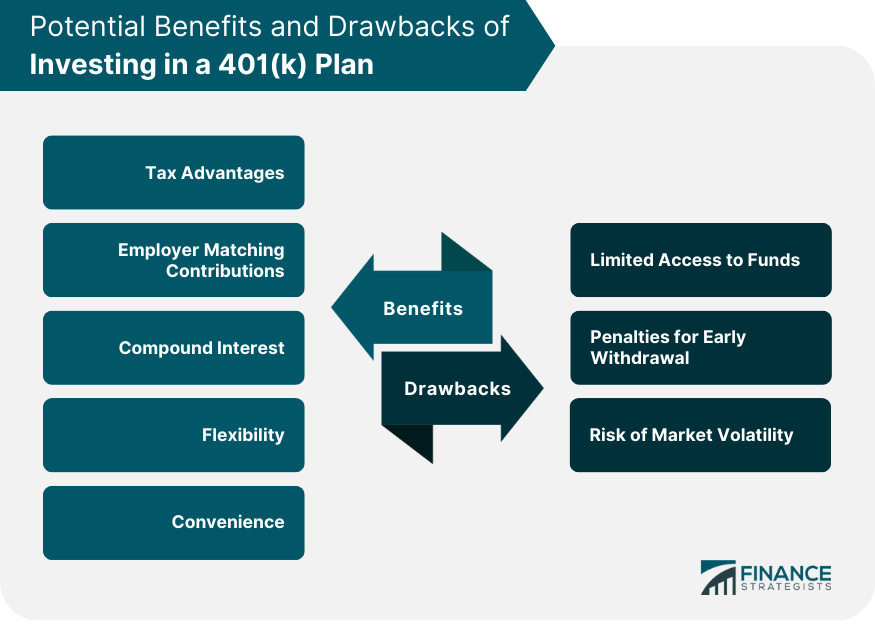

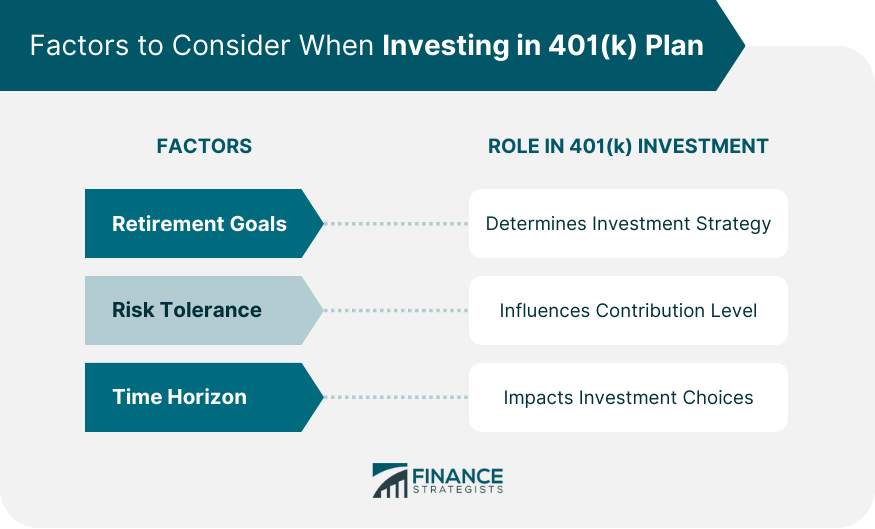

Retirement planning is an essential financial process, ensuring an individual's financial security when they're no longer part of the active workforce. An integral component of retirement planning in the United States is the 401(k) plan, a type of retirement savings account offered by many employers. 401(k) plans allow employees to save and invest a part of their paycheck before taxes are taken out. Taxes aren't paid until the money is withdrawn from the account. This deferral of taxes is a significant advantage that can lead to greater compound growth over time. Employers often match a certain percentage of the employee's contributions, further enhancing the benefits of a 401(k). It's important to understand the specific rules of your plan, including withdrawal penalties and required minimum distributions, to fully benefit from a 401(k). 401(k) plans offer significant tax advantages that can make them a desirable choice for long-term saving. Contributions to a traditional 401(k) are tax-deductible in the year they're made. This implies you won't pay income tax on the money you invest until you withdraw it in retirement, potentially saving you from a higher tax bracket today. Additionally, the earnings on your investments grow tax-deferred until withdrawal. One of the primary reasons to keep investing in your 401(k) is the possibility of employer-matching contributions. If your employer offers a match, they will contribute a certain amount to your 401(k) based on how much you contribute. This is essentially "free money" that significantly increases your savings and compounds over time, providing a substantial boost to your retirement fund. 401(k) plans benefit from the power of compound interest. The money you put into your 401(k) earns interest, and that interest, in turn, earns interest on itself, and so on. This effect is especially potent over long periods, which is why it's so beneficial for retirement savings. You can choose how much you want to contribute to your 401(k) each paycheck, and you can change your contribution amount at any time. For example, you could start by contributing 5% of your paycheck and then increase your contribution amount as you get raises or your financial situation improves. Contributions to your 401(k) are automatically deducted from your paycheck, so you don't have to remember to make a separate payment. This can help you save money because you're less likely to forget to make a payment or to spend the money before you have a chance to save it. One drawback of 401(k) plans is that they limit your access to your money. Funds in a 401(k) are meant for retirement, and if you need to access them before you reach the age of 59 ½, you may have to pay a penalty in addition to regular income taxes. If you withdraw from your 401(k) before the age of 59 ½, you typically have to pay a 10% early withdrawal penalty. There are certain exceptions to this rule, but generally, early withdrawals are discouraged due to this punitive penalty. As with any investment, 401(k) accounts are subject to market risks. While these plans often allow for a broad range of investment options, the possibility of investment losses is a risk one must be prepared to assume. Investing in a 401(k) is not a one-size-fits-all strategy. The right approach depends on your individual retirement goals. You'll need to ask yourself questions like: At what age do you plan to retire? What kind of lifestyle do you want in retirement? How much income will you need to support that lifestyle? Risk tolerance refers to the amount of loss an investor is prepared to endure in their investment portfolio. When deciding how much to contribute to a 401(k), you need to consider your risk tolerance. A person with a high-risk tolerance might choose to invest heavily in a 401(k), while someone with a low-risk tolerance might opt for more conservative investments. Investment diversification is a strategy that aims to optimize returns by investing in different areas that would each react differently to the same event. In simple terms, don't put all your eggs in one basket. While 401(k)s are an excellent vehicle for retirement savings, they should not be your only form of investment. Stocks, bonds, real estate, and other retirement accounts like IRAs can all play a role in a diversified portfolio. Your 401(k) should generally be a significant part of your overall investment strategy, but it's also important to balance it with other investments. Consider your financial goals, risk tolerance, and timeline, and then diversify your portfolio accordingly. Having a mixture of investments can help protect against losses and set you up for overall financial success. Your time horizon—how long until you plan to retire—also plays a crucial role in your investment decisions. Generally, the longer your time horizon, the more risk you can afford to take, as your investments have more time to recover from any short-term losses. Therefore, younger investors can typically afford to contribute more to a 401(k) and invest more aggressively, while older investors might start shifting towards more conservative investments. As you get closer to retirement, you'll generally want to start shifting your 401(k) away from riskier investments like stocks and towards safer ones like bonds. This is to protect the money you've accumulated from sudden market downturns. However, every person's situation is different, and you should consider your financial circumstances and retirement goals when deciding on an asset allocation strategy. Younger investors, who have a longer time horizon, are generally advised to make more aggressive investments, which can include a higher percentage of stocks in their portfolio. They can also afford to contribute more to their 401(k) due to the power of compound interest over time. On the other hand, older investors who are closer to retirement need to focus more on preserving their savings rather than growing them. This might mean shifting their portfolio towards more stable investments and reviewing their contribution rates to ensure they are on track to meet their retirement goals. A 401(k) plan, despite its few limitations, remains a valuable tool for securing financial comfort in retirement. Its tax advantages, potential for employer matching, compounding interest, flexibility, and convenience collectively provide a compelling incentive to continue investing in it. However, diversifying your investment portfolio is crucial, with other vehicles like stocks, bonds, and real estate helping to optimize your returns and minimize risk. The factors to consider when investing in a 401(k) plan include your retirement goals, risk tolerance, and the investment options available in your plan.. As you age, altering your asset allocation and contribution strategies in line with your changing risk tolerance and financial circumstances is essential. If you need further guidance or clarity on investing in a 401(k) plan, consider reaching out to a financial advisor to ensure your financial decisions align with your unique retirement goals.Overview of Retirement Planning and 401(k)

Should You Keep Investing in Your 401(k) Plan?

Potential Benefits

Tax Advantages

Employer Matching Contributions

Compound Interest

Flexibility

Convenience

Potential Drawbacks

Limited Access to Funds

Penalties for Early Withdrawal

Risk of Market Volatility

Factors to Consider When Investing in 401(k) Plan

Retirement Goals

Risk Tolerance

Role of 401(k) in Diversification of Investment Portfolio

Importance of Diversification

Balance 401(k) With Other Investment Options

Time Horizon

Altering 401(k) Investment Strategies As You Age

Shifting Asset Allocation Over Time

Strategies for Younger Investors vs Older Investors

Bottom Line

Should You Keep Investing in Your 401(k) Plan? FAQs

The contributions made to a traditional 401(k) are tax-deductible, and the earnings on your investments grow tax-deferred until withdrawal.

Yes, limitations include limited access to funds until you reach 59.5 years, penalties for early withdrawal, and the risk of market volatility.

A 401(k) should form a significant part of your portfolio, complemented by investments in stocks, bonds, real estate, and possibly other retirement accounts like IRAs.

As you near retirement, you may want to shift your 401(k) from riskier investments like stocks towards safer ones like bonds to protect your accumulated savings.

Employer matching contributes a certain amount based on your contribution, effectively providing "free money" that increases your savings and compounds over time.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.