Supplemental life insurance refers to an optional policy that can be purchased in addition to basic life insurance coverage. It provides an extra layer of financial protection to beneficiaries in the event of the insured person's death. Supplemental life insurance plays a crucial role in ensuring the financial well-being of dependents and beneficiaries. It helps bridge potential coverage gaps and offers an added sense of security by providing an increased death benefit. Supplemental life insurance differs from basic life insurance in terms of its optional nature and the ability to customize coverage according to individual needs. It allows policyholders to increase the death benefit beyond what basic life insurance provides. It ensures that your beneficiaries receive a death benefit that can help cover various expenses, including funeral costs, outstanding debts, mortgage payments, and everyday living expenses. With supplemental coverage, you can have peace of mind knowing that your loved ones will be financially supported during a challenging time. One advantage of supplemental life insurance is the ability to tailor the coverage to meet specific needs. For example, you can choose a policy that offers additional coverage specifically for mortgage payments, education expenses for children, or medical bills. This targeted coverage allows you to address specific financial obligations that may arise after your passing. Supplemental life insurance policies often provide flexibility in coverage options. You can choose the coverage amount that aligns with your financial goals and the needs of your beneficiaries. This flexibility allows you to customize the policy to suit your specific circumstances and budget. Supplemental life insurance can be tailored to meet individual needs, considering factors such as age, health condition, and lifestyle. Depending on your circumstances, you may have unique financial responsibilities or specific financial goals. Supplemental coverage allows you to address those needs by providing additional protection beyond what basic life insurance offers. Depending on the type of supplemental life insurance, there may be little or no medical underwriting involved. This can be advantageous for individuals who may have pre-existing medical conditions or may find it challenging to qualify for traditional life insurance policies. Limited underwriting or simplified application processes make it easier to obtain supplemental coverage, providing an opportunity for individuals who may otherwise be denied traditional life insurance. Supplemental life insurance can complement employer-sponsored coverage by allowing individuals to increase their coverage beyond what their employer provides. Employer-sponsored coverage often has limitations, such as a maximum coverage amount or restrictions on coverage for dependents. Supplemental coverage fills those gaps, ensuring that you have adequate protection for your unique needs. Depending on the type of supplemental life insurance policy, such as whole life or universal life insurance, there may be a potential for cash value accumulation over time. These policies may include a savings or investment component that grows over the life of the policy. The accumulated cash value can be accessed or borrowed against, providing additional financial flexibility during your lifetime. Before considering supplemental life insurance, it is important to assess the adequacy of existing life insurance coverage. This involves reviewing the coverage amount, policy terms, and any limitations or exclusions. By understanding the current coverage, individuals can determine whether additional protection is necessary. Personal and financial circumstances play a significant role in determining the need for supplemental life insurance. Factors such as income, debt obligations, dependents' financial needs, and long-term financial goals should be carefully evaluated. This assessment will help determine the appropriate coverage amount and type of supplemental insurance. These gaps may arise due to factors such as insufficient coverage for specific financial needs, changing life circumstances, or the desire to leave a larger financial legacy for beneficiaries. By pinpointing these gaps, individuals can make informed decisions about supplemental coverage. Individuals should evaluate the potential financial impact of their death on their loved ones, including ongoing living expenses, educational costs, mortgage or rent payments, and any outstanding debts. Many employers offer group supplemental life insurance as part of their employee benefits package. This coverage allows employees to purchase additional life insurance at competitive group rates. Group supplemental life insurance policies often require minimal underwriting. Voluntary supplemental life insurance is a type of group coverage where employees have the option to purchase additional insurance beyond the basic employer-provided coverage. It allows individuals to tailor their coverage to their specific needs by selecting from various coverage levels. Individuals can work with insurance agents or brokers who specialize in life insurance to explore individual supplemental life insurance options. These professionals can provide guidance, assess coverage needs, and help find suitable policies from various insurance providers. It is important to compare different individual supplemental life insurance policies to find the one that best aligns with personal needs and preferences. Factors to consider include coverage options, policy terms, premium costs, and additional benefits or riders. The underwriting and application process for supplemental life insurance typically involve providing detailed information about personal and medical history. This information helps insurance companies assess the risk and determine premium rates. Applicants may be required to undergo a medical examination or provide medical records. Individuals should understand the premium payment options available, such as annual, semi-annual, or monthly payments. Additionally, policyholders need to be aware of policy management tasks such as updating beneficiary designations or making changes to coverage as needed. Individuals should evaluate their financial needs and determine the appropriate coverage amount that would adequately protect their beneficiaries. The cost of premiums is an important consideration when selecting supplemental life insurance. Individuals should compare premium rates from different insurance providers and consider their budgetary constraints. Additionally, exploring various payment options such as annual, semi-annual, or monthly premiums can help individuals choose a payment schedule that suits their financial situation. Supplemental life insurance policies often offer riders or additional benefits that can enhance coverage. These riders can include options for accelerated death benefits, disability income, or waiver of premium. Individuals should inquire about the renewal terms and whether the policy can be renewed without the need for additional medical underwriting. Additionally, investigating conversion options allows policyholders to convert their supplemental policy to a permanent policy in the future if desired. Researching the insurance company's ratings and reputation is vital to ensure the financial stability and reliability of the insurer. Checking ratings from independent rating agencies and reading reviews or testimonials can provide insights into the company's track record and customer satisfaction. In general, premiums paid for supplemental life insurance coverage with after-tax dollars are not considered taxable income. Therefore, individuals do not need to report the premiums as taxable income on their federal tax returns. Death benefits received from a supplemental life insurance policy are generally income tax-free to the beneficiaries. However, if the policy has an investment component, such as cash value, the tax treatment may vary. Supplemental life insurance proceeds are typically not included in the insured person's estate for estate tax purposes. This can be advantageous for individuals with substantial estates, as it may help reduce potential estate tax liabilities. In certain situations, supplemental life insurance can offer tax advantages. For example, cash value accumulation within a policy may grow on a tax-deferred basis. This means policyholders do not pay taxes on the cash value growth until they withdraw or borrow against it. Regular evaluation and review of supplemental life insurance policies are crucial to ensure that coverage remains adequate and aligned with changing circumstances. Life circumstances change over time, so it is important to conduct periodic assessments of coverage needs. Factors such as the birth of a child, changes in income, or paying off debts may necessitate adjustments to supplemental life insurance coverage. As personal circumstances evolve, it is important to re-evaluate policy options and riders to ensure they align with current needs. Adding or removing riders or adjusting coverage amounts can help optimize the policy to better suit individual requirements. Periodically comparing supplemental life insurance policies available in the market can help individuals ensure they have the most suitable coverage at the best possible premium rates. If a policy no longer meets the individual's needs or if a better policy becomes available, switching policies may be a viable option. However, it is essential to carefully review the terms and potential implications before making any changes. Regularly reviewing and updating beneficiary designations is crucial to ensure that the intended individuals receive the death benefit. Life events such as marriage, divorce, or the birth of children may necessitate changes to beneficiary designations. Supplemental life insurance is an optional policy that provides an additional layer of financial protection to beneficiaries upon the insured person's death. It offers additional financial security by covering expenses such as funeral costs, outstanding debts, and everyday living expenses. Flexibility in coverage options enables individuals to choose the coverage amount that aligns with their financial goals and tailor the policy to their circumstances and budget. It may involve little or no medical underwriting, making it accessible for individuals with pre-existing conditions or difficulty qualifying for traditional life insurance. Determining the need for supplemental life insurance involves assessing existing coverage, evaluating personal and financial circumstances, and identifying potential coverage gaps. Individuals can obtain supplemental coverage through employer-sponsored plans, voluntary group plans, or individual policies. When choosing supplemental life insurance, factors to consider include coverage limits, premium costs, policy riders, renewal and conversion options, and the reputation of the insurance company. Tax implications of supplemental life insurance, such as income tax treatment of premiums and taxation of death benefits, should be understood. Regular evaluation and review of supplemental life insurance policies are essential to ensure coverage remains adequate.Definition of Supplemental Life Insurance

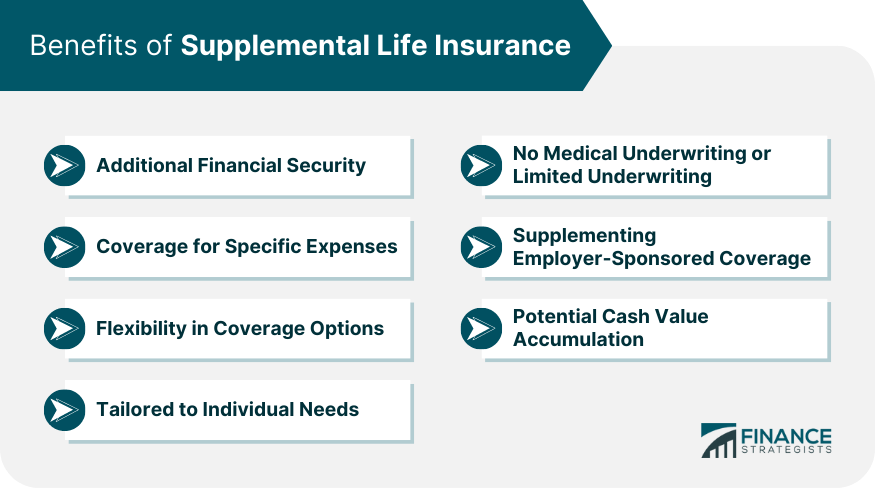

Benefits of Supplemental Life Insurance

Additional Financial Security

Coverage for Specific Expenses

Flexibility in Coverage Options

Tailored to Individual Needs

No Medical Underwriting or Limited Underwriting

Supplementing Employer-Sponsored Coverage

Potential Cash Value Accumulation

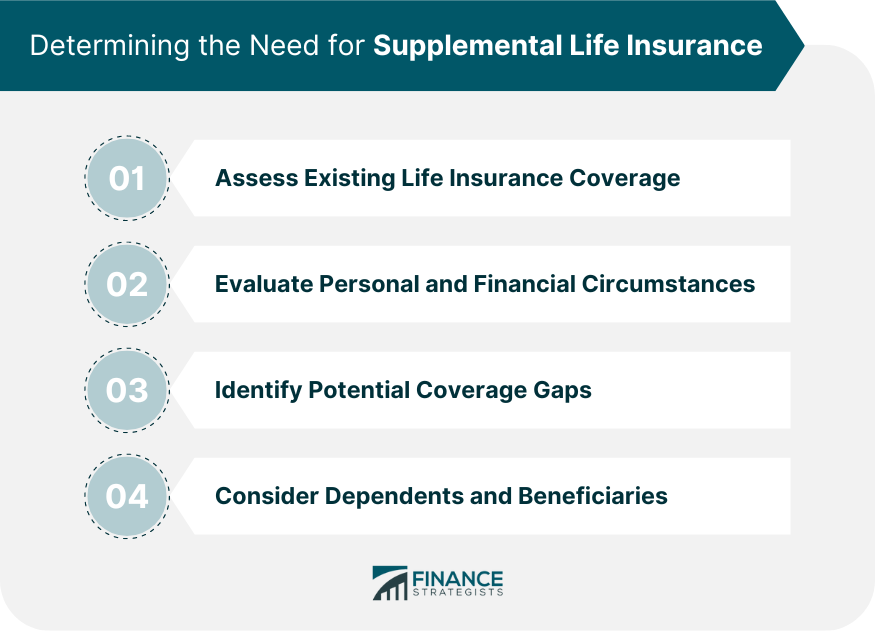

Determining the Need for Supplemental Life Insurance

Assessing Existing Life Insurance Coverage

Evaluating Personal and Financial Circumstances

Identifying Potential Coverage Gaps

Considerations for Dependents and Beneficiaries

Obtaining Supplemental Life Insurance

Employer-Sponsored Supplemental Life Insurance

Group Supplemental Life Insurance

Voluntary Supplemental Life Insurance

Individual Supplemental Life Insurance Policies

Underwriting and Application Process

Premium Payments and Policy Management

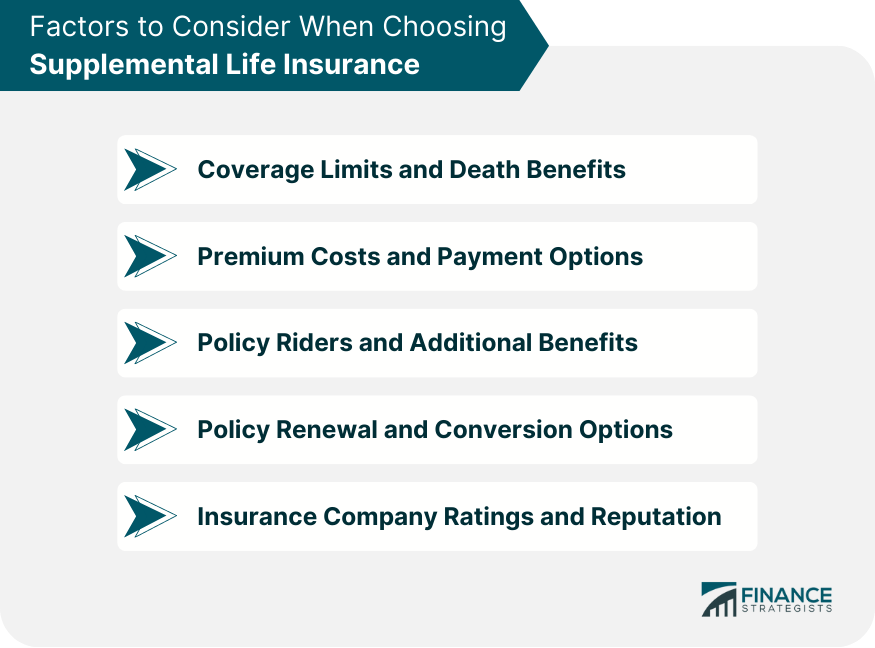

Factors to Consider When Choosing Supplemental Life Insurance

Coverage Limits and Death Benefits

Premium Costs and Payment Options

Policy Riders and Additional Benefits

Policy Renewal and Conversion Options

Insurance Company Ratings and Reputation

Tax Implications of Supplemental Life Insurance

Income Tax Treatment of Premiums

Taxation of Death Benefits

Estate Tax Considerations

Potential Tax Advantages of Supplemental Life Insurance

Evaluating and Reviewing Supplemental Life Insurance

Regular Assessment of Coverage Needs

Re-Evaluating Policy Options and Riders

Comparing and Switching Policies if Necessary

Reviewing Beneficiary Designations and Updates

Conclusion

Supplemental Life Insurance FAQs

Supplemental life insurance refers to an optional policy that provides additional financial protection on top of basic life insurance coverage.

Supplemental life insurance differs from basic life insurance in that it is optional and can be customized to meet individual needs, offering an increased death benefit beyond what basic coverage provides.

Supplemental life insurance is beneficial for individuals who want to bridge potential coverage gaps, tailor coverage to specific needs, and provide additional financial security to their beneficiaries.

Depending on the type of supplemental life insurance, there may be little or no medical underwriting involved, making it accessible for individuals with pre-existing conditions who may have difficulty qualifying for traditional life insurance.

Supplemental life insurance can be obtained through employer-sponsored plans, voluntary group plans, or individual policies. It is recommended to work with insurance agents or brokers who specialize in life insurance to explore individual options and find suitable policies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.