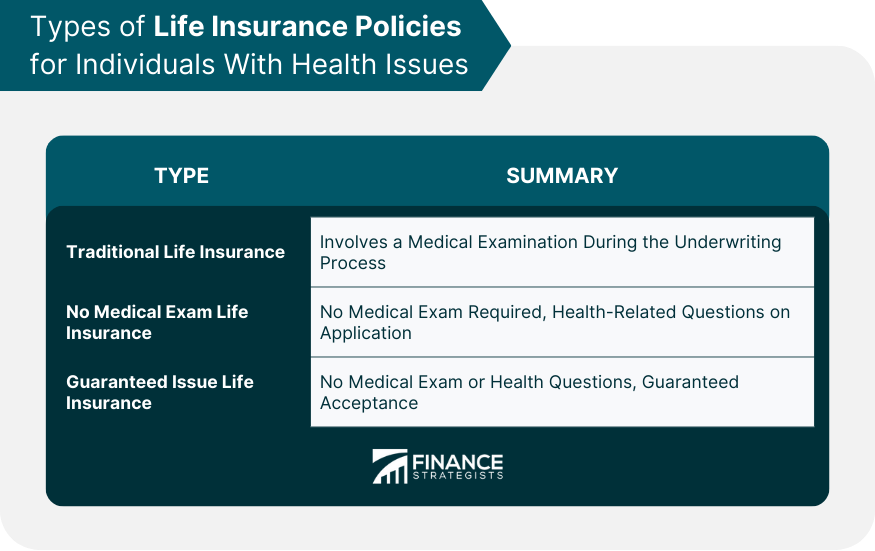

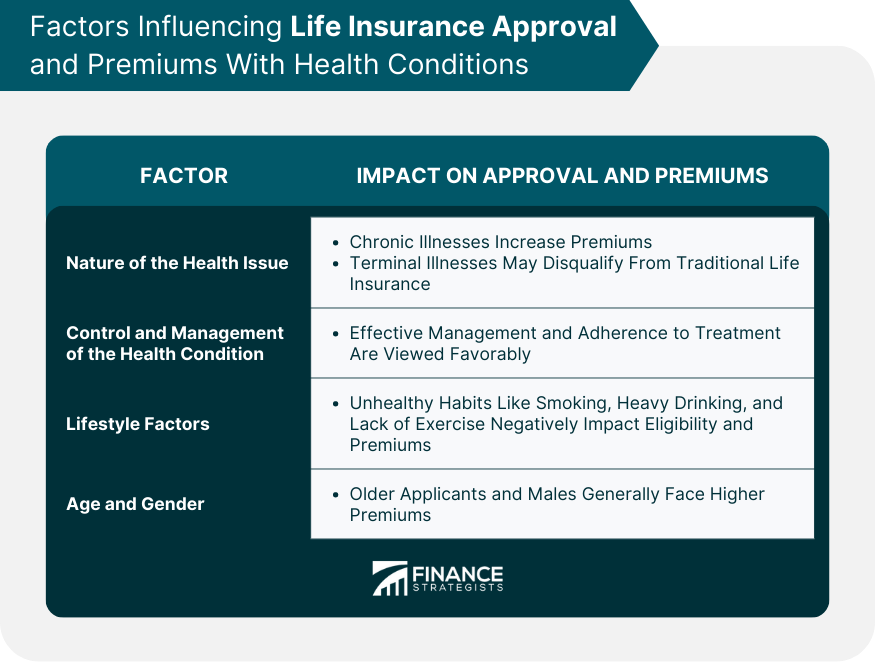

Yes, it's possible to obtain life insurance even with health issues, with premiums dependent on factors such as the type and severity of your condition, its management, your lifestyle, and the specific life insurance policy you opt for. There are various types of life insurance policies tailored to diverse needs. Traditional life insurance typically involves a detailed health examination during underwriting. Despite potentially leading to higher premiums, health issues don't necessarily result in coverage denial. Alternatively, for those preferring to avoid a medical exam or with severe health issues, 'no medical exam' life insurance or 'guaranteed issue' life insurance could be options. These policies often offer guaranteed acceptance, albeit with higher premiums and smaller coverage amounts. Keep in mind that different insurance companies utilize varying underwriting criteria, so shopping around is essential. The underwriting process for traditional life insurance usually includes a medical examination, where a healthcare professional collects information about your health. They may draw blood, check your blood pressure, ask about your medical history, and perform other tests. While it is possible to get a traditional life insurance policy with a health condition, certain conditions may complicate the process. For instance, if you have a severe or poorly controlled condition, insurers might consider you a high-risk applicant and charge higher premiums or deny coverage altogether. No medical exam life insurance, as the name suggests, does not require a medical exam during the underwriting process. Instead, you answer health-related questions on your application. These policies can be beneficial for those with health issues since they bypass the medical exam. However, they tend to be more expensive, and the coverage amount is often lower than traditional life insurance policies. Guaranteed issue life insurance offers coverage without a medical exam or health questions. As long as you meet the age requirements, you are guaranteed acceptance. Those with severe or multiple health issues who have been denied traditional life insurance may benefit from these policies. However, they tend to have higher premiums and lower coverage amounts. Chronic illnesses such as diabetes, heart disease, or cancer can increase your premiums. The insurer will consider the severity of the condition, how well it's managed, and the prognosis. Terminal illnesses, like advanced cancer, may disqualify you from traditional life insurance. However, options like guaranteed issue life insurance might still be available. Insurers look favorably upon applicants who show they can effectively manage their health conditions. This may involve regular doctor's visits, medication adherence, and lifestyle modifications. Your lifestyle can also affect your eligibility and premiums. For instance, smoking, heavy drinking, or lack of regular exercise can negatively influence your application. In addition to health, insurers consider your age and gender when determining premiums. Older applicants and males usually face higher rates. Just like any other major purchase, it's essential to shop around when looking for life insurance. Different insurers have different underwriting criteria and rates. Insurance brokers or agents can help you find policies suited to your unique situation. They can also assist with the application process, potentially increasing your chances of approval. If you opt for a policy with a medical exam, prepare by staying hydrated, getting good sleep, and avoiding nicotine and caffeine. Show that you are managing your condition effectively. Regular doctor visits, healthy lifestyle choices, and medication compliance are viewed favorably. Health issues often result in higher premiums. However, by managing your condition, maintaining a healthy lifestyle, and shopping around, you can find more affordable rates. You might struggle to find an insurer willing to offer coverage. Working with an insurance broker can alleviate this challenge, as they have connections with various companies. Despite health issues, you have legal rights during the insurance application process. For instance, insurers cannot deny coverage based on genetic information. It is possible to obtain life insurance coverage even if you have health issues. The availability and cost of coverage depend on various factors, such as the type and severity of your condition, its management, your lifestyle, and the type of policy you choose. Traditional life insurance may require a medical exam, but a health condition doesn't necessarily result in denial of coverage, although premiums may be higher. Alternatively, you can consider 'no medical exam' or guaranteed issue life insurance, which generally has higher premiums and lower coverage, but avoid the medical exam process. It's advisable to compare policies and consider consulting with insurance brokers or agents to find the most suitable policy. Effectively managing your health, maintaining a healthy lifestyle, and preparing for a medical examination can enhance your chances of getting coverage. Can I Get Life Insurance If I Have Health Issues?

Types of Life Insurance Policies for Individuals With Health Issues

Traditional Life Insurance

No Medical Exam Life Insurance

Guaranteed Issue Life Insurance

Factors Influencing Life Insurance Approval and Premiums With Health Conditions

Nature of the Health Issue

Chronic Illnesses

Terminal Illnesses

Control and Management of the Health Condition

Lifestyle Factors

Age and Gender

Strategies for Securing Life Insurance With Health Issues

Shop Around

Work With an Insurance Broker or Agent

Prepare for a Medical Examination

Demonstrate Control and Management of Health Conditions

Potential Challenges and Solutions

Possibility of Higher Premiums

Difficulty Finding a Willing Insurer

Legal Protections and Rights for Applicants With Health Issues

Bottom Line

Can I Get Life Insurance If I Have Health Issues? FAQs

Yes, you can potentially get life insurance even if you have health conditions such as diabetes or heart disease. However, insurance companies may consider these conditions during the underwriting process, which could lead to higher premiums or restrictions on the type of policy you can obtain.

If you have health issues and prefer to avoid a medical exam, you might consider 'no medical exam' life insurance or 'guaranteed issue life insurance. These policies usually come with higher premiums and lower coverage amounts than traditional life insurance.

Yes, insurance companies often view favorably applicants who demonstrate effective control and management of their health conditions. This might involve regular doctor visits, medication compliance, and lifestyle modifications such as a healthy diet and regular exercise.

Yes, several strategies can improve your chances of securing life insurance. Shopping around, working with an insurance broker or agent, preparing for a medical examination, and demonstrating control of your health condition are all effective strategies.

Some potential challenges include higher premiums, difficulty finding a willing insurer, and navigating the complexities of the insurance application process. However, there are solutions to these challenges, including legal protections that safeguard your rights as an applicant.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.