Treasury bills, bonds, and notes are financial securities issued by the U.S. Department of the Treasury, representing loans from investors to the government. They are popular among individual and institutional investors due to their relative safety, backed by the full faith and credit of the U.S. government. However, each of these instruments carries unique features, risks, and potential returns that prospective investors should understand before making investment decisions. Understanding these treasury securities is crucial for several reasons. Firstly, they serve as benchmark rates for all other interest rates in the economy. Secondly, they offer investors a safe harbor, especially during periods of market turbulence, given their low default risk. Finally, understanding these instruments helps investors construct diversified portfolios to balance risk and return efficiently.

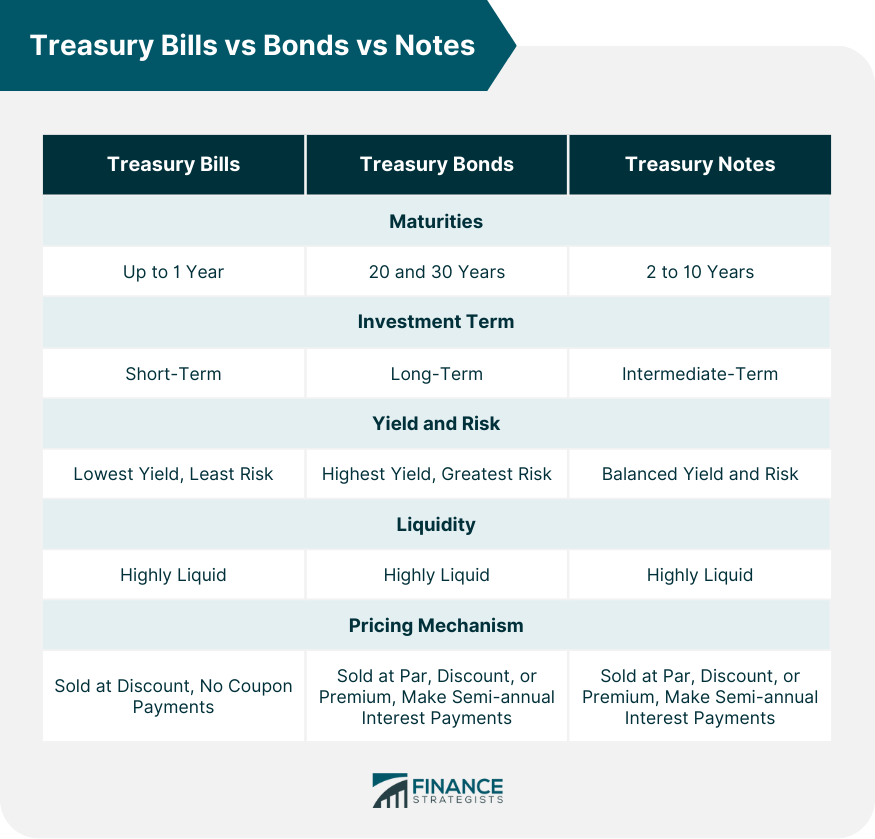

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Treasury Bills (T-Bills) are short-term securities maturing in one year or less, offering investors a safe but lower yield option. Treasury Notes (T-Notes) have longer maturities, ranging from two to ten years, providing a higher yield in exchange for a slightly higher risk. Treasury Bonds (T-Bonds) are the longest-term government securities, with maturities of 20 to 30 years, offering the highest yields among Treasuries. Strategy-wise, diversify your portfolio across these options to balance risk and return. Ready to optimize your investment strategy? Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation Treasury bills, commonly referred to as T-bills, are short-term debt obligations issued by the U.S. Treasury. They have a maturity period of less than one year, making them ideal for short-term investments. Treasury bills come in three standard maturity periods: 4 weeks (1 month), 13 weeks (3 months), and 26 weeks (6 months). There's also a 52-week (1-year) T-bill. However, no matter the initial term, the final maturity will be less than one year. Treasury bills are available in increments of $1,000, although certain ones may have a higher maximum denomination of up to $5 million. Unlike notes or bonds, T-bills do not pay interest to the holder. Instead, they are issued at a discount to their face value, which is the amount they will be worth at maturity. The difference between the purchase price and the face value represents the investor's return. Despite their safe reputation, T-bills are not entirely risk-free. Their short maturity means they offer lower yields compared to longer-term securities, providing less compensation for inflation risk. Moreover, while the risk of default is virtually non-existent, T-bills are still subject to interest rate risk. If market interest rates rise, the value of existing T-bills may decrease. Treasury bills are ideal for investors seeking a short-term, low-risk investment option. They are particularly appealing to institutional investors and corporations with short-term cash surpluses and to individuals looking to safeguard a portion of their investment portfolio against market volatility. Treasury bonds, or T-bonds, are long-term securities issued by the U.S. Treasury. They come with maturities of 20 and 30 years, and they pay interest to the holder every six months until maturity, at which point the face value of the bond is also returned. As previously mentioned, T-bonds have lengthy maturity terms of 20 or 30 years, making them a long-term investment choice. This extensive time commitment exposes investors to the possibility of higher returns but also greater interest rate risk. T-bonds provide semi-annual interest payments, known as coupons, based on a fixed interest rate determined at the time of issuance. This feature offers a steady stream of income, which can be attractive for income-focused investors such as retirees. T-bonds carry a higher degree of interest rate risk compared to T-bills due to their long maturity. If interest rates rise, the price of existing T-bonds falls. However, they offer a higher yield to compensate for this risk. Like T-bills, T-bonds also carry minimal default risk. T-bonds are suitable for investors looking for a secure, long-term investment with a consistent income stream. They are often a preferred choice for retirement portfolios due to their reliable interest payments. Treasury notes, also known as T-notes, are intermediate-term securities issued by the U.S. Treasury. They come with various maturities, including 2, 3, 5, 7, and 10 years. Like T-bonds, T-notes pay semi-annual interest to their holders and return the face value upon maturity. T-notes offer investors a range of maturity dates that can be matched to the timing of future financial needs. They are thus often used for intermediate-term financial goals, such as funding a college education or supplementing retirement income. T-notes make semi-annual interest payments at a fixed rate determined at the time of issuance. The predictable income makes them an attractive investment for those seeking consistent returns. While T-notes carry more interest rate risk than T-bills due to their longer maturity, they have less than T-bonds. They offer higher yields than T-bills, making them a potential option for investors seeking a balance between risk and return. As with other Treasury securities, they have minimal default risk. T-notes are well-suited for investors looking for a predictable income over the medium term, such as those saving for intermediate-term financial goals or those seeking to augment their income in retirement. They are also a solid choice for investors looking for a middle-ground between the low risk and return of T-bills and the higher risk and return of T-bonds. Treasury bills have the shortest maturities, up to one year, making them the best choice for short-term investment. Treasury bonds, with maturities of 20 and 30 years, suit long-term investment needs. Treasury notes, with maturities ranging from 2 to 10 years, are suitable for intermediate-term investment. T-bills offer the lowest yield but also the least risk, while T-bonds provide the highest yield and the greatest risk. T-notes offer a balanced middle ground between yield and risk. All three types of Treasury securities offer high liquidity due to the vast secondary market. However, T-bills, given their short maturity, can often be more readily converted into cash without loss. T-bills are sold at a discount and do not make coupon payments, while T-bonds and T-notes are sold at par, discount, or premium and make semi-annual interest payments. The choice between T-bills, T-bonds, and T-notes depends largely on the investor's time horizon. Short-term investors may favor T-bills, long-term investors may opt for T-bonds, while those with intermediate-term goals may find T-notes most attractive. Investors with low-risk tolerance may prefer T-bills due to their short maturity and negligible default risk, while those with higher risk tolerance might be drawn to the higher yields of T-bonds or T-notes. T-bills may be ideal for investors seeking preservation of capital, T-bonds for those seeking a consistent income stream over the long term, and T-notes for those aiming for steady income over the medium term. Diversifying a portfolio with a mix of T-bills, T-bonds, and T-notes can help manage risk and stabilize returns. Each security responds differently to changes in the economic environment, and owning a blend of them can ensure the portfolio is well-positioned to weather varying market conditions. This diversification can create a balanced portfolio that reflects the investor's financial goals, risk tolerance, and investment horizon. The fundamental distinctions between treasury bills, bonds, and notes lie in their maturities, yield and risk profiles, and pricing mechanisms. Treasury bills are short-term securities with maturities of one year or less, sold at a discount and yielding no interest payments. Treasury bonds are long-term securities with maturities of 20 to 30 years, sold at par, discount, or premium and offering semi-annual interest payments. Treasury notes fall in the middle, with maturities ranging from 2 to 10 years and similar pricing and payment structures to T-bonds. Choosing between treasury bills, bonds, and notes should depend on an investor's unique financial situation, goals, and risk tolerance. While T-bills offer a safe harbor for capital, T-bonds can provide a steady income stream over a long horizon, and T-notes can cater to intermediate-term financial needs. Understanding these differences is crucial in portfolio management, where diversification using a blend of these securities can help manage risk and optimize returns.Overview of Treasury Bills, Bonds, and Notes

Learn From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

Understanding Treasury Bills

Features of Treasury Bills

Maturity

Denomination

Discounted Pricing

Risks and Returns Associated With Treasury Bills

Who Should Consider Investing in Treasury Bills?

Exploring Treasury Bonds

Features of Treasury Bonds

Maturity

Interest Payments

Risks and Returns Associated With Treasury Bonds

Who Should Consider Investing in Treasury Bonds?

Delving Into Treasury Notes

Features of Treasury Notes

Maturity

Interest Payments

Risks and Returns Associated With Treasury Notes

Who Should Consider Investing in Treasury Notes?

Treasury Bills vs Bonds vs Notes

Comparison of Maturities

Comparison of Yield and Risk

Comparison of Liquidity

Comparison of Pricing Mechanisms

Factors to Consider When Choosing Between Treasury Bills, Bonds, and Notes

Investment Horizon

Risk Tolerance

Financial Goals

Role of Diversification in Portfolio Management

Bottom Line

Treasury Bills vs Bonds vs Notes FAQs

The key differences lie in their maturities and payment structures. Treasury bills are short-term investments, treasury bonds are long-term, and treasury notes are intermediate-term. Additionally, T-bills do not pay interest, while T-bonds and T-notes do.

While these securities carry minimal default risk as they are backed by the U.S. government, they are still subject to interest rate risk. This risk varies depending on the security's maturity.

Treasury bills, with maturities of one year or less, are ideal for short-term investment.

Typically, treasury bonds offer the highest yield to compensate for their longer maturity and higher interest rate risk.

While the risk of default is almost non-existent, the market value of these securities can fall if interest rates rise, potentially causing losses if you sell before maturity.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.