An open-end fund is a type of mutual fund that is open to new investors at any time and can issue an unlimited number of shares. Open-end funds pool money from multiple investors and invest in a diversified portfolio of securities, such as stocks, bonds, and other assets. When investors buy shares in an open-end fund, the fund's managers use the money to purchase securities in accordance with the fund's investment objectives. When investors sell their shares, the fund sells securities to generate cash to pay the investors. The price of the shares is determined by the net asset value (NAV) of the fund, which is calculated by dividing the total value of the fund's assets by the number of shares outstanding. Open-end funds offer investors the advantages of diversification, professional management, and liquidity, as they can be bought or sold at any time at the NAV price. However, open-end funds also have disadvantages, such as the possibility of high fees and expenses, as well as the potential for lower returns compared to individual securities or other investment vehicles. Open-end funds come in various forms, each catering to different investment objectives and risk appetites. Some of the most common types of open-end funds include: Equity funds primarily invest in stocks of publicly traded companies. These funds can be further classified based on market capitalization (large-cap, mid-cap, and small-cap), investment style (value, growth, or blend), and geographic focus (domestic, international, or global). Bond funds invest in fixed income securities such as government bonds, corporate bonds, and municipal bonds. These funds can be categorized based on the credit quality (investment grade, high-yield), duration (short-term, intermediate-term, long-term), and issuer (government, corporate, or municipal). Money market funds invest in short-term, high-quality debt securities such as Treasury bills, commercial paper, and certificates of deposit. These funds are designed to provide stability and liquidity, with relatively low returns compared to equity and bond funds. Balanced funds, also known as hybrid or asset allocation funds, invest in a mix of stocks, bonds, and other assets to provide both growth and income. The allocation can vary based on the fund's objective, risk profile, and market conditions. Index funds track the performance of a specific market index, such as the S&P 500 or the NASDAQ Composite. These funds offer broad market exposure, with lower fees and expenses compared to actively managed funds. Sector funds focus on a specific industry or sector, such as technology, healthcare, or financial services. These funds offer targeted exposure to a particular area of the market but may carry higher risks due to their concentrated investments. Target-date funds, also known as lifecycle or age-based funds, adjust their asset allocation over time, gradually shifting from aggressive to conservative investments as the target retirement date approaches. These funds provide a simplified investment strategy for long-term investors. Open-end funds offer several benefits to investors, such as: Open-end funds can be bought or sold at the end of each trading day at their net asset value (NAV). This provides investors with the flexibility to enter or exit their positions easily, without worrying about finding a buyer or seller in the market. By pooling investments from various investors, open-end funds can spread their holdings across a wide range of assets, reducing the risk associated with individual securities. This diversification can help protect investors' portfolios from market volatility and downturns. Open-end funds are managed by experienced investment professionals who have access to sophisticated research, analysis, and trading tools. This can help investors benefit from expert insights and strategies, without having to actively manage their portfolios. As open-end funds manage large pools of assets, they can take advantage of economies of scale, resulting in lower trading costs and more efficient execution of trades. This can help improve the overall performance of the fund. Open-end funds often provide the option to automatically reinvest dividends and capital gains, allowing investors to compound their returns over time without incurring additional transaction costs. Investors can easily access open-end funds through various platforms, such as brokerages, banks, or directly from the fund company. Additionally, open-end funds offer features like systematic investment plans (SIPs) and automatic withdrawal plans, making it convenient for investors to regularly invest or redeem their holdings. Despite their numerous advantages, open-end funds also come with certain drawbacks: Open-end funds charge management fees and other expenses to cover the cost of professional management, administration, and distribution. These fees can erode the fund's returns, especially in the case of actively managed funds with higher expense ratios. Open-end funds, particularly those that are actively managed, are not guaranteed to outperform the market or their benchmark index. In some cases, fund managers may make poor investment decisions, leading to underperformance compared to passive investment alternatives. Investors in open-end funds do not have direct control over the individual securities held within the fund. This means they cannot make specific investment decisions or adjust the portfolio based on their preferences or market outlook. Open-end funds can generate taxable events, such as dividends, interest, and capital gains, which may result in tax liabilities for investors. Additionally, investors may be subject to taxes on capital gains even if they have not sold their shares in the fund. As open-end funds continuously issue and redeem shares, the fund's assets may grow or shrink rapidly. This can lead to increased trading costs, portfolio turnover, and potential dilution of the fund's returns. The NAV is the per-share value of an open-end fund, calculated by dividing the fund's total net assets by the number of outstanding shares. NAV is the price at which investors can buy or sell shares of the fund. The NAV is calculated by subtracting the fund's liabilities (such as management fees and expenses) from its total assets (including stocks, bonds, cash, and other securities) and then dividing the result by the number of outstanding shares. The NAV of an open-end fund can be influenced by various factors, including changes in the value of the underlying securities, fund expenses, and inflows or outflows of investor capital. Open-end funds are priced once per day, typically at the end of the trading day. This daily pricing model ensures that all investors receive the same NAV when buying or selling shares, regardless of the timing of their transactions. Investors can purchase or redeem shares of open-end funds through various channels, including financial advisors, brokerages, banks, or directly from the fund company. Transactions are processed at the end of the trading day, based on the fund's NAV. When evaluating the performance of an open-end fund, investors should consider factors such as historical returns, risk-adjusted performance, consistency of returns, and performance relative to the fund's benchmark index or peer group. The expense ratio is the annual fee charged by an open-end fund to cover management, administration, and distribution costs. A higher expense ratio can reduce the fund's net returns, making it crucial for investors to compare fees when selecting funds. Investors should assess the risks and potential returns of an open-end fund, considering factors such as the fund's investment strategy, portfolio composition, historical volatility, and the track To build a well-diversified investment portfolio, investors can use open-end funds to gain exposure to various asset classes, sectors, and geographical regions. This diversification can help reduce the overall risk of the portfolio while providing potential for growth and income. In the United States, open-end funds are regulated by the Securities and Exchange Commission (SEC) to ensure transparency, fairness, and investor protection. The Investment Company Act of 1940 sets forth the legal framework for the registration, operation, and oversight of open-end funds in the United States. It establishes rules for fund governance, disclosure, and reporting, among other requirements. Open-end funds are required to provide a prospectus to potential investors, outlining the fund's investment objectives, strategies, risks, fees, and other pertinent information. This document helps investors make informed decisions about whether to invest in the fund. Open-end funds must issue regular shareholder reports, including annual and semi-annual financial statements, as well as updates on the fund's performance, portfolio holdings, and management team. Open-end funds are required to report taxable events, such as dividends, interest, and capital gains, to both investors and the Internal Revenue Service (IRS). Investors must consider the tax implications of their open-end fund investments when filing their tax returns. Open-end funds can serve as a cornerstone in an investment portfolio, offering investors the benefits of diversification, professional management, and access to a wide range of asset classes, sectors, and strategies. When incorporating open-end funds into their investment strategy, investors should carefully consider their risk tolerance, investment objectives, and time horizon. Evaluating factors such as fund performance, fees, and portfolio composition is essential in order to select the most suitable open-end funds for one's investment goals. By strategically combining open-end funds with other investment vehicles, investors can create a well-rounded portfolio tailored to their specific needs and financial goals. In today's ever-evolving financial landscape, open-end funds continue to play a significant role in helping investors navigate market fluctuations, manage risks, and capitalize on growth opportunities. As the industry continues to innovate and adapt to changing investor preferences, open-end funds are likely to remain a popular and essential component of a successful investment strategy.What Is an Open-End Fund?

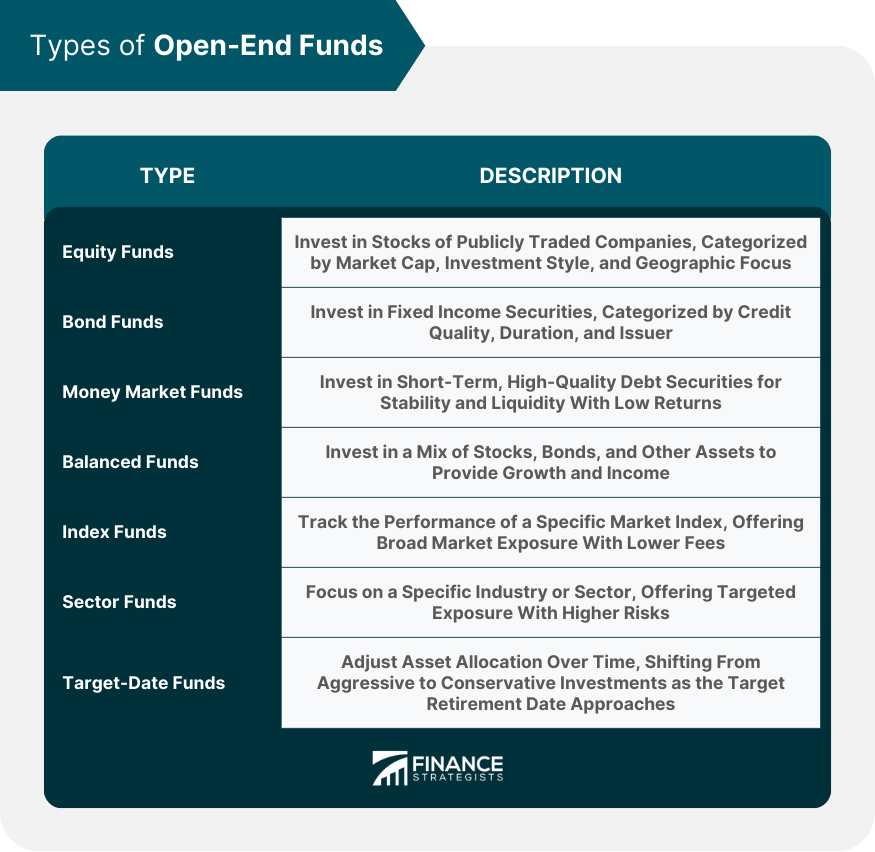

Types of Open-End Funds

Equity Funds

Bond Funds

Money Market Funds

Balanced Funds

Index Funds

Sector Funds

Target-Date Funds

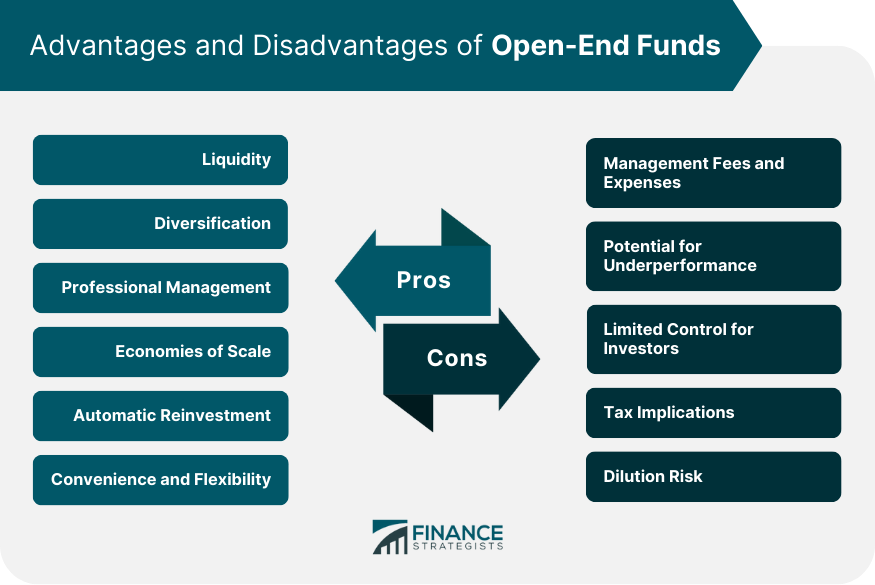

Advantages of Open-End Funds

Liquidity

Diversification

Professional Management

Economies of Scale

Automatic Reinvestment

Convenience and Flexibility

Disadvantages of Open-End Funds

Management Fees and Expenses

Potential for Underperformance

Limited Control for Investors

Tax Implications

Dilution Risk

Pricing and Valuation of Open-End Funds

Net Asset Value

Calculation of NAV

Factors Influencing NAV

Pricing Models and Frequency

Investing in Open-End Funds

How to Buy and Sell Open-End Funds

Evaluating Fund Performance

Expense Ratio and Its Impact

Identifying Fund Risks and Potential Returns

Diversifying With Open-End Funds

Regulation and Compliance for Open-End Funds

US Securities and Exchange Commission (SEC) Oversight

Investment Company Act of 1940

Prospectus Requirements

Shareholder Reports and Disclosure

Tax Reporting and Implications

Conclusion

Open-End Fund FAQs

An open-end fund is a type of mutual fund that does not have a fixed number of shares outstanding. Instead, it continuously issues new shares to investors and redeems them when investors sell. This allows investors to buy and sell shares of the fund at any time.

The price of an open-end fund is determined by its net asset value (NAV). The NAV is calculated by dividing the total value of the fund's assets by the number of shares outstanding.

One advantage of investing in an open-end fund is the ability to buy and sell shares at any time. Additionally, open-end funds provide diversification by investing in a variety of securities. They are also professionally managed, making them a good option for investors who may not have the time or expertise to manage their own portfolio.

One potential disadvantage of investing in an open-end fund is that the management fees can be higher than other investment options, such as exchange-traded funds (ETFs). Additionally, because the fund continuously issues new shares, it can be difficult to track the fund's performance over time.

While open-end funds typically continuously issue new shares, there are instances where a fund may close to new investors. This can occur if the fund becomes too large, making it difficult to invest in the desired securities or causing liquidity issues. Additionally, a fund may close to new investors if the investment manager believes it is in the best interest of current shareholders.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.