An open-end management company is a type of investment management firm that operates and manages open-end investment funds, such as mutual funds, exchange-traded funds (ETFs), and unit investment trusts (UITs). These funds issue and redeem shares on an ongoing basis, allowing investors to buy and sell shares directly from the fund at the net asset value (NAV) per share. The primary purpose of open-end management companies is to provide investors with professionally managed, diversified investment portfolios. These companies pool investors' funds and use them to invest in a variety of securities, such as stocks, bonds, and other financial instruments, according to the fund's investment objectives and strategies. Open-end management companies play a crucial role in the financial industry, as they offer investors easy access to a wide range of investment strategies and asset classes. By pooling funds from multiple investors, open-end management companies can achieve economies of scale, reduce transaction costs, and provide investment opportunities that might not be accessible to individual investors. Open-end management companies are typically organized as corporations or trusts, and they are subject to a specific legal and regulatory framework. In the United States, for example, open-end management companies are regulated under the Investment Company Act of 1940, which establishes rules for the registration, operation, and disclosure requirements of these firms. The creation and operation of open-end management companies involve several steps, including the establishment of the legal entity, the appointment of a board of directors or trustees, and the hiring of professional investment managers. Additionally, these companies must develop and maintain detailed investment policies and guidelines, as well as compliance and risk management procedures. Open-end management companies are subject to rigorous regulatory oversight to ensure they operate in the best interests of their investors. This includes regular reporting to regulatory authorities, adherence to strict investment and operational guidelines, and maintaining a high degree of transparency in their investment activities and financial reporting. Mutual funds are one of the most common types of investment vehicles managed by open-end management companies. These funds pool investors' money and invest in a diversified portfolio of securities, such as stocks, bonds, or other financial instruments. Mutual funds are known for their daily liquidity, allowing investors to buy or sell shares at the net asset value (NAV) per share. Exchange-traded funds (ETFs) are another type of open-end investment fund managed by open-end management companies. Similar to mutual funds, ETFs pool investors' funds to invest in a diversified portfolio of securities. However, ETFs are traded on stock exchanges like individual stocks, which allows for intraday trading and potentially lower costs for investors. Unit investment trusts (UITs) are a less common type of open-end investment fund managed by open-end management companies. UITs are similar to mutual funds in that they pool investors' funds and invest in a diversified portfolio of securities. However, UITs typically have a fixed termination date, and their portfolios are generally not actively managed, resulting in lower management fees. One of the key advantages of open-end management companies is the liquidity and flexibility they provide to investors. Open-end funds, such as mutual funds and ETFs, allow investors to buy and sell shares on an ongoing basis, making it easy for them to enter or exit positions as needed. This feature can be particularly beneficial for individual investors who may need to access their investments for cash or adjust their portfolios based on changing financial goals or market conditions. Another advantage of open-end management companies is the professional investment management they offer. These firms employ experienced investment managers and research teams who analyze market trends, identify investment opportunities, and make informed decisions on behalf of fund shareholders. This expertise can potentially lead to better investment outcomes for investors who may not have the time, knowledge, or resources to manage their own portfolios. Open-end management companies also provide investors with the opportunity to achieve diversification in their investment portfolios. By pooling funds from multiple investors, open-end funds can invest in a wide range of securities and asset classes, which can help to reduce the overall risk of the portfolio. This diversification can be particularly valuable for individual investors who may have limited resources or access to a variety of investment options. One of the main disadvantages of open-end management companies is the costs and fees associated with their services. These fees can include management fees, administrative expenses, and sales charges, which can reduce the overall return on investment for shareholders. It's important for investors to carefully evaluate the expense ratio and total costs of an open-end fund before investing. Another potential drawback of open-end management companies is the risk of underperformance. While professional investment managers may provide valuable expertise and insights, there is no guarantee that their investment decisions will consistently outperform the market or meet the fund's objectives. In some cases, open-end funds may underperform their benchmarks or comparable passive investment options, such as index funds. Finally, investing in open-end funds managed by open-end management companies can result in a lack of control for investors over their investment decisions. Investors in these funds must rely on the expertise of the fund's managers and may not have the ability to influence or direct the fund's investment strategies. This can be a disadvantage for investors who prefer a more hands-on approach to managing their portfolios. Open-end management companies offer a wide range of investment strategies and objectives to meet the diverse needs of investors. These strategies can include growth, value, income, or a combination of these approaches, as well as investments in specific sectors, geographic regions, or asset classes. This variety enables investors to select funds that align with their risk tolerance, financial goals, and investment preferences. Open-end management companies focus on achieving specific risk and return objectives for their funds, based on the fund's investment mandate and the needs of its shareholders. This can involve balancing the potential for capital appreciation, income generation, and risk management to create an investment portfolio that meets the fund's objectives while providing an appropriate level of risk for investors. When selecting open-end funds managed by open-end management companies, it's important for investors to ensure that the fund's investment strategies and objectives align with their own financial goals and risk tolerance. This may involve considering factors such as the investor's investment horizon, risk preferences, and income needs when evaluating different open-end funds and their management companies. One of the key performance metrics for open-end funds is the net asset value (NAV) per share. The NAV represents the total value of the fund's assets, minus liabilities, divided by the number of shares outstanding. Open-end management companies calculate the NAV for their funds on a daily basis, providing investors with a transparent measure of the fund's performance and value. Benchmarking is another important aspect of performance measurement for open-end funds. Open-end management companies often compare their funds' performance to relevant market indices or peer groups to evaluate the effectiveness of their investment strategies and the fund's overall performance. This information can help investors determine whether a fund is meeting its stated objectives and assess the relative performance of different funds and management companies. Open-end management companies are required to provide regular reporting and disclosures to their investors, including financial statements, portfolio holdings, and performance information. These reports offer investors insight into the fund's investment activities, risks, and performance, helping them make informed decisions about their investments and monitor the activities of the open-end management company. When considering an investment in an open-end fund managed by an open-end management company, investors should carefully assess the risks associated with the fund and determine whether it is suitable for their investment objectives and risk tolerance. This may involve evaluating the fund's investment strategies, historical performance, and the potential for losses, as well as considering the investor's own financial situation and goals. Another important consideration for investors is the expense ratio and total costs associated with an open-end fund. High fees and expenses can erode investment returns over time, so it's important for investors to compare the costs of different open-end funds and management companies and select those that offer competitive fee structures without sacrificing investment quality or performance. While past performance is not necessarily indicative of future results, reviewing the historical performance and track record of an open-end fund and its management company can provide valuable insights into the fund's potential for success. Investors should consider the fund's performance relative to its benchmark and peers, as well as the overall reputation and experience of the open-end management company. An open-end management company is a type of investment firm that operates and manages open-end investment funds, providing investors with professionally managed, diversified investment portfolios. Open-end management companies offer several advantages, including liquidity, professional investment management, and diversification benefits. However, they also have some drawbacks, such as costs and fees, potential for underperformance, and a lack of control for investors. Before investing in an open-end fund managed by an open-end management company, investors should consider factors such as risk assessment, expense ratio, and historical performance to ensure the fund aligns with their financial goals and risk tolerance. By carefully evaluating these factors, investors can make informed decisions about whether open-end funds and their management companies are suitable for their investment needs.What Is an Open-End Management Company?

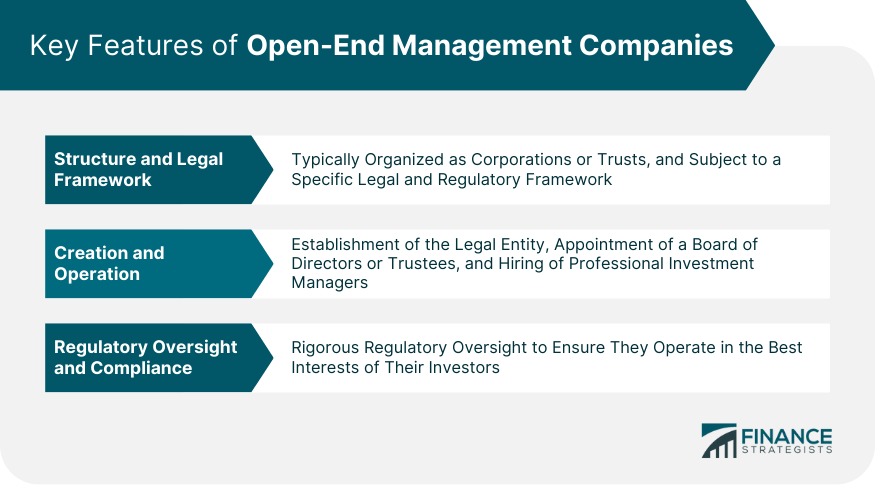

Key Features of Open-End Management Companies

Structure and Legal Framework

Creation and Operation of Open-End Management Companies

Regulatory Oversight and Compliance

Types of Investment Funds Managed by Open-End Management Companies

Mutual Funds

Exchange-Traded Funds (ETFs)

Unit Investment Trusts (UITs)

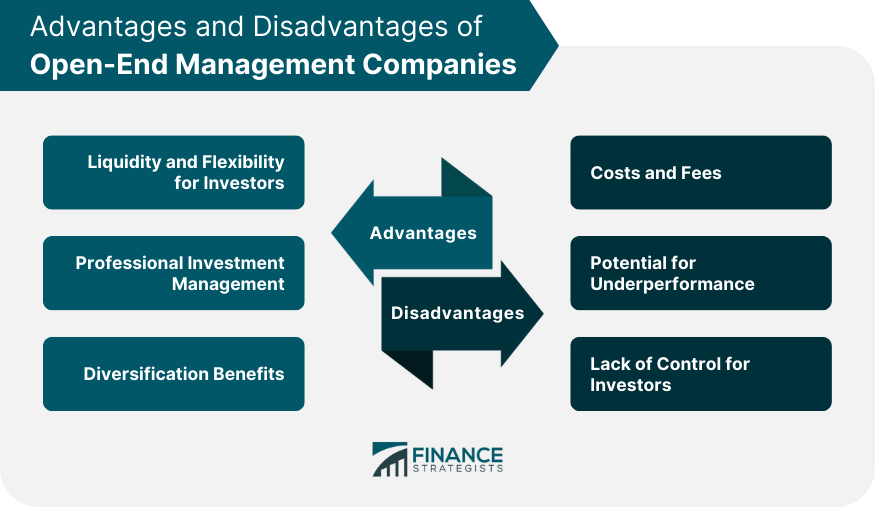

Advantages of Open-End Management Companies

Liquidity and Flexibility for Investors

Professional Investment Management

Diversification Benefits

Disadvantages of Open-End Management Companies

Costs and Fees

Potential for Underperformance

Lack of Control for Investors

Investment Strategies and Objectives

Different Types of Investment Strategies

Focus on Risk and Return Objectives

Alignment With Investor Goals

Performance Measurement and Reporting

Net Asset Value (NAV)

Benchmarking and Performance Evaluation

Investor Reporting and Disclosures

Considerations for Investors

Risk Assessment and Suitability

Expense Ratio and Total Costs

Historical Performance and Track Record

Conclusion

Open-End Management Company FAQs

Open-End Management Company is a financial institution that manages investment funds, such as mutual funds, providing liquidity and professional management.

Open-End Management Companies have a flexible structure, regulatory oversight, and manage various investment funds like mutual funds, ETFs, and UITs.

Open-End Management Companies typically manage mutual funds, exchange-traded funds (ETFs), and unit investment trusts (UITs).

Investing in Open-End Management Companies offers liquidity, professional management, and diversification benefits for investors.

Disadvantages of investing in Open-End Management Companies include costs and fees, potential underperformance, and limited control for individual investors.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.