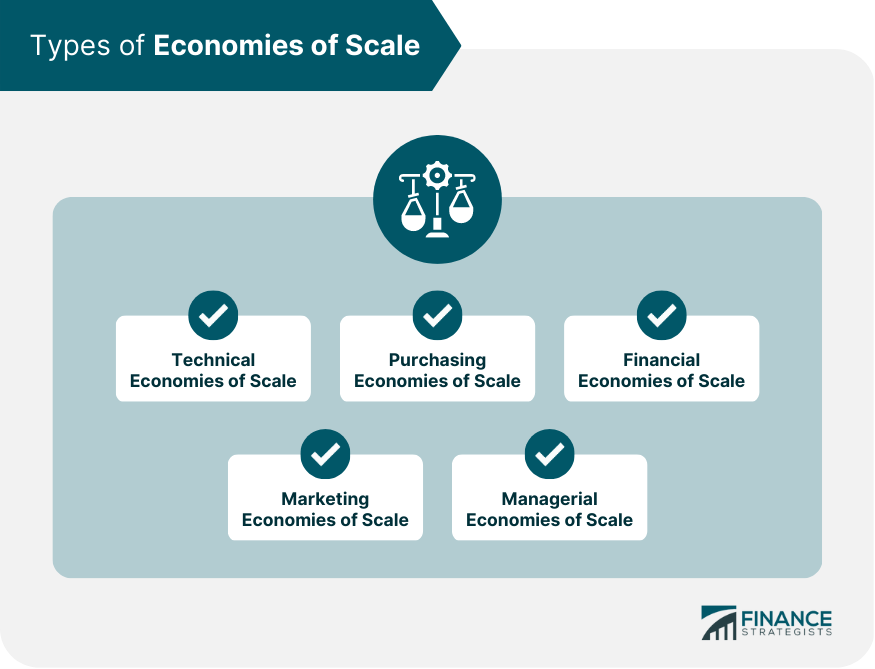

Economies of scale refer to the cost advantages that a business or organization can achieve as it increases the scale of its operations. In simpler terms, the more a company produces, the lower the cost per unit. This is because fixed costs, such as rent and salaries, can be spread out over a larger output, leading to lower average costs incurred by small businesses. Economies of scale can be achieved in various ways, including the use of specialized equipment, negotiating better prices for raw materials, and spreading advertising and marketing costs over a larger output. There are several types of economies of scale, each of which arises from a different source. Understanding these types is crucial for businesses looking to scale up and achieve cost savings. Technical economies of scale arise from the use of specialized equipment or production techniques that become more efficient as output increases. For example, a manufacturing company may invest in a high-capacity machine that can produce more goods in a shorter time, resulting in lower costs per unit. Similarly, a software company may develop an automated system for testing and debugging code, which can reduce the time and effort required for quality assurance. Purchasing economies of scale arise from the ability to negotiate better prices for raw materials, components, or finished products as the volume of purchases increases. For example, a retailer may be able to negotiate a lower price per unit from a supplier by agreeing to buy larger quantities of a product. Similarly, a manufacturer may be able to negotiate better prices for raw materials by purchasing them in bulk. Financial economies of scale arise from the ability to borrow money at lower interest rates due to the larger size of the organization. As a company grows, it may become more attractive to lenders and investors, who may offer lower interest rates or more favorable terms. This can help the company reduce its financing costs and invest more in growth and expansion. Marketing economies of scale arise from the ability to spread advertising and marketing costs over a larger output. For example, a company that produces a high volume of goods may be able to advertise more effectively by using mass media, such as television or radio. Similarly, a company that operates in multiple regions or countries may be able to spread its marketing costs over a larger customer base. Managerial economies of scale arise from the ability to spread fixed management costs over a larger output. For example, a company may be able to hire more specialized managers or consultants as it grows, allowing it to improve efficiency and reduce costs. Similarly, a company may be able to centralize its management functions, such as accounting or human resources, to reduce duplication and improve coordination. Economies of scale can be found in various industries, including manufacturing, services, and agriculture. Here are a few examples: Manufacturing Industry: A car manufacturer may achieve economies of scale by investing in high-capacity production equipment that can produce more cars in a shorter time. Similarly, a food manufacturer may be able to negotiate better prices for ingredients by purchasing them in bulk. Service Industry: A consulting firm may achieve economies of scale by hiring more consultants as it grows, which can help it provide a wider range of services to clients. A retail chain may be able to negotiate better prices from suppliers by purchasing more goods. Agriculture Industry: A farm may achieve economies of scale by investing in specialized equipment, such as a combine harvester, which can help it harvest crops more efficiently. A livestock farm may be able to reduce its costs per animal by increasing the size of its herd. Economies of scale can offer numerous benefits to businesses looking to scale up and improve profitability. These benefits include: Lower Production Costs: As mentioned earlier, economies of scale can help businesses reduce their production costs per unit, which can lead to higher profits or lower prices for customers. Increase Profitability: By reducing costs and increasing efficiency, economies of scale can help businesses achieve higher profits over the long term. Offer Lower Prices to Customers: When businesses achieve economies of scale, they can pass the savings on to customers in the form of lower prices, which can help them compete more effectively in the market. Provide a Competitive Advantage: Businesses that achieve economies of scale may be able to offer a wider range of products or services at lower prices than their competitors, which can give them a competitive advantage. While economies of scale can offer significant benefits, there are also some drawbacks that businesses should consider before scaling up. These include: Decrease Flexibility: As businesses become larger, they may become less flexible and more bureaucratic, making it harder to adapt to changing market conditions or customer needs. Increase Bureaucracy: As businesses grow, they may need to introduce more processes and procedures to manage the increased complexity, which can lead to increased bureaucracy and reduced efficiency. Risk of Diseconomies of Scale: In some cases, businesses may experience diseconomies of scale, which occur when the costs of production per unit start to increase as output increases. Economies of scale can offer significant benefits to businesses, including lower production costs, increased profitability, and competitive advantage. However, the degree to which a business can achieve economies of scale depends on several factors. The size of the organization is one of the most important factors influencing economies of scale. Generally, the larger the organization, the more likely it is to achieve economies of scale. This is because fixed costs, such as rent, salaries, and utilities, can be spread out over a larger output, leading to lower average costs. Larger organizations may also have more bargaining power with suppliers and lenders, which can help them negotiate better prices and terms. However, it is important to note that there are limits to how large an organization can grow before it starts to experience diseconomies of scale. Diseconomies of scale occur when the costs of production per unit start to increase as output increases. This can happen if the business becomes too large to manage effectively or if there are inefficiencies in the production process. The use of advanced technology and production techniques can help businesses achieve economies of scale more easily. For example, a manufacturing company may invest in high-capacity production equipment that can produce more goods in a shorter time, resulting in lower costs per unit. Similarly, a software company may develop an automated system for testing and debugging code, which can reduce the time and effort required for quality assurance. The adoption of new technology can also help businesses improve efficiency and reduce waste. For example, a company may use software to automate inventory management or production scheduling, which can help it reduce its costs and improve its overall performance. Some industries are more conducive to achieving economies of scale than others. Industries with high fixed costs, such as manufacturing, may be more likely to achieve economies of scale. This is because fixed costs can be spread out over a larger output, leading to lower average costs. However, other industries, such as consulting or professional services, may be less conducive to achieving economies of scale. This is because these industries often require highly skilled professionals who cannot be easily replaced, and the services they provide may be highly customized to individual clients. The level of demand for a product or service can affect the degree to which a business can achieve economies of scale. If demand is high, the business may be able to achieve economies of scale more easily. This is because it can sell more products or services, which can help it spread out its fixed costs over a larger output. However, if demand is low or unpredictable, the business may struggle to achieve economies of scale. This is because it may not be able to sell enough products or services to spread out its fixed costs, leading to higher average costs per unit. Economies of scale are a powerful tool for businesses looking to achieve long-term success and profitability. By understanding the different types of economies of scale, their benefits and drawbacks, and the factors that influence them, businesses can make informed decisions about how to scale up and achieve cost savings. However, it is important to carefully consider the potential drawbacks of economies of scale, such as decreased flexibility and increased bureaucracy, before making any major changes to the organization. By striking the right balance, businesses can achieve sustainable growth and success over the long term.Economies of Scale: Definition

Types of Economies of Scale

Technical Economies of Scale

Purchasing Economies of Scale

Financial Economies of Scale

Marketing Economies of Scale

Managerial Economies of Scale

Examples of Economies of Scale

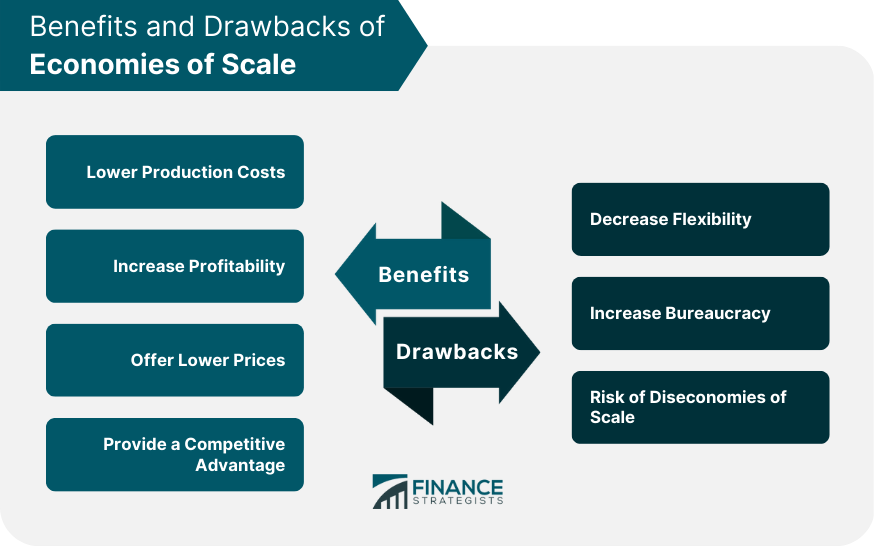

Benefits of Economies of Scale

Drawbacks of Economies of Scale

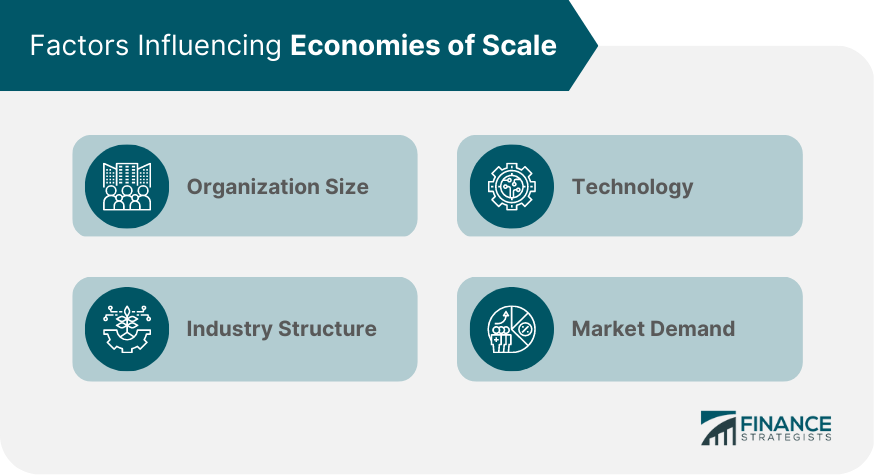

Factors Influencing Economies of Scale

Organization Size

Technology

Industry Structure

Market Demand

Conclusion

For more information on how to understand and apply the concept of economies of scale, you may consult a financial advisor.

Economies of Scale FAQs

Economies of scale refer to the cost advantages that a business or organization can achieve as it increases the scale of its operations. In other words, the more a company produces, the lower the cost per unit.

Economies of scale can offer numerous benefits to businesses, including lower production costs, increased profitability, the ability to offer lower prices to customers, and a competitive advantage.

While economies of scale can offer significant benefits, there are also some drawbacks that businesses should consider before scaling up, such as decreased flexibility, increased bureaucracy, and the risk of diseconomies of scale.

Several factors can influence the degree to which a business can achieve economies of scale, including the size of the organization, technology, industry structure, and market demand.

Economies of scale can be achieved in various industries, including manufacturing, services, and agriculture. However, some industries are more conducive to achieving economies of scale than others, depending on factors such as the level of fixed costs and market demand.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.