Life insurance policies are financial contracts between an individual and an insurance company. These policies provide a death benefit, a predetermined amount of money, to the beneficiaries upon the policyholder's death. These policies are designed to provide financial protection and security to the policyholder's loved ones, ensuring that they are supported in the event of the policyholder's passing. The death benefit can be used to cover various expenses, such as funeral costs, mortgage payments, outstanding debts, and the financial needs of dependents. The purpose of a life insurance policy extends beyond just providing financial support. It serves as a tool for long-term financial planning and risk management. It offers peace of mind, allowing individuals to have confidence that their loved ones will be taken care of financially. Life insurance policies can be cashed in before the policyholder's death, but the ability to do so and the amount received will depend on several factors. It's important to understand the concept of cash surrender value and how it applies to different types of life insurance policies. The cash surrender value refers to the amount of money that a policyholder is entitled to receive if they choose to surrender their life insurance policy before the end of its term. This value is determined by various factors, including the length of time the policy has been in force, the amount of premiums paid, and any fees or surrender charges associated with the policy. It's important to note that cashing in a life insurance policy may result in financial consequences and the loss of insurance coverage. The cash surrender value is the amount of money that a policyholder will receive if they decide to surrender or cancel their life insurance policy before its maturity or before the insured's death. This value represents the accumulated savings or investment component of the policy and is typically lower than the death benefit. The cash surrender value is influenced by factors such as the length of time the policy has been in force, the premiums paid, the policy type, and any applicable fees or surrender charges. Determining the cash surrender value involves considering the premiums paid, any outstanding loans or interest, and the policy's growth or investment returns. It's important to note that surrendering a policy for its cash value may have financial implications, including potential tax consequences and the loss of insurance coverage. In times of financial hardship or emergencies, accessing the cash surrender value of a life insurance policy can provide much-needed funds. This may help individuals cover immediate expenses, pay off debts, or address unexpected financial obligations. It's important to carefully evaluate the financial situation and explore alternative options before surrendering the policy, as this decision can have long-term consequences. As life circumstances change, individuals may find that their financial goals or needs have shifted. The coverage provided by an existing life insurance policy may no longer align with their current situation. In such cases, cashing in the policy may allow individuals to redirect funds towards other financial priorities, such as retirement savings, education expenses, or investments that better suit their current objectives. If individuals come across alternative investment opportunities that offer higher returns or better align with their investment strategy, they may consider cashing in their life insurance policy to access the funds. It's important to carefully evaluate the potential risks and returns of any alternative investments and consult with a financial advisor before making such a decision. Some individuals may choose to surrender a life insurance policy with a low cash value if they no longer see the need for the coverage or find it unaffordable. It's important to consider the potential consequences, such as the loss of insurance coverage and the potential impact on future insurability, before making this decision. It's crucial to carefully evaluate the financial implications and consider other alternatives before deciding to cash in a life insurance policy before death. Discussing the options with a financial advisor or insurance professional can provide valuable insights and guidance to make an informed decision based on individual circumstances. Cashing in a life insurance policy may have tax implications. The cash surrender value is considered taxable income to the extent that it exceeds the total premiums paid into the policy. The tax treatment can vary depending on factors such as the policy type, the length of time the policy has been in force, and the specific tax laws of the jurisdiction. It's advisable to consult with a tax advisor or financial professional to fully understand the potential tax consequences before making a decision. Surrendering a life insurance policy before death will result in the loss of the death benefit, which is the primary purpose of the policy. This can have significant implications for the financial security of loved ones and dependents who may rely on the death benefit to cover expenses and maintain their standard of living after the policyholder's passing. It's crucial to carefully consider the impact on beneficiaries and explore alternative options to provide financial protection in case of death. Cashing in a life insurance policy results in the termination of the policy, leading to the loss of insurance coverage. This means that individuals will no longer have the financial protection and security provided by the policy. If there is a need for life insurance coverage in the future, it may be more difficult to obtain or may come at higher premiums due to changes in health or other factors. Evaluate the need for ongoing coverage and consider alternative solutions before surrendering the policy. The first step is to contact the insurance company that issued the policy. Policyholders can reach out to their insurance agent or contact the company's customer service department. They will guide policyholders through the necessary steps and provide the required information and forms to initiate the surrender process. The insurance company will require certain documents to process the policy surrender. These may include a surrender request form, a copy of the policy, identification documents, and any other documentation specified by the insurer. Carefully review the instructions provided by the company and ensure all necessary paperwork is completed accurately. Once the surrender request and required documents are submitted, there is typically a waiting period for the insurance company to process the request. The processing time may vary depending on the company's procedures and the complexity of the policy. Policyholders should be prepared for a potential delay in receiving the cash surrender value. The specific process and requirements for surrendering a life insurance policy may vary depending on the insurance company and the policy's terms and conditions. Policyholders should reach out to their insurance provider directly to obtain detailed instructions tailored to their specific policy. Before deciding to cash in a life insurance policy, individuals should consider alternative options that may provide access to funds while maintaining insurance coverage: Many life insurance policies offer the option to take out a policy loan against the cash value. This allows individuals to access funds without surrendering the policy. Policy loans typically have lower interest rates compared to traditional loans, and the borrowed amount is secured by the policy's cash value. It's important to review the terms and conditions of the policy loan, including any potential impact on the death benefit, before considering this option. In certain situations, individuals with a life-threatening illness may have the option to sell their life insurance policy through a process known as a viatical settlement. This allows them to receive a lump sum payment from a third-party investor in exchange for the policy's death benefit. Policy settlements or viatical settlements can provide access to immediate funds, but it's important to carefully evaluate the terms, fees, and potential impact on the death benefit before pursuing this option. Some life insurance policies offer additional riders or options that allow policyholders to access the cash value under specific circumstances. For example, an accelerated death benefit rider may provide the option to receive a portion of the death benefit if the policyholder is diagnosed with a terminal illness. Exploring these options within the policy can provide alternatives to cashing in the entire policy while still addressing financial needs. It is possible to cash in a life insurance policy before death, but it is important to understand how it works, consider the advantages and risks involved, and follow the appropriate process. When cashing in a policy, the policyholder receives the cash surrender value, which is the accumulated savings within the policy. The advantages of cashing in include accessing funds for financial difficulties or changing needs, and potential investment opportunities. However, there are risks to consider, such as potential tax implications, reduced death benefit, and loss of insurance coverage. The process typically involves contacting the insurance company, submitting required documents, and waiting for the processing period. Before making a decision, it is advisable to consult a financial advisor or insurance professional to fully understand the implications and explore alternative options such as policy loans, settlements, or riders that may better suit the individual's needs.Overview of Life Insurance Policies

Can You Cash in a Life Insurance Policy Before Death?

Understanding the Cash Surrender Value

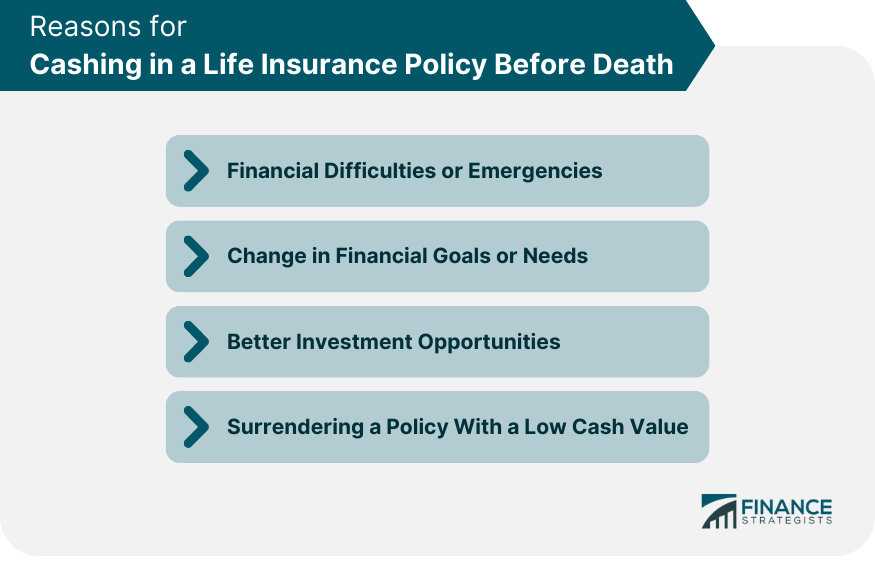

Reasons for Cashing in a Life Insurance Policy Before Death

Financial Difficulties or Emergencies

Change in Financial Goals or Needs

Better Investment Opportunities

Surrendering a Policy With a Low Cash Value

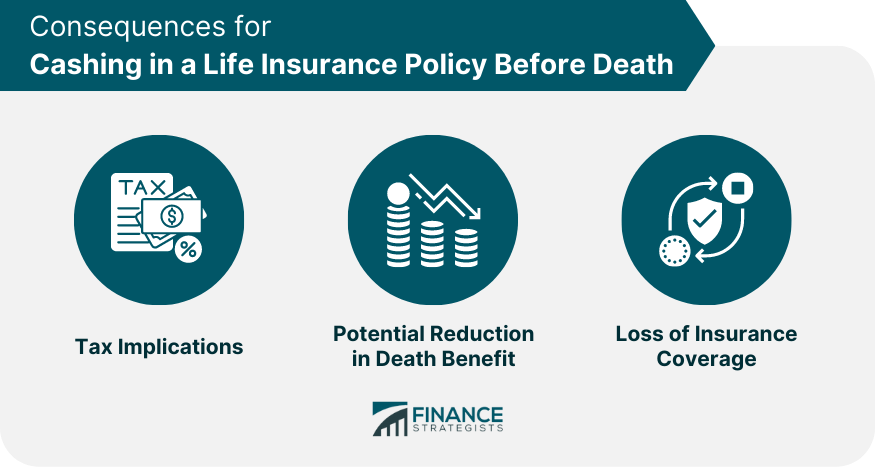

Consequences of Cashing in a Life Insurance Policy Before Death

Tax Implications

Potential Reduction in Death Benefit

Loss of Insurance Coverage

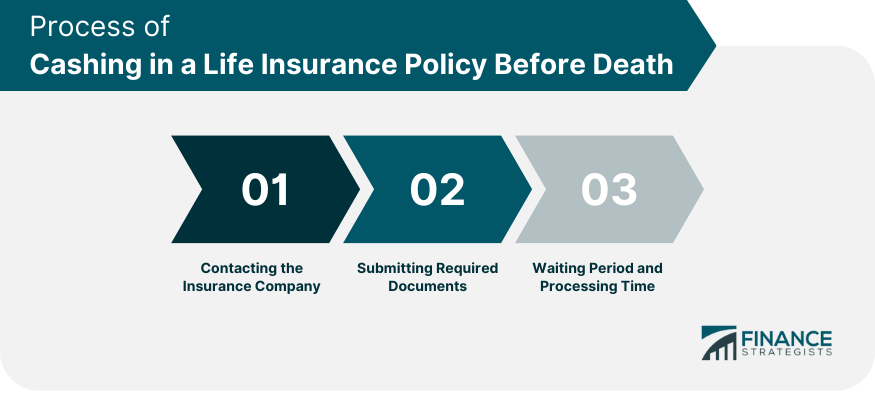

Process of Cashing in a Life Insurance Policy Before Death

Contacting the Insurance Company

Submitting Required Documents

Waiting Period and Processing Time

Alternatives to Cashing in a Life Insurance Policy Before Death

Policy Loans

Policy Settlements or Viatical Settlements

Policy Riders or Options to Access Funds

Conclusion

Can You Cash in a Life Insurance Policy Before Death? FAQs

Not all types of life insurance policies have a cash surrender value. Term life insurance policies, for example, do not typically accumulate cash value. Cash value is commonly associated with permanent life insurance policies such as whole life insurance or universal life insurance. These policies build cash value over time, which can be accessed if the policy is surrendered.

The cash surrender value is determined by several factors, including the length of time the policy has been in force, the total premiums paid, any fees or surrender charges associated with the policy, and the policy's investment performance. The insurance company uses actuarial calculations and policy provisions to determine the precise cash surrender value.

Cashing in a life insurance policy before its maturity date may incur surrender charges or fees. These charges are often highest in the early years of the policy and decrease over time. It's important to review the policy contract or consult with the insurance company to understand the specific charges that may apply.

Alternatives to cashing in a life insurance policy include taking out a policy loan, exploring policy settlements or viatical settlements, or utilizing policy riders or options that allow access to funds. These alternatives can provide access to funds while maintaining the insurance coverage provided by the policy. Each option has its own considerations and potential impact, so it's important to evaluate them carefully.

Consulting with a financial advisor or insurance professional is highly recommended before making the decision to cash in a life insurance policy. These professionals can provide guidance based on your specific financial situation, goals, and needs. They can help you evaluate the potential consequences, explore alternative options, and make an informed decision that aligns with your overall financial plan.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.