A beneficiary designation is a legal document that specifies the individual or entity that will receive the proceeds or benefits from a particular financial asset upon the owner's death. These designations help avoid the lengthy and costly probate process and provide a more efficient means of transferring assets. Properly designating beneficiaries ensures that your assets are transferred smoothly and according to your wishes. This can provide financial security for your loved ones and help avoid potential disputes among family members. Various financial assets allow for beneficiary designations, including life insurance policies, retirement accounts, annuities, and Transfer on Death (TOD) or Payable on Death (POD) accounts. Beneficiary designations are governed by federal and state laws, which may vary depending on the type of asset and the jurisdiction. It is essential to be aware of the applicable laws when designating beneficiaries and updating your estate plan. Financial institutions play a vital role in implementing and managing beneficiary designations. They are responsible for maintaining accurate records, ensuring that the designations comply with relevant laws, and distributing assets according to the designated beneficiaries. The probate process is a legal procedure that involves the validation of a will, identifying and valuing assets, paying debts and taxes, and distributing the remaining assets to the heirs. Assets with beneficiary designations typically bypass the probate process, allowing for a more efficient and cost-effective transfer of assets. The primary beneficiary is the individual or entity that you designate to receive the proceeds or benefits from your asset upon your death. If the primary beneficiary is unable or unwilling to accept the asset, the contingent beneficiary will receive the proceeds. A contingent beneficiary is an alternative beneficiary who will inherit the assets if the primary beneficiary is unable or unwilling to accept them. This ensures that your assets are distributed according to your wishes even if the primary beneficiary cannot claim them. Revocable beneficiary designations can be changed or updated at any time without the consent of the beneficiary. In contrast, irrevocable designations cannot be changed without the beneficiary's consent, providing more certainty and stability. Both per stirpes and per capita are legal terms used in inheritance and estate law. Per stirpes distribution means that if a beneficiary predeceases you, their share will be divided among their descendants. On the other hand, per capita distribution allocates equal shares to each surviving beneficiary. Life insurance policies often include a beneficiary designation, ensuring that the policy proceeds are distributed to the designated individual(s) upon the policyholder's death. Retirement accounts, such as 401(k)s and IRAs, allow for beneficiary designations, which determine who will inherit the remaining account balance after the account holder's death. Annuities are financial products that provide periodic payments over a specified period. Beneficiary designations ensure that any remaining annuity payments are distributed according to your wishes. TOD and POD accounts allow for the direct transfer of assets to the designated beneficiaries upon the account holder's death, bypassing the probate process. Trusts are legal arrangements in which assets are held and managed by a trustee for the benefit of designated beneficiaries. Trusts can include beneficiary designations, ensuring that trust assets are distributed according to your wishes. It is crucial to regularly review and update your beneficiary designations, especially after significant life events, such as marriage, divorce, or the birth of a child. This helps ensure that your assets are distributed according to your current wishes and circumstances. When designating beneficiaries, consider the following factors: Family members: Spouses, children, and other relatives are common choices for beneficiaries. Friends: You may choose to designate close friends as beneficiaries. Charities or organizations: You can also designate a charity or organization to receive your assets. Certain situations may require additional consideration when designating beneficiaries: Minors as beneficiaries: If you designate a minor as a beneficiary, consider appointing a legal guardian or establishing a trust to manage the assets until the minor reaches the age of majority. Disabled individuals: Designating a special needs trust as a beneficiary can help ensure that a disabled individual receives proper care without jeopardizing their eligibility for government benefits. Non-US citizens: Be aware of potential tax implications and legal restrictions when designating non-US citizens as beneficiaries. Neglecting to update beneficiary designations after significant life events can result in unintended consequences, such as assets being distributed to an ex-spouse or excluding a new family member. Naming your estate as a beneficiary can subject the assets to the probate process, delaying the distribution of assets and potentially increasing costs and taxes. Providing incomplete or unclear beneficiary information can lead to disputes and delays in distributing assets. Ensure that your beneficiary designations include full names, Social Security numbers, and other identifying information. Failing to consider the tax implications of beneficiary designations can result in unintended tax burdens for your beneficiaries. Consult with a financial advisor or estate planning attorney to minimize potential tax liabilities. Mediation and arbitration are alternative dispute resolution methods that can help resolve beneficiary designation disputes without resorting to litigation. These methods are typically faster, less expensive, and more private than court proceedings. If disputes cannot be resolved through mediation or arbitration, legal remedies and court proceedings may be necessary. This can involve complex litigation and potentially significant legal fees. Executors and trustees play a crucial role in resolving disputes related to beneficiary designations. They are responsible for administering the estate or trust according to the decedent's wishes and ensuring that assets are distributed according to the designated beneficiaries. Beneficiary designations are an essential component of estate planning, ensuring that your assets are distributed according to your wishes. It is vital to regularly review and update your designations, considering potential tax implications and special situations. Consulting with professionals, such as financial advisors and estate planning attorneys, can help you navigate the complexities of beneficiary designations and provide peace of mind for you and your loved ones.What Are Beneficiary Designations?

Legal Framework for Beneficiary Designations

Governing Laws and Regulations

Role of Financial Institutions

Probate Process and Its Relation to Beneficiary Designations

Types of Beneficiary Designations

Primary Beneficiary

Contingent Beneficiary

Revocable and Irrevocable Designations

Per Stirpes vs Per Capita Distribution

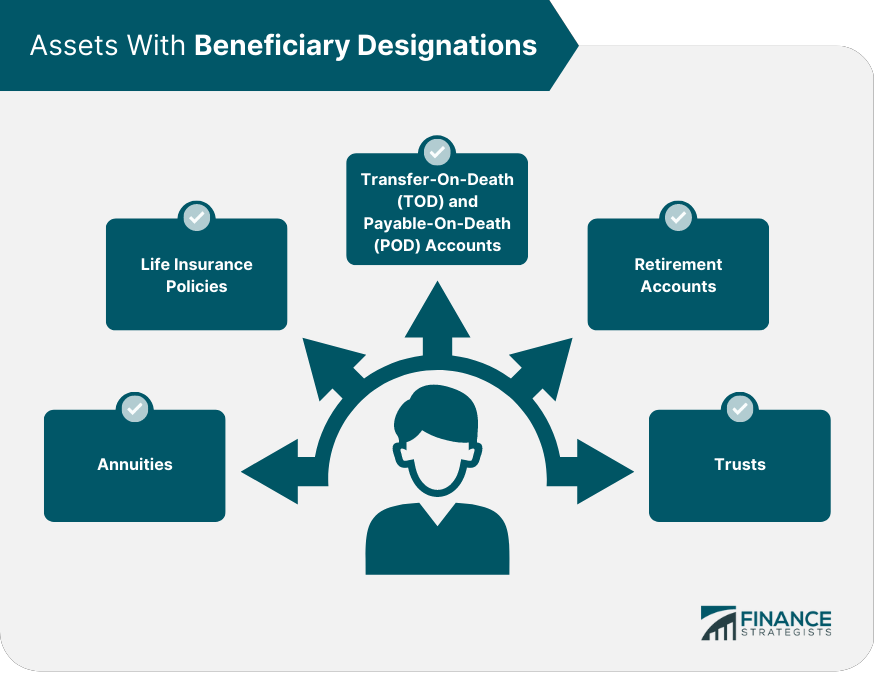

Assets With Beneficiary Designations

Life Insurance Policies

Retirement Accounts (401(k), IRA)

Annuities

Transfer-On-Death (TOD) and Payable-On-Death (POD) Accounts

Trusts

Properly Designating Beneficiaries

Importance of Keeping Designations up to Date

Considerations When Choosing Beneficiaries

Special Situations

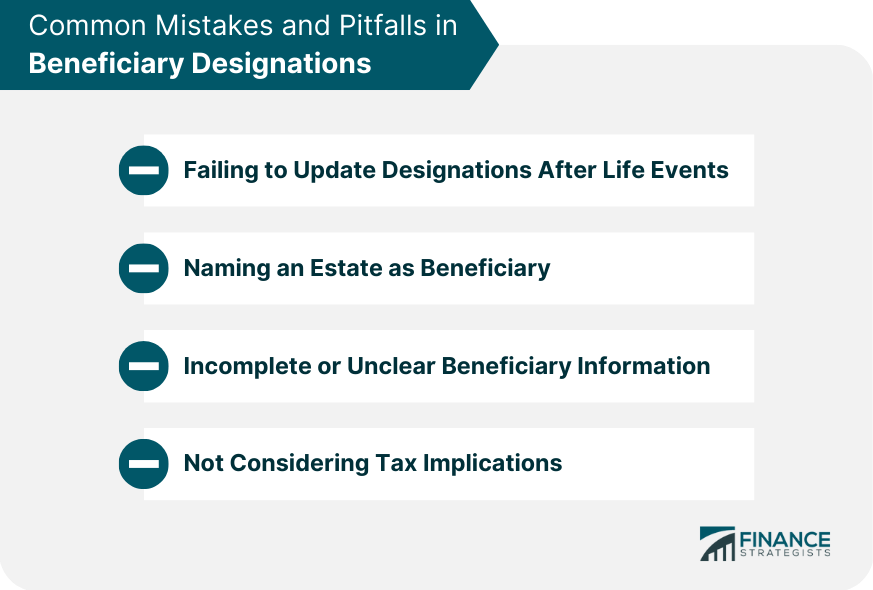

Common Mistakes and Pitfalls in Beneficiary Designations

Failing to Update Designations After Life Events

Naming an Estate as Beneficiary

Incomplete or Unclear Beneficiary Information

Not Considering Tax Implications

Resolving Disputes and Conflicts

Mediation and Arbitration

Legal Remedies and Court Proceedings

Role of Executors and Trustees in Resolving Disputes

Conclusion

Beneficiary Designations FAQs

A beneficiary designation is a legal document that allows you to name the person or entity who will receive your assets or benefits in the event of your death.

You can name anyone you choose as your beneficiary, such as a spouse, child, friend, or charity. It's important to review and update your beneficiary designations regularly to ensure they align with your current wishes and circumstances.

Common assets that require beneficiary designations include retirement accounts (e.g. 401(k), IRA), life insurance policies, and annuities.

If you do not have a beneficiary designation or your designated beneficiary predeceases you, the asset will typically be distributed according to the terms of your will or the laws of your state.

Yes, beneficiary designations can override a will or trust. This is why it's important to review and update your beneficiary designations regularly to ensure they align with your overall estate planning goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.