Term life insurance is a type of life insurance policy that provides coverage for a specific period known as the term. If the policyholder dies within this term, their beneficiaries receive a death benefit. No benefit is paid out if the term expires while the policyholder is still alive. On the other hand, whole life insurance provides lifelong coverage and includes an investment component known as the policy's cash value. The policy remains active as long as the policyholder pays the premiums and provides a death benefit and cash value when the policyholder dies. Insurance conversion refers to the process of changing one type of insurance policy into another, in this case, converting term life insurance to whole life insurance. A legal clause in your insurance policy gives you the right to convert from your term life insurance policy to a whole life policy without undergoing a medical examination. Conversion is a policy feature allowing you to change your term life insurance policy to a permanent one, such as whole life insurance. It's a strategy employed when a policyholder's insurance needs change over time. The decision to convert term to whole life insurance should be guided by a person's changing needs and circumstances. Here are some reasons why and when one might consider making the switch: One of the main reasons people convert term policies to whole life insurance is the desire for permanent coverage. Whole life insurance offers a death benefit that lasts for the policyholder's entire life, not just a specified term. This can be particularly beneficial for individuals who have dependents with lifelong dependencies, such as a child with special needs. Whole life insurance policies build cash value over time that can be borrowed against or even withdrawn for emergencies, retirement income, funding a child's education, or any other financial need. Building cash value is an important financial goal; converting the term to whole life insurance is worth considering. As people move through different stages of life, their financial situations change. For example, early in one's career, a term life policy might be the most affordable way to obtain substantial coverage. However, as income increases and financial stability improves, one might consider converting to a whole-life policy that offers both insurance protection and a method of savings. If an individual's health has deteriorated during the policy term, conversion to a whole-life policy can allow for continued coverage without needing a new medical exam. This is because the conversion typically honors the policyholder's health status at the time the original term policy was purchased. Whole life insurance can be useful for estate planning. The death benefit from a whole-life policy can provide a lump sum that can help cover estate taxes and final expenses and provide an inheritance. When it comes to the timing of conversion, it largely depends on the terms set by the insurance company. Many insurers provide a conversion option, but this must be exercised before the term life policy expires and often before the policyholder reaches a certain age. Reviewing the policy or consulting with an insurance agent to understand these parameters is important. Whole life insurance and term life insurance each have their advantages. Still, several key benefits of whole life insurance make it a more comprehensive type of coverage compared to term life insurance. Here are some of the primary benefits: Unlike term life insurance which provides coverage for a specific period (the term), whole life insurance covers the policyholder's entire life. This means that as long as the premiums are paid, the insurance company will pay a death benefit no matter when the policyholder dies. One of the distinguishing features of whole life insurance is its cash value component. A portion of your premium goes into a tax-deferred savings account that grows over time. This cash value can be borrowed against or withdrawn during the policyholder's lifetime for any reason, including funding retirement or paying for a child’s education. Whole life insurance policies typically come with fixed premiums. This means the premium amount will stay the same over the policy's life, regardless of age or health changes. This can provide budgeting predictability that term life insurance policies (which often increase in cost at renewal) cannot. Some types of whole life insurance, known as participating policies, pay dividends to policyholders. While dividends are not guaranteed, they can be used to reduce premiums, increase the death benefit, or increase the policy's cash value. Since whole life insurance builds cash value, it can be used as collateral for a loan. If the policyholder needs to borrow money, they can use their whole life insurance policy as a guarantee to lenders. Whole life insurance can also be integral to an estate planning strategy. The death benefit proceeds from a whole life insurance policy can provide immediate funds to cover estate taxes and other final expenses. The conversion process is not typically complicated, but it does require a series of steps to ensure the transition is smooth and beneficial. Below are the key steps involved in the conversion process. First, check whether your term life insurance policy has a conversion feature. This information will be detailed in your policy documents. If you’re unsure, contact your insurance agent or company. Different policies have different conversion deadlines, which are usually a certain age or a certain number of years after the policy is issued. Identifying this deadline is crucial to ensure you take advantage of your chance to convert. Once you understand your policy's conversion feature, contact your insurance provider. They can provide information about the whole-life policies available for conversion. Your insurance provider can also give you an idea of how much the premiums would be for the whole life policy. This can help you determine whether the conversion is financially feasible. Analyze your current and projected financial situation. This assessment will help you determine whether you can comfortably afford the higher premiums of whole life insurance. Choose a whole life policy that fits your financial goals and needs. Remember, whole life insurance is a long-term commitment, so consider your choice carefully. Once you've chosen a policy, you must complete a conversion application. This process is generally straightforward, and your insurer will guide you through it. After you submit your conversion application, you'll need to wait for the insurance company to process it. Once it's processed, you'll receive confirmation of your new whole-life policy. It's important to note that while this process might seem straightforward, the decision to convert should be taken with seriousness. It's recommended to consult with a financial advisor or insurance professional before converting your term life insurance to a whole life insurance policy. Converting term to whole life will generally increase your premiums. Whole life insurance premiums are higher due to the cash value component and lifelong coverage. Term insurance premiums are significantly lower compared to whole-life insurance premiums. However, term insurance lacks the investment component and lifelong coverage that whole life insurance offers. Over the long term, conversion to a whole life policy can be beneficial. The policy builds cash value over time that can be accessed during the policyholder's lifetime. Additionally, fixed premiums can result in savings as they don't increase with age. While conversion from term life insurance to whole life insurance can have numerous benefits, it's important to be aware of the potential challenges and limitations that come with it. Let's explore some of these: Each term life insurance policy will have a specific timeframe within which the policy can be converted. This deadline often correlates with either a certain age or a specific number of years after the term policy is issued. If this deadline is met, the option to convert might be recovered. Not all term life insurance policies come with the option to convert to whole life insurance. Even if a policy does offer a conversion feature, the options might be limited. Insurance companies often have specific policies to which a term policy can be converted, which may include only some of the company's whole-life policy options. The cost difference between term life insurance and whole life insurance can be significant. Whole life insurance premiums can be several times higher than term life insurance premiums. The higher cost can be a challenge for some policyholders and could even lead to a lapse in coverage if the premiums become unaffordable. There's a risk associated with the conversion if the policyholder's financial situation changes drastically. For example, if a policyholder converts to a whole-life policy and can't keep up with the higher premiums, they might risk losing coverage. Additionally, if the cash value is withdrawn or borrowed against, it could reduce the death benefit or even lead to policy termination if not managed properly. Converting term life insurance to whole life insurance is a process that offers various benefits and considerations. It allows policyholders to obtain permanent coverage, build cash value, and adapt to changing financial situations. Converting to whole life insurance can be advantageous for individuals seeking lifelong coverage, cash value accumulation, and a fixed premium structure. It can also serve as an effective estate planning tool and provide financial stability for dependents. Understanding the conversion process is crucial, including reviewing the policy's conversion features, contacting the insurance provider, evaluating costs, selecting a suitable policy, and completing the conversion application. However, it's essential to carefully assess the financial impact and potential challenges of conversion, such as increased premiums, limited conversion options, and potential risks associated with policy termination or reduced death benefits. Before making the decision to convert, consulting with a financial advisor or insurance professional can provide valuable guidance and help ensure the conversion aligns with your long-term financial goals.What Are Term Life and Whole Life Insurance?

Understanding the Conversion of Term Life Insurance to Whole Life Insurance

What Is Conversion?

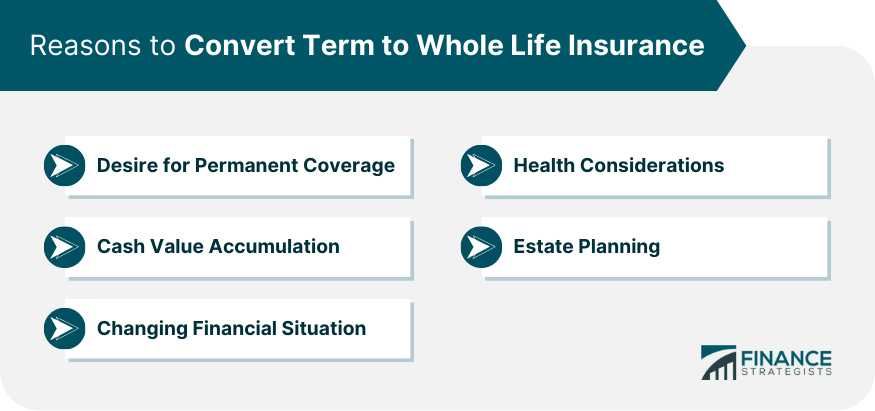

Reasons to Convert Term to Whole Life Insurance

Desire for Permanent Coverage

Cash Value Accumulation

Changing Financial Situation

Health Considerations

Estate Planning

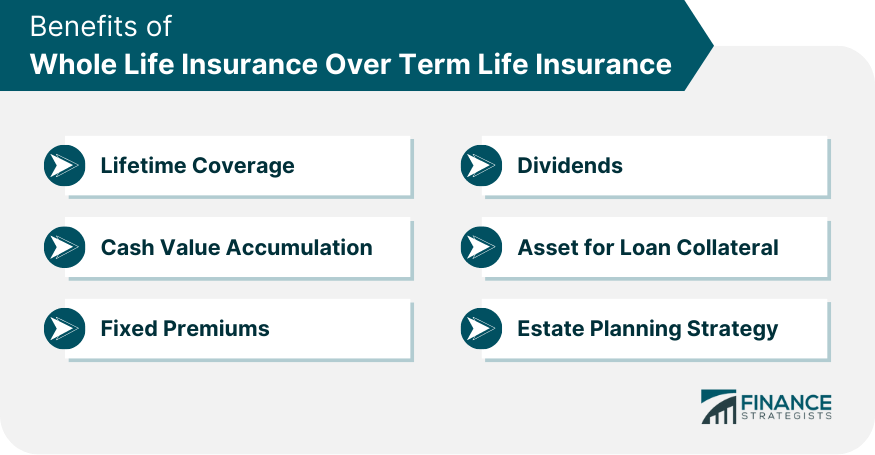

Benefits of Whole Life Insurance Over Term Life Insurance

Lifetime Coverage

Cash Value Accumulation

Fixed Premiums

Dividends

Asset for Loan Collateral

Estate Planning Strategy

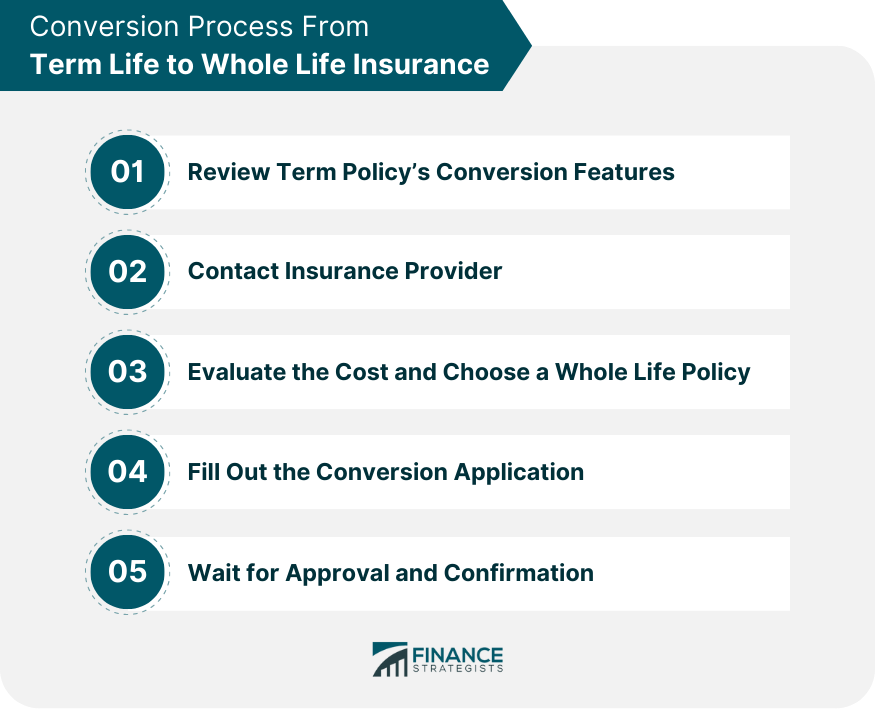

Process of Conversion of Term Life Insurance to Whole Life Insurance

Review Term Policy’s Conversion Features

Understand Conversion Privilege

Determine the Conversion Deadline

Contact Insurance Provider

Discuss Conversion Options

Confirm the Conversion Cost

Evaluate the Cost and Choose a Whole Life Policy

Assess Financial Situation

Select a Suitable Policy

Fill Out the Conversion Application

Wait for Approval and Confirmation

Cost Implications of Conversion of Term Life Insurance to Whole Life Insurance

How Conversion Affects Premiums

Comparison of Term Life and Whole Life Insurance Premiums

Long-Term Financial Impact of Conversion

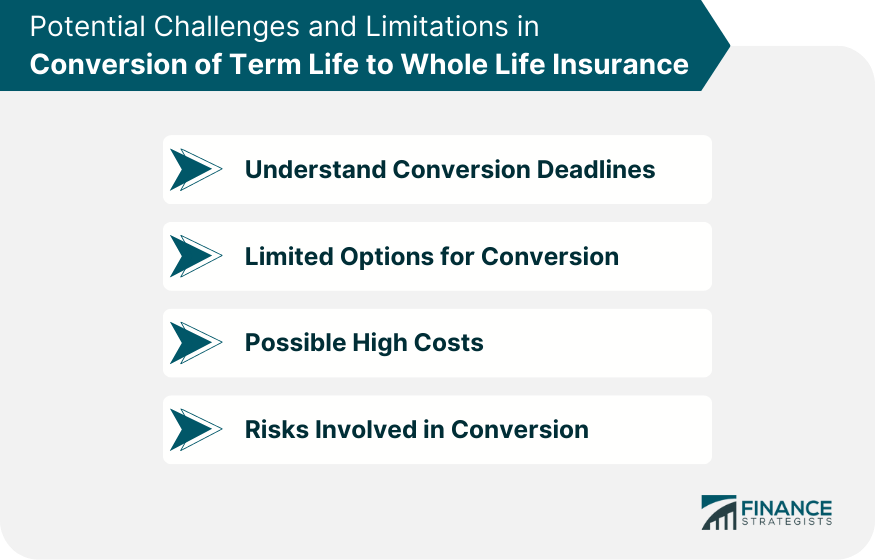

Potential Challenges and Limitations of Conversion of Term Life Insurance to Whole Life Insurance

Understanding Conversion Deadlines

Limited Options for Conversion

Possible High Costs

Risks Involved in Conversion

Bottom Line

Conversion of Term Life Insurance to Whole Life Insurance FAQs

The process involves reviewing the conversion feature of the term policy, contacting the insurance provider, selecting an appropriate whole-life policy, filling out the conversion application, and awaiting approval.

The conversion is worth considering when there is a need for extended coverage, an interest in building cash value, or when financial situations have improved sufficiently to accommodate the higher premiums.

The benefits of conversion include providing lifelong coverage, accumulating cash value, and the potential to borrow against or sell the policy.

Conversion usually results in higher premiums due to whole life insurance's lifelong coverage and cash value component.

Possible challenges include the necessity to meet conversion deadlines, potentially high costs, and limited options for conversion. There's also a risk associated with failing to keep up with the higher premiums, which could result in the loss of coverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.