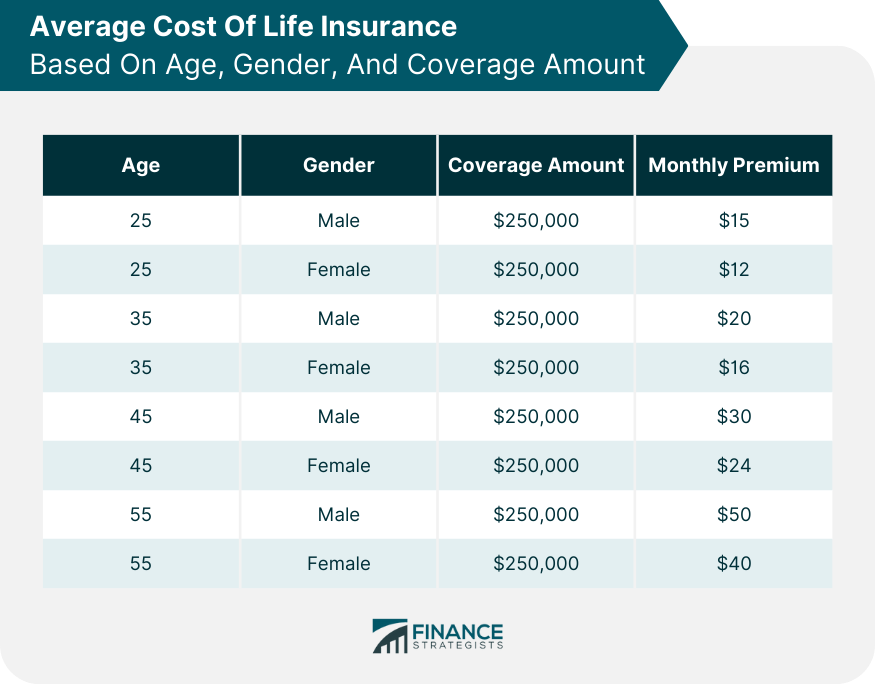

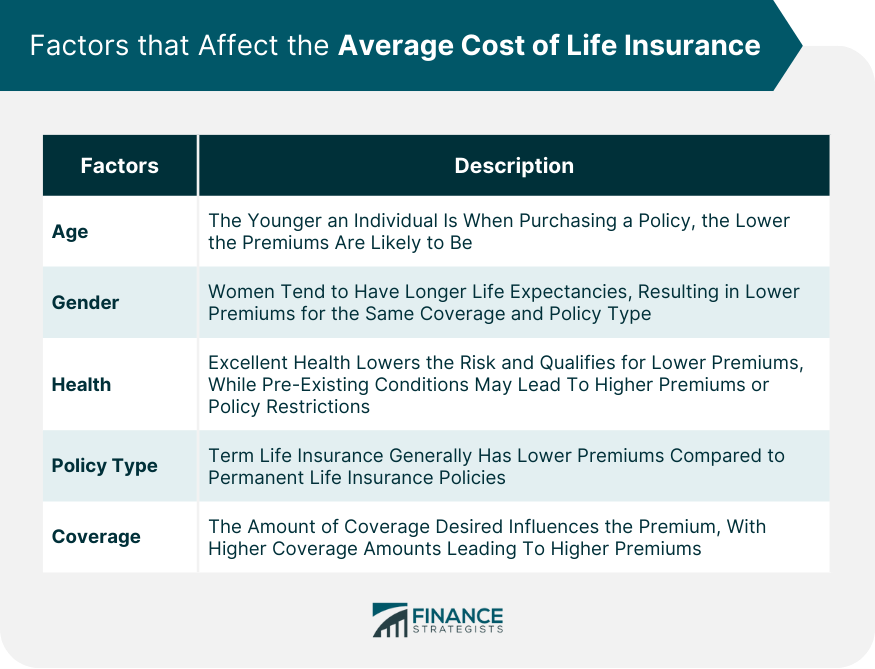

Life insurance is a financial contract between an individual, known as the policyholder, and an insurance company. It provides a payout, known as the death benefit, to the designated beneficiaries upon the policyholder's death. This payout is intended to provide financial protection and support to the policyholder's loved ones in the event of their passing. Life insurance is a crucial tool in mitigating the financial risks associated with unexpected death and ensuring the financial stability of dependents. Life insurance plays a vital role in providing financial security and peace of mind. It serves as a safety net, protecting loved ones from the financial burdens that may arise from the policyholder's death. The death benefit received by beneficiaries can be used to cover various expenses, such as funeral costs, mortgage payments, outstanding debts, and daily living expenses. Life insurance is especially important for individuals with dependents, such as a spouse, children, or aging parents, as it ensures their financial well-being and helps maintain their standard of living. Additionally, life insurance can be a valuable tool in estate planning, wealth transfer, and charitable giving, providing individuals with opportunities to leave a legacy and support causes close to their hearts. Below is a table presenting the average cost of life insurance policies based on different factors such as age, coverage amount, and policy type. It is important for individuals to consider that these figures are averages, and their actual premium may vary depending on their individual circumstances. Factors like health, lifestyle, and smoking habits can influence the premium amount. To secure the most favorable rate, individuals are advised to obtain life insurance quotes from multiple companies and compare them before making a policy purchase. Age is a significant determinant of life insurance premiums. Generally, the younger an individual is when purchasing a policy, the lower the premiums are likely to be. This is because younger individuals are typically considered to be at a lower risk of mortality and may have a longer premium-paying period ahead. Gender is another factor that affects life insurance costs. On average, women tend to have longer life expectancies compared to men. As a result, women often pay lower premiums for the same coverage amount and policy type. Insurers assess the health risk of applicants through medical underwriting, which may involve reviewing medical records, conducting medical examinations, or assessing health questionnaires. Individuals with excellent health are generally considered lower risk and may qualify for lower premiums, while those with pre-existing conditions or higher health risks may face higher premiums or possible policy restrictions. The type of life insurance policy chosen also affects the cost. Term life insurance, which provides coverage for a specific period, typically has lower premiums compared to permanent life insurance policies. Permanent life insurance, such as whole life insurance or universal life insurance, combines insurance coverage with a savings component, leading to higher premiums. The amount of coverage, or the death benefit, desired by the policyholder also influences the cost of life insurance. As the coverage amount increases, so does the premium. Insurers consider the financial risk they undertake when providing a higher death benefit, leading to higher premiums for larger coverage amounts. To determine the average cost of life insurance, it is essential to consider multiple factors, such as age, gender, health, type of policy, and coverage amount. Insurance companies utilize actuarial tables, underwriting guidelines, and statistical data to assess risk and calculate premiums. Individuals can obtain personalized quotes from insurance providers by providing the necessary information and specifications relevant to their circumstances. Choosing the right life insurance policy involves evaluating personal circumstances, financial goals, and risk tolerance. It's crucial to consider factors such as coverage needs, affordability, flexibility, and the policy's ability to meet long-term financial objectives. Individuals should assess their financial obligations, such as mortgage payments, outstanding debts, and education expenses, and select a policy that adequately covers these needs. Additionally, policyholders need to consider factors such as the length of coverage, the potential for cash value accumulation, and any riders or endorsements that may be beneficial. While life insurance is an essential financial tool, there are strategies individuals can employ to help reduce the costs associated with coverage. Maintaining a healthy lifestyle, such as regular exercise, a balanced diet, and refraining from smoking or excessive alcohol consumption, can positively impact life insurance premiums. Individuals who demonstrate healthier habits and lower health risks may be eligible for lower rates. Selecting a policy type and coverage amount that aligns with one's financial goals and needs is crucial. Opting for term life insurance, which offers coverage for a specific period, can be a cost-effective solution for individuals with temporary financial obligations. On the other hand, permanent life insurance policies provide lifelong coverage and potential cash value accumulation, but come with higher premiums. Life insurance riders are additional features that can be added to a policy to enhance its coverage. For example, a critical illness rider may provide a lump sum payment if the policyholder is diagnosed with a specified critical illness. By carefully considering which riders or endorsements are relevant and necessary, individuals can customize their policy to their specific needs while managing costs effectively. Life insurance needs can change over time as financial obligations evolve. Regularly reviewing the policy and assessing its relevance and adequacy is essential. By updating the coverage amount or adjusting the policy type as circumstances change, individuals can ensure they have the most appropriate and cost-effective coverage. Life insurance provides financial protection to individuals and their families in the event of death. The average cost of life insurance is influenced by several factors. Age and health conditions play a significant role. Gender also affects the cost, as statistically, women tend to have longer life expectancies. Lifestyle habits, such as smoking or engaging in high-risk activities, can increase premiums. The type and coverage amount of the policy are additional factors to consider. Term life insurance tends to be more affordable compared to whole life insurance. To lower life insurance costs, there are effective strategies to consider. Improving health and adopting a healthy lifestyle can positively impact premiums. Choosing the right policy type and coverage amount that aligns with individual needs is essential. Utilizing riders and endorsements can customize the policy to provide additional benefits. Regularly reviewing and updating the policy helps ensure it remains suitable as circumstances change. It is important to shop around, compare quotes from different insurers, and consider working with a knowledgeable insurance agent to find the most affordable and suitable policy. While cost is a significant consideration, it should not be the sole determining factor in choosing life insurance. It is essential to strike a balance between affordability and the coverage that meets your financial goals and provides peace of mind for your loved ones.What Is Life Insurance?

Why Life Insurance Is Important

Average Cost Of Life Insurance

Factors that Affect the Average Cost of Life Insurance

Age

Gender

Health

Type of Policy

Amount of Coverage

Determining the Average Cost of Life Insurance

Choosing the Right Life Insurance Policy

Strategies to Lower Life Insurance Costs

Improving Health and Lifestyle Habits

Choosing the Right Policy Type and Coverage Amount

Utilizing Riders and Endorsements

Regularly Reviewing and Updating the Policy

Final Thoughts

Average Cost of Life Insurance FAQs

The average cost of life insurance varies depending on factors such as age, gender, health, policy type, and coverage amount. It is advisable to obtain personalized quotes from insurance providers based on individual circumstances and requirements.

Yes, age is a significant factor in determining life insurance premiums. Typically, younger individuals pay lower premiums compared to older individuals due to the perceived lower risk of mortality.

Yes, health conditions can impact life insurance costs. Individuals with pre-existing conditions or higher health risks may face higher premiums or possible policy restrictions. Good health and healthy lifestyle habits can positively impact life insurance premiums.

Term life insurance provides coverage for a specific period, such as 10, 20, or 30 years, while permanent life insurance offers coverage for the entire lifetime of the insured. Permanent life insurance policies also include a cash value component, whereas term life insurance does not.

Life insurance premiums can be lowered over time by employing strategies such as improving health, adjusting coverage amounts, utilizing riders and endorsements, and regularly reviewing and updating the policy to ensure it aligns with changing circumstances and needs

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.