Life insurance policy ownership is crucial to insurance planning. As a policy owner, you retain the rights and responsibilities related to the policy, including paying premiums, nominating beneficiaries, and making any necessary changes. Although the policy owner is often the person insured under the policy, it's not a rule. There is a distinct difference between the policy owner and the insured. The insured is the individual whose life the policy covers. The death benefit is paid out if someone dies during the policy term. The policy owner is the person or entity that owns and controls the policy. This includes the rights to change beneficiaries, transfer ownership, borrow against the policy, or even surrender the policy for its cash value. Understanding the distinct role of a policy owner versus the insured, and the implications of a potential policy transfer, is essential in effective life insurance management. While it's possible to transfer a life insurance policy to another person, certain conditions and circumstances need to be met. For instance, the type of policy in question could affect the transferability. The insurance company's specific terms and conditions may also play a significant role. A thorough review of the policy document is recommended before considering a transfer. Transferring a life insurance policy is not just a simple transaction; it has various legal and financial implications. Potential tax liabilities arise from the transfer, particularly if the policy has a cash value. The transfer could alter the policy's benefit structure, affecting the benefits that the new policy owner or beneficiaries might receive. Policy assignment transfers a life insurance policy wherein the current policy owner assigns their rights to a new owner. This can be an absolute assignment where all rights, responsibilities, and benefits are transferred, or it could be a collateral assignment where only some rights are transferred. A policy owner could also choose to sell the policy to a third party through a policy sale or a viatical settlement. In this scenario, the policy owner receives a lump-sum payment, typically less than the death benefit but more than the policy's cash surrender value. This method, however, should be considered carefully due to potential tax implications and impact on beneficiaries. Transferring the policy into a trust is another method of changing policy ownership. This option can offer greater control over the distribution of policy benefits after the policy owner's death, potentially providing tax advantages and protecting the death benefit from creditors. The first step in the procedure to transfer a life insurance policy is to understand and establish the need for such a transfer. This could arise from various circumstances such as financial need, changes in family structure, or estate planning considerations. The policy owner should consider the pros and cons of a transfer, considering their personal circumstances, financial situation, and potential impact on the policy's benefits. Once the decision to transfer has been made, the next step involves contacting the insurance company. The policy owner should request information about the transfer process, including any specific forms or documentation required. Different insurance companies may have varying procedures, so obtaining accurate, company-specific information is important. Completing the transfer involves filling out and submitting the necessary forms to the insurance company. This could include a transfer of ownership form, a new policy application, or other legal documents. The forms should be completed accurately and thoroughly to avoid any potential issues or delays in the transfer process. After submitting the forms, the policy owner should follow up with the insurance company to ensure the transfer has been processed correctly. Once the insurance company confirms the transfer, the new policy owner should receive an updated policy document reflecting the change in ownership. Once the transfer process is complete, the previous and new policy owners must retain copies of all transfer-related documents. This includes the filled and submitted forms, any legal documentation involved, and the updated policy document received from the insurance company. These records may prove useful in the future for tax purposes or resolving any disputes or confusion regarding policy ownership. In addition to maintaining records of the transfer, it's also important to update any related documents. For example, if the life insurance policy was originally part of an estate plan, that plan should be updated to reflect the change in policy ownership. If the policy was listed as an asset in financial documents or legal agreements, those should be revised accordingly. With the completion of the transfer, the new policy owner should take the time to review the policy terms, coverage, and benefits thoroughly. This includes understanding when and how the death benefit will be paid, any exclusions or limitations in the policy, and the rights and responsibilities the new owner now holds. Transferring a life insurance policy can have significant legal and financial implications. Thus, after the transfer, it may be beneficial for the new policy owner to consult with a financial advisor or insurance professional. This can help them understand the potential impact on their financial planning, potential tax implications, and how to manage the policy moving forward effectively. A life insurance policy transfer might be considered a gift, especially if it's transferred for little or no consideration. The value of the gift, determined by the policy's cash value, might be subject to federal gift tax. This tax is generally the responsibility of the person who makes the gift—the policy's original owner in this case. Each individual has a lifetime gift tax exclusion, which allows for a certain amount of gifts to be given tax-free. However, any amount exceeding this exclusion could be taxed. When a life insurance policy is sold or virtually settled, the original policy owner may have to pay income taxes. Specifically, they would likely owe taxes on the difference between the sale price (or settlement amount) and the total premiums they have paid into the policy. This income tax can be significant, particularly for policies with high cash value or that are sold for a large amount. In addition to gift and income taxes, the transfer of a life insurance policy may also have estate tax implications. If the original policy owner dies within three years of transferring the policy, the policy's death benefit might be included in their estate for estate tax purposes. This is known as the "three-year rule." An irrevocable life insurance trust (ILIT) can be a potential solution to avoid the three-year rule, but it involves complex legal processes and should be established under professional guidance. There are several potential advantages to transferring a life insurance policy, including: Transferring a life insurance policy might offer immediate financial relief if the policy is sold for cash. This could be particularly advantageous when the policy owner faces financial hardship. Transferring a policy to a trust could help manage an estate or tax planning. It can be a strategic move to protect the policy's benefits from estate taxes and maintain control over its disposition after death. If the original purpose for the policy no longer applies, transfer the policy to another individual who could better utilize the policy's benefits. This could be a family member or someone with an insurable interest in the policy owner. While there are advantages to transferring a life insurance policy, it's also important to consider the potential disadvantages: The transfer may create tax liabilities for the original policy owner. These could include gift taxes if the policy is given away or income taxes if the policy is sold. If a policy is sold, the policy's death benefit may be significantly reduced for the beneficiaries. This is because the new owner will likely want to recoup their investment in the policy, which often means reducing the death benefit. A transferred policy may still influence the original owner's insurability. If they wish to purchase a new policy later, the existence of the transferred policy could affect their ability to secure new coverage or the premium rates they are offered. Immediately following the transfer, the new policy owner will have control over the policy, including its death benefit. They can decide who the beneficiaries are and how the death benefit is allocated. This could disrupt the original owner's plans for the policy's payout. In the long run, transferring a policy could significantly impact the policy's death benefit. The death benefit would likely be reduced if the policy were sold or settled. If transferred to a trust, the death benefit distribution could be controlled based on the trust's terms. Understanding these potential consequences and considering them in your planning is important. Transferring a life insurance policy to another person is possible but comes with certain conditions and considerations. The process of transferring ownership involves methods such as policy assignment, policy sale or viatical settlements, and transferring into a trust. However, it is essential to review the policy's terms and benefits, seek professional advice, and understand the potential tax implications. The advantages of transferring a policy include financial relief, estate and tax planning, and policy utilization, while potential disadvantages include tax liabilities, reduced death benefits, and influence on insurability. The transfer can have immediate implications on the death benefit, and long-term consequences should be considered. Consulting a financial advisor, understanding the policy's fine print, assessing the impact on beneficiaries, and evaluating the receiving party are crucial steps for those considering a transfer.Overview of Life Insurance Policy Ownership

Can You Transfer a Life Insurance Policy to Another Person?

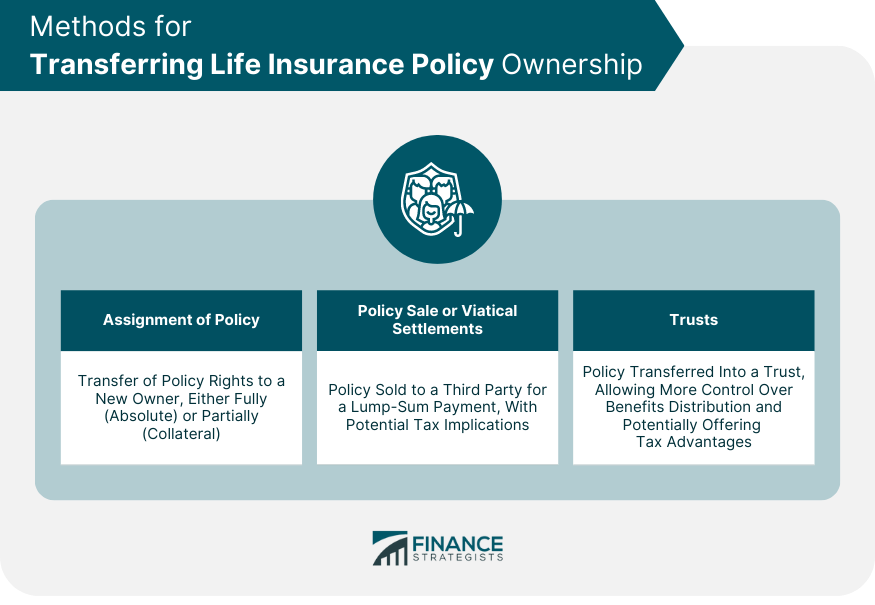

Methods of Transferring Life Insurance Policy Ownership

Assignment of Policy

Policy Sale or Viatical Settlements

Trusts

Process for Transferring a Life Insurance Policy

Determine the Need for Transfer

Contact the Insurance Company

Complete the Transfer Process

Follow-up and Confirmation

Document the Transfer

Update Related Documents

Implications of Transferring Life Insurance Policy Ownership

Review the Policy Terms and Benefits

Seek Professional Advice

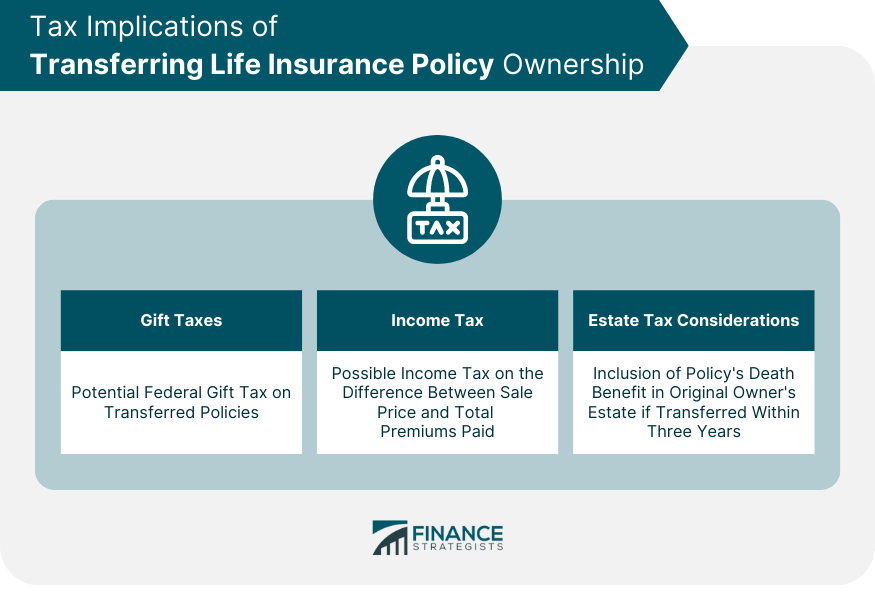

Potential Tax Implications of Transferring Life Insurance Policy Ownership

Gift Taxes

Income Tax on Policy Sale or Viatical Settlements

Estate Tax Considerations

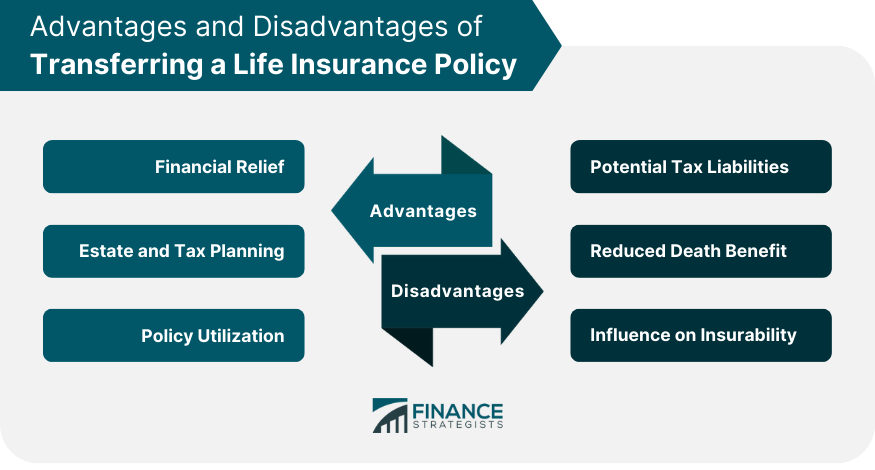

Advantages of Transferring a Life Insurance Policy

Financial Relief

Estate and Tax Planning

Policy Utilization

Disadvantages of Transferring a Life Insurance Policy

Potential Tax Liabilities

Reduced Death Benefit

Influence on Insurability

Impact of the Transfer on the Policy's Death Benefit

Immediate Implications

Long-Term Consequences

Conclusion

Can You Transfer a Life Insurance Policy to Another Person? FAQs

Transferring a life insurance policy is possible; however, there are typically certain implications to consider. These could include legal and financial impacts as well as changes to the benefits derived from the policy. Thus, seeking counsel from a financial advisor or an insurance professional is advisable to comprehend the potential ramifications fully.

Key factors to mull over before transferring a life insurance policy encompass the nature of the policy, its conditions and stipulations, any potential tax obligations, and how the transfer might influence the death benefit. Comprehending the motive behind the transfer and whether it is congruent with broader financial and estate planning objectives is pivotal.

The retention of benefits depends on the mode of transfer chosen. A collateral assignment may transfer only certain rights, thereby allowing some benefits to be retained. However, a complete assignment or sale usually results in the transfer of all policy rights and benefits. Consultation with a professional is advised to understand the specific implications relative to the policy and the chosen transfer method.

The financial repercussions are dependent on the method of transfer. If the policy is given away without value exchange, it may attract gift taxes. If sold, income tax may be due on the amount that exceeds the total premiums paid over the sale price. Guidance from a financial advisor or tax professional is essential to navigating these potential obligations.

When a life insurance policy is transferred, the new owner gains control over the policy, including the death benefit. They can modify the beneficiaries and make decisions on the death benefit distribution. The death benefit will likely be significantly curtailed if the policy is sold. Consequently, comprehending the implications of a policy transfer on the death benefit is crucial.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.