Coverdell Education Savings Accounts (ESAs) are tax-advantaged investment accounts designed to help families save for future educational expenses. Established under the U.S. Internal Revenue Code, these accounts provide a tax-efficient way to save and invest for a child's education, including both K-12 and postsecondary expenses. The primary purpose of Coverdell ESAs is to encourage families to save for educational expenses, thereby reducing reliance on student loans and other forms of debt. The main benefits of ESAs include tax-deferred investment growth and tax-free withdrawals for qualified education expenses. To establish a Coverdell ESA, the account owner must meet certain eligibility requirements, including being a U.S. citizen or resident alien. Additionally, the beneficiary of the ESA must be under the age of 18 or have special needs. Coverdell ESAs can be opened at a variety of financial institutions, such as brokerage firms, banks, and credit unions. The account owner must complete an ESA application and provide the required personal information for both the account owner and the designated beneficiary. When establishing a Coverdell ESA, the account owner must designate a beneficiary who will be the recipient of the account's funds for educational purposes. The beneficiary can be a child, grandchild, or other relative, as long as they meet the age and eligibility requirements. Coverdell ESAs have an annual contribution limit of $2,000 per beneficiary, regardless of the number of accounts opened for the beneficiary. Contributions can be made by parents, grandparents, other family members, or even friends, as long as the total contributions do not exceed the annual limit. Income restrictions apply to individuals who contribute to a Coverdell ESA. The ability to contribute is phased out for individuals with modified adjusted gross incomes (MAGIs) between $95,000 and $110,000 and for married couples filing jointly with MAGIs between $190,000 and $220,000. Contributions to a Coverdell ESA can be made until the beneficiary reaches the age of 18, with exceptions for special needs beneficiaries. Funds in the account must be used for qualified education expenses by the time the beneficiary turns 30, unless they have special needs. Coverdell ESA funds can be rolled over to another Coverdell ESA for a qualifying family member without tax consequences, provided the rollover is completed within 60 days of the distribution. Coverdell ESAs offer a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). Account owners can choose the investments that best align with their risk tolerance, investment horizon, and financial goals. The account owner is responsible for managing the investments within the Coverdell ESA, including selecting and monitoring the investments and adjusting the portfolio as needed. Many financial institutions offer tools and resources to help account owners manage their investments effectively. As with any investment account, the risks and rewards of the investments within a Coverdell ESA depend on the specific investments chosen. Account owners should carefully consider their investment choices and be prepared to accept the potential risks and rewards associated with those choices. Investments in a Coverdell ESA grow tax-deferred, meaning that any interest, dividends, or capital gains generated within the account are not subject to taxes while the funds remain in the account. This tax-deferred growth can help the account owner build a larger education fund over time. Withdrawals from a Coverdell ESA for qualified education expenses are tax-free, meaning that the account owner will not have to pay taxes on the earnings when the funds are used for eligible expenses. This tax benefit can significantly reduce the overall cost of education for the beneficiary. Contributions to a Coverdell ESA must be made by the tax filing deadline (typically April 15) for the tax year in which the contribution is being made. The account owner is responsible for reporting contributions on their tax return, but contributions are not tax-deductible. Coverdell ESAs can be used to pay for a wide range of K-12 educational expenses, including tuition and fees, books, supplies, uniforms, and even computer equipment and software. In addition to K-12 expenses, Coverdell ESA funds can also be used for qualified higher education expenses, such as tuition, fees, books, supplies, and room and board for students enrolled at least half-time. For beneficiaries with special needs, Coverdell ESA funds can be used to pay for expenses related to their unique educational requirements, including specialized tutoring, therapy, and transportation costs. If funds are withdrawn from a Coverdell ESA for non-qualified expenses, the earnings portion of the withdrawal will be subject to income tax and a 10% penalty. The account owner is responsible for determining whether a withdrawal is for qualified or non-qualified expenses. The account owner may change the beneficiary of a Coverdell ESA to another qualifying family member without tax consequences. Additionally, funds can be rolled over to another Coverdell ESA for a qualifying family member, as long as the rollover is completed within 60 days of the distribution. In the event of the beneficiary's death or disability, the funds in the Coverdell ESA can be distributed to the beneficiary's estate or used to pay for the beneficiary's disability expenses without incurring the 10% penalty. While both Coverdell ESAs and 529 plans offer tax advantages for education savings, there are key differences between the two, such as the annual contribution limits, income restrictions, and eligible expenses. Coverdell ESAs offer more flexibility in investment options and can be used for K-12 expenses, while 529 plans typically have higher contribution limits and no income restrictions. Uniform Gift to Minors Act (UGMA) and Uniform Transfers to Minors Act (UTMA) accounts are custodial accounts that can be used for any purpose, including education. However, unlike Coverdell ESAs, these accounts do not offer tax-free withdrawals for education expenses, and the assets in the account become the property of the beneficiary once they reach the age of majority. Coverdell ESAs offer significant tax advantages compared to traditional savings accounts, including tax-deferred growth and tax-free withdrawals for qualified education expenses. Additionally, ESAs provide more investment options than traditional savings accounts, allowing for potentially higher returns over time. Given the rising costs of education, it is essential for families to plan and save for their children's future educational expenses. Coverdell ESAs are one of the many tools available to help families achieve their education savings goals in a tax-efficient manner. While Coverdell ESAs offer several advantages, such as tax-free withdrawals for qualified education expenses and flexibility in investment options, there are also drawbacks to consider, including annual contribution limits, income restrictions, and age limits for beneficiaries. It is important for families to carefully evaluate the benefits and drawbacks of Coverdell ESAs to determine if they are the best fit for their education savings strategy. A comprehensive education savings strategy may involve using a combination of savings tools, such as Coverdell ESAs, 529 plans, UGMA/UTMA accounts, and traditional savings accounts. By carefully considering the unique features and benefits of each option, families can create a tailored education savings plan that meets their specific needs and goals.What Are Coverdell Education Savings Accounts (ESAs)?

Establishing a Coverdell ESA

Eligibility Requirements

Opening an ESA

Designating a Beneficiary

Contribution Rules and Limits

Annual Contribution Limits

Income Restrictions

Age Limits for Beneficiaries

Rollover Provisions

Investment Options

Types of Investments

Managing the ESA Investments

Risks and Rewards of Different Investment Choices

Tax Advantages

Tax-Deferred Growth

Tax-Free Withdrawals for Qualified Education Expenses

Contribution Deadlines and Tax Reporting

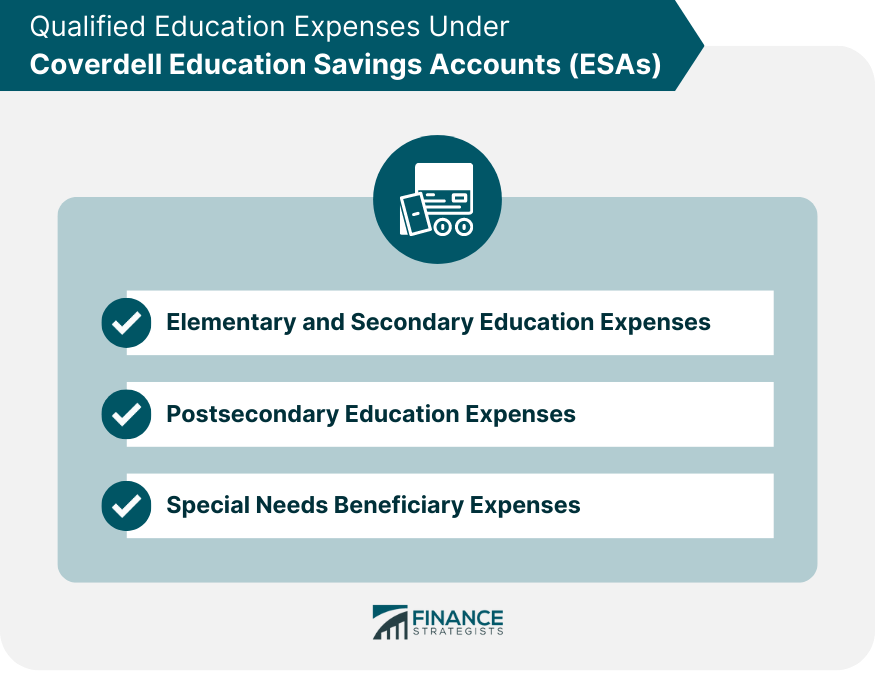

Qualified Education Expenses Under Coverdell ESAs

Elementary and Secondary Education Expenses

Postsecondary Education Expenses

Special Needs Beneficiary Expenses

Withdrawals and Penalties

Non-qualified Withdrawal Penalties

Change of Beneficiary and Rollovers

Withdrawal Rules Upon Beneficiary's Death or Disability

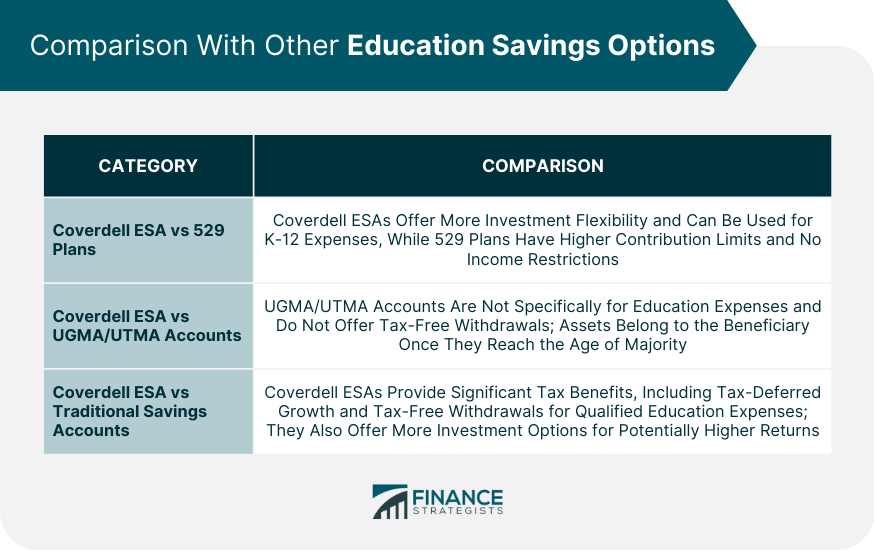

Comparison With Other Education Savings Options

Coverdell ESA vs 529 Plans

Coverdell ESA vs UGMA/UTMA Accounts

Coverdell ESA vs Traditional Savings Accounts

Conclusion

Coverdell Education Savings Accounts (ESAs) FAQs

A Coverdell Education Savings Account (ESA) is a tax-advantaged investment account that allows parents or guardians to save for a child's education expenses, including tuition, books, and supplies.

The main benefits of a Coverdell ESA are tax-free growth and withdrawals for qualified education expenses, flexibility in investment options, and the ability to use funds for K-12 expenses in addition to higher education expenses.

Anyone can contribute to a Coverdell ESA, including parents, grandparents, other relatives, and friends, as long as their income falls within certain limits.

The contribution limit for a Coverdell ESA is $2,000 per year per child, and contributions must be made before the beneficiary reaches age 18. Contributions are subject to income limits, with reduced contribution limits for single filers with modified adjusted gross incomes (MAGIs) above $95,000 and joint filers with MAGIs above $190,000.

Unused funds in a Coverdell ESA can be rolled over to another family member's Coverdell ESA or 529 plan without penalty, or can be withdrawn and used for non-qualified expenses, subject to taxes and penalties.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.