Universal life insurance is a type of permanent life insurance that offers both a death benefit and an investment component that allows for cash value accumulation. This type of policy provides flexibility in premium payments, death benefit amounts, and investment options. Universal life insurance policies are known for their flexible premiums, adjustable death benefits, cash value accumulation, and investment components, which can be tailored to meet the policyholder's needs and financial goals. The primary purpose of universal life insurance is to provide financial protection to the policyholder's beneficiaries in the event of the policyholder's death. Additionally, the cash value accumulation feature allows for potential growth and can be accessed by the policyholder during their lifetime for various financial needs. Traditional universal life insurance policies offer a guaranteed minimum interest rate on the cash value component, providing a more conservative investment option. Indexed universal life insurance policies link the cash value component's growth to a specific market index, such as the S&P 500, allowing for potentially higher returns based on market performance. Variable universal life insurance policies offer a range of investment options for the cash value component, including stocks, bonds, and mutual funds, providing the policyholder with more control over their investment strategy. Guaranteed universal life insurance policies focus on providing a guaranteed death benefit with minimal cash value accumulation, offering a more cost-effective option for those primarily seeking life insurance coverage. Universal life insurance policies allow for flexible premium payments, enabling policyholders to adjust their premiums based on their financial situation. Policyholders can increase or decrease the death benefit of their universal life insurance policy, subject to certain limitations and underwriting requirements. Universal life insurance policies include a cash value component that accumulates on a tax-deferred basis, potentially providing an additional source of funds for the policyholder during their lifetime. The cash value component of universal life insurance policies can be invested in various options, such as fixed interest accounts, indexed accounts, or variable subaccounts, depending on the policy type. Universal life insurance policies offer premium flexibility, allowing policyholders to adjust their premium payments based on their financial needs and goals. The cash value component of universal life insurance policies has the potential for growth, providing an additional source of funds for the policyholder during their lifetime. Universal life insurance policies allow policyholders to adjust their death benefit, providing flexibility in the amount of coverage provided to beneficiaries. Universal life insurance policies offer several tax advantages, including tax-deferred cash value growth and generally tax-free death benefits for beneficiaries. Universal life insurance policies can be more complex than other types of life insurance, requiring a greater understanding of the policy's features and investment options. Universal life insurance policies can be more expensive than other types of life insurance, such as term life insurance, due to the cash value accumulation and investment components. Some types of universal life insurance policies, such as indexed or variable policies, carry investment risk, potentially resulting in lower cash value accumulation or reduced death benefits if the investment options underperform. If the cash value component of a universal life insurance policy is not managed properly, it may be insufficient to cover the policy's costs, potentially resulting in a reduced death benefit or policy lapse. When choosing a universal life insurance policy, it's essential to consider your long-term financial goals, including the desired level of life insurance coverage, potential cash value accumulation, and investment strategy. Your risk tolerance plays a crucial role in determining the type of universal life insurance policy that best suits your needs. Consider whether you prefer a more conservative investment approach with a guaranteed interest rate or a more aggressive strategy with potential for higher returns based on market performance. The time horizon for your financial goals is another important factor to consider when selecting a universal life insurance policy. Some policy types may be more suitable for long-term goals, while others may offer more flexibility for shorter time frames. Evaluate your financial situation to determine the affordability of a universal life insurance policy's premium payments and consider the potential impact of premium flexibility on your overall financial plan. Term life insurance provides coverage for a specific period, typically 10, 20, or 30 years, and does not include a cash value component. This type of insurance is generally more affordable than universal life insurance but does not offer the same flexibility or potential for cash value growth. Whole life insurance is another type of permanent life insurance that provides a guaranteed death benefit and cash value accumulation. However, whole life policies generally have less flexibility in premium payments and death benefit adjustments compared to universal life insurance. Variable life insurance is similar to universal life insurance in that it offers both a death benefit and cash value component with investment options. However, variable life policies typically have less flexibility in premium payments and death benefit adjustments. Universal life insurance can be a valuable part of a comprehensive financial plan, providing both life insurance coverage and the potential for cash value accumulation to meet various financial needs and goals. When considering universal life insurance, it's essential to carefully evaluate your individual needs, financial goals, risk tolerance, and affordability to select the policy that best suits your situation. Due to the complexity of universal life insurance policies and the variety of options available, it's often helpful to seek professional guidance from a financial advisor or insurance agent to ensure you make an informed decision.What Is Universal Life Insurance?

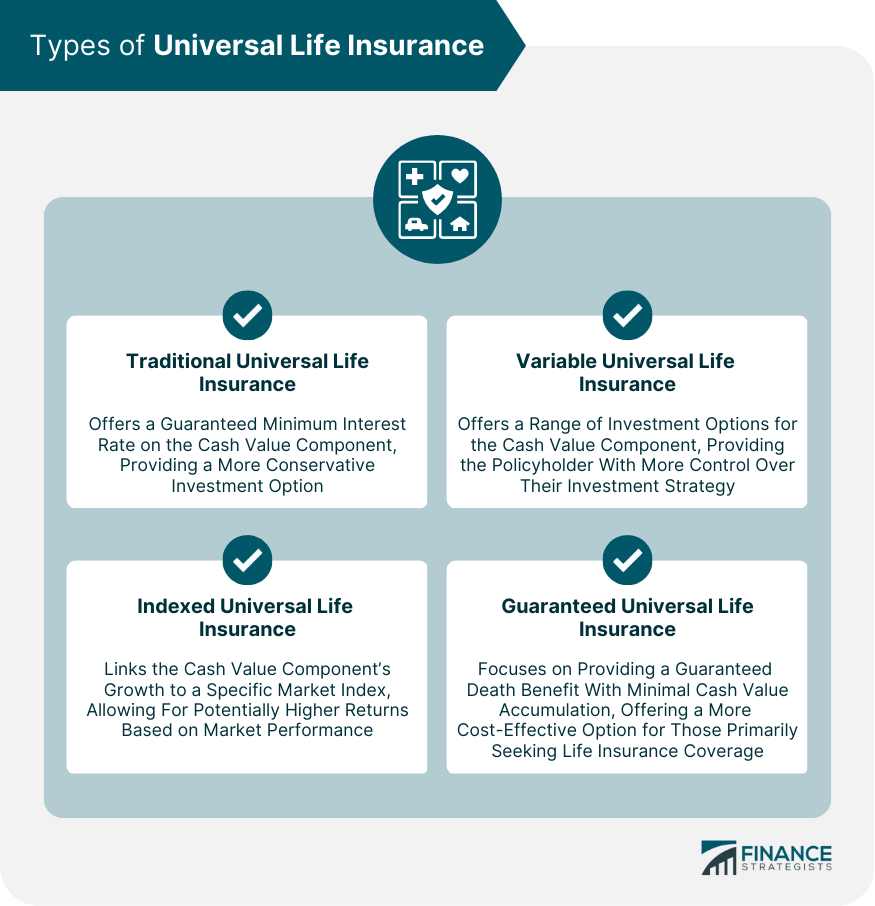

Types of Universal Life Insurance

Traditional Universal Life Insurance

Indexed Universal Life Insurance

Variable Universal Life Insurance

Guaranteed Universal Life Insurance

Key Features of Universal Life Insurance

Flexible Premiums

Adjustable Death Benefit

Cash Value Accumulation

Investment Component

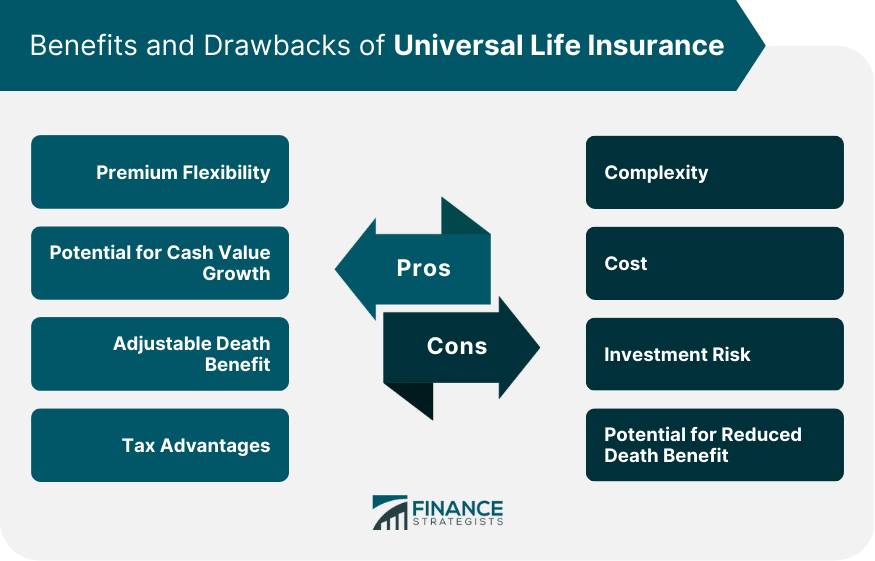

Advantages of Universal Life Insurance

Premium Flexibility

Potential for Cash Value Growth

Adjustable Death Benefit

Tax Advantages

Disadvantages of Universal Life Insurance

Complexity

Cost

Investment Risk

Potential for Reduced Death Benefit

Factors to Consider When Choosing Universal Life Insurance

Financial Goals

Risk Tolerance

Time Horizon

Affordability

Comparing Universal Life Insurance to Other Life Insurance Options

Term Life Insurance

Whole Life Insurance

Variable Life Insurance

Conclusion

Role of Universal Life Insurance in Financial Planning

Importance of Evaluating Individual Needs and Goals

Seeking Professional Guidance

Universal Life Insurance FAQs

Universal life insurance is a type of permanent life insurance that provides coverage for the entirety of an individual's life. It also includes a savings component that earns interest over time and can be used to pay for the insurance premiums or as a source of cash value.

Unlike term life insurance, which only provides coverage for a specific period of time, universal life insurance is a form of permanent life insurance. It also offers more flexibility than whole life insurance, allowing policyholders to adjust their premiums and death benefits over time.

The primary benefit of universal life insurance is its flexibility. Policyholders can adjust their premiums and death benefits as their financial situation changes. Additionally, the savings component of the policy can accumulate tax-deferred interest over time, providing a source of cash value that can be used for a variety of purposes.

The cost of universal life insurance depends on a variety of factors, including the policyholder's age, health, and lifestyle. Generally speaking, universal life insurance premiums are more expensive than term life insurance premiums but less expensive than whole life insurance premiums.

Universal life insurance may be a good choice for individuals who are looking for flexibility in their life insurance coverage and are willing to invest in a savings component that can accumulate cash value over time. However, it may not be the best choice for everyone, particularly those who are primarily interested in a low-cost life insurance policy. It's important to consult with a financial professional to determine the best type of life insurance policy for your individual needs.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.