Life insurance is a contractual agreement between an individual and an insurance company. The policyholder, who is the individual, makes regular payments referred to as premiums to the insurance company. In return, the insurance company commits to providing a lump sum amount known as a death benefit to the policyholder's designated beneficiaries upon the policyholder's demise. The primary purpose of life insurance is to provide financial protection to the policyholder's dependents in the event of the policyholder's untimely death. It can cover funeral expenses, pay off debts, provide income replacement, fund a child's education, and more. Life insurance is essential for anyone who has financial dependents. Most adults can qualify for some type of life insurance, although eligibility can vary significantly between different types and providers. Key eligibility factors typically include age, health status, lifestyle, and occupational risks. However, there are exceptions. Insurers often have upper age limits for new policies, and certain medical conditions can lead to declined applications. Risky occupations or dangerous hobbies can increase premiums or policy exclusions. Certain groups face particular challenges in obtaining life insurance. High-risk individuals, such as smokers or those with serious health conditions, may face higher premiums or have trouble finding coverage. Seniors may also need help finding affordable policies due to increased age-related risks. Children, while generally eligible for coverage, usually only require insurance for specific financial planning purposes. Term life insurance offers coverage for a set duration, typically ranging from 10, 20, or 30 years. The insurance company pays a predetermined death benefit to the policyholder's beneficiaries if the policyholder dies within the specified term. However, if the policyholder survives the term, the policy ceases to exist without any financial benefit. This simplicity and straightforwardness make term life insurance a popular choice for those seeking substantial coverage at a lower cost. Whole life insurance provides lifelong coverage and includes a cash value component. This type of policy guarantees a death benefit payout upon the policyholder's death, regardless of when that happens. The cash value, which grows tax-deferred over time, can be borrowed against if the policyholder requires funds for emergencies, education, or other significant expenses. This policy's lifelong coverage and savings make it suitable for those seeking insurance and investment. Universal life insurance allows policyholders to modify the premium and death benefit amounts to accommodate changes in their financial circumstances or goals. The cash value of a universal life policy is linked to the insurer's performance and interest rates, potentially leading to higher returns. This policy is ideal for those wanting life coverage with a side of financial adaptability. Variable life insurance allows policyholders to allocate a portion of their premiums to various investment options, such as stocks, bonds, and money market mutual funds. These investments can lead to a higher cash value but also introduce more risk due to potential market fluctuations. For individuals comfortable with investment risks and seeking a life insurance policy that could yield higher returns, variable life insurance is a viable choice. The life insurance application process begins by identifying the right policy to suit your individual needs and financial aspirations. Once a policy is chosen, the application requires comprehensive personal information that includes age, health history, occupation, and lifestyle habits. It's vital to provide precise and accurate information during this stage to prevent any potential hindrances down the line. Most life insurance policies necessitate a medical exam after the application is submitted. The medical exam evaluates the applicant's overall health status and may involve blood tests and blood pressure measurements. The health data gathered from this exam is pivotal in determining insurability and the premiums to be offered. Following the medical examination, the application undergoes underwriting. The underwriting process includes a detailed evaluation of the information provided in the application, including the medical examination results. Underwriters gauge the risk associated with insuring the applicant and decide on the premium rates based on this risk assessment. The duration of this process may range from a few days to several weeks, depending on the intricacies of the applicant's case. After successfully completing the underwriting process, the insurer approves the application, and the policy is issued. You'll receive a policy document outlining the details of your coverage, and you must pay your first premium to activate the policy. Thoroughly reviewing all policy details and understanding the terms before making the payment is crucial. Life insurance is a dynamic financial product that requires periodic review and updates. It's prudent to assess and amend your policy whenever there are significant life changes, like marriage, the birth of a child, or alterations in income or health status. This practice ensures that your coverage remains relevant to your ever-changing financial needs and goals. Age and health are among the most influential factors determining life insurance premiums. Generally, younger individuals are offered lower premiums since they pose a lower risk to the insurer. Individuals in good health are less likely to claim, leading to lower premiums. Medical conditions, on the other hand, can elevate the risk and, consequently, the premiums. Lifestyle habits such as smoking, alcohol consumption, and drug use significantly influence life insurance premiums. Those who engage in such habits are considered high-risk due to potential health complications. They're typically charged higher premiums. Active and healthy lifestyle practices often result in lower premiums. The nature of your job plays a substantial role in determining life insurance premiums. Occupations deemed high-risk, such as construction workers, firefighters, or pilots, could mean higher premiums. This is due to these professions' increased risk of injury or death. The type and term length of your chosen policy also affects the premiums. Generally, term life insurance is less expensive than whole or universal life insurance because it only covers a specific period. In contrast, the latter types provide lifelong coverage and accumulate cash value, leading to higher premiums. The longer the policy term, the higher the premium tends to be, as the risk of the policyholder's death increases over time. Where you live can also influence your life insurance premiums. Insurance companies may consider the general health and life expectancy of the population in your region, local environmental risks, and even the cost of living. Living in an area with a high crime rate or natural disasters could increase premiums. Full disclosure is crucial when applying for life insurance. Withholding information or providing misleading details can result in policy denial or cancellation. In extreme cases, it could also lead to the insurer refusing to pay out the death benefit upon the policyholder's death. Accurate medical history is especially important. It allows insurers to assess risk correctly and set fair premiums. If the insurer discovers undisclosed medical conditions later, it could increase premiums or make the policy void. Applicants should also know that their information is handled with strict confidentiality. Privacy laws bind insurers and can only use the information to assess insurance applications and manage policies. Hence, applicants should feel comfortable disclosing complete and accurate information. The first step in choosing the right life insurance policy is understanding your financial needs and long-term goals. Consider the living costs your family would need to cover if you were no longer around, including mortgage payments, educational expenses, and everyday living costs. Also, consider your long-term financial obligations and aspirations, such as supporting your spouse in retirement or leaving an inheritance. Once you've determined your financial needs, compare different life insurance policies. Term life insurance might suit those seeking cost-effective coverage for a specific period. In contrast, like whole or universal, permanent life insurance could be better for those looking for lifelong coverage and a cash-value component. The process of selecting the right policy can be complex. Consulting with insurance professionals or financial advisors can be beneficial. These experts can guide you through the process, helping you understand the fine print and make an informed decision based on your unique circumstances and goals. Always ensure the advisor or agent you consult with is licensed and has a good reputation in the industry. Most adults can qualify for some form of life insurance, although eligibility and premiums may vary based on factors such as age, health, lifestyle, and occupation. While there are exceptions and certain challenges for high-risk individuals or seniors, there are options available to meet different needs. Full disclosure of information is important during the application process to ensure accurate risk assessment and appropriate coverage. Life insurance provides financial protection for individuals and their dependents, making it crucial for those with financial obligations. Consulting with insurance professionals can help navigate the process and find the most suitable coverage based on individual circumstances. Despite some limitations, the majority of individuals can obtain life insurance coverage to safeguard their loved ones in the event of their passing.What Is Life Insurance?

Can Anyone Get Life Insurance?

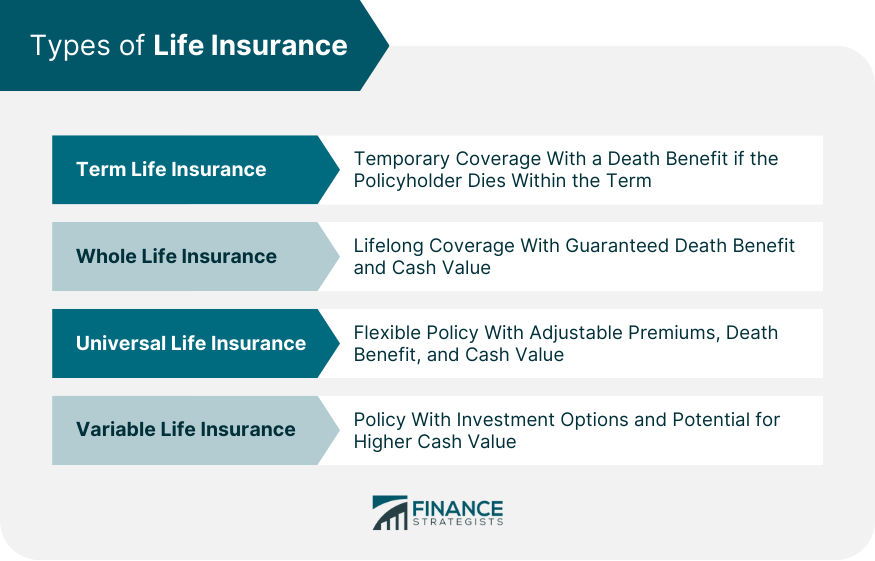

Types of Life Insurance

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Variable Life Insurance

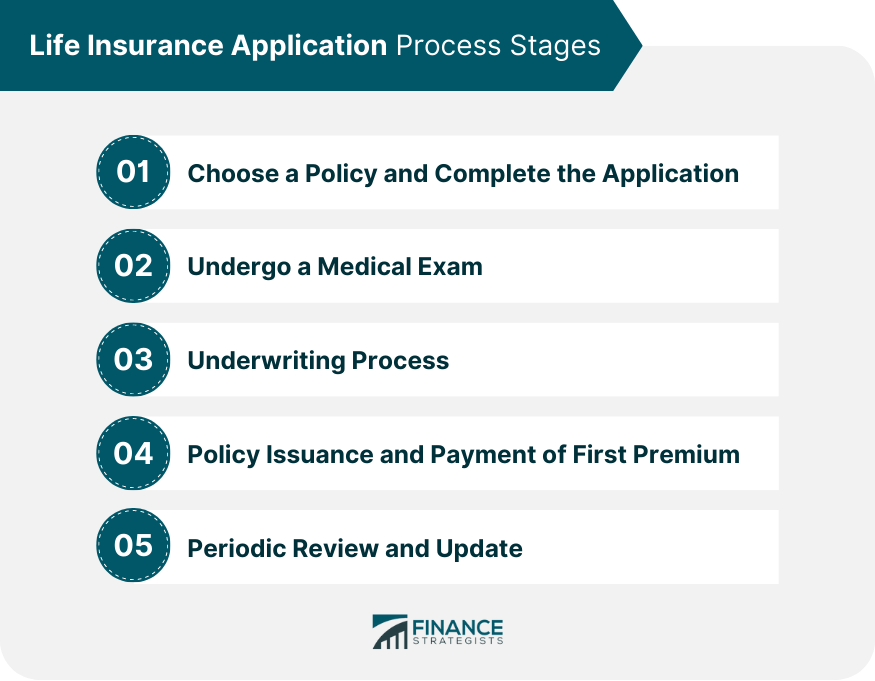

Life Insurance Application Process

Choosing a Policy and Completing the Application

Undergoing a Medical Exam

Underwriting Process

Policy Issuance and Payment of First Premium

Periodic Review and Update

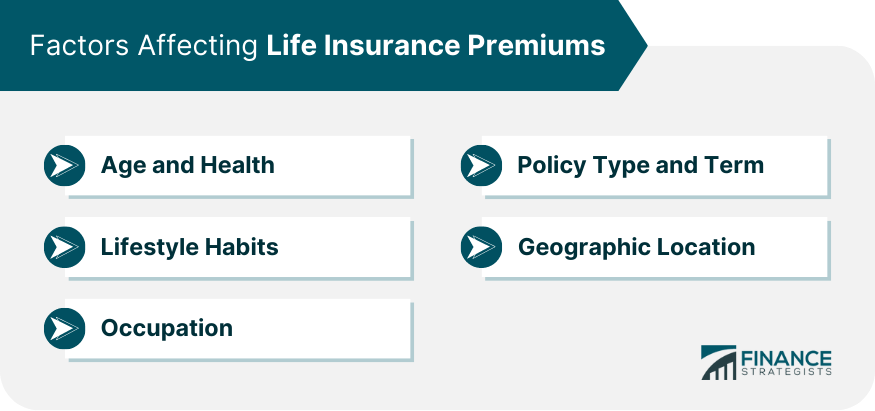

Factors Affecting Life Insurance Premiums

Age and Health

Lifestyle Habits

Occupation

Policy Type and Term Length

Geographic Location

Importance of Full Disclosure When Applying for Life Insurance

Consequences of Withholding Information

Importance of Accurate Medical History

Confidentiality of Personal Information

How to Choose the Right Life Insurance Policy

Assessing Financial Needs and Goals

Comparing Different Policy Types

Consulting With Insurance Professionals

Conclusion

Can Anyone Get Life Insurance? FAQs

Generally, anyone under a certain age, typically between 75 to 85, can apply for life insurance. However, premiums increase with age, and certain types of policies may not be available to seniors. Some companies also offer specialized policies for older adults, like final expense insurance.

Yes, individuals with pre-existing medical conditions can still get life insurance, but it may affect the types of policies they qualify for and the premiums they pay. Some companies specialize in high-risk insurance policies for those with trouble finding coverage elsewhere.

Yes, certain life insurance policies, such as guaranteed and simplified issue policies, do not require a medical exam. However, these policies often come with higher premiums and lower coverage amounts due to the higher risk the insurer takes.

Those who engage in high-risk activities, like extreme sports or dangerous occupations, can still generally get life insurance. Still, they may face higher premiums or exclusions related to their high-risk activities.

Yes, smokers and heavy drinkers can usually get life insurance, but they will likely pay higher premiums due to the increased health risks associated with these habits.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.