benefit, individuals must meet specific eligibility requirements set by their insurance provider. Once approved, the individual can receive a portion of their policy's death benefit in a lump sum or installments to cover medical expenses, hospice care, and other end-of-life costs. The payout is typically tax-free and will reduce the policy's death benefit upon the individual's passing.

Adding an accelerated death benefit to a life insurance policy can provide individuals with additional financial security in the event of a terminal illness. The benefit provides access to funds to help cover medical expenses, hospice care, and other end-of-life costs, which can alleviate some of the financial burden on the individual and their loved ones.

Accessing the accelerated death benefit will reduce the policy's death benefit, which means less money will be paid out to beneficiaries upon the individual's death. Additionally, policyholders may need to pay a processing fee to access the funds, which can further reduce the payout. Eligibility requirements must also be met, which may limit the number of individuals who can access the benefit.

No, the funds received from accelerated death benefit can only be used for specific purposes, such as medical expenses, hospice care, and other end-of-life costs. These funds cannot be used for other expenses such as debts, mortgages, or college tuition. It is important to understand the limitations of the benefit and plan accordingly.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.