A Life Insurance Exam is a health assessment typically conducted by a licensed medical professional as part of the process of obtaining life insurance coverage. This exam may include a review of the applicant's medical history, a physical examination, and laboratory tests. The primary purpose is to assess the applicant's health status and risk level, which life insurance companies use to determine policy premiums and coverage limits. Considering life insurance, understanding the exam's implications is crucial. Poor results could lead to higher premiums or even denial of coverage. Hence, preparing adequately for this exam, including maintaining a healthy lifestyle, can positively impact the life insurance policy's terms. In the broader context, these exams underscore the role of personal health in financial planning instruments like life insurance. During a life insurance exam, the medical professional will review your past and present health conditions. They may ask questions about any surgeries, hospitalizations, medications, and chronic conditions. They may also ask about your lifestyle habits, including smoking, drinking, exercise, and dietary habits. The physical examination usually involves checking vital signs like heart rate, blood pressure, and respiratory rate. The examiner may also measure your height and weight to calculate your body mass index (BMI). Laboratory tests often include blood and urine tests to check for the presence of health issues like diabetes, high cholesterol, liver or kidney disease, HIV/AIDS, and drug use. Not all life insurance companies require these tests, but they are common, especially for policies with higher coverage amounts. Maintaining a healthy lifestyle is the best preparation for a life insurance exam. Regular exercise, a balanced diet, adequate sleep, and regular medical check-ups are essential. These habits improve not only your overall health but also your exam results and, consequently, your life insurance premiums. Smoking and excessive drinking are considered high-risk behaviors by life insurance companies. They increase the risk of many health issues, including heart disease and lung cancer. Limiting alcohol intake and avoiding tobacco can improve your health and your exam results. Having a comprehensive record of your medical history can expedite the examination process. This includes details of past and present health conditions, surgeries, and medications. It's especially important to have this information at hand if you have a complex medical history. Once you apply for a life insurance policy, the insurance company will arrange for the exam. The exam is typically conducted by a licensed paramedical professional and can often be scheduled at a time and location convenient for you, such as your home or workplace. On the day of the exam, the examiner will verify your identity, typically requiring a government-issued ID. The medical interview involves questions about your medical history and lifestyle habits. Being honest and thorough in this interview is crucial, as any discrepancies between your answers and the test results may lead to higher premiums or even denial of coverage. During the physical examination, the examiner will check your vital signs, height, and weight. This part of the exam is similar to a routine check-up at a doctor's office. If required, the examiner will collect blood and urine samples. These tests check for various health issues and drug use. The collected specimens will be sent to a laboratory for analysis. The laboratory will test for various health indicators and any substances that might indicate high-risk behaviors. The lab results will be sent to the insurance company for review. The underwriting department will use these results, along with your medical interview responses, to assess your risk profile and determine your policy premium. The results of your life insurance exam play a crucial role in determining your insurance premium. The healthier you are, the lower the perceived risk and the lower your premiums. High-risk findings, such as elevated cholesterol or blood sugar levels, can lead to higher premiums. The exam results can also influence the amount of coverage the insurance company is willing to offer. Certain health conditions might limit the amount of coverage you can get. If your exam results indicate that you are in good health, you may qualify for standard or preferred premium rates. Preferred rates are typically offered to those with excellent health and low-risk lifestyle habits. If your exam results indicate certain health risks, you may be offered substandard rates, also known as "rated" or "table-rated" policies. These have higher premiums to compensate for the increased risk. In some cases, if the perceived risk is too high – for example, due to severe health conditions – the insurance company may deny coverage altogether. If you believe your exam results are inaccurate, you can request a re-exam or appeal the decision. If your health improves significantly, you can also request a new exam to try and get lower premium rates. A Life Insurance Exam serves as a crucial assessment tool for insurers to gauge an applicant's health and lifestyle risks, influencing the insurance premium and coverage terms. As such, understanding this process is fundamental for prospective policyholders. Preparing for the exam by maintaining a healthy lifestyle, avoiding high-risk behaviors, and organizing your medical history can be advantageous. The examination includes a medical history review, a physical examination, and potentially laboratory tests. Results guide the underwriting process, determining premiums and coverage limits. While good health can lead to preferred rates, health risks might attract substandard rates or even coverage denial. However, there's the provision to appeal results or request a re-exam, particularly when health improvements are significant. Essentially, the life insurance exam underscores the intersection of personal health and financial planning.What Is a Life Insurance Exam?

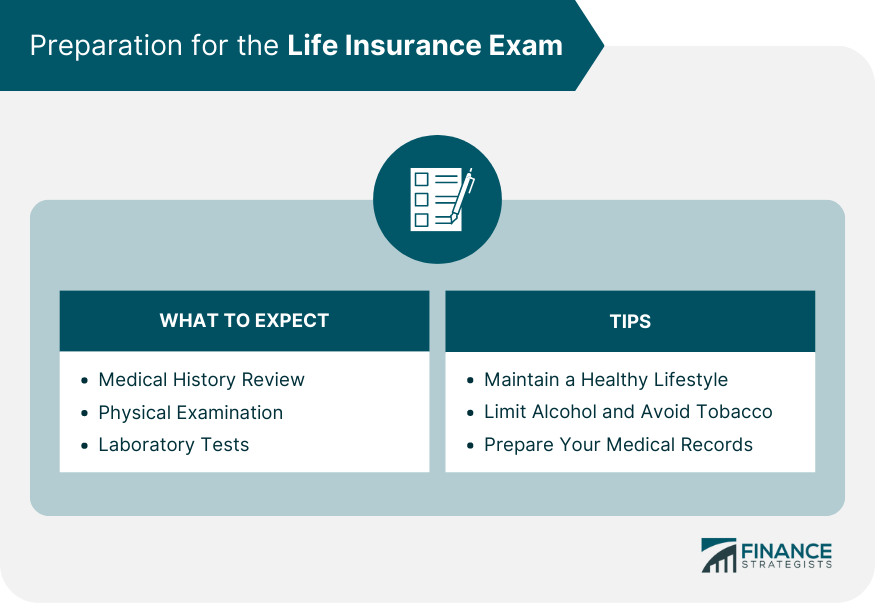

Preparation for the Life Insurance Exam

Knowing What to Expect in the Exam

Medical History Review

Physical Examination

Laboratory Tests

Tips on How to Prepare for Life Insurance Exam

Maintain a Healthy Lifestyle

Limit Alcohol and Avoid Tobacco

Prepare Your Medical Records

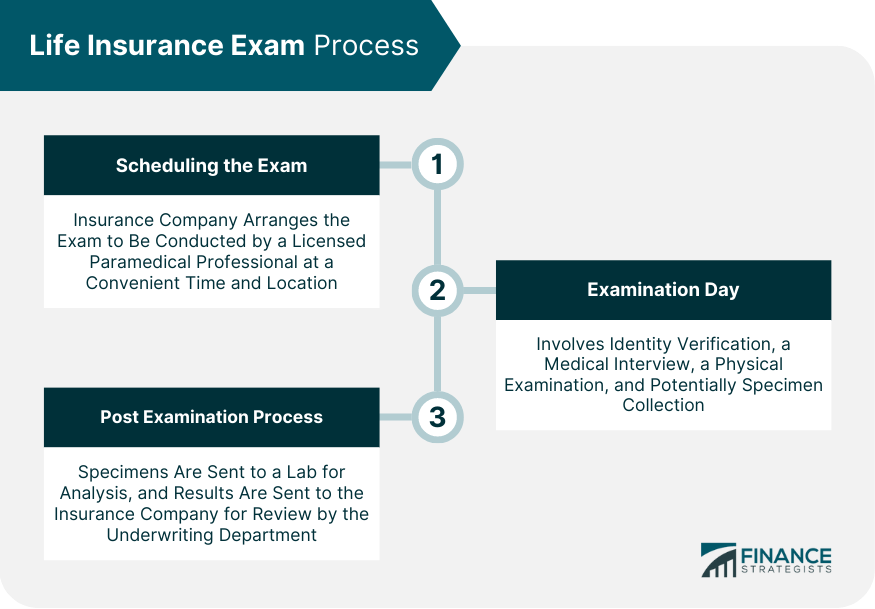

Life Insurance Exam Process

Scheduling the Exam

Examination Day

Identity Verification

Medical Interview

Physical Examination

Specimen Collection (Blood and Urine)

Post-Examination Process

Lab Analysis

Results and Reporting

Understanding the Results of the Life Insurance Exam

How the Results Influence the Policy

Premium Calculation

Determining Coverage Limits

Potential Outcomes

Standard or Preferred Rates

Substandard Rates

Denial of Coverage

Appealing the Results and Re-Examination Options

Final Thoughts

Life Insurance Exam FAQs

A life insurance exam is a health assessment conducted by a medical professional, usually including a medical history review, a physical examination, and possibly laboratory tests. The purpose of the exam is for the life insurance company to evaluate the risk associated with insuring the applicant. This assessment helps determine the policy's premium rate and whether the applicant is eligible for coverage.

To prepare for a life insurance exam, it's recommended to maintain a healthy lifestyle, which includes regular exercise, a balanced diet, and adequate sleep. Limiting alcohol intake and avoiding tobacco can also be beneficial. Additionally, preparing your medical records beforehand can expedite the examination process.

On the day of the life insurance exam, the examiner will verify your identity, conduct a medical interview, perform a physical examination, and potentially collect blood and urine samples for laboratory tests.

The results of your life insurance exam significantly influence your insurance policy. They help the insurance company calculate your premium rate and determine your coverage limits. If the exam results indicate good health, you may qualify for lower premium rates. Conversely, certain health risks could lead to higher premiums or even denial of coverage.

Yes, if you believe your life insurance exam results are inaccurate, you can typically request a re-exam or appeal the decision with the insurance company. If your health improves significantly, you may also request a new exam to potentially obtain lower premium rates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.