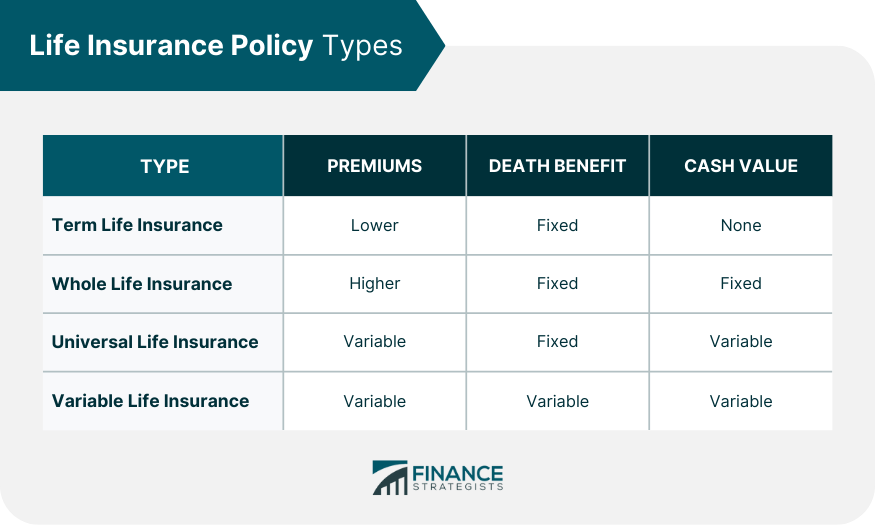

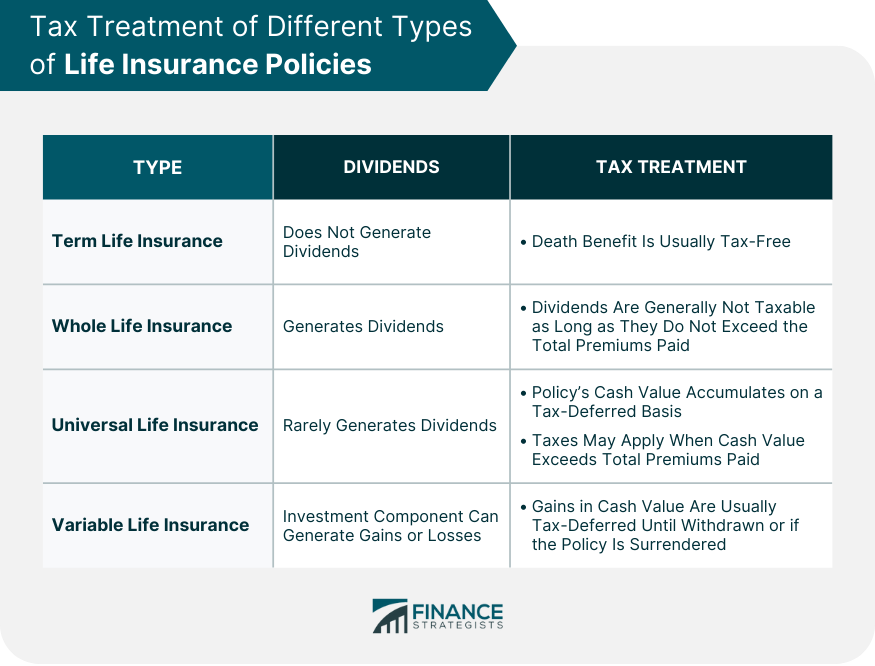

Generally, dividends on a life insurance policy are not considered taxable income by the IRS. This is often because they are viewed as a return of premiums that you've already paid into the policy. However, if dividends exceed the total amount of premiums paid into the policy, the excess may be considered taxable. Also, if dividends are left to accumulate interest within the policy, the interest portion could be subject to taxes. If a policyholder decides to surrender their policy for cash, any gain (cash received in excess of premiums paid) could be taxable. It's important to remember that tax laws can be complex and individual circumstances can vary, so you should consult with a tax advisor for advice based on your specific situation. Life insurance is a contractual agreement between an individual (policyholder) and an insurance company. In this contract, the policyholder pays premiums regularly or in a lump sum. In return, the insurance company agrees to pay a designated beneficiary a sum of money (death benefit) upon the death of the insured person. Life insurance policies come in several forms, such as the following: Term Life Insurance: This offers coverage for a specified "term" of years. If the insured person dies during this term, the death benefit is paid to the beneficiaries. If the policyholder survives the term, coverage ends, and no death benefit is paid out. Whole Life Insurance: This provides coverage for the policyholder's entire lifetime. In addition to a death benefit, it also includes a cash value component that grows over time. Universal Life Insurance: This is a type of permanent life insurance with a cash value component that earns interest. It offers more flexibility than whole life insurance, allowing policyholders to adjust their premiums and death benefits. Variable Life Insurance: This is a form of permanent life insurance with an investment component. The cash value is invested in a series of sub-accounts, similar to mutual funds, that can fluctuate in value. In the context of life insurance, dividends represent a return of a portion of the premiums paid on a participating policy. These dividends are generated from the insurance company's profits. But are these dividends on a life insurance policy taxable? The term 'dividends' in life insurance refers to the portion of the insurance company's profits that are distributed to policyholders of participating policies. This profit is generated from investments, premium payments, and savings on operating expenses. Insurance companies generate profits mainly through premium payments and investments. When these profits exceed the costs of claims, operating expenses, and reserves, the surplus is often shared with policyholders in the form of dividends. Several factors can influence the taxability of dividends. The type of policy, the way dividends are used, and the policy's cash value can all impact whether dividends are taxable. The taxation rules differ for term life, whole life, universal life, and variable life insurance policies. Term life insurance policies do not generally generate dividends; hence, there's no question of dividend taxation. However, the death benefit received by beneficiaries is typically tax-free. Whole life policies often generate dividends, but as previously discussed, these dividends are usually not taxable as long as they don't exceed the total premiums paid. Dividends in universal life insurance are rare. However, the policy's cash value accumulates on a tax-deferred basis. When the cash value is withdrawn, it could be subject to taxes if it exceeds the total premiums paid. Variable life insurance policies have an investment component that can generate gains or losses. Any gains in the cash value are typically tax-deferred until withdrawn or if the policy is surrendered. Understanding the tax implications of different policies can influence the decision-making process for potential policyholders. Whole-life policies can provide tax-free dividends, while universal and variable life policies offer tax-deferred growth. Understanding the tax implications of life insurance policy dividends is crucial, but it's equally important to consult with a tax advisor. Tax laws can be complicated, and individual circumstances can vary. A tax advisor can provide personalized advice based on an individual's unique financial situation and help navigate the complex world of taxes and life insurance. Several strategies can minimize tax liability on life insurance dividends. These may include utilizing dividends to pay premiums, buying additional insurance, or leaving the dividends to accumulate interest within the policy. The tax laws can significantly impact the choice of life insurance policies. Understanding these laws can help policyholders maximize their benefits and minimize their tax liability. Life insurance, a crucial tool for financial planning, comes in various forms: Term, Whole, Universal, and Variable. Each has unique features and tax implications. Dividends from these policies, a return of premiums, are typically non-taxable, provided they don't exceed the total premiums paid. However, certain situations, like policy surrender or leaving dividends to earn interest, may trigger taxes. A nuanced understanding of these tax aspects can impact policy choices and optimize financial benefits. It's vital to consult a tax advisor to navigate these complexities. Having a good grasp of the taxation rules surrounding life insurance dividends is crucial for making well-informed financial decisions and planning, as it enables the utilization of strategies like using dividends to cover insurance premiums or acquire extra coverage. This approach aids in reducing tax obligations effectively.Are Dividends on a Life Insurance Policy Taxable?

Overview of Life Insurance Policies

Dividends on Life Insurance Policies

Understanding Dividends in Life Insurance

How Dividends Are Generated

Factors Influencing the Taxability of Dividends

Tax Treatment of Different Types of Life Insurance Policies

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Variable Life Insurance

Practical Considerations for Life Insurance Policyholders

Importance of Consulting With a Tax Advisor

Methods to Minimize Tax Liability on Life Insurance Dividends

Impact of Tax Laws on Policy Choices

Bottom Line

Are Dividends on a Life Insurance Policy Taxable? FAQs

No, dividends received on a life insurance policy are generally not considered taxable income, as they're often viewed as a return of premiums already paid. However, if dividends exceed the total amount of premiums paid into the policy, the excess may be taxable.

The dividends themselves remain non-taxable. However, any interest earned on those dividends is typically considered taxable income. You should consult with a tax advisor to understand your specific situation.

If you surrender your policy for cash, the amount you receive that exceeds the total premiums you've paid into the policy could be considered taxable income. This includes dividends that have been left to accumulate within the policy.

No, different types of life insurance policies have different tax implications. For instance, term life insurance policies typically don't pay dividends, while whole life policies do. The dividends from whole-life policies are generally not taxable as long as they do not exceed the total premiums paid into the policy.

No, using dividends to purchase additional insurance (paid-up additions) is usually not considered a taxable event. The dividends are considered a return of premiums and hence are typically not subject to taxes.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.