The annual gift tax exclusion is a provision in the United States tax code that allows individuals to give a certain amount of money or assets to others each year without incurring gift tax liability. This exclusion encourages financial generosity and helps minimize the tax consequences of transferring wealth between family members or friends. For 2024, the gift tax exclusion is set at $18,000 per individual. The purpose of the annual gift tax exclusion is to prevent the excessive taxation of wealth transfers, promote economic activity, and allow for a more efficient transfer of assets between generations. This exclusion helps to ensure that smaller gifts, which are more likely to be made for personal reasons rather than tax avoidance, are not subject to unnecessary taxation. The Internal Revenue Service (IRS) is responsible for administering and enforcing federal tax laws, including the gift tax. The gift tax is imposed on the transfer of property or assets by one individual to another without receiving something of equal value in return. The annual gift tax exclusion is an important aspect of these regulations, as it dictates the amount of gifts that can be given tax-free each year.

I'm Taylor Kovar, a Certified Financial Planner (CFP), specializing in helping business owners with strategic financial planning. Maximize the Annual Gift Tax Exclusion by gifting up to $18,000 to as many individuals as you wish each year, without triggering a gift tax. For couples, this amount doubles to $36,000 per recipient. Utilize this strategy to reduce your taxable estate and pass wealth to your heirs tax-free. Consider making gifts early in the year to benefit from potential growth. Let's optimize your financial legacy together. Contact me at (936) 899 - 5629 or [email protected] to discuss how we can achieve your financial objectives. WHY WE RECOMMEND: IDEAL CLIENTS: Business Owners, Executives & Medical Professionals FOCUS: Strategic Planning, Alternative Investments, Stock Options & Wealth Preservation The modern gift tax in the United States was first introduced in 1932 as part of the Revenue Act. It was implemented to prevent wealthy individuals from avoiding estate taxes by transferring their assets as gifts during their lifetime. Over time, the gift tax has evolved, and the annual gift tax exclusion was introduced to provide relief for smaller, non-tax-motivated gifts. Since its inception, the annual gift tax exclusion amount has increased periodically to account for inflation and changes in economic conditions. For example, in 1982, the annual exclusion was $10,000, which increased to $17,000 by 2023. It is $18,000 in 2024. The IRS adjusts the exclusion amount for inflation in certain years, ensuring that the exclusion remains relevant and practical. Several important changes have been made to gift tax legislation over the years, including the introduction of the lifetime exemption, which allows individuals to transfer a certain amount of wealth tax-free during their lifetime, in addition to the annual gift tax exclusion. The Tax Cuts and Jobs Act of 2017 also significantly increased the lifetime exemption amount, further impacting gift tax planning strategies. The annual gift tax exclusion covers various types of gifts, including cash, property, stocks, and other assets. Gifts can be made outright or placed in certain types of trusts, depending on the donor's preferences and estate planning objectives. Both the donor and the recipient must meet specific requirements to qualify for the annual gift tax exclusion. The donor must be a U.S. citizen or resident, and the recipient can be any individual, including family members, friends, or even strangers. Gifts to organizations, such as charities, may qualify for a separate charitable deduction rather than the annual exclusion. There are some limitations and exclusions to the annual gift tax exclusion. For instance, gifts above the annual exclusion amount may be subject to gift tax, although the donor can also use their lifetime exemption to offset any additional tax liability. Moreover, certain types of gifts, such as those made for tuition or medical expenses, may be excluded from gift tax if paid directly to the provider. To determine the value of a gift for tax purposes, donors should use the fair market value of the asset at the time of the transfer. For assets like stocks or real estate, this may require obtaining a professional appraisal or referencing the current market prices. Once the value of a gift is determined, the donor can apply the annual exclusion amount to determine if the gift is tax-free. If the value of a gift is equal to or less than the annual exclusion amount, it is not subject to gift tax. However, if the value exceeds the exclusion amount, the donor must report the gift and may be liable for gift tax. The IRS periodically adjusts the annual gift tax exclusion amount for inflation, ensuring that the exclusion remains relevant and practical. These adjustments can affect the amount of tax-free gifts that individuals can make each year, and donors should stay informed about any changes to the exclusion amount to optimize their tax planning strategies. If a donor gives a gift that exceeds the annual exclusion amount and does not qualify for any additional exclusions, they may be liable for gift tax. However, the donor can utilize their lifetime exemption to offset the tax liability. It is important to note that using the lifetime exemption can reduce the amount available for estate tax purposes. In most cases, recipients do not owe tax on gifts they receive. However, recipients may be liable for income tax if they receive gifts that generate income, such as dividends or rental income. Donors who make gifts that exceed the annual exclusion amount must file a gift tax return (Form 709) with the IRS. This requirement applies even if no gift tax is owed due to the use of the lifetime exemption. Both donors and recipients should maintain thorough records of gifts received and given, including documentation of the gift's fair market value, any professional appraisals, and copies of gift tax returns. This information may be necessary for future tax filings or estate planning purposes. Donors can optimize their use of the annual gift tax exclusion by carefully planning the timing of their gifts. For example, making gifts at the beginning of the calendar year can allow donors to take advantage of the exclusion for both the current and following years. Married couples can split gifts, effectively doubling the annual exclusion amount for gifts made to the same recipient. This strategy allows couples to transfer more wealth tax-free and can be particularly beneficial for large gifts or transfers made for estate planning purposes. Donors can use their lifetime exemption to offset gift tax liability for gifts that exceed the annual exclusion amount. By strategically combining the annual exclusion and lifetime exemption, donors can minimize their tax liability and maximize the transfer of wealth to their beneficiaries. Gifts made to qualified charitable organizations are generally exempt from gift tax and can be deducted from the donor's income tax. Donors can leverage charitable giving to reduce their tax liability while also supporting causes they care about. Utilizing the annual gift tax exclusion can help donors reduce the size of their taxable estate, thereby minimizing potential estate tax liability. By making regular tax-free gifts, donors can transfer wealth to their beneficiaries during their lifetime and potentially avoid estate tax consequences. Certain types of trusts, such as Crummey trusts or 529 plans, can be used in conjunction with the annual gift tax exclusion to facilitate tax-efficient wealth transfers. These trusts allow donors to maintain some control over the gifted assets while also providing tax benefits. The generation-skipping transfer (GST) tax is an additional tax imposed on certain transfers made to beneficiaries who are two or more generations younger than the donor, such as grandchildren. The annual gift tax exclusion and the GST tax exemption can be used in tandem to minimize the tax consequences of these transfers and facilitate the efficient transfer of wealth across generations. Some taxpayers may be confused about the annual exclusion amount and mistakenly believe that they can give unlimited gifts tax-free. It is essential for donors to understand the current annual exclusion amount and how it applies to their gifting strategy. Donors who make gifts that exceed the annual exclusion amount must file a gift tax return with the IRS, even if no gift tax is owed. Failure to file the required forms can result in penalties and potential tax consequences. Some donors may not be aware of the lifetime exemption or may not fully understand its benefits. The lifetime exemption can be a valuable tool for minimizing gift tax liability and maximizing the transfer of wealth to beneficiaries. Various legislative proposals may impact the annual gift tax exclusion, such as changes to the exclusion amount, the introduction of new tax rates, or adjustments to the lifetime exemption. Donors should stay informed about potential changes to tax laws and adjust their gifting strategies accordingly. Economic factors, such as inflation, can influence the annual gift tax exclusion amount. As the IRS periodically adjusts the exclusion amount for inflation, donors should be aware of any changes and adjust their gifting strategies accordingly. Changes to gift tax laws and the annual exclusion amount can have significant implications for estate planning and wealth transfer strategies. Donors should consult with a financial advisor or estate planning attorney to ensure that their plans remain tax-efficient and in line with their goals. Understanding the annual gift tax exclusion is crucial for individuals who want to make tax-efficient gifts to their loved ones or plan for the transfer of wealth. By staying informed about the exclusion amount and applicable tax laws, donors can maximize the benefits of their gifting strategies. The annual gift tax exclusion can be an essential tool in financial and estate planning, allowing individuals to transfer wealth tax-free and potentially avoid estate tax liability. By utilizing the exclusion strategically, donors can ensure that their wealth is preserved and passed on to future generations. Tax laws are subject to change, and it is essential for donors to stay informed about potential changes that could impact their gifting strategies. By staying up-to-date on tax laws and working with financial professionals, donors can optimize their gifting strategies and navigate the complex world of gift tax regulations.What Is the Annual Gift Tax Exclusion?

Hear It From Taylor

Fee-Only Financial Advisor

Certified Financial Planner™

3x Investopedia Top 100 Advisor

Author of The 5 Money Personalities & Keynote Speaker

History of the Annual Gift Tax Exclusion

Origin of Gift Tax in the United States

Evolution of the Annual Gift Tax Exclusion Amount

Notable Changes in Gift Tax Legislation

Eligibility for the Annual Gift Tax Exclusion

Types of Gifts Covered

Donor and Recipient Requirements

Limitations and Exclusions

Calculating the Annual Gift Tax Exclusion

Determining the Gift Value

Applying the Annual Exclusion Amount

Impact of Inflation Adjustments

Tax Consequences and Reporting Requirements

Donor Tax Liability

Recipient Tax Liability

Reporting Gifts on Tax Forms

Recordkeeping for Gift Tax Purposes

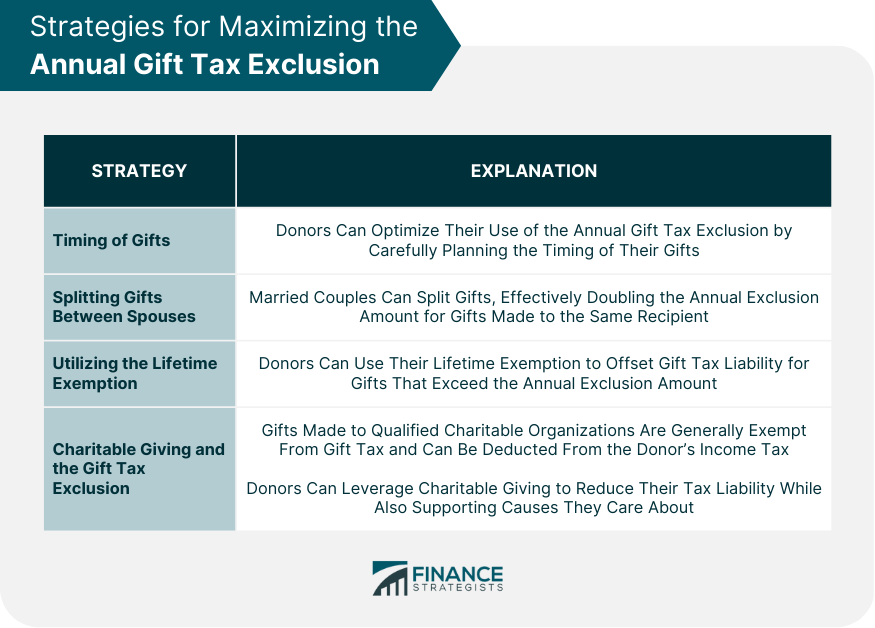

Strategies for Maximizing the Annual Gift Tax Exclusion

Timing of Gifts

Splitting Gifts Between Spouses

Utilizing the Lifetime Exemption

Charitable Giving and the Gift Tax Exclusion

Annual Gift Tax Exclusion and Estate Planning

Reducing Taxable Estate Size

Trusts and the Annual Gift Tax Exclusion

Generation-Skipping Transfer Tax Considerations

Common Misconceptions and Pitfalls

Misunderstanding the Annual Exclusion Amount

Failing to Report Gifts When Required

Overlooking the Lifetime Exemption

Future Outlook and Potential Changes

Legislative Proposals Affecting the Annual Gift Tax Exclusion

Impact of Economic Factors on Exclusion Amounts

Potential Implications for Estate Planning and Wealth Transfer

Conclusion

Annual Gift Tax Exclusion FAQs

The annual gift tax exclusion is the amount of money that an individual can give to another person each year without incurring any gift tax. In 2024, the annual gift tax exclusion is $18,000 per recipient.

Anyone can take advantage of the annual gift tax exclusion, whether they are an individual or a couple. The exclusion applies to each recipient, so if you give a gift to more than one person, you can use the exclusion for each recipient.

Yes, there is a limit to how much money you can give away tax-free using the annual gift tax exclusion. In 2024, the limit is $18,000 per recipient. If you give more than this amount to a single recipient, you may be subject to gift tax.

No, you do not have to report gifts given using the annual gift tax exclusion on your tax return. However, if you give a gift that exceeds the annual exclusion amount, you will need to file a gift tax return.

Yes, you can use the annual gift tax exclusion to reduce your estate tax liability. Gifts made using the exclusion are not subject to gift tax or estate tax, which can help you reduce the value of your estate and lower your estate tax liability.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.