The United States Government Life Insurance (USGLI) is a government-sponsored insurance program designed to provide financial protection to eligible military personnel and their families. It offers life insurance coverage to servicemembers, veterans, and their dependents, ensuring they receive financial assistance in the event of death or disability. The USGLI is administered by the Department of Veterans Affairs (VA) and operates similarly to a private life insurance policy, with beneficiaries receiving a tax-free lump sum payment upon the insured's death or qualifying disability. The primary purpose of USGLI is to provide affordable, dependable life insurance coverage for military personnel, veterans, and their families. This program aims to fill the gap in coverage that may exist due to the unique risks and challenges faced by servicemembers, who may have difficulty securing affordable life insurance in the private market. Furthermore, USGLI offers peace of mind to servicemembers and their families, knowing that they are protected financially should the unthinkable occur. The USGLI program has its roots in World War I when the United States government recognized the need to provide financial protection to servicemembers and their families. In 1917, Congress passed the War Risk Insurance Act, establishing a government-operated life insurance program for military personnel. This program laid the foundation for what would eventually become the United States Government Life Insurance. Over time, the program expanded to cover additional groups, such as veterans and their dependents, as well as active-duty military personnel. It has since played a crucial role in ensuring financial stability for those who serve our country and their loved ones. Following World War I, the program continued to evolve, adapting to the changing needs of military personnel and veterans. The USGLI program underwent several significant changes, including the introduction of disability benefits and the expansion of coverage to include family members. Throughout its history, the USGLI program has undergone numerous changes to better serve the needs of military personnel, veterans, and their families. These changes include adjustments to the eligibility criteria, types of coverage available, and the amount of coverage provided. The program has also been modified to accommodate the unique risks and challenges faced by servicemembers in different eras, ensuring its continued relevance and effectiveness. Eligibility for the USGLI program is determined by factors such as military service status, the presence of a qualifying disability, and the relationship to an insured servicemember or veteran. Active-duty military personnel, reservists, and members of the National Guard may be eligible for coverage, as well as honorably discharged veterans and their dependents. Additionally, certain disabled veterans and their families may qualify for USGLI coverage. The USGLI program offers a variety of coverage options to meet the diverse needs of its participants. These options include term life insurance, whole life insurance, and endowment insurance. Each type of coverage provides different levels of protection and benefits, allowing individuals to choose the policy that best suits their needs and circumstances. The amount of coverage available under the USGLI program varies depending on the type of policy selected and the individual's eligibility status. Coverage amounts can range from modest sums to provide basic financial protection, to larger amounts designed to secure a family's financial future in the event of a servicemember's death or disability. Participants may also have the option to increase their coverage over time, subject to certain restrictions and limitations. One of the primary benefits of USGLI is the provision of death benefits to beneficiaries in the event of a policyholder's passing. These benefits are paid as a tax-free lump sum, providing immediate financial support to the deceased's loved ones. The amount of the death benefit depends on the type and amount of coverage selected, and it can be used by beneficiaries for any purpose, including covering funeral expenses, paying off debts, or ensuring the family's long-term financial stability. In addition to death benefits, the USGLI program offers disability benefits to eligible policyholders who become permanently and totally disabled as a result of a service-related injury or illness. These benefits provide ongoing financial assistance to disabled veterans and their families, helping to offset the loss of income and increased expenses that often accompany a serious disability. The USGLI program also includes a waiver of premium benefit for eligible policyholders who become totally disabled due to a service-related injury or illness. This benefit allows the disabled policyholder to maintain their life insurance coverage without having to pay premiums during their period of disability, ensuring that their loved ones remain protected even if the policyholder is unable to work and earn an income. Although the USGLI program is backed by the United States government, there is always a small risk of insolvency. This risk is mitigated by the program's strict financial management practices and the government's commitment to supporting the financial well-being of military personnel, veterans, and their families. However, it's essential for policyholders to be aware of this potential risk and take it into consideration when selecting a life insurance policy. As with any insurance policy, USGLI policyholders face the risk that their coverage may not fully meet their needs or the needs of their beneficiaries. Factors such as inflation, changes in personal circumstances, or inadequate coverage amounts can all impact the effectiveness of a life insurance policy. To minimize this risk, policyholders should carefully evaluate their coverage options, regularly review their policies, and make any necessary adjustments to ensure their coverage remains adequate. USGLI policyholders also face market risk, particularly in relation to the investment performance of certain policy types, such as endowment insurance. Market fluctuations can impact the investment returns on these policies, potentially affecting the policy's overall value and the benefits payable to beneficiaries. While the USGLI program is designed to minimize market risk through prudent investment strategies, it's important for policyholders to understand the potential impact of market conditions on their coverage. In the event of a policyholder's death or qualifying disability, beneficiaries or their authorized representatives must file a claim with the USGLI program to receive the benefits payable under the policy. The process typically involves completing a claim form, providing the required documentation, and submitting the claim to the appropriate USGLI office. The specific documentation required to process a USGLI claim varies depending on the nature of the claim and the circumstances surrounding the policyholder's death or disability. Some common documents that may be required include a certified copy of the death certificate, medical records, proof of the beneficiary's identity, and any relevant military service records. Claimants should consult the USGLI program guidelines or contact the program administrators for guidance on the specific documentation required for their claim. The processing time for USGLI claims can vary depending on the complexity of the claim and the availability of the required documentation. However, the program is committed to processing claims as quickly and efficiently as possible, with the goal of providing beneficiaries with the financial support they need in a timely manner. In some cases, expedited processing may be available for urgent claims or those involving extreme financial hardship. The USGLI program offers competitive premium rates, making life insurance coverage more affordable for military personnel, veterans, and their families. Premium rates are determined by factors such as the policyholder's age, gender, health status, and the type and amount of coverage selected. The program strives to keep premium rates as low as possible, while still maintaining the financial stability necessary to provide reliable coverage. USGLI policyholders have several payment options to choose from, including monthly, quarterly, semi-annual, and annual payments. These options provide flexibility, allowing policyholders to select the payment frequency that best suits their financial circumstances. Additionally, policyholders can choose from a variety of payment methods, such as electronic funds transfer, credit card, or check. The USGLI program includes a grace period for late premium payments, providing policyholders with a temporary extension to make their payment without risking policy cancellation. However, if a policyholder fails to make their premium payment within the grace period, their policy may be terminated, resulting in a loss of coverage. To avoid this, policy holders should make every effort to pay their premiums on time and contact the USGLI program administrators if they anticipate any difficulties in making a payment. The United States Government Life Insurance (USGLI) program is a government-sponsored insurance initiative aimed at providing financial protection to eligible military personnel, veterans, and their families. With its roots dating back to World War I, the USGLI has evolved over time to better serve the unique needs and challenges faced by servicemembers and their loved ones, offering various types of coverage and benefits to meet their diverse needs. Eligibility for USGLI is determined by factors such as military service status, the presence of a qualifying disability, and the relationship to an insured servicemember or veteran. The program offers a range of coverage options and amounts, allowing participants to choose the policy that best suits their individual needs and circumstances. The USGLI program offers numerous benefits, including death benefits, disability benefits, and waiver of premium benefits. However, policyholders should also be aware of the potential risks associated with the program, such as insolvency risk, policyholder risk, and market risk. By carefully evaluating their coverage options and staying informed about the program's features and potential risks, policyholders can ensure that they and their loved ones are adequately protected by the USGLI program.What Is the United States Government Life Insurance (USGLI)?

History of the USGLI

Origin

Development of the USGLI

Changes in the USGLI Over Time

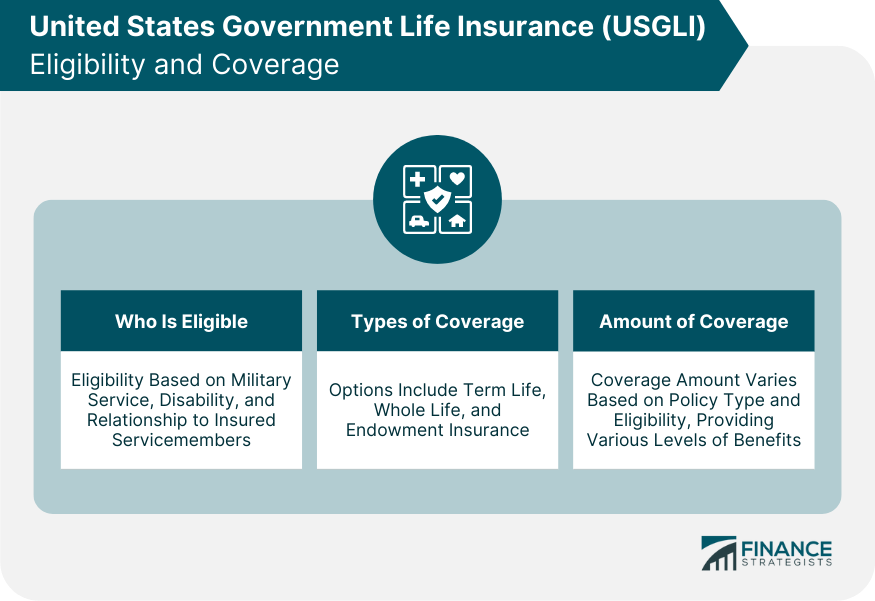

Eligibility for the USGLI

Who Is Eligible

Types of Coverage Available

Amount of Coverage Available

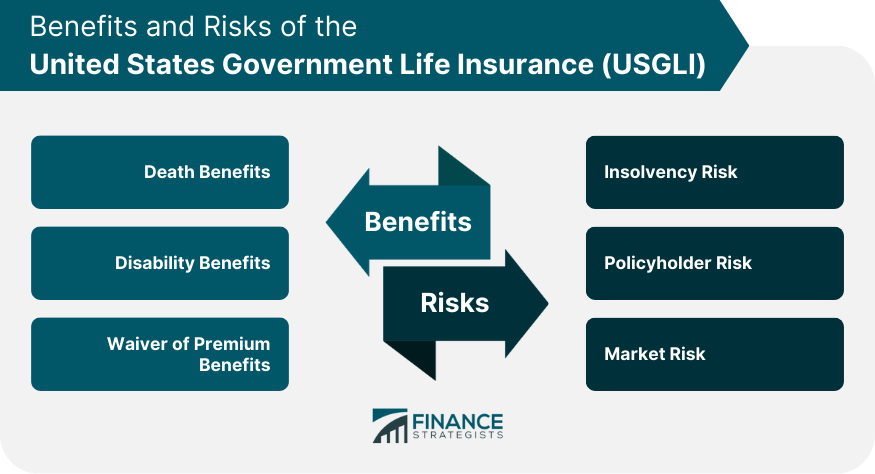

Benefits of the USGLI

Death Benefits

Disability Benefits

Waiver of Premium Benefits

Risks

Insolvency Risk

Policyholder Risk

Market Risk

Claims Process

Filing a Claim

Documentation Required for Claim Processing

Processing Time

Premiums and Payment Options

Premium Rates

Payment Options

Grace Periods and Late Payments

The Bottom Line

United States Government Life Insurance (USGLI) FAQs

USGLI is a life insurance policy established by the US government in 1919 to provide life insurance coverage to members of the military, veterans, and certain federal employees. It is a term life insurance policy that provides coverage for a set period of time.

Members of the military, including active-duty personnel and reservists, veterans, and certain federal employees are eligible for USGLI. Eligibility criteria may vary depending on the type of coverage sought and other factors such as age and health.

USGLI provides a variety of benefits to policyholders, including death benefits, which pay out a sum of money to the beneficiary in the event of the policyholder's death, disability benefits, which provide income replacement in the event of the policyholder's disability, and a waiver of premium benefits, which allow the policyholder to stop paying premiums if they become totally and permanently disabled.

Premium rates for USGLI depend on a variety of factors, such as the policyholder's age, health status, and the coverage amount. Premium rates for USGLI tend to be lower than those for private life insurance policies.

Risks associated with USGLI include insolvency risk, which is the risk that the insurance provider may become insolvent and unable to pay out claims, policyholder risk, which is the risk that the policyholder may die before the end of the policy term, and market risk, which is the risk that the policy's cash value may decline due to market conditions. However, USGLI is backed by the US government, which makes it a relatively safe and secure option for life insurance coverage.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.