Credit life insurance is a specialized type of insurance policy intended to protect borrowers by covering their remaining debts should they pass away before complete repayment. The insurance payout is directed to the lender to settle the outstanding debt. The primary role of credit line insurance is to provide borrowers with a sense of security. With this policy, they can rest assured that their debts will not be transferred to their loved ones upon death. This coverage primarily benefits individuals with considerable debt or significant health issues. Knowledge of credit life insurance can provide a valuable safety net, ensuring that your financial obligations do not add to your family's burdens in the event of your untimely death. The emergence of credit life insurance dates back to the early 20th century. It was developed to shield lenders from financial loss when borrowers died before their loans were repaid. Since then, it has grown and adapted to meet the modern lending practices and varied needs of customers. Regulatory alterations over the years have played a crucial role in shaping the face of credit life insurance. For instance, the Truth in Lending Act mandates lenders to openly disclose the terms and costs of credit insurance before initiating a loan, thereby guarding consumers against unscrupulous lending practices. Market trends, like the growth of consumer debt and the extended lifespan of the average individual, have increased the demand for credit life insurance. These trends and those to come will likely affect the relevance and features of this type of insurance. In credit life insurance, "coverage" refers explicitly to the outstanding loan balance the insurance policy will cover. Upon the borrower's death, the policy's payout should ideally equal this outstanding amount, thus ultimately settling the debt without burdening the borrower's loved ones. Term duration denotes the active period of the insurance policy, which is typically synonymous with the loan term. The policy's term diminishes as the loan is gradually repaid. When the loan is fully repaid, the policy ceases to exist. Unlike traditional life insurance, which typically designates a family member or a loved one as a beneficiary, credit life insurance works differently. The beneficiary of a credit life insurance policy is invariably the lender or the creditor. This is because the policy's purpose is to repay the loan rather than provide a payout to the family. Initiating a credit life insurance policy usually begins with an application process. Prospective borrowers often need to answer a series of health-related questions. Sometimes, the lender might propose credit life insurance when the borrower sets up their loan. The calculation of premiums in credit life insurance is based on various elements. These include the total loan amount, the loan term, and the borrower's age and health status. Generally, the more significant the perceived risk, the higher the insurance premium. Premium payments for credit life insurance policies are often integrated with loan payments, offering a more seamless process for the borrower. However, this arrangement could mask the actual cost of the insurance policy, making it less costly than it truly is. Term and credit life insurance differ significantly in their operations and intended purposes. Term life insurance pays a predetermined death benefit to the policyholder's selected beneficiaries, which they can use as they see fit. On the other hand, credit life insurance directly addresses specific debts, paying off the owed amount to the creditor in case of the policyholder's death. The distinction between credit life insurance and whole life insurance lies in coverage duration and financial benefits. Whole life insurance covers the policyholder's entire life, with a cash value component that builds over time and can be borrowed against or withdrawn during the policyholder's lifetime. In contrast, credit life insurance offers coverage only for the term of the associated loan. Although both types relate to loans, mortgage and credit life insurance serve different purposes. Mortgage insurance is specifically designed to protect the lender if the borrower defaults. Meanwhile, credit life insurance's primary function is to cover the outstanding loan balance if the borrower dies before repaying the loan. One of the most salient features of credit life insurance is its role in managing outstanding loans. Ensuring these loans are paid off after the borrower's death helps reduce the financial stress on surviving family members. Although less common, credit life insurance can be used to manage credit card debt. If the policy explicitly includes credit card debts, the outstanding balance can be paid off upon the borrower's death. A credit life insurance policy can include auto loans and mortgages. If the borrower passes away before repaying these loans, the policy can cover the remaining balance, avoiding the need for the assets (car or house) to be sold to cover the debt. One of the primary advantages of credit life insurance is that it provides financial protection for your loved ones in the event of your untimely death. It ensures that the outstanding debts, such as loans or mortgages, are paid off directly to the creditor, relieving your family members from the burden of repaying those debts. Credit life insurance provides peace of mind to borrowers. Knowing that their debts will not become a financial burden for their loved ones can alleviate stress and allow individuals to focus on other essential aspects of their lives. Credit life insurance is often integrated into the loan process, making it a seamless and convenient option for borrowers. Premium payments are typically combined with loan payments, eliminating the need for separate payments and ensuring that the coverage remains effective as long as the loan is active. Unlike other life insurance forms, credit life insurance often does not require a medical exam or extensive health assessments. This makes it accessible to individuals with pre-existing health conditions or those who may have difficulty obtaining traditional life insurance coverage. Credit life insurance is designed to address specific debts, providing coverage that directly aligns with the outstanding loan balance. This targeted coverage ensures that the loan is paid in full, protecting both the borrower and their family from the financial consequences of unpaid debts. Credit life insurance gives borrowers greater flexibility in managing their loan repayment. In the event of the borrower's death, the insurance coverage settles the outstanding loan amount, potentially saving the borrower's assets from being sold to repay the debt. Life is unpredictable, and unforeseen events can happen. Credit life insurance offers protection against unexpected circumstances such as accidents, illnesses, or premature death, ensuring that the borrower's financial responsibilities are taken care of if the worst were to happen. One common criticism of credit life insurance revolves around its premium costs. The premiums for this type of insurance can be significantly higher than those for standard life insurance policies. This is often because the insurer bears a higher risk, mainly when the underwriting process does not involve in-depth health assessments, causing the premiums to be more substantial. Credit life insurance offers limited flexibility in comparison to traditional life insurance. This is because the insurance payout is dedicated solely to settling the loan it's tied to and not allocated according to the needs or wishes of the borrower's family. With traditional life insurance, beneficiaries can use the payout for various purposes as they see fit. Credit life insurance might not be the most cost-effective choice for younger and healthier individuals. These individuals could get a larger payout for the exact cost with a term life insurance policy. Considering other insurance options may be worth it before opting for credit life insurance. Your current financial situation plays a significant role in determining the necessity and suitability of credit life insurance. If you have significant debts and your family struggles to repay them during your untimely demise, this type of insurance could offer valuable protection. Consideration of your family's needs and financial capacity is also crucial. If your family has adequate resources to handle any outstanding debts, the need for credit life insurance might be less pronounced. An honest evaluation of your debt and credit situation is essential. If you have high-risk loans or if your debts are sizeable relative to your income and savings, credit life insurance can provide an added layer of security. Credit life insurance is a critical tool in financial planning, providing valuable protection against debt burdens during unfortunate life events. This insurance safeguards your loved ones from inherited debts, ensuring peace of mind by covering key liabilities like mortgages or auto loans. It's vital, however, to remember that credit life insurance isn't a universal solution and should be tailored to individual circumstances, considering factors like age, health, debt type, and family financial resources. Understanding your financial health isn't only about income and expenses or assets and liabilities; it also involves recognizing how tools like credit life insurance can support financial stability. As a potentially valuable part of your financial strategy, credit life insurance merits careful consideration, ideally with professional financial or insurance advice.What Is Credit Life Insurance?

History of Credit Life Insurance

Origins and Evolution

Regulatory Changes

Impact of Market Trends

Understanding the Terms of Credit Life Insurance

Coverage

Term Duration

Beneficiary Assignment

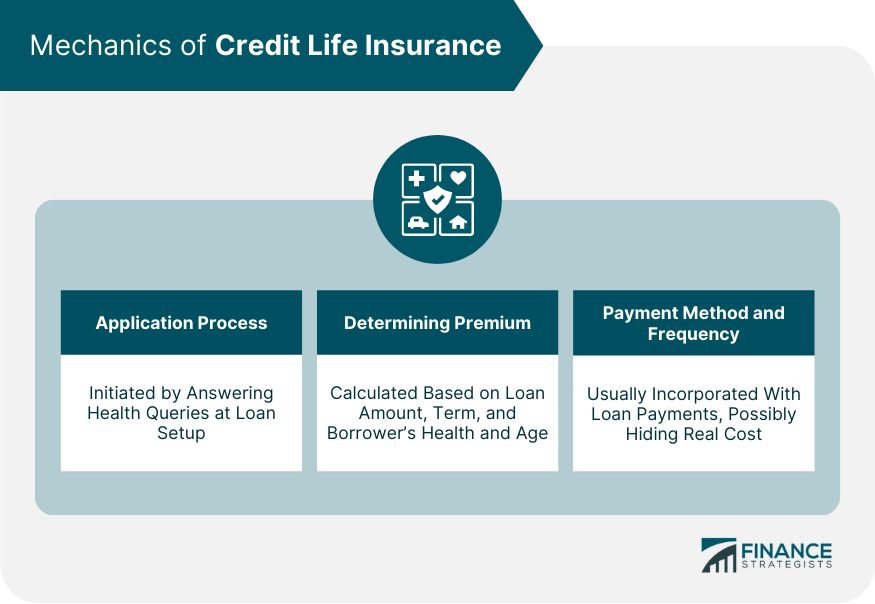

Mechanics of Credit Life Insurance

Application Process

How Premium Is Determined

Payment Method and Frequency

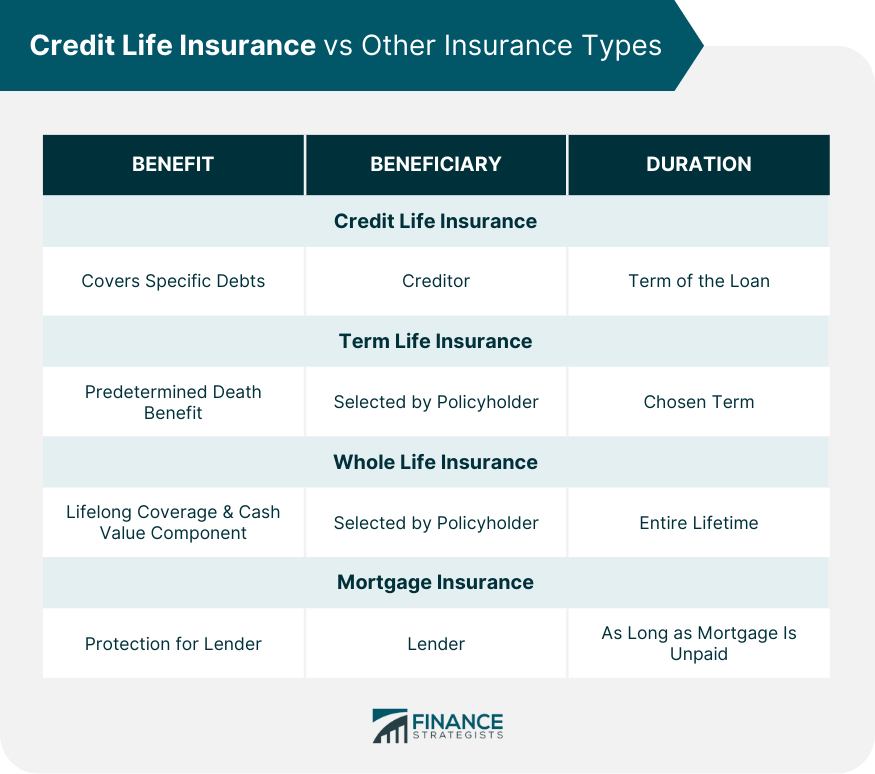

Credit Life Insurance vs Other Insurance Types

Term Life Insurance

Whole Life Insurance

Mortgage Insurance

Role of Credit Life Insurance in Debt Management

Impact on Outstanding Loans

Use in Managing Credit Card Debts

Function in Auto Loans and Mortgages

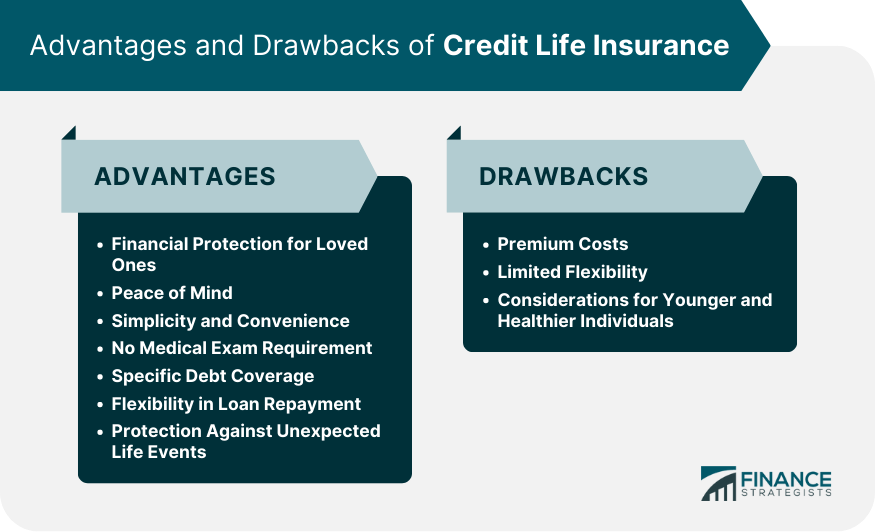

Advantages of Credit Life Insurance

Financial Protection for Loved Ones

Peace of Mind

Simplicity and Convenience

No Medical Exam Requirement

Specific Debt Coverage

Flexibility in Loan Repayment

Protection Against Unexpected Life Events

Potential Drawbacks of Credit Life Insurance

Premium Costs

Limited Flexibility

Considerations for Younger and Healthier Individuals

Is Credit Life Insurance Right for You?

Personal Finance Considerations

Family Needs

Analyzing Your Debt and Credit Situation

Takeaway

Credit Life Insurance FAQs

No, your credit life insurance ends when your loan is completely paid off.

Yes, in many cases, you can still get credit life insurance with a pre-existing condition. However, it may affect the premium rate.

While both are forms of credit protection insurance, credit life insurance pays off your loan if you die, while credit disability insurance covers your loan payments if you become disabled and cannot work.

No, credit life insurance is optional. A lender can only accept a loan if you choose not to purchase credit life insurance.

Credit life insurance can cover any type of loan, but it must be specified in the policy. Commonly covered loans include mortgages, auto loans, and personal loans.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.