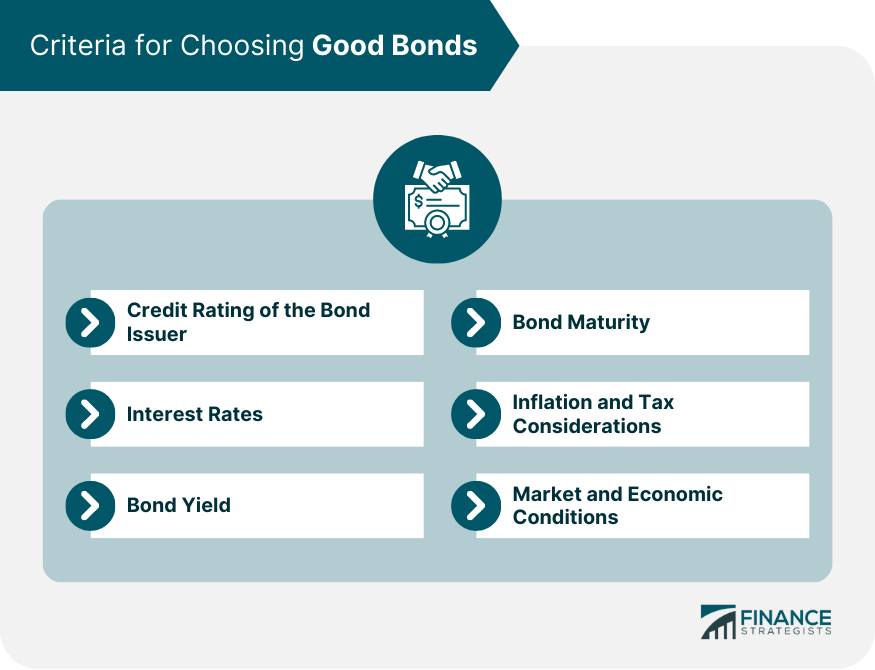

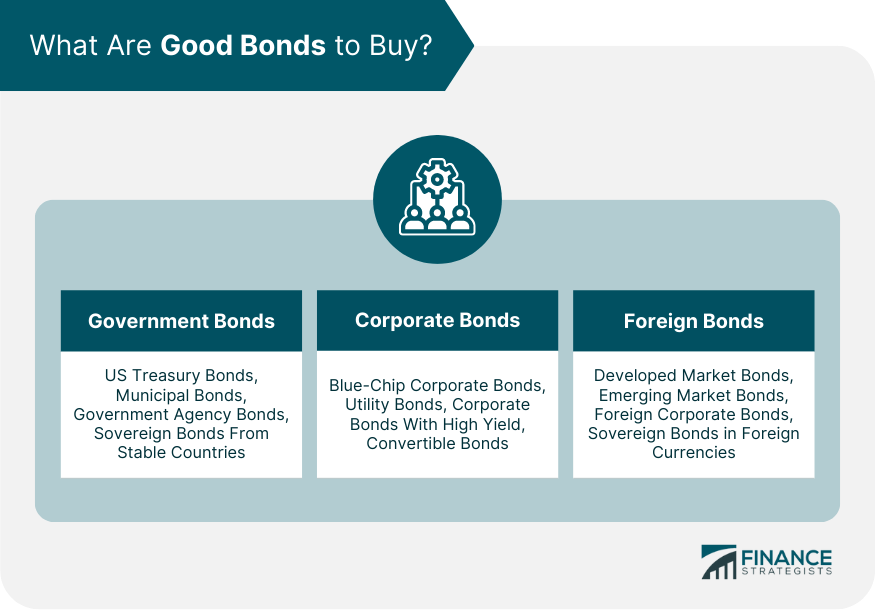

Bonds are considered advantageous or "good" for investors based on various factors like risk tolerance, investment horizon, and financial goals. Understanding this concept aims to aid investors in making informed decisions, as bonds form a crucial component of a well-balanced investment portfolio. Identifying good bonds to buy can significantly impact readers by enhancing their potential for steady income, capital preservation, and portfolio diversification. Evaluating good bonds to buy often involves thorough research into factors like the bond's yield, maturity, the issuer's credit rating, and overall market trends. The decision to buy bonds should be based on various factors, including the issuer's credit rating, interest rates, bond yield, bond maturity, inflation and tax considerations, and market and economic conditions. Credit ratings indicate the creditworthiness of the issuer and the likelihood that they will be able to pay back the bond's principal and interest. Bonds rated 'AAA' are considered the safest, while bonds with 'D' ratings are considered the riskiest. The interest rate environment can affect the value of bonds. When interest rates rise, bond prices usually fall and vice versa. The bond yield, or the return an investor realizes on a bond, is another crucial factor to consider. The yield should be compared across similar bonds to determine which provides the best return for a given level of risk. Maturity refers to the length of time until the bond issuer must repay the bond's principal. Bonds with longer maturities usually offer higher yields but are more sensitive to interest rate changes. Inflation can erode the purchasing power of the fixed-interest payments that bonds provide. Additionally, the impact of taxes should be considered, especially for investors in high tax brackets. The overall health of the economy can affect bond prices. In times of economic uncertainty, government bonds are often seen as safe havens, while corporate and foreign bonds might be more volatile. Choosing "good" government bonds largely depends on the investor's individual financial goals, risk tolerance, and investment horizon. However, some government bonds are generally considered to be solid investments due to their relative safety and stability. Treasury bonds are backed by the full faith and credit of the U.S. government, making them one of the safest investments. They offer fixed interest payments every six months until they mature, which is typically in 10, 20, or 30 years. These are issued by states, cities, and counties to finance public projects. They are generally considered safe, and the interest they generate is often tax-free at the state and local level, making them attractive to investors in high tax brackets. These bonds are issued by U.S. government-sponsored enterprises (GSEs) like Fannie Mae or Freddie Mac. While they're not technically backed by the U.S. government, they're considered to be very safe due to their connection to the government. Sovereign bonds issued by governments of stable countries like Canada, Germany, or Australia can also be a good choice. These bonds tend to have a lower yield than bonds issued by countries with higher economic risk but are generally considered to be safer investments. corporate bonds from financially stable companies with good credit ratings are generally considered to be good investments. Here are some examples: These are bonds issued by large, financially sound companies with a long history of stability, reliability, and strong performance. These companies often have a high credit rating, indicating a low risk of default. Bonds issued by utility companies can also be a good investment. These companies tend to have steady cash flows because of the constant demand for their services, regardless of the economic environment. Sometimes referred to as "junk bonds," these are bonds from companies with a lower credit rating. They offer a higher yield to compensate for the increased risk of default. While they do come with more risk, if done right, they can provide a significant boost to your investment income. These are corporate bonds that can be converted into a predetermined amount of the company's equity at certain times during its life, usually at the discretion of the bondholder. This provides the potential for capital appreciation if the company does well. Here are some categories of foreign bonds that may be considered good to buy depending on an investor's individual financial goals, risk tolerance, and investment horizon: Bonds issued by governments or corporations in developed markets, such as Japan, Germany, and Australia, can offer stability and reliable returns. These bonds may have lower yields compared to emerging market bonds, but they generally carry less risk. These bonds are issued by governments or corporations in emerging economies, such as India, Brazil, or South Africa. They tend to offer higher yields to compensate for the increased economic and political risks associated with these markets. Similar to domestic corporate bonds, foreign corporate bonds offer a higher yield than government bonds. However, these bonds carry both the risks of corporate bonds and the additional risks of investing internationally. Some foreign governments issue bonds in currencies other than their own, often in US dollars or euros. These can offer an additional level of diversification and may help mitigate currency risk. While bonds are often considered safer than stocks, they are not without risk. 1. Interest Rate Risk: Refers to the risk that a bond's price will decrease due to rising interest rates. Long-term bonds are more susceptible to this risk than short-term bonds. 2. Credit Risk: Refers to the risk that the bond issuer will default on their payment obligations. 3. Inflation Risk: This is the risk that the inflation rate will outpace and erode investment returns. 4.Liquidity Risk: This is the risk that you may not be able to sell your bond at a fair price. Diversification is a crucial strategy to manage risk in your bond portfolio. 1. Geographic Diversification: By investing in bonds from different countries, you can protect yourself against downturns in any single country's economy. 2. Sector Diversification: Investing in bonds from different sectors (e.g., government, corporate, municipal) can also help manage risk. Different sectors may respond differently to the same economic conditions. 3. Diversification by Maturity: Including bonds with different maturity dates can help manage interest rate risk. Generally, shorter-term bonds are less sensitive to interest rate changes than longer-term bonds. Investing wisely in bonds requires understanding the various types and their unique characteristics, including government, corporate, and foreign bonds. Crucial criteria when choosing good bonds to purchase encompass credit ratings, interest rates, bond yield, maturity, inflation, tax considerations, and market conditions. Diversification in bond investments is pivotal, offering a balanced approach by investing in a mix of bonds from different countries, sectors, and maturities. Despite their relative safety compared to stocks, bonds do carry risks like interest rate risk, credit risk, inflation risk, and liquidity risk. An investor's financial goals, risk tolerance, and investment horizon are key considerations when identifying good bonds to buy. Ultimately, bonds can play a crucial role in providing steady income, capital preservation, and portfolio diversification, contributing significantly to long-term financial health. Remember to consult a financial advisor before making any investment decisions.What Are Good Bonds to Buy?

Criteria for Choosing Good Bonds

Credit Rating of the Bond Issuer

Interest Rates

Bond Yield

Bond Maturity

Inflation and Tax Considerations

Market and Economic Conditions

Good Government Bonds to Buy

US Treasury Bonds

Municipal Bonds

Government Agency Bonds

Sovereign Bonds From Stable Countries

Good Corporate Bonds to Buy

Blue-Chip Corporate Bonds

Utility Bonds

Corporate Bonds With High Yield

Convertible Bonds

Good Foreign Bonds to Buy

Developed Market Bonds

Emerging Market Bonds

Foreign Corporate Bonds

Sovereign Bonds in Foreign Currencies

Risks Associated With Buying Bonds

Importance of Diversification in Bond Investments

Conclusion

Good Bonds to Buy FAQs

Some good government bonds to buy include U.S. Treasury Bonds, Municipal Bonds, Government Agency Bonds, and Sovereign Bonds from stable countries. These are considered safe due to the credibility of the issuer and their relative stability in the market.

When choosing good corporate bonds to buy, consider companies with high credit ratings and stable financial performance, like blue-chip corporate bonds. Other options include bonds from utility companies, high yield corporate bonds, or convertible bonds, depending on your risk tolerance and investment goals.

Good foreign bonds to buy can come from both developed and emerging markets. Developed market bonds, like those from Japan or Germany, are usually stable. Bonds from emerging markets, such as India or Brazil, offer higher yields but come with higher risk. Sovereign bonds in foreign currencies also provide an additional layer of diversification.

Despite being considered safer than stocks, buying bonds involves risks such as interest rate risk (the risk that a bond's price will decrease due to rising interest rates), credit risk (the risk of the issuer defaulting), inflation risk (the risk that inflation will erode returns), and liquidity risk (the risk that you may not be able to sell the bond at a fair price).

Diversification in bond investments is crucial to manage risk. This involves spreading your investments across different countries (geographic diversification), different sectors such as government, corporate, and municipal (sector diversification), and bonds with different maturity dates (diversification by maturity). This strategy can protect against downturns in any single economy, sector, or interest rate environment.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.