Retirement income ladders are financial planning strategies designed to provide retirees with a stable and sustainable income throughout their retirement years. By combining multiple income sources and staggering the maturity of investments, retirement income ladders aim to mitigate various risks associated with retirement income, such as market fluctuations and inflation. Social security benefits form a crucial component of most retirees' income ladders. These benefits are paid by the government and depend on factors such as earnings history, age, and the year of retirement. It is essential to consider the timing and amount of social security benefits when constructing a retirement income ladder. Pensions and annuities are additional sources of income that can help retirees meet their financial needs. Pensions are typically provided by employers, while annuities are purchased from insurance companies. Both pensions and annuities can be tailored to provide a steady income for life or a specified period. Investment income can help supplement other sources of retirement income. Common investment vehicles include: Various tax-advantaged retirement accounts can help individuals save and invest for retirement. These accounts include: The first step in building a retirement income ladder is to assess your financial needs during retirement. This includes estimating your living expenses, healthcare costs, and any other financial obligations. Next, identify all available sources of income, including social security benefits, pensions, annuities, and investment income from various assets. Diversifying income sources can help mitigate risks associated with retirement income. A diverse retirement income ladder may include a mix of social security benefits, pensions, annuities, and investment income from various assets. Establish a withdrawal strategy that takes into account the sequence of returns risk, safe withdrawal rates, and adjustments for inflation. This strategy will help ensure that your retirement income ladder remains sustainable over time. Retirement income ladders are investment strategies designed to provide a steady and reliable stream of income during retirement. These strategies involve investing in a diversified portfolio of bonds with varying maturities. As each bond matures, the principal is reinvested in a new bond with a longer maturity, creating a “ladder” of bonds with varying maturities. This approach helps to mitigate interest rate risk and provides a stable source of income over time. Bond ladders involve investing in a diversified portfolio of bonds with varying maturities. The ladder typically consists of bonds with maturities ranging from one to ten years. As each bond matures, the principal is reinvested in a new bond with a longer maturity. This approach helps to mitigate interest rate risk because as interest rates rise, bonds with shorter maturities can be reinvested at higher rates. Additionally, because the ladder consists of bonds with varying maturities, it provides a steady stream of income over time. Dividend ladders involve investing in a diversified portfolio of dividend-paying stocks with varying yields. The ladder typically consists of stocks with yields ranging from one to five percent. As each stock pays a dividend, the income is reinvested in a new stock with a higher yield. This approach helps to provide a steady stream of income over time and can potentially offer capital appreciation. Additionally, because the ladder consists of stocks with varying yields, it helps to mitigate market risk. Both types of retirement income ladders offer advantages and disadvantages depending on an individual's financial goals and risk tolerance. As with any investment strategy, it is important to carefully consider the risks and potential rewards before investing. It is essential to monitor the performance of your investments and retirement income ladder periodically to ensure they continue to meet your financial objectives. Rebalance your investment portfolio as needed to maintain your desired asset allocation and risk tolerance. Be prepared to adapt your retirement income ladder to changes in your personal circumstances, such as unexpected expenses or changes in your health. Regularly update your retirement income ladder to account for longevity and inflation. This may involve adjusting withdrawal rates, rebalancing investments, or purchasing additional annuities. Retirement income ladders are financial planning strategies that can provide retirees with a stable and sustainable income throughout their retirement years. By combining multiple income sources and staggering the maturity of investments, these strategies aim to mitigate various risks associated with retirement income, such as market fluctuations and inflation. The components of retirement income ladders include social security benefits, pensions, annuities, investment income, and retirement accounts. Building a retirement income ladder involves assessing financial needs, identifying available sources of income, diversifying income sources, and establishing a withdrawal strategy. Common retirement income ladders include bond ladders and dividend ladders, each with their advantages and disadvantages. Strategies for maintaining and adjusting retirement income ladders include monitoring investment performance, rebalancing investment portfolios, adapting to changes in personal circumstances, and updating retirement income ladders for longevity and inflation. It is important to carefully consider the risks and potential rewards of retirement income ladders before investing and to periodically review and adjust them to meet changing circumstances. Financial advisors can play a vital role in creating and managing retirement income ladders, highlighting the importance of proactive retirement planning for long-term financial success.What Are Retirement Income Ladders?

Components of Retirement Income Ladders

Social Security Benefits

Pensions and Annuities

Investment Income

Retirement Accounts

Building a Retirement Income Ladder

Assessing Financial Needs in Retirement

Identifying Available Sources of Income

Diversifying Income Sources

Establishing a Withdrawal Strategy

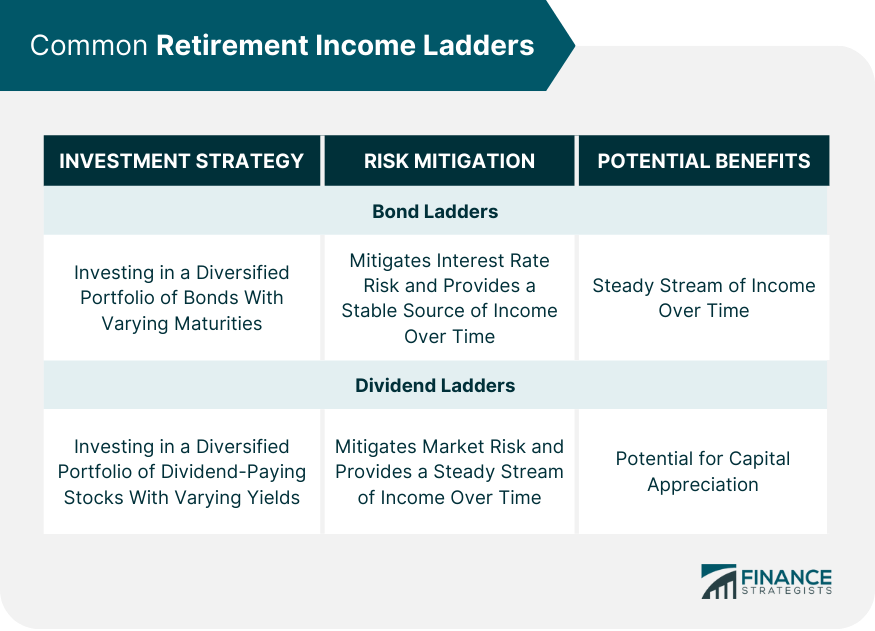

Common Retirement Income Ladders

Bond Ladders

Dividend Ladders

Strategies for Maintaining and Adjusting Retirement Income Ladders

Monitoring Investment Performance

Rebalancing Investment Portfolios

Adapting to Changes in Personal Circumstances

Updating Retirement Income Ladders for Longevity and Inflation

Conclusion

Retirement Income Ladders FAQs

Retirement income ladders are financial planning strategies designed to provide a stable and sustainable income for retirees by combining multiple income sources and staggering the maturity of investments. They are important because they help mitigate risks associated with retirement income, such as market fluctuations and inflation, ensuring financial security throughout retirement.

The key components of retirement income ladders include social security benefits, pensions and annuities, investment income from various assets (e.g., stocks, bonds, mutual funds, ETFs, REITs), and tax-advantaged retirement accounts (e.g., Traditional IRA, Roth IRA, 401(k), 403(b), SEP IRA, SIMPLE IRA)

Bond and dividend ladders can be incorporated into retirement income ladders by investing in a diversified portfolio of bonds or dividend-paying stocks with varying maturities or yields. As each bond or stock matures or pays a dividend, the income is reinvested in a new bond or stock with a longer maturity or higher yield, creating a steady and reliable stream of income during retirement.

Retirees should monitor their investment performance, rebalance their investment portfolios, adapt their retirement income ladders to changes in personal circumstances, and update their ladders for longevity and inflation. Regular evaluation and adjustments help ensure that their retirement income ladder continues to meet their financial needs and risk tolerance.

Yes, financial advisors can play a crucial role in helping individuals create and manage their retirement income ladders. They can provide guidance on income sources, investment strategies, risk management, and tax-efficient withdrawal strategies, ensuring that retirees achieve their long-term financial goals.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.