Bonds are a popular investment instrument that allows individuals, corporations, and governments to raise capital by issuing debt securities. Investing in bonds can provide a steady income stream and relative stability compared to other financial instruments. However, like any investment, there are risks involved, and it is possible to lose money on bonds. Such risks include interest rate increases, issuer default, reinvestment risk, and inflation, all of which can potentially lead to financial loss. Understanding these factors allows investors to make informed decisions and better manage their portfolio's risk. When interest rates rise, the price of existing bonds typically falls. This inverse relationship happens because new bonds issued at higher interest rates make older, lower-yielding bonds less attractive. Therefore, if you need to sell a bond before its maturity date during a period of rising interest rates, you might have to sell at a discount. If the bond issuer faces financial difficulties or declares bankruptcy, it may fail to make interest payments or repay the principal. This scenario, known as default risk, is particularly relevant for corporate bonds. Some bonds come with a "call" feature, allowing the issuer to repay the bond before its maturity date. While beneficial for the issuer, this can be detrimental for investors if interest rates have dropped since the bond's issuance. The investor will receive their principal back sooner than expected, and they might not be able to reinvest it at a similarly high rate. When a bond matures or is called, you'll need to reinvest the principal. However, if interest rates have fallen since you first invested, you may have to reinvest at a lower rate. Inflation erodes the purchasing power of a bond's fixed interest payments. If inflation rises rapidly, the real return on bonds can become negative, leading to a loss for the investor. Central banks set short-term interest rates, directly affecting the bond market. When a central bank raises interest rates, bond prices usually fall, and vice versa. Inflation and economic growth also impact bond prices. High inflation can erode the value of bonds, while strong economic growth can lead to rising interest rates, which can depress bond prices. Market volatility, driven by factors such as geopolitical events or changes in investor sentiment, can affect bond prices. During periods of high volatility, investors may sell riskier assets like corporate bonds and buy safer assets like government bonds, influencing their prices Corporate bonds are issued by companies. They carry credit risk, the risk that the company will default on its debt payments due to financial difficulties. They also carry market risk, as their prices can fluctuate with changes in market interest rates. Considered the safest type of bond, as the full faith and credit of the government back them. However, they are not immune to interest rate risk and inflation risk. If interest rates rise, the value of government bonds can decline. Similarly, rising inflation can erode the real return of these bonds. Municipal bonds are issued by local governments or municipalities. While they often have tax advantages, they can carry default risk if the municipality faces financial difficulties. They can also have liquidity risk, as it may be harder to find a buyer if you need to sell a municipal bond. High-yield bonds, also known as junk bonds, offer higher interest rates to compensate for their higher risk. They are typically issued by companies with lower credit ratings, which means they have a higher risk of default. International bonds are issued by foreign governments or corporations. They carry currency risk, as changes in exchange rates can affect the value of these bonds. They also have political risks, as changes in foreign government policies or political instability can impact the value of these bonds. Diversification is a key strategy to manage risk. By spreading your investments across different types of bonds, you can mitigate the risk of a single bond or type of bond performing poorly. A bond ladder is a strategy for investing in bonds with different maturity dates. This can help manage interest rate and reinvestment risk, as you'll have bonds maturing and the principal returning at regular intervals. Active management involves using a professional financial advisor or fund manager to manage your bond investments. They can help navigate the complex world of bonds, making adjustments in response to changing market conditions. Investing in bond funds or exchange-traded funds (ETFs) can be a good way to spread risk. These funds invest in a diversified portfolio of bonds, reducing the impact of any single bond's performance. Understanding how money is lost on bonds is a crucial aspect of risk management in bond investing. Though bonds are generally considered safer than stocks, they carry inherent risks such as changes in interest rates, issuer defaults, call and reinvestment risks, and inflation impact. Specific bond types pose unique risk profiles and understanding these is vital for diversified and balanced investing. Economic factors including central bank policies, inflation rates, and market volatility further influence these risks. Mitigation strategies like diversification, bond laddering, active management, and investing in bond funds or ETFs can help minimize potential losses. Regardless of these risks, bonds play an essential role in long-term investment planning due to their potential for providing stable returns and income. Overall, informed investment decisions are key to navigating the complex bond market and effectively managing the risk of losing money on bonds.How Is Money Lost on Bonds?

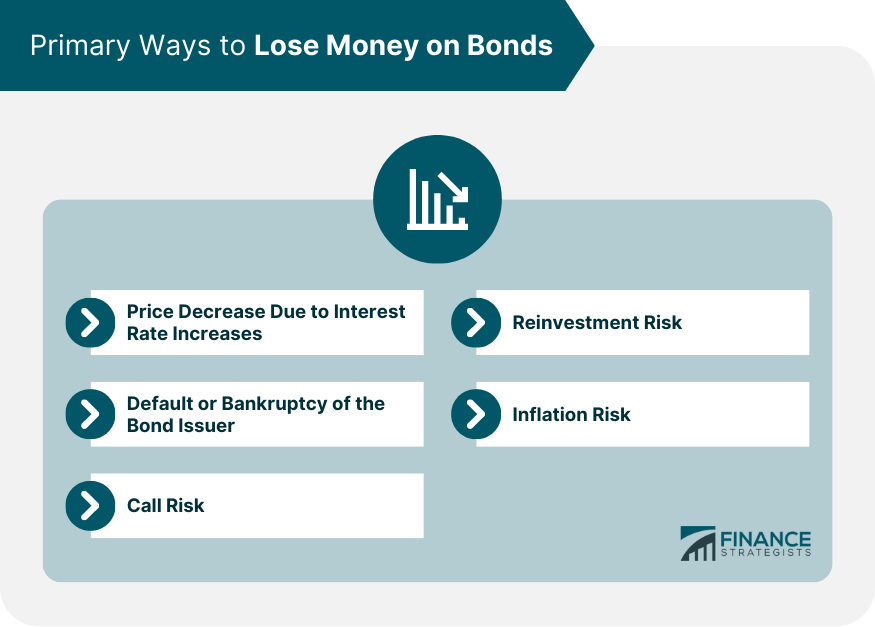

Primary Ways to Lose Money on Bonds

Price Decrease Due to Interest Rate Increases

Default or Bankruptcy of the Bond Issuer

Call Risk

Reinvestment Risk

Inflation Risk

Economic Factors That Impact Bonds

Role of Central Bank Policies and Interest Rates

Influence of Inflation and Economic Growth

Effect of Market Volatility on Bond Prices

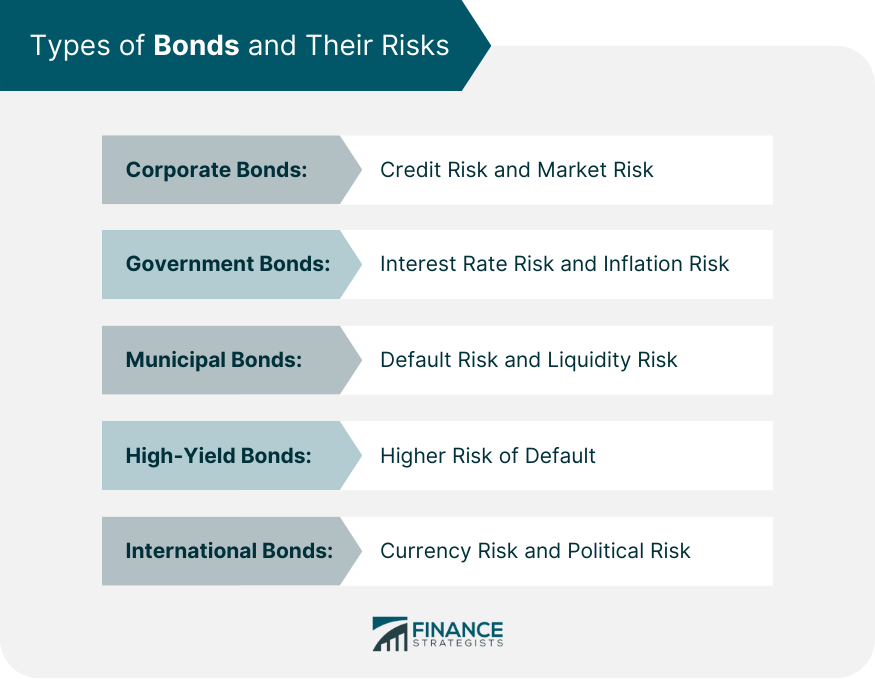

Types of Bonds and Their Risks

Corporate Bonds

Government Bonds

Municipal Bonds

High-Yield Bonds

International Bonds

Strategies to Minimize Risk

Diversification

Ladder Strategy

Active Management

Using Bond Funds or ETFs to Spread Risk

Conclusion

How to Lose Money on Bonds FAQs

The main ways to lose money on bonds include price decreases due to interest rate increases, default or bankruptcy of the bond issuer, call risk, reinvestment risk, and inflation risk. Each of these factors can potentially lead to a decrease in the value of your bond investment or a loss of your initial investment.

Understanding how to lose money on bonds can help you make more informed investment decisions. By knowing the risks associated with different types of bonds and the economic factors that can influence these risks, you can better manage your portfolio and potentially mitigate the likelihood of financial loss.

There are several strategies to minimize the potential of losing money on bonds. These include diversifying your investments across different types of bonds, using a bond ladder strategy, actively managing your investments with professional financial advice, and investing in bond funds or ETFs to spread risk.

Different types of bonds carry unique risk profiles. For example, corporate bonds carry credit and market risk, government bonds carry interest rate and inflation risk, and international bonds carry currency and political risk. Understanding these risks can help you manage the potential for losing money on your bond investments.

Several economic factors can influence the risks associated with bonds. Central bank policies and interest rates can directly affect bond prices. Inflation and economic growth can also impact the value of bonds. Finally, market volatility, driven by geopolitical events or changes in investor sentiment, can affect bond prices. Understanding these factors can help you manage your risk of losing money on bonds.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.