Term life insurance is a type of life insurance policy that provides coverage for a specified term, typically ranging from 10 to 30 years. If the insured individual dies during the term, the policy pays a death benefit to the designated beneficiaries. The primary purpose of term life insurance is to provide financial protection for the insured's dependents in the event of the insured's death during the policy term. This can help cover expenses such as mortgage payments, educational costs, or lost income. There are several types of term life insurance policies, including level term, decreasing term, and annual renewable term, each with its unique features and benefits. Term life insurance policies provide coverage for a specific term, which can be selected by the policyholder. Common terms include 10, 20, or 30 years. Coverage expires at the end of the term unless the policy is renewed or converted to a permanent policy. Policyholders pay premiums for the duration of the term, which are generally fixed and remain level throughout the policy term. Some policies may have increasing premiums, particularly with annual renewable term policies. If the insured individual dies during the policy term, the policy pays a death benefit to the designated beneficiaries. This death benefit is typically tax-free and can be used to cover various expenses or provide financial support to the beneficiaries. Some term life insurance policies offer the option to renew the policy at the end of the term or convert it to a permanent policy without requiring additional medical underwriting. These features can provide additional flexibility and continuity of coverage for the insured. Term life insurance policies generally have lower premiums compared to permanent life insurance policies, making them more affordable for individuals seeking life insurance coverage on a budget. Term life insurance policies are relatively straightforward, with few complexities or additional features. This simplicity makes them easier to understand and manage for policyholders. Policyholders can choose the term length that best aligns with their financial needs and goals, ensuring that coverage is in place for the desired period. Term life insurance provides temporary financial protection for the insured's dependents, helping to cover expenses and provide support during a critical period. The primary disadvantage of term life insurance is that coverage is limited to the policy term. If the insured individual does not die during the term, the policy does not pay a death benefit, and coverage expires. Unlike permanent life insurance policies, term life insurance policies do not accumulate cash value. This means that policyholders do not have access to any funds within the policy during their lifetime. While many term life insurance policies have level premiums throughout the term, some policies, particularly annual renewable term policies, may have increasing premiums as the insured individual ages or upon renewal. Term life insurance policies do not provide permanent financial protection for the insured's dependents, as coverage expires at the end of the term. When selecting a term life insurance policy, consider the desired length of coverage based on factors such as outstanding debts, dependents' ages, and financial goals. Evaluate the appropriate amount of coverage needed to ensure financial protection for dependents, taking into account current and future expenses, income replacement, and other financial needs. Compare premium costs across different term life insurance policies and providers to find an option that fits within your budget. Keep in mind that factors such as age, health, and coverage amount can impact premium rates. Consider any additional features or riders that may be available with a term life insurance policy, such as a waiver of premium rider, accidental death benefit rider, or the ability to convert to a permanent policy. These options can provide added flexibility and benefits to your policy. Term life insurance provides coverage for a specified term, while permanent life insurance provides lifelong coverage. Consider your long-term financial goals and needs when deciding between these two types of life insurance. Term life insurance policies generally have lower premiums than permanent life insurance policies, making them a more affordable option for those seeking temporary coverage. However, permanent life insurance policies may provide greater long-term value due to their cash value accumulation and lifelong coverage. Permanent life insurance policies typically include a cash value component, which can grow over time on a tax-deferred basis. This cash value can be accessed during the insured's lifetime through policy loans or withdrawals, providing additional financial flexibility. Term life insurance policies do not accumulate cash value. Permanent life insurance policies provide lifelong financial protection and the potential for cash value accumulation, offering more flexibility for policyholders. Term life insurance policies, on the other hand, provide temporary financial protection and do not have a cash value component. Term life insurance can play an essential role in financial planning by providing temporary financial protection for the insured's dependents at an affordable cost. It can be an excellent choice for individuals seeking life insurance coverage for a specific period, such as until children become financially independent or a mortgage is paid off. When considering term life insurance, it is crucial to weigh the benefits and drawbacks in the context of your unique financial situation, goals, and needs. This includes assessing factors such as the desired length and amount of coverage, premium costs, and any additional policy features or riders. Ultimately, the decision to purchase term life insurance should be based on an individual's specific needs and financial goals. By carefully evaluating your situation and comparing different policy options, you can make an informed decision that best aligns with your needs and provides the necessary financial protection for your loved ones.What Is Term Life Insurance?

Key Features of Term Life Insurance

Duration of Coverage

Premium Payments

Death Benefits

Policy Renewability and Convertibility

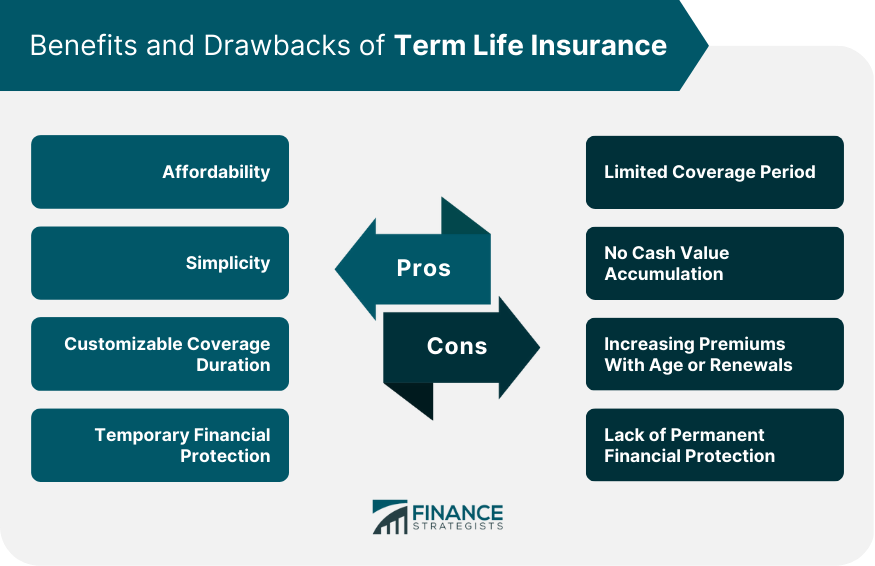

Advantages of Term Life Insurance

Affordability

Simplicity

Customizable Coverage Duration

Temporary Financial Protection

Disadvantages of Term Life Insurance

Limited Coverage Period

No Cash Value Accumulation

Increasing Premiums With Age or Renewals

Lack of Permanent Financial Protection

Factors to Consider When Choosing Term Life Insurance

Length of Coverage

Amount of Coverage

Premium Costs

Policy Riders and Additional Features

Comparing Term Life Insurance With Permanent Life Insurance

Coverage Duration

Premiums and Affordability

Cash Value Accumulation

Financial Protection and Flexibility

Conclusion

Term Life Insurance FAQs

Term life insurance is a type of life insurance policy that provides coverage for a specified period of time, typically 10 to 30 years, in exchange for premium payments.

In a term life insurance policy, the insured pays a premium to the insurance company for a specified term, such as 10 or 20 years. If the insured dies during the term of the policy, the death benefit is paid out to the designated beneficiaries.

Term life insurance can provide several benefits, including lower premiums compared to other types of life insurance policies, flexibility in coverage amounts and terms, and the ability to convert to permanent life insurance.

Term life insurance is best suited for individuals who need temporary coverage for a specific period of time, such as to cover a mortgage or to provide for their children's education.

The amount of term life insurance coverage needed will depend on several factors, including the insured's income, debts, and future expenses. A general rule of thumb is to have coverage that is 10 to 12 times the insured's annual income.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.