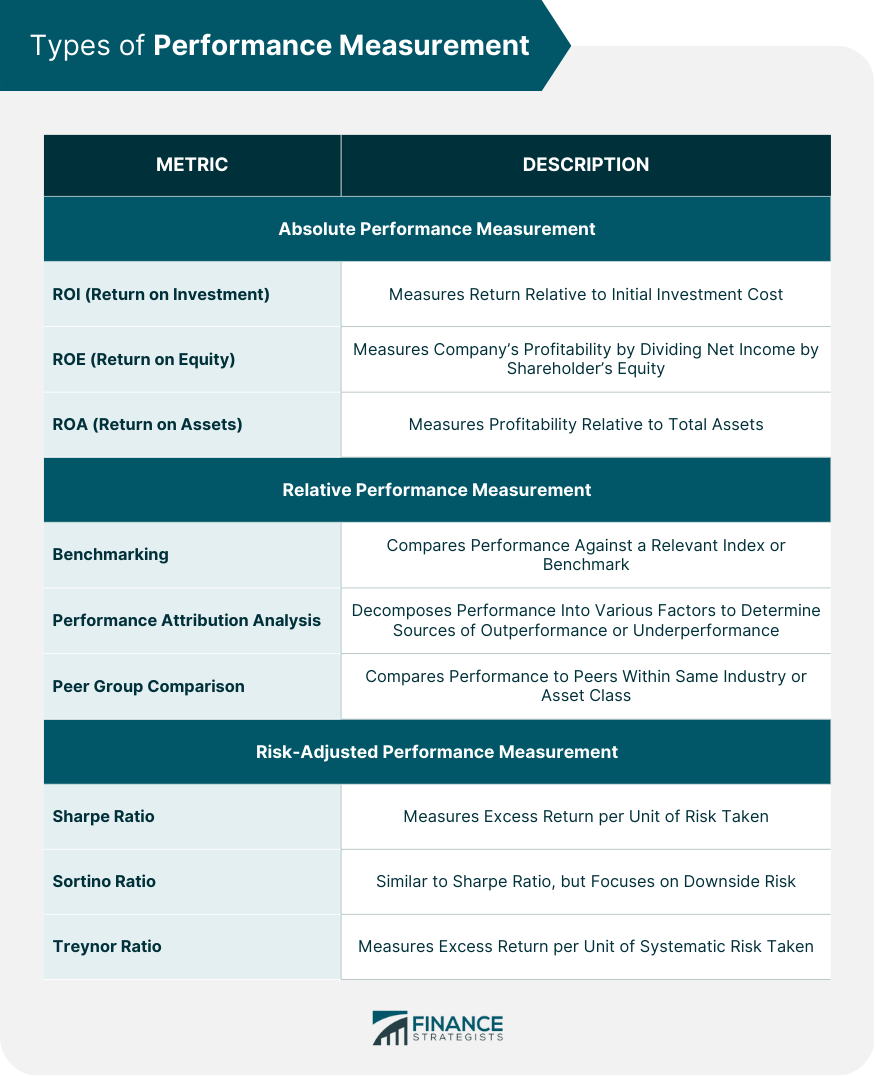

Performance measurement is the systematic process of evaluating the financial performance of an organization, investment, or asset. It is a critical aspect of financial management that helps investors, managers, and stakeholders make informed decisions based on the financial health and progress of an entity. Performance measurement serves several key objectives: 1. To assess the effectiveness of investment decisions and strategies. 2. To monitor the financial health of organizations and identify areas of improvement. 3. To facilitate comparisons between entities, such as peers or industry benchmarks. 4. To align financial goals with overall organizational objectives and strategies. There are three main types of performance measurement: absolute, relative, and risk-adjusted performance measurement. Absolute performance measurement focuses on the evaluation of an investment or organization's performance without comparing it to any external benchmarks. Return on Investment (ROI) is a widely used performance metric that measures the return on an investment relative to its initial cost. It is calculated by dividing the net profit of an investment by the initial investment cost. Return on Equity (ROE) measures a company's profitability by dividing its net income by its shareholder's equity. It indicates how efficiently a company is using its equity to generate profits. Return on Assets (ROA) is a performance metric that measures a company's profitability relative to its total assets. It is calculated by dividing the net income by the total assets of the company. Relative performance measurement compares an investment or organization's performance to an external benchmark or peer group. Benchmarking is the process of comparing an investment or organization's performance against a relevant index or benchmark, such as the S&P 500 for U.S. equities. Performance attribution analysis is the process of decomposing an investment's performance into various factors, such as asset allocation, security selection, and market timing, to determine the sources of outperformance or underperformance. Peer group comparison involves comparing an organization's or investment's performance to that of its peers, typically within the same industry or asset class. Risk-adjusted performance measurement evaluates an investment's performance while considering the level of risk taken to achieve those returns. The Sharpe ratio measures the excess return per unit of risk taken by an investment. It is calculated by dividing the difference between an investment's return and the risk-free rate by the investment's standard deviation. The Sortino ratio is similar to the Sharpe ratio, but it focuses on downside risk. It is calculated by dividing the difference between an investment's return and the risk-free rate by the investment's downside deviation. The Treynor ratio measures the excess return per unit of systematic risk taken by an investment. It is calculated by dividing the difference between an investment's return and the risk-free rate by the investment's beta. Financial ratios are widely used to assess the performance of organizations across various dimensions, including profitability, liquidity, solvency, and efficiency. Profitability ratios measure an organization's ability to generate profits relative to its sales, assets, or equity. The gross profit margin measures the percentage of revenue that remains after subtracting the cost of goods sold. It is calculated by dividing the gross profit by the total revenue. The operating profit margin measures the percentage of revenue that remains after subtracting the cost of goods sold and operating expenses. It is calculated by dividing the operating profit by the total revenue. The net profit margin measures the percentage of revenue that remains after subtracting all expenses, including taxes and interest. It is calculated by dividing the net income by the total revenue. Liquidity ratios measure an organization's ability to meet its short-term financial obligations. The current ratio measures an organization's ability to pay its short-term liabilities with its short-term assets. It is calculated by dividing the total current assets by the total current liabilities. The quick ratio, also known as the acid-test ratio, measures an organization's ability to pay its short-term liabilities using its most liquid assets. It is calculated by dividing the total liquid assets (excluding inventory) by the total current liabilities. The cash ratio measures an organization's ability to pay its short-term liabilities using only its cash and cash equivalents. It is calculated by dividing the total cash and cash equivalents by the total current liabilities. Solvency ratios measure an organization's ability to meet its long-term financial obligations. The debt-to-equity ratio measures the proportion of an organization's capital that is funded by debt relative to equity. It is calculated by dividing the total debt by the total shareholder's equity. The equity ratio measures the proportion of an organization's assets that are funded by equity. It is calculated by dividing the total shareholder's equity by the total assets. The debt ratio measures the proportion of an organization's assets that are funded by debt. It is calculated by dividing the total debt by the total assets. Efficiency ratios measure how effectively an organization utilizes its assets to generate revenue. The asset turnover ratio measures the efficiency with which an organization uses its assets to generate sales. It is calculated by dividing the total revenue by the average total assets. The inventory turnover ratio measures the number of times an organization's inventory is sold and replaced during a given period. It is calculated by dividing the cost of goods sold by the average inventory. The receivables turnover ratio measures the efficiency with which an organization collects its receivables. It is calculated by dividing the total revenue by the average accounts receivable. Performance measurement plays a crucial role in investment management, helping investors assess the effectiveness of their investment decisions and strategies. In active management, portfolio managers aim to outperform a specific benchmark by making investment decisions based on research, analysis, and their own judgment. In passive management, portfolio managers seek to replicate the performance of a specific benchmark or index by holding all or a representative sample of its constituent securities. Portfolio performance evaluation involves assessing the return, risk, and risk-adjusted performance of an investment portfolio. Portfolio return measures the overall gain or loss generated by an investment portfolio over a specific period. Portfolio risk measures the variability of an investment portfolio's returns, typically represented by its standard deviation or value-at-risk (VaR). Risk-adjusted performance measures the return generated by an investment portfolio per unit of risk taken, typically represented by the Sharpe ratio, Sortino ratio, or Treynor ratio. Investment performance benchmarks serve as a point of reference for evaluating an investment's performance. Market indices, such as the S&P 500 or the MSCI World Index, are widely used benchmarks for comparing the performance of investments in various asset classes and geographical regions. Customized benchmarks are tailored to an investment's specific objectives, strategies, and risk profiles, providing a more relevant point of comparison. Style indices, such as growth or value indices, provide a benchmark for comparing the performance of investments that follow a particular investment style. Performance measurement is also vital in corporate finance, where it helps organizations assess their financial performance and create shareholder value. Shareholder value creation is the primary goal of many organizations, and performance measurement helps evaluate the extent to which this goal is being achieved. EVA is a measure of a company's financial performance that reflects the true economic profit generated by the company after accounting for the cost of capital. It is calculated by subtracting the weighted average cost of capital multiplied by the invested capital from the company's operating profit after tax. MVA is a measure of a company's financial performance that reflects the difference between the market value of the company's equity and the book value of its invested capital. A positive MVA indicates that the company has created value for its shareholders, while a negative MVA implies a destruction of shareholder value. Key Performance Indicators (KPIs) are quantifiable metrics that organizations use to track their performance and progress toward specific objectives. They help organizations align their financial goals with their overall strategic objectives and monitor their progress over time. The balanced scorecard approach is a performance measurement framework that incorporates financial and non-financial metrics to provide a comprehensive view of an organization's performance. It typically includes metrics related to financial performance, customer satisfaction, internal processes, and innovation and learning. Despite its importance, performance measurement faces several challenges and limitations: The accuracy and reliability of performance measurement depend on the quality and availability of financial data, which may be subject to errors, omissions, or inconsistencies. The choice of benchmarks can influence the relative performance assessment of investments or organizations, introducing potential biases in the evaluation process. Performance measurement often focuses on short-term results, which may not accurately reflect an investment's or organization's long-term prospects or performance. An excessive focus on short-term performance metrics can lead to short-termism, potentially compromising the long-term success and sustainability of investments or organizations. Performance measurement is a critical aspect of financial management. It serves several key objectives, including assessing the effectiveness of investment decisions and strategies, monitoring the financial health of organizations, facilitating comparisons between entities, and aligning financial goals with overall organizational objectives and strategies. There are three main types of performance measurement: absolute, relative, and risk-adjusted performance measurement, each with its own set of metrics and calculations. Financial ratios are also widely used to assess the performance of organizations across various dimensions, including profitability, liquidity, solvency, and efficiency. However, performance measurement faces several challenges and limitations, such as data quality and availability, biases in benchmark selection, time horizon considerations, and an overemphasis on short-term results. Despite these challenges, performance measurement remains an essential tool for investors, managers, and stakeholders in evaluating financial performance and making informed decisions.Performance Measurement Overview

Importance of Performance Measurement

Types of Performance Measurement

Absolute Performance Measurement

Return on Investment (ROI)

Return on Equity (ROE)

Return on Assets (ROA)

Relative Performance Measurement

Benchmarking

Performance Attribution Analysis

Peer Group Comparison

Risk-Adjusted Performance Measurement

Sharpe Ratio

Sortino Ratio

Treynor Ratio

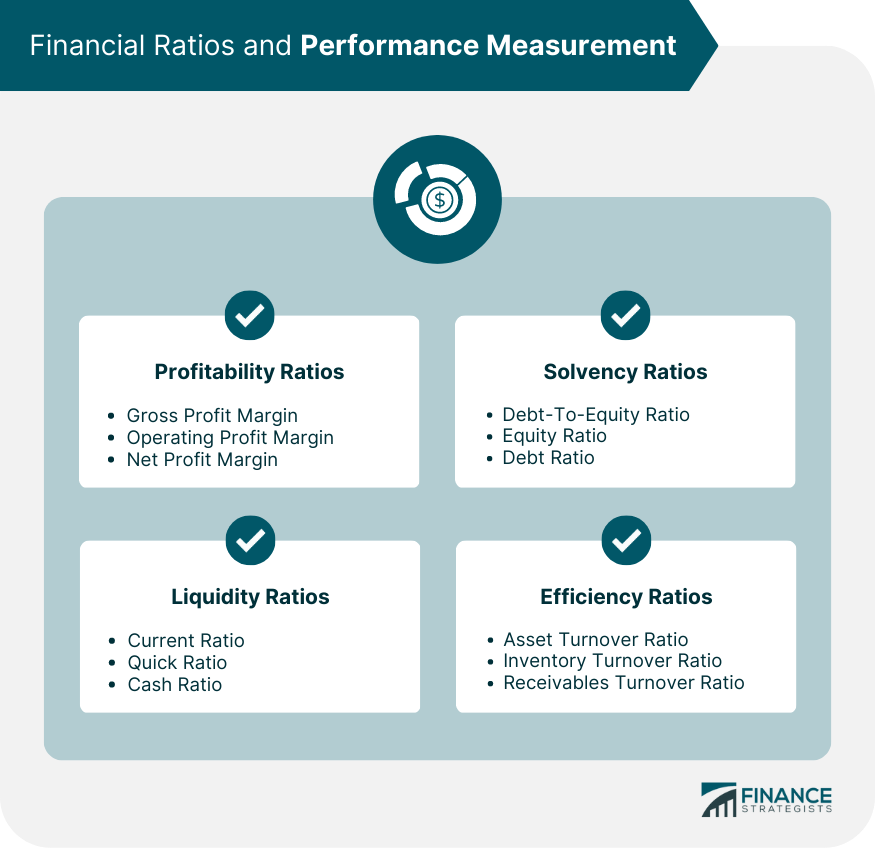

Financial Ratios and Performance Measurement

Profitability Ratios

Gross Profit Margin

Operating Profit Margin

Net Profit Margin

Liquidity Ratios

Current Ratio

Quick Ratio

Cash Ratio

Solvency Ratios

Debt-to-Equity Ratio

Equity Ratio

Debt Ratio

Efficiency Ratios

Asset Turnover Ratio

Inventory Turnover Ratio

Receivables Turnover Ratio

Performance Measurement in Investment Management

Active vs Passive Management

Portfolio Performance Evaluation

Portfolio Return

Portfolio Risk

Risk-Adjusted Performance

Investment Performance Benchmarks

Market Indices

Customized Benchmarks

Style Indices

Performance Measurement in Corporate Finance

Shareholder Value Creation

Economic Value Added (EVA)

Market Value Added (MVA)

Key Performance Indicators (KPIs)

Balanced Scorecard Approach

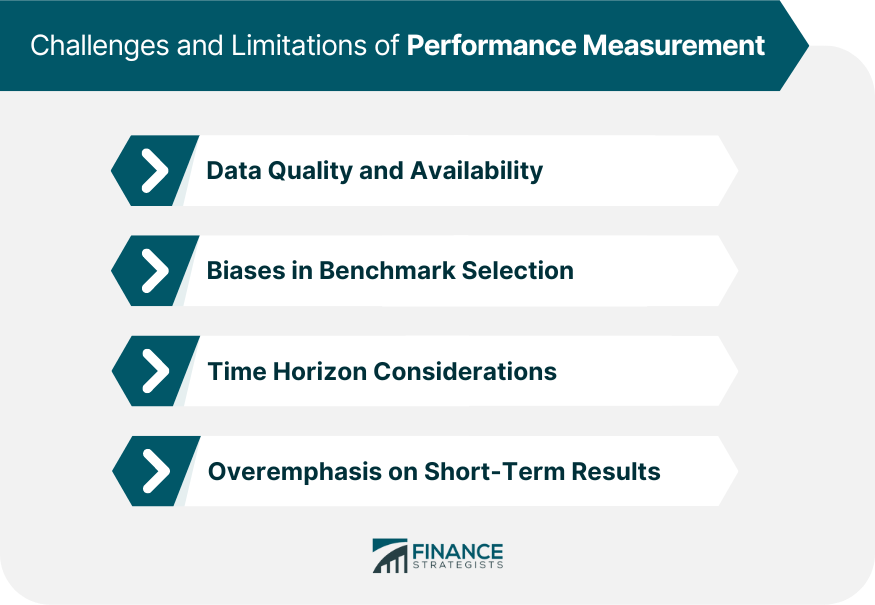

Challenges and Limitations of Performance Measurement

Data Quality and Availability

Biases in Benchmark Selection

Time Horizon Considerations

Overemphasis on Short-Term Results

Conclusion

Performance Measurement FAQs

Performance measurement is crucial for evaluating the financial performance of an organization, investment, or asset. It helps investors, managers, and stakeholders make informed decisions based on the financial health and progress of the entity, align financial goals with overall organizational objectives, and facilitate comparisons between entities.

There are three main types of performance measurement: absolute, relative, and risk-adjusted performance measurement. Absolute performance measurement evaluates an investment or organization's performance without comparing it to external benchmarks. Relative performance measurement compares an investment or organization's performance to external benchmarks or peer groups. Risk-adjusted performance measurement evaluates an investment's performance while considering the level of risk taken to achieve those returns.

Performance measurement plays a vital role in investment management by helping investors assess the effectiveness of their investment decisions and strategies. It enables investors to evaluate the return, risk, and risk-adjusted performance of an investment portfolio and compare its performance against relevant benchmarks or indices.

Some challenges and limitations of performance measurement include data quality and availability, biases in benchmark selection, time horizon considerations, and an overemphasis on short-term results. These challenges can impact the accuracy, reliability, and relevance of performance measurement, potentially leading to suboptimal decision-making.

Financial ratios are widely used in performance measurement to assess various aspects of an organization's financial performance. These ratios evaluate profitability, liquidity, solvency, and efficiency, providing insights into an organization's ability to generate profits, meet financial obligations, and utilize assets effectively.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.