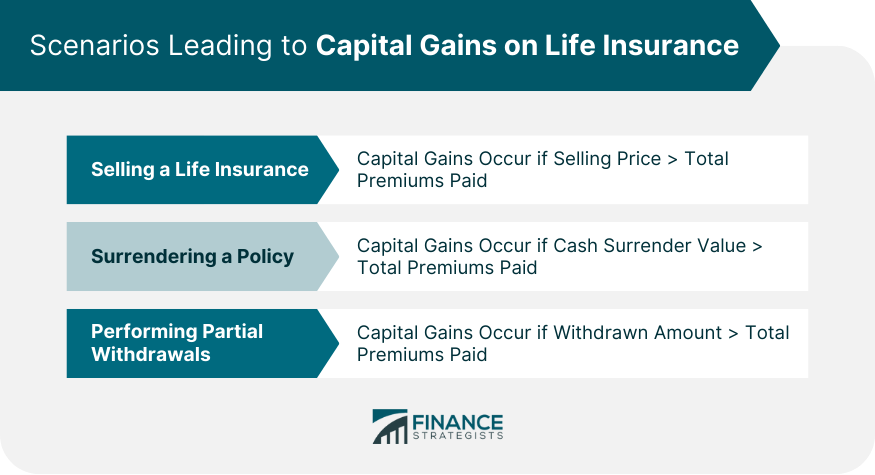

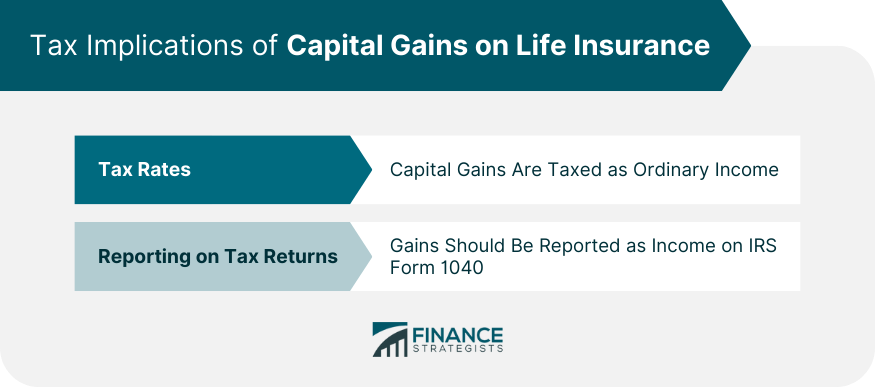

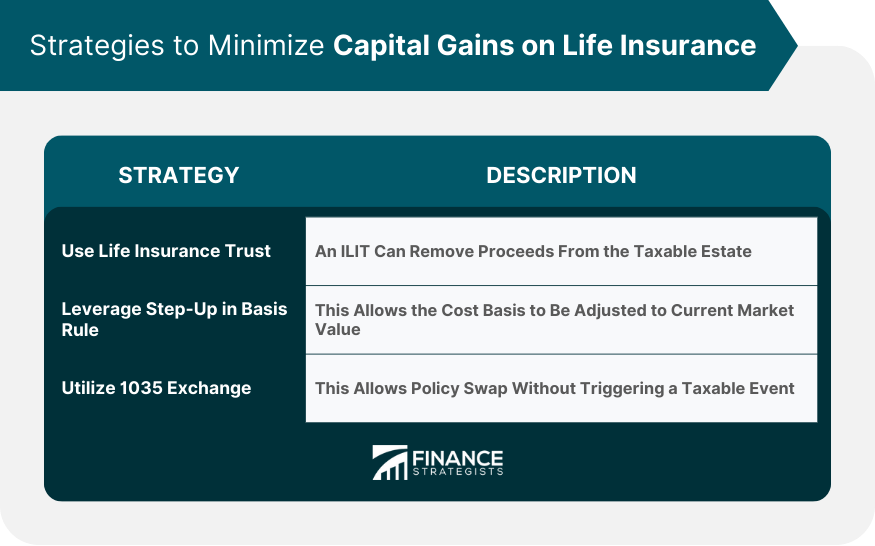

Life insurance provides a vital financial safeguard for beneficiaries upon the death of a policyholder. While many recognize this fundamental purpose, the overlap between life insurance payouts and capital gains might be less familiar. Upon a policyholder's death, beneficiaries receive life insurance payouts or death benefits, which are typically tax-free. These funds can be received as a lump sum or a structured settlement based on the policy's stipulations. The chosen payout method can influence how these funds are utilized and invested, thus affecting potential future capital gains. Capital gains signify the value appreciation of an asset or investment over its purchase price. This gain is acknowledged upon the asset's sale. For life insurance, death benefits usually don't incur capital gains. However, certain scenarios, like policy sales, surrenders, or when cash value withdrawals surpass the policyholder's cost basis, might trigger them. Life insurance policies, particularly permanent ones with a cash value component, can be sold in a transaction known as a life settlement. If the selling price is higher than the policy's cost basis (generally the total amount of premiums paid), the difference is considered a capital gain. Awareness of this fact can help a policyholder plan strategically if they choose to sell their policy. Surrendering a life insurance policy involves giving it up for the cash surrender value. Any amount received above the total premiums paid constitutes a capital gain. Policyholders should keep in mind the tax implications when considering this option. When partial withdrawals from a cash value life insurance policy exceed the cost basis, the excess is treated as a capital gain. This rule applies even when the policy remains in effect. Therefore, policyholders should be cautious about the amount and frequency of withdrawals. Capital gains from life insurance are taxed as ordinary income, not as long-term capital gains. Therefore, they're subject to the policyholder's or beneficiary's regular income tax rate, not the preferable long-term capital gains tax rates. This means that the tax rate can be significantly higher, which underscores the importance of considering taxes when making decisions related to life insurance. Capital gains from life insurance should be reported on IRS Form 1040, the individual income tax return. Specifically, they are reported as income, not as capital gains, which has implications for tax calculation. Therefore, accurate reporting is vital to prevent potential issues with the IRS. Creating an irrevocable life insurance trust (ILIT) can help avoid capital gains. By placing a life insurance policy inside an ILIT, the policyholder gives up ownership rights, preventing the proceeds from being part of their taxable estate. However, ILITs have their complexities and require careful planning. Professional guidance is recommended when setting up an ILIT. The "step-up in basis" rule allows the cost basis of an asset to be adjusted to its current market value when inherited. This rule can also apply to life insurance policies sold by the beneficiary and can lower capital gains. Beneficiaries can use this rule to their advantage, potentially saving substantial amounts in taxes. The 1035 exchange is a provision in the tax code that allows a policyholder to swap one life insurance policy for another without triggering a taxable event. This strategy can defer potential capital gains. However, the exchange must meet specific requirements to be valid, making it essential to understand these rules or consult a tax professional. Consider a policyholder who has paid $50,000 in premiums on their life insurance policy. They sell the policy for $80,000. The capital gain would be $30,000 ($80,000 - $50,000), which would be subject to their ordinary income tax rate. In this situation, the policyholder will need to account for this tax liability in their financial planning. If a policyholder has a policy with a cash surrender value of $100,000 and they've paid $70,000 in premiums, surrendering this policy would result in a capital gain of $30,000. This amount would be subject to income tax. Therefore, they should be aware of this tax implication before deciding to surrender their policy. Life insurance plays a critical role in providing financial security to beneficiaries. But while most are familiar with the primary benefits, fewer may be aware of the intersections between life insurance payouts and capital gains. Beneficiaries typically receive life insurance payouts tax-free, either as lump sums or structured settlements. However, actions like selling, surrendering, or making excessive withdrawals from a policy can lead to capital gains. These gains from life insurance are taxed as ordinary income, demanding vigilance in accurate reporting on tax returns to avoid IRS complications. The tax rates can be significantly steeper than those for long-term capital gains. Fortunately, strategies like the irrevocable life insurance trust, leveraging the "step-up in basis" rule, and the 1035 exchange can help minimize or defer these gains. As the nuances of life insurance and taxation intertwine, expert advice becomes invaluable. Consult a professional for tax planning services to navigate the complexities.Basics of Capital Gains on Life Insurance

When Can Life Insurance Lead to Capital Gains?

Selling a Life Insurance Policy

Surrendering a Life Insurance Policy

Performing Partial Withdrawals From a Life Insurance Policy

Tax Implications of Capital Gains on Life Insurance

Tax Rates on Life Insurance Capital Gains

Reporting Capital Gains From Life Insurance on Tax Returns

Strategies for Minimizing Capital Gains on Life Insurance

Use a Life Insurance Trust

Leverage the "Step-Up in Basis" Rule

Utilize 1035 Exchange for Life Insurance Policies

Impact of Capital Gains on Life Insurance Through Real-Life Scenarios

Example of Selling a Life Insurance Policy

Example of Surrendering a Life Insurance Policy

Bottom Line

Capital Gains on Life Insurance FAQs

Capital gains in life insurance typically arise when the policy is sold, surrendered, or when cash value withdrawals exceed the premiums paid.

Generally, life insurance payouts or death benefits are not subject to capital gains. However, certain exceptions may apply.

You can avoid or minimize capital gains on life insurance through strategies like 1035 exchanges, using a life insurance trust, or leveraging the "step-up in basis" rule.

Capital gains from life insurance are taxed as ordinary income, not as long-term capital gains. They should be reported as income on your tax return.

Yes, if you sell a life insurance policy for more than the total amount of premiums paid, the difference is considered a capital gain.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.