Kiwi Bonds are debt securities issued by the New Zealand government to raise funds for the country's public expenditures. These bonds are denominated in New Zealand dollars and can be purchased by both local and international investors. The government uses the funds raised through the sale of these bonds for various public projects, such as infrastructure development, healthcare, and education. Kiwi Bonds are considered a secure and low-risk investment due to the backing of the New Zealand government. Investors receive periodic interest payments, known as coupons, throughout the bond's term. Upon maturity, investors receive the principal amount initially invested. The main purpose of issuing Kiwi Bonds is to raise funds for the New Zealand government to finance its public projects and manage its fiscal policy. By issuing these bonds, the government can secure the necessary funds without relying solely on taxation or other forms of revenue. Additionally, it allows the government to manage its cash flow and meet its financial obligations. Kiwi Bonds also serve as a tool for investors seeking a low-risk investment option with regular income. They are an attractive option for conservative investors who prioritize capital preservation and steady income over high returns. The origin of Kiwi Bonds can be traced back to the 1980s when the New Zealand government began issuing debt securities to fund its public expenditures. Initially, these bonds were primarily targeted at domestic investors. However, as the popularity of the bonds grew, the government expanded the scope of the Kiwi Bond program, allowing international investors to participate. This move was aimed at attracting more foreign capital to the country, which would help strengthen the New Zealand dollar and promote economic growth. Over the years, Kiwi Bonds have gained a reputation for being a secure and reliable investment option, backed by the New Zealand government. Kiwi Bonds have played a significant role in the New Zealand economy by providing the government with a stable source of funding for public projects. The sale of these bonds has allowed the government to undertake infrastructure development, improve healthcare and education, and manage the country's fiscal policy more effectively. Additionally, Kiwi Bonds have helped promote financial market development in New Zealand by providing a low-risk investment option for both domestic and international investors. This has contributed to the growth and stability of the country's financial markets, further strengthening the New Zealand economy. Fixed-rate Kiwi Bonds pay a predetermined interest rate, which remains constant throughout the bond's term. This means that the coupon payments received by the investor do not change over time, providing a predictable and stable income stream. Fixed-rate bonds are ideal for investors seeking a reliable and consistent return on their investment. Investors in fixed-rate Kiwi Bonds can benefit from the predictability of their returns, as they know exactly how much interest they will receive during the bond's term. This can be advantageous for those looking to plan their finances or create a steady income stream for retirement or other long-term financial goals. Inflation-indexed Kiwi Bonds are designed to protect investors from the adverse effects of inflation on their investment returns. The principal and interest payments of these bonds are adjusted according to changes in the Consumer Price Index (CPI), ensuring that the real value of the investment is preserved over time. This type of bond is particularly beneficial for investors who are concerned about inflation eroding their purchasing power. By investing in inflation-indexed Kiwi Bonds, they can ensure that their returns keep pace with the rising cost of living, maintaining the real value of their investment. Interest rates on Kiwi Bonds are determined by the New Zealand government and are influenced by factors such as market conditions, economic outlook, and monetary policy. These rates can vary depending on the bond's maturity and the type of bond (fixed-rate or inflation-indexed). Generally, the interest rates on Kiwi Bonds are competitive when compared to other low-risk investment options in the market. Investors receive interest payments, known as coupons, periodically throughout the bond's term. These payments can be made annually, semi-annually, or quarterly, depending on the specific bond issue. The interest rate remains constant for fixed-rate bonds, while it may be adjusted for inflation-indexed bonds to account for changes in the CPI. The maturity date of a Kiwi Bond refers to the date when the bond's term ends, and the investor is repaid their initial investment (principal amount). Kiwi Bonds typically come with various maturity options, ranging from short-term bonds with a maturity of one year to long-term bonds with a maturity of ten years or more. Investors should consider their investment goals and time horizon when selecting a bond with an appropriate maturity. Longer-term bonds may offer higher interest rates but are subject to greater interest rate risk, as changes in market interest rates can have a more significant impact on the bond's value. Kiwi Bonds have a minimum investment requirement, which is typically set at a relatively low level to make them accessible to a broad range of investors. The minimum investment for most Kiwi Bonds is usually around NZD 1,000, with additional increments of NZD 1,000 thereafter. This low minimum investment threshold makes Kiwi Bonds an attractive option for investors with limited funds or those looking to diversify their portfolio without making a substantial financial commitment. Interest earned on Kiwi Bonds is subject to taxation in New Zealand. For local investors, interest income is taxed at their marginal tax rate. However, non-resident investors may be eligible for a reduced withholding tax rate on their interest income, depending on their country of residence and any applicable tax treaties. Before investing in Kiwi Bonds, both local and international investors should consult with a tax professional to understand their specific tax obligations and any potential tax benefits available to them. One of the main benefits of investing in Kiwi Bonds is their low-risk profile. These bonds are backed by the New Zealand government, meaning that the risk of default is minimal. This makes them an attractive option for conservative investors who prioritize capital preservation and steady income over high returns. Additionally, Kiwi Bonds provide investors with a predictable income stream through regular coupon payments, making them suitable for those seeking stability and consistency in their investment returns. Investing in Kiwi Bonds can offer certain tax advantages for both domestic and international investors. Local investors may be eligible for tax credits on their interest income, while non-resident investors could benefit from reduced withholding tax rates on their interest income, depending on their country of residence and applicable tax treaties. These tax benefits can enhance the overall returns on Kiwi Bonds, making them an attractive investment option for those looking to minimize their tax liabilities. Kiwi Bonds are considered highly liquid investments, meaning they can be easily bought and sold in the secondary market without significantly impacting their price. This liquidity allows investors to access their funds quickly if they need to sell their bonds before maturity. High liquidity also provides a level of flexibility for investors, enabling them to adjust their investment strategy as their financial goals and market conditions change. While Kiwi Bonds offer a secure and steady income stream, their returns are generally lower compared to riskier investment options, such as stocks or real estate. This lower return is due to the lower risk associated with these government-backed bonds. Investors seeking higher returns may need to consider other investment options that involve a higher level of risk. However, for conservative investors who prioritize capital preservation and regular income over high returns, Kiwi Bonds can still be an attractive option. Kiwi Bonds offer limited flexibility in terms of interest rate adjustments and early redemption. Fixed-rate bonds come with a predetermined interest rate, which remains constant throughout the bond's term, regardless of changes in market interest rates. Inflation-indexed bonds do adjust for changes in the CPI, but their interest rates are not influenced by other market factors. Additionally, early redemption of Kiwi Bonds is generally not allowed, except in certain circumstances, such as the death of the bondholder. This lack of flexibility can be a disadvantage for investors who may need to access their funds or adjust their investment strategy before the bond reaches its maturity date. Both Kiwi Bonds and term deposits are considered low-risk investment options, offering a predictable and steady income stream. However, there are some differences between the two. Kiwi Bonds are government-backed securities, while term deposits are provided by banks and financial institutions. This means that Kiwi Bonds generally carry a lower risk of default compared to term deposits. Additionally, the interest rates on Kiwi Bonds may be more competitive than those on term deposits, depending on market conditions and the specific bond issue. However, term deposits may offer greater flexibility in terms of early withdrawal, while Kiwi Bonds generally do not permit early redemption. Shares represent an ownership stake in a company and tend to offer higher potential returns than Kiwi Bonds, but they also come with a higher level of risk. Share prices can be volatile, and investors may experience capital losses if the company's performance declines or the overall stock market experiences a downturn. In contrast, Kiwi Bonds provide a more stable and predictable income stream, with a lower risk of capital loss. Investors seeking capital preservation and regular income may prefer Kiwi Bonds, while those looking for higher returns and capital growth may be more inclined to invest in shares. Property investment involves purchasing real estate, such as residential or commercial properties, with the expectation of generating rental income and capital appreciation. Property investments can offer higher returns compared to Kiwi Bonds, but they also come with higher risks, including property market fluctuations, tenant issues, and ongoing maintenance costs. Kiwi Bonds, on the other hand, provide a more stable and predictable income stream with a lower risk profile. Investors who prioritize capital preservation and steady income may find Kiwi Bonds more suitable, while those seeking potential capital growth and higher returns may consider property investment. Kiwi Bonds are a type of government bond issued by the New Zealand government, designed to provide retail investors with a low-risk, fixed-income investment option. These bonds come in two types, Fixed-rate Kiwi Bond and Inflation-indexed Kiwi Bond, each with their own set of features. While Kiwi Bonds offer several benefits, such as low risk, tax benefits, and high liquidity, they also have drawbacks, such as low returns compared to other investment options and lack of flexibility. Investors should weigh these factors carefully before investing in Kiwi Bonds. Overall, Kiwi Bonds can be a suitable investment option for conservative investors who prioritize capital preservation over high returns. They offer a low-risk investment option with a predictable income stream. With features such as competitive interest rates, various maturity options, and tax benefits, they can be an attractive choice for conservative investors. However, Kiwi Bonds may not be suitable for those seeking higher returns or greater flexibility in their investment strategy. Before investing in Kiwi Bonds, it's essential to consider your financial goals, risk tolerance, and investment time horizon, and compare them with other available investment options to determine the most suitable choice for your individual needs.What Is a Kiwi Bond?

History of Kiwi Bonds

Origin

Kiwi Bonds in New Zealand Economy

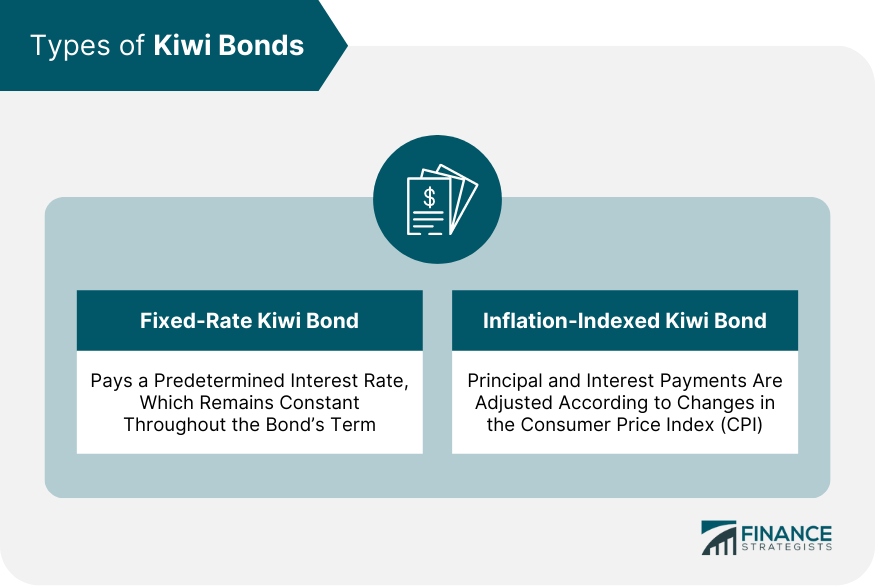

Types of Kiwi Bonds

Fixed-Rate Kiwi Bond

Inflation-Indexed Kiwi Bond

Features of Kiwi Bonds

Interest Rates

Maturity Date

Minimum Investment

Taxation

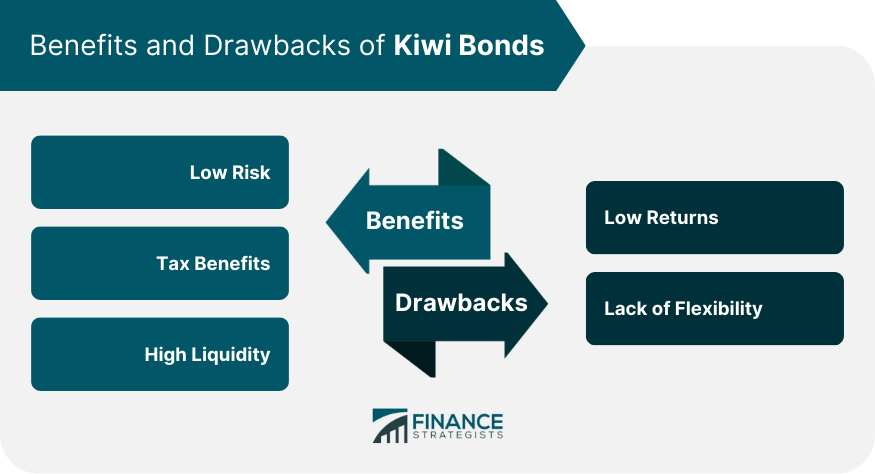

Benefits of Kiwi Bonds

Low Risk

Tax Benefits

High Liquidity

Drawbacks of Kiwi Bonds

Low Returns

Lack of Flexibility

Comparison of Kiwi Bonds With Other Investments

Kiwi Bond vs Term Deposits

Kiwi Bond vs Shares

Kiwi Bond vs Property

Final Thoughts

Kiwi Bond FAQs

Kiwi Bond is a government bond issued by the New Zealand government, aimed at retail investors who want to invest in low-risk, fixed-income securities.

There are two types of Kiwi Bonds: Fixed-rate Kiwi Bond and Inflation-indexed Kiwi Bond.

Kiwi Bonds offer low-risk investment options, tax benefits, and high liquidity, making them an attractive investment option for conservative investors.

Kiwi Bonds offer low returns compared to other investment options, and they lack flexibility, as investors cannot withdraw their funds before the maturity date.

You can invest in Kiwi Bonds directly through the Reserve Bank of New Zealand's website or through a licensed financial advisor. The minimum investment amount is $1,000.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.