The marginal tax rate is the percentage of tax applied to an individual's or business's incremental income. It is the tax rate that applies to the next dollar earned and is a critical concept in understanding tax systems. It serves multiple purposes, including promoting fairness, affecting financial decisions, and generating government revenue. Understanding one's marginal tax rate can help individuals and businesses make informed choices regarding income, investments, and tax planning. The marginal tax rate differs from the average tax rate, which is the total tax paid divided by the taxpayer's total income. The average tax rate provides a broader view of a taxpayer's overall tax burden, while the marginal tax rate focuses on the tax implications of earning additional income. Tax brackets are ranges of income subject to specific tax rates within a progressive tax system. As a taxpayer's income increases, they move into higher tax brackets, resulting in a higher marginal tax rate for their additional income. For example, in the United States, the federal income tax system consists of multiple tax brackets, each with a specific tax rate. A taxpayer might pay a 10% tax rate on their first $10,000 of income, a 12% rate on income between $10,001 and $40,000, and a 22% rate on income between $40,001 and $85,000. Income thresholds are the specific levels of income that separate different tax brackets. These thresholds determine which tax rate applies to a given portion of a taxpayer's income. Income thresholds are typically adjusted for inflation annually, ensuring that taxpayers are not subject to higher tax rates simply due to the effects of inflation on their income. This adjustment maintains the fairness and effectiveness of the tax system. Single filing status is used by individuals who are unmarried or legally separated. These taxpayers face different income thresholds and tax rates than those who file jointly with a spouse or as head of household. Married filing jointly is a filing status used by married couples who choose to combine their incomes and deductions on a single tax return. This status typically results in lower tax rates and higher income thresholds than other filing statuses. Married filing separately is a filing status option for married couples who choose to file their tax returns separately. While this status may offer certain advantages in specific situations, it generally results in a higher overall tax burden. Head of household is a filing status available to unmarried individuals who provide financial support for at least one dependent. This status offers more favorable tax rates and income thresholds compared to the single filing status. Calculating the marginal tax rate involves determining which tax bracket a taxpayer's additional income falls into and applying the corresponding tax rate. This calculation can be more complex for taxpayers with multiple sources of income or deductions that affect their taxable income. A progressive tax system is one in which higher-income earners pay a higher percentage of their income in taxes. This system aims to promote fairness by distributing the tax burden based on an individual's ability to pay. Proponents of a progressive tax system argue that it is more equitable and helps to reduce income inequality. However, critics argue that it can discourage economic growth and investment by penalizing higher earners with higher tax rates. Consider an individual earning $60,000 per year with a tax system consisting of three brackets: 10% for income up to $20,000, 20% for income between $20,001 and $50,000, and 30% for income above $50,000. The taxpayer would pay 10% on the first $20,000, 20% on the next $30,000, and 30% on the remaining $10,000. The marginal tax rate for additional income would be 30%. Taxable income refers to the portion of an individual's or business's income subject to taxation after accounting for deductions and exemptions. Understanding one's marginal tax rate can help taxpayers make informed decisions about how to manage their taxable income. Tax deductions and credits can significantly reduce a taxpayer's tax liability, potentially lowering their marginal tax rate. By strategically utilizing deductions and credits, taxpayers can optimize their tax situation and minimize their tax burden. Capital gains tax is a tax on the profits from the sale of an asset, such as stocks, real estate, or other investments. Marginal tax rates can influence investment decisions, as higher rates may discourage taxpayers from realizing capital gains. Dividend tax is a tax on income received from dividends paid by corporations to their shareholders. Understanding one's marginal tax rate can help investors make informed decisions about holding dividend-paying stocks or investing in other assets. Traditional IRAs and 401(k)s are tax-deferred retirement savings accounts, allowing contributions to be made with pre-tax dollars. By reducing taxable income, these accounts can lower a taxpayer's marginal tax rate and provide significant tax savings over time. Roth IRAs and 401(k)s are retirement savings accounts funded with after-tax dollars, allowing for tax-free withdrawals in retirement. Considering one's current and future marginal tax rates can help determine whether a Roth or traditional account is the better choice for long-term retirement planning. Marginal tax rates vary widely across countries, with some nations imposing high rates on top earners, while others maintain lower rates across the board. Comparing marginal tax rates can provide valuable insight into the overall tax burden faced by individuals and businesses in different countries. A flat tax system is one in which all taxpayers pay the same percentage of their income in taxes, regardless of their income level. While proponents argue that flat tax systems are simpler and promote economic growth, critics contend that they can be regressive and disproportionately burden lower-income earners. Tax havens are countries or jurisdictions with low or nonexistent tax rates, often attracting wealthy individuals and businesses seeking to minimize their tax liabilities. While tax havens can offer significant tax savings, they may also face scrutiny and potential penalties from governments cracking down on tax evasion. Understanding marginal tax rates is crucial for making informed financial decisions and managing tax liabilities. It involves calculating the tax rate that applies to the next dollar earned, considering the taxpayer's income bracket, income thresholds, and filing status. Marginal tax rates are an essential component of progressive tax systems, which aim to distribute the tax burden based on an individual's ability to pay. They can influence decisions regarding income, deductions, investments, and retirement planning. Comparing marginal tax rates across countries can provide valuable insights into global tax policies and their impact on individuals and businesses. Finally, while tax havens may offer significant tax savings, they may also face scrutiny and potential penalties from governments cracking down on tax evasion. Overall, understanding marginal tax rates is critical for navigating the complex world of taxation and maximizing financial well-being.What Is Marginal Tax Rate?

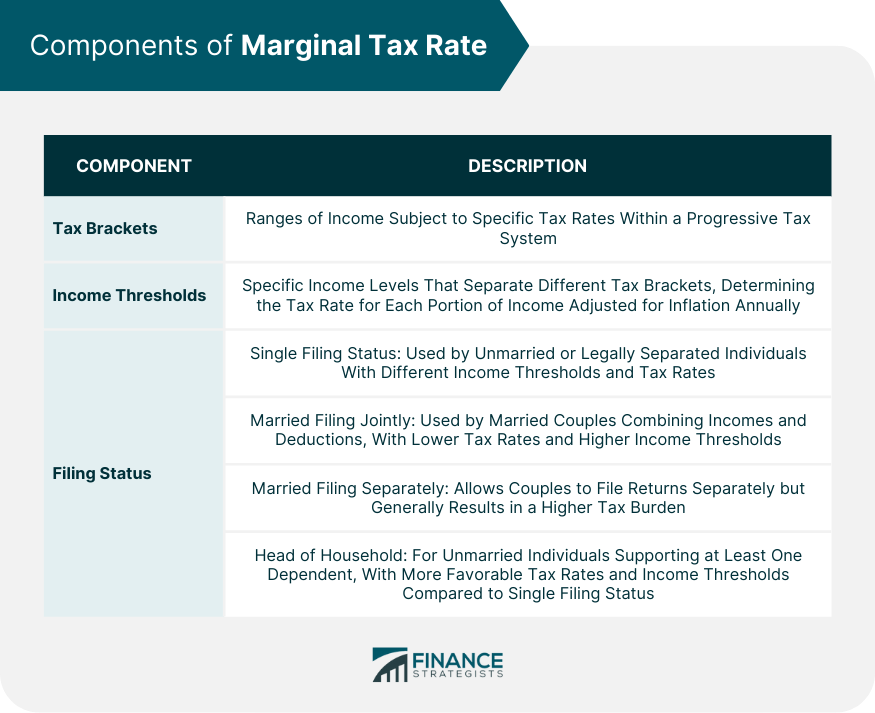

Components of Marginal Tax Rate

Tax Brackets

Income Thresholds

Filing Status

Single

Married Filing Jointly

Married Filing Separately

Head of Household

How Marginal Tax Rate Works

Calculation of Marginal Tax Rate

Progressive Tax System

Applying Marginal Tax Rate to Income

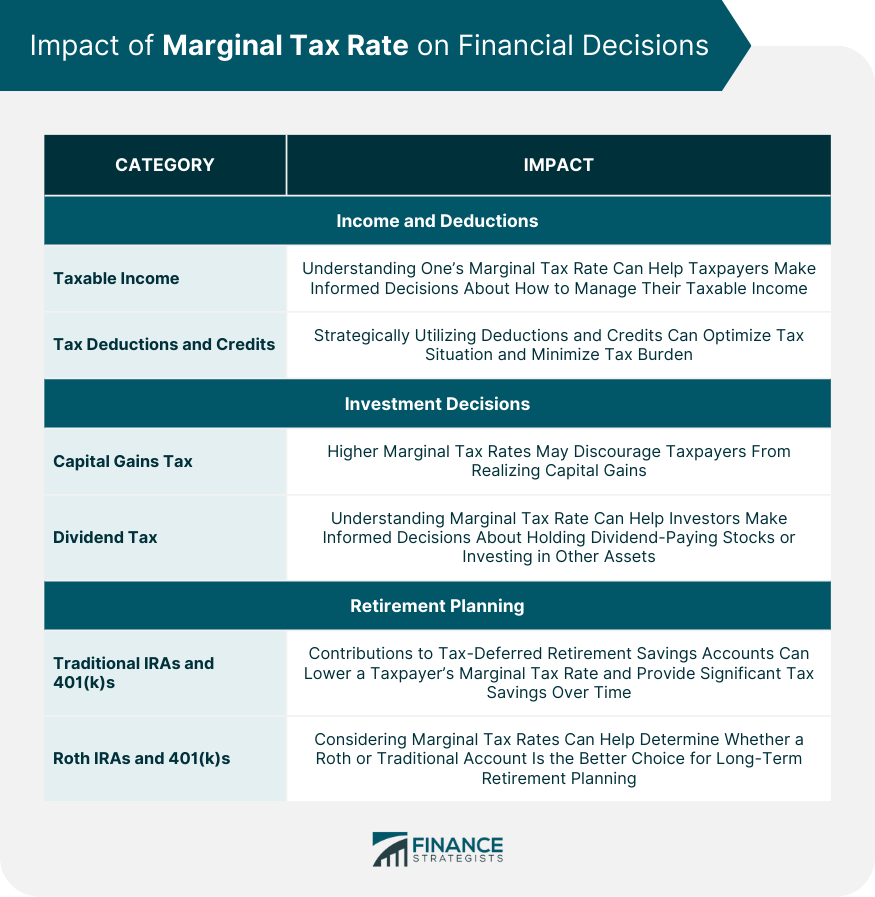

Impact of Marginal Tax Rate on Financial Decisions

Income and Deductions

Taxable Income

Tax Deductions and Credits

Investment Decisions

Capital Gains Tax

Dividend Tax

Retirement Planning

Traditional IRAs and 401(k)s

Roth IRAs and 401(k)s

Marginal Tax Rate Around the World

Comparison of Marginal Tax Rates

Flat Tax Systems

Tax Havens

Final Thoughts

Marginal Tax Rate FAQs

The marginal tax rate is the percentage of tax applied to an individual's or business's incremental income. Understanding your marginal tax rate is essential for making informed financial decisions and effectively managing your tax liability.

The marginal tax rate focuses on the tax implications of earning additional income, while the average tax rate is the total tax paid divided by the taxpayer's total income. The average tax rate provides a broader view of a taxpayer's overall tax burden.

A progressive tax system is one in which higher-income earners pay a higher percentage of their income in taxes. As your income increases, you move into higher tax brackets, resulting in a higher marginal tax rate for your additional income.

Tax deductions and credits can reduce your taxable income, potentially lowering your marginal tax rate. By strategically utilizing deductions and credits, you can optimize your tax situation and minimize your tax burden.

Yes, your marginal tax rate can influence your investment decisions. A higher marginal tax rate may discourage taxpayers from realizing capital gains or encourage them to seek investments with more favorable tax treatment, such as stocks with lower dividend tax rates.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.