The Simplified Employee Pension (SEP) plan enables small businesses to set up IRA accounts for all their employees with equal employer contributions. SEP plans offer flexibility to employers because they can vary their contributions for a given year to the account based on the state of their business. For example, they can increase or decrease contributions to the account depending on revenue. They can also choose to not make any contributions to the SEP IRA, when business is bad. SEP IRAs are best suited for freelancers and self-employed individuals because their income levels can vary depending on the market for their services. The main advantage of SEP plans is their flexible contribution structure. They also offer the same tax benefits as traditional IRAs and have contribution limits that can be as much as ten times of regular IRAs. The disadvantage of SEP IRAs is that they are not suited for growing businesses. As the business grows, it may be difficult for employers to make equal contributions to all employee accounts. SEP plans also do not have catch-up contributions for those 50 years or older.

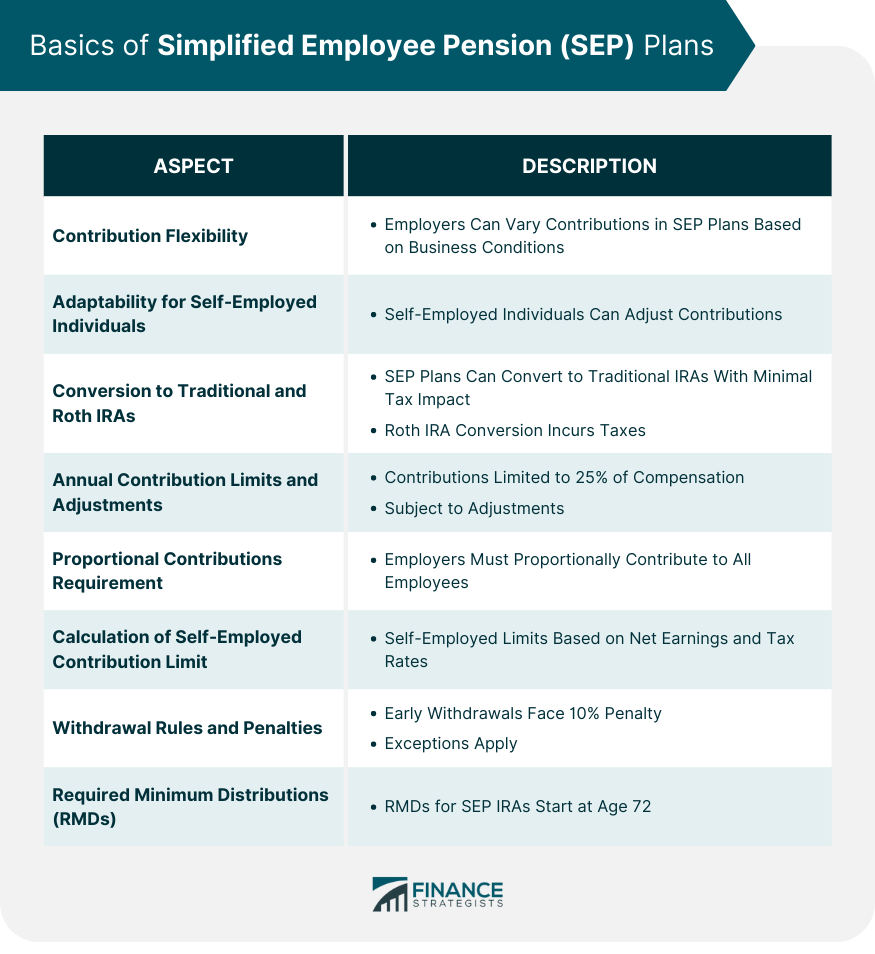

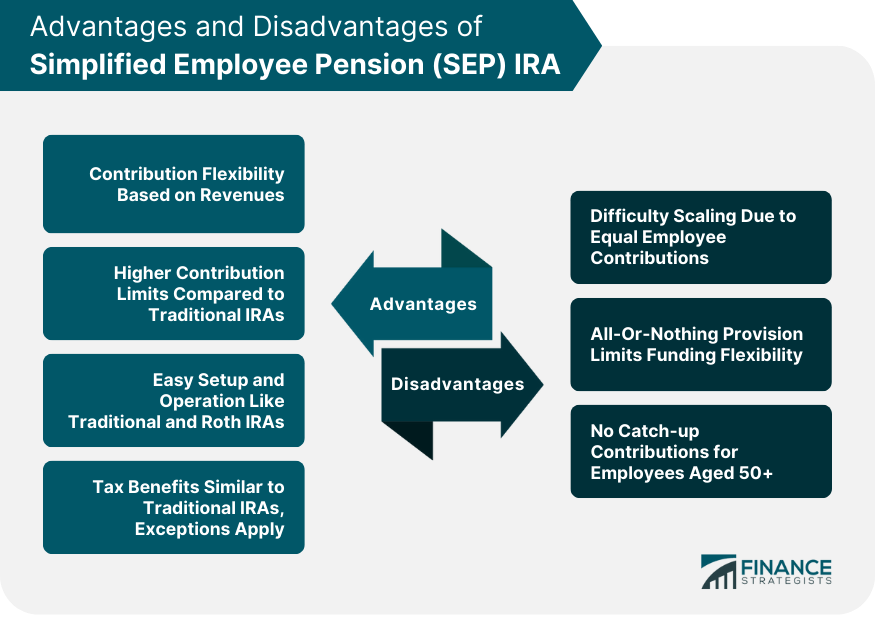

SEP Plans are different from traditional IRAs because they allow employers to make varying contributions instead of a set pre-determined amount. This can be a useful strategy for small businesses that provide services whose market has not yet matured. Self-employed individuals can also categorize themselves as employees of their sole proprietorships and change annual contributions depending on fluctuations to their income. SEP plans can be converted to traditional IRAs without significant tax implications. However, conversion of SEP plans into Roth IRAs incurs taxes because the latter uses after tax income for contributions and the former type of IRA is funded with pre-tax dollars. Annual employer contributions in a SEP plan are limited annually to the lesser of 25% of compensation, or $69,000 for 2024 and subject to annual cost-of-living adjustments for later years). The catch with SEP plan contributions is that employers must make proportional amount contributions to all employees. Thus, the contribution amounts can sum up to a tidy package in a SEP IRA. The contribution limit for self-employed individuals is calculated using a different formula. First, you need to calculate the adjusted net earnings for your business. This is the sole proprietorship’s net profit minus half of the calculated self-employment tax rate for that year. Multiply the adjusted net earnings with 25% i.e., the maximum allowable limit for an employee contribution in SEP IRA, to calculate the maximum contribution limit. In spite of their differences, SEP plans function much like traditional IRAs. Withdrawals from SEP IRAs follow the standard rules. Therefore, withdrawing funds from a SEP IRA account before the age of 59.5 years incurs 10% penalty plus regular taxation rates. The early withdrawal penalty does not apply in the following instances: First-time home purchase (up to $10,000) Birth or adoption of a child (up to $5,000) Qualified higher education expenses Qualified medical expenses Health insurance premiums when unemployed Substantially equal payments Withdrawals by a beneficiary, after the account holder has died Required Minimum Distributions (RMD) for SEP IRAs begin at the age of 72. The process to create a SEP plan is fairly easy. Small businesses need to draw up an agreement and distribute it to their employees. A good template to use is the Form 5305-SEP from the IRS website. The form documents SEP IRA eligibility criteria for the business’s employees and establishes the employer’s contribution percentage for the account. It also serves as notifications to employees about the account. If you already have a 401(k) or use contractors or want to use a different allocation structure with Social Security allowances factored in, then you will have to draw up a custom agreement. Employees who are 21 and older and have worked or rendered services in, at least, three of the last five years and earned, at least, $600 in income from your business are eligible for SEP plans. The next step is to choose a financial institution that will serve as trustee of the SIMPLE IRA accounts and manage the account. Banks, Savings and Loan institutions, federally-insured credit unions, and brokerages are all examples of financial institutions that are approved for this task. Each employee in your business should have a separate IRA account with the institution. The advantages of SEP plans are as follows: SEP plans can be changed based on revenues. As detailed earlier, employer contributions to SEP plans can be changed based on the current state of business. SEP plans have higher contribution limits as compared to traditional IRAs enabling small business owners and self-employed professionals to save more of their pre-tax income. Much like traditional and Roth IRAs, SEP plans are easy to setup and operate. SEP plans offer tax benefits. For the most part, these tax benefits are the same as those of traditional IRAs. The disadvantages of SEP IRAs are as follows: It is difficult to scale SEP IRAs because employers are required to make equal contributions to all employee accounts. SEP plans have an all-or-nothing provision that makes it difficult to fund the account, even if a single employee refuses to the plan. The employer will not be able to set up SEP plans for other employees, in such instances. SEP plans do not allow persons aged 50 or over to make catch-up contributions to increase the amount available to them in their accounts. A Simplified Employee Pension (SEP) IRA is a retirement savings option that empowers small businesses to offer equal contributions to employee accounts. SEP plans offer flexibility to employers, allowing contributions to be adjusted based on business conditions. While advantageous for freelancers and self-employed individuals, SEP IRAs are less suitable for growing businesses due to potential scaling challenges. The benefits of SEP plans encompass higher contribution limits, ease of setup and operation, and tax advantages. However, they come with drawbacks such as the necessity for equal contributions, an all-or-nothing provision, and the absence of catch-up contributions for those aged 50 and above. Informed consideration of the pros and cons will guide businesses and individuals in determining whether a SEP IRA aligns with their retirement savings goals. Have questions about SEP IRAs? Click here.What Is a Simplified Employee Pension (SEP) IRA?

Basics of SEP Plans

How to Set up a SEP Plan

Establish Agreements and Employee Distribution

Implement Age and Work History Criteria

Select a Financial Institution

Advantages and Disadvantages of SEP Plan

If a business has had a good year, then the employer can make the maximum permissible contribution limit.

In years when the business is not doing well, the contributions can be minimized or the employer can even choose to forgo making contributions to the plan.

Under certain circumstances, SEP plans offer the added advantage of forgoing the 10% penalty that is charged for early withdrawals.

Therefore, if the amount is high, then the employer might end up spending a significant chunk of their income in funding the accounts.

Conclusion

Simplified Employee Pension (SEP) IRA FAQs

Annual employer contributions in a SEP plan are limited annually to the lesser of 25% of compensation, or $69,000 for 2024, and subject to annual cost-of-living adjustments for later years).

The main drawback of SEP IRAs is that they are difficult to scale becase employers are required to make equal contributions to all employee accounts. SEP plans also do not allow catch-up contributions for those 50 or older.

SEP plans allow employers to vary their retirement account contributions based on the state of their business i.e., they can increase or decrease their annual contributions depending on the market for their product or service.

While SEP plans are designed for all small businesses, SEP plans are ideal for self-employed professionals and sole proprietorships.

The early withdrawal penalty does not apply in the following instances: first-time home purchase (up to $10,000), birth or adoption of a child (up to $5,000), qualified higher education expenses, qualified medical expenses, health insurance premiums when unemployed, substantially equal payments, withdrawals by a beneficiary after the account holder has died.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.