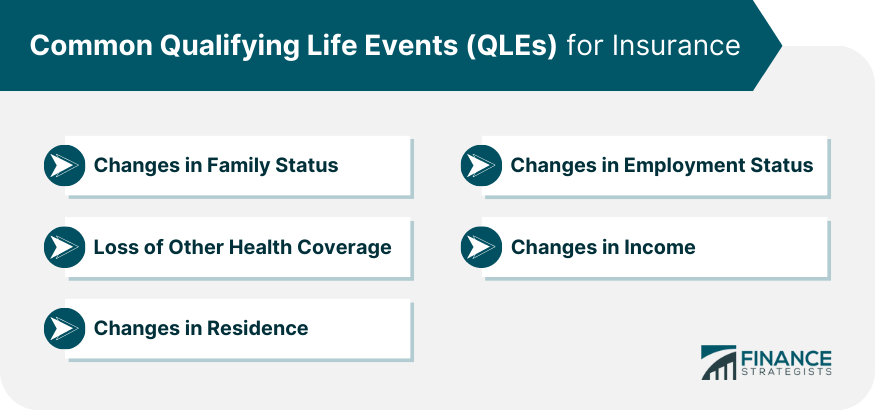

Qualifying Life Events (QLEs) for insurance refer to significant life changes that can impact a person's health insurance needs or eligibility, allowing them to enroll in or alter their insurance coverage outside the standard open enrollment period. Examples include marriage, divorce, birth or adoption of a child, job loss, and moving residences. Understanding QLEs is essential because they allow individuals to adapt their insurance coverage to evolving life circumstances, ensuring continuous and suitable coverage. This knowledge equips readers to make timely and informed decisions about their insurance policies, which can significantly affect their financial security and health protection. QLEs vary depending on the type of insurance, but some of the most common ones include changes in family status, loss of other health coverage, changes in residence, changes in employment status, and changes in income. Changes in Family Status Major life changes in your family can significantly affect your insurance coverage needs. These changes can include: 1. Marriage: Getting married is a qualifying event that can affect several types of insurance, from health to auto insurance. For example, you may want to add your spouse to your health insurance plan, or you might want to combine auto insurance policies for a potential discount. 2. Divorce: Similarly divorce is also a qualifying event that can necessitate changes to your insurance plans. You might need to remove your ex-spouse from your policy or look for new coverage if your previous coverage was under your ex-spouse's policy. 3. Birth or Adoption of a Child: The addition of a child to your family, either through birth or adoption, is another significant life event that affects insurance needs. You will likely need to add your new child to your health insurance policy. 4. Death of a Spouse or Dependent: The unfortunate event of losing a spouse or dependent can also trigger changes in your insurance coverage. Losing your health coverage can be a stressful experience, but it's also considered a qualifying life event. It can happen through a few scenarios, such as job loss, expiration of benefits, or aging out of a parent's plan. In these cases, you may be eligible to apply for new health insurance or change your existing coverage. Moving to a new residence, especially when crossing state lines, can also be a qualifying life event, mainly because insurance laws and coverage options can vary from state to state. If you move to a new state, you may need to find a new health insurance plan that provides coverage in that state. Your employment status can significantly affect your insurance coverage. If you start a new job that offers health insurance, you may want to switch to the new plan. Similarly, if you leave a job and lose your health coverage, you'll likely need to find new coverage. Significant changes in income, either increases or decreases, can affect your eligibility for insurance subsidies. For instance, if your income decreases significantly, you may become eligible for subsidies to help pay for health insurance or qualify for Medicaid. QLEs are closely related to Special Enrollment Periods (SEPs). A SEP is a time outside of the annual open enrollment period during which you can sign up for health insurance. These periods are triggered by specific QLEs, allowing you to make changes to your insurance outside the usual timeframes. You generally have 60 days following the event to enroll in a plan, although this can vary. To apply during a SEP, you typically need to provide evidence of the qualifying life event, such as a marriage certificate, divorce decree, or birth certificate. While the concept of QLEs is commonly associated with health insurance, they also play a role in other types of insurance, such as life insurance, homeowners and renters insurance, and auto insurance. For example, if you get married or have a child, you might want to increase your life insurance coverage to better provide for your new family. Similarly, if you get divorced, or your children become financially independent, you might choose to reduce your coverage. Major life events can also impact your needs for homeowners or renters insurance. For instance, if you get married and move into a new home, you may need to update or get a new homeowners insurance policy. Changes in your family situation or place of residence can also affect your auto insurance. For instance, if you get married, and your spouse has a vehicle, you might want to consider a multi-car policy, which could potentially offer cost savings. Qualifying Life Events (QLEs) play a critical role in insurance management, facilitating needed adjustments to coverage that align with significant life changes. These events, encompassing alterations in family status, health coverage, residence, employment, or income, can trigger Special Enrollment Periods, thus permitting changes outside standard enrollment times. The recognition of QLEs extends beyond health insurance, impacting life, homeowners, renters, and auto insurance, ensuring continuous, relevant coverage across different areas of life. As life evolves, understanding QLEs equips individuals to make informed decisions about their insurance policies, safeguarding their health and financial security. Consequently, an awareness of QLEs proves instrumental in navigating the complexities of insurance, contributing to overall well-being.Qualifying Life Events (QLEs) for Insurance Overview

Common QLEs for Insurance

Loss of Other Health Coverage

Changes in Residence

Changes in Employment Status

Changes in Income

Special Enrollment Periods (SEPs): An Exception to Regular Enrollment Timeframes

Role of QLEs in Other Types of Insurance

Life Insurance

Homeowners and Renters Insurance

Auto Insurance

Bottom Line

Qualifying Life Events (QLEs) for Insurance FAQs

Qualifying Life Events (QLEs) for insurance are significant changes in your life situation that affect your insurance needs or eligibility. Examples include marriage, divorce, birth or adoption of a child, death of a spouse or dependent, loss of other health coverage, changes in residence, changes in employment status, and significant changes in income.

Qualifying Life Events (QLEs) for insurance is crucial because they provide you an opportunity to enroll in or change your insurance coverage outside of the standard open enrollment period. This ensures that you and your family can stay protected as your life circumstances change.

Typically, you have a 60-day window, known as a Special Enrollment Period, to change your insurance after a qualifying life event. However, it's essential to verify the specific rules and timelines with your particular insurance provider.

If you miss the deadline to apply for or change your insurance after a qualifying life event, you'll generally need to wait until the next open enrollment period to make changes. There can be exceptions, so it's always best to contact your insurance provider for guidance.

To prove a qualifying life event for insurance, you'll usually need to provide specific documentation related to the event. This can include things like a marriage or birth certificate, a divorce decree, proof of job loss, or proof of a change in residence. Always check with your insurance provider to determine exactly what documentation is needed.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.