Mortgage life insurance is a specialized form of life insurance. Unlike traditional life insurance, its purpose is to provide a payout that can cover the outstanding balance on a mortgage loan in the event of the policyholder's death. This means that if the policyholder dies before they are able to pay off their mortgage, their insurance policy will ensure that their loved ones are not burdened with the outstanding debt. The basic function of mortgage life insurance is to protect the policyholder's loved ones from the financial burden of an unpaid mortgage. Its operating principle is straightforward – in the event of the policyholder's death, the insurer pays the outstanding balance of the mortgage, effectively clearing the debt. This policy type is aligned with the diminishing value of your mortgage debt. As the mortgage balance reduces over time, so does the potential payout from the policy. Contrarily, a level-term policy maintains a fixed payout throughout the term. It doesn’t reduce over time and can be particularly beneficial if you have an interest-only mortgage. The application process for mortgage life insurance typically involves assessing the applicant's health and lifestyle. In some cases, medical examinations may also be required. Premiums are typically paid monthly or annually. The cost of premiums may vary depending on factors such as age, health, and the value of the mortgage. The claim process begins when the insured person dies. The insurer then pays the outstanding mortgage balance directly to the lender. Coverage Period: The coverage period for a mortgage life insurance policy typically corresponds to the length of the mortgage term. Payout Rules: The payout from a mortgage life insurance policy is made directly to the mortgage lender to clear the outstanding mortgage debt. Exceptions and Exclusions: Like most insurance policies, there are exceptions and exclusions to what is covered. These may include death from pre-existing medical conditions or suicide within a specified period from the start of the policy. One of the key benefits of mortgage life insurance is the protection it provides to beneficiaries. Should the policyholder pass away, this policy ensures that beneficiaries, such as spouses or children, will not be left with the burden of mortgage payments. Another critical advantage is the assurance of paying off the mortgage debt. The policy covers the remaining balance on the mortgage, freeing beneficiaries from this debt obligation. The peace of mind offered by mortgage life insurance cannot be underestimated. Knowing that their loved ones will not struggle with mortgage payments in their absence can provide significant emotional comfort to policyholders. One downside of mortgage life insurance is that the benefits decrease over time as the mortgage balance diminishes while the premium stays the same. Unlike term or whole life insurance, the payout from mortgage life insurance must be used to pay off the mortgage, limiting flexibility in how the funds can be used. On a cost-benefit basis, mortgage life insurance can be more expensive than term life insurance while providing fewer benefits. While both offer a death benefit, term life insurance offers more flexibility as the payout can be used for any purpose. Moreover, it tends to be less expensive than mortgage life insurance for comparable coverage. Whole life insurance offers a lifetime of coverage and an investment component, unlike mortgage life insurance. However, it is also significantly more expensive. While mortgage life insurance pays off the mortgage upon the policyholder's death, mortgage payment protection insurance covers mortgage payments if the policyholder is unable to pay due to unemployment or disability. Insurance regulatory authorities ensure the protection of consumer rights, promote fair and efficient insurance markets, and encourage a stable insurance industry. Policyholders have the right to transparent information about their policy, while they are obligated to pay premiums and provide accurate information to their insurers. Common disputes can arise from policy exclusions, disputes about whether a death was accidental, or allegations of misrepresentation on the application. It's important to assess your personal financial situation and understand whether you need mortgage life insurance or if other forms of life insurance may better suit your needs. You should evaluate the necessity of mortgage life insurance based on your health, age, mortgage balance, and the financial situation of your dependents. Always shop around and compare rates and terms from different insurers. This will ensure that you get the best deal possible. Mortgage Life Insurance provides financial protection to policyholders by clearing mortgage debts in case of their untimely demise. This product offers significant benefits, including peace of mind and protection for beneficiaries, but it also has certain drawbacks, such as decreasing benefits and less flexibility compared to other insurance types. With this in mind, individuals should evaluate their financial situation, health, and family needs when considering Mortgage Life Insurance. The comparison with other insurance types, like term life or whole life, is crucial in making informed decisions. As the industry evolves, influenced by changing demographics and technology, potential buyers should keep an eye on emerging trends and adaptations. Ultimately, the choice for Mortgage Life Insurance depends on personal circumstances and objectives, highlighting the necessity of thorough research and understanding before purchasing such a policy.Definition of Mortgage Life Insurance

Understanding the Policies of Mortgage Life Insurance

Types of Mortgage Life Insurance Policies

Decreasing Term Coverage

Level Term Coverage

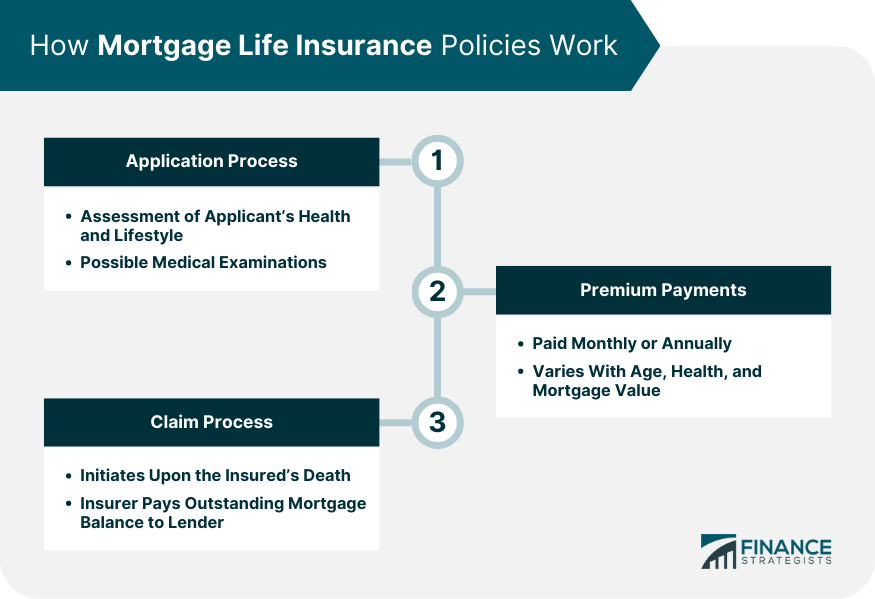

How Mortgage Life Insurance Policies Work

Policy Application Process

Premium Payments

Claim Process

Features of a Mortgage Life Insurance Policy

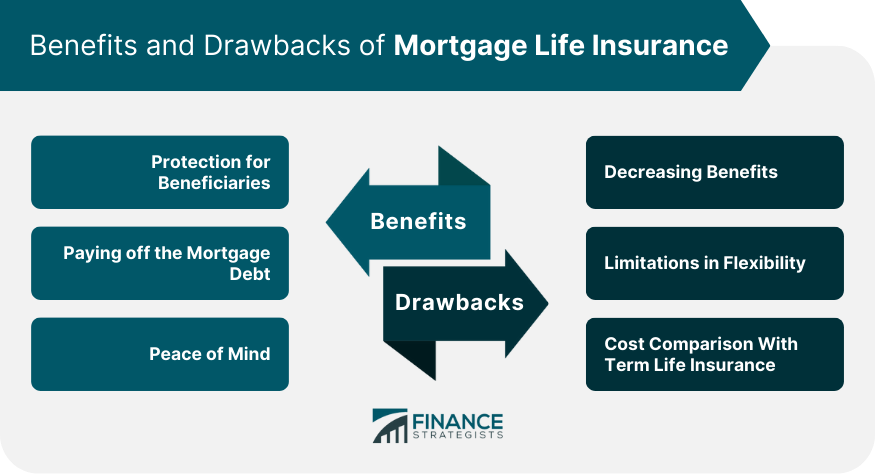

Benefits of Mortgage Life Insurance

Protection for Beneficiaries

Paying Off the Mortgage Debt

Peace of Mind

Drawbacks of Mortgage Life Insurance

Decreasing Benefits

Limitations in Flexibility

Cost Comparison With Term Life Insurance

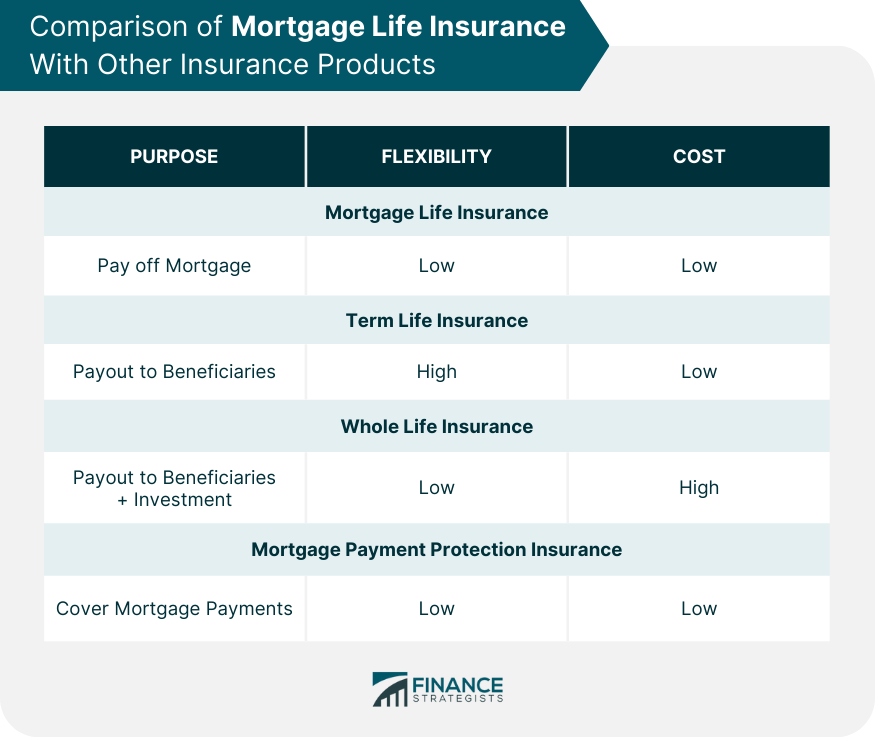

Comparison of Mortgage Life Insurance With Other Insurance Products

Mortgage Life Insurance vs Term Life Insurance

Mortgage Life Insurance vs Whole Life Insurance

Mortgage Life Insurance vs Mortgage Payment Protection Insurance

Legal Aspects and Regulatory Bodies for Mortgage Life Insurance

Insurance Regulatory Authorities

Legal Rights and Obligations of Policyholders

Common Legal Issues and Disputes Related to Mortgage Life Insurance

Practical Considerations and Tips for Choosing Mortgage Life Insurance

Assess Personal Financial Situation

Evaluate the Need for Mortgage Life Insurance

Shop Around for the Best Rates and Terms

Final Thoughts

Mortgage Life Insurance FAQs

Mortgage Life Insurance is a type of insurance policy designed to pay off the policyholder's outstanding mortgage debt in the event of their death. This ensures that the policyholder's beneficiaries are not left with the burden of the mortgage payments.

Mortgage Life Insurance works by paying off the outstanding mortgage balance directly to the lender upon the death of the policyholder. The policyholder pays regular premiums to maintain this coverage. The coverage amount decreases over time in line with the reduced mortgage balance.

The benefits of Mortgage Life Insurance include protection for beneficiaries, paying off the mortgage debt, and peace of mind for the policyholder. However, the drawbacks include decreasing benefits over time as the mortgage balance decreases, limitations in flexibility of fund usage, and potentially higher costs compared to term life insurance.

Unlike term life insurance or whole life insurance, the payout from Mortgage Life Insurance can only be used to pay off the mortgage. Additionally, compared to mortgage payment protection insurance which covers mortgage payments due to unemployment or disability, mortgage life insurance pays off the mortgage only upon the policyholder's death.

When choosing Mortgage Life Insurance, consider factors such as your personal financial situation, the financial situation of your dependents, your health, age, the balance on your mortgage, and the cost and terms of the insurance policy. It's also recommended to shop around to get the best rates and terms.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.