The concept of insurable interest is central to life insurance policies. This refers to the interest one person has in ensuring that another person remains alive. For instance, a parent has an insurable interest in their child, and vice versa. Therefore, you can get a life insurance policy on a parent because you possess an insurable interest. While insurable interest forms a legal basis for purchasing a life insurance policy on a parent, various laws must be adhered to, which differ by jurisdiction. For example, privacy laws in the United States stipulate that the person being insured must know about and consent to the insurance policy. The principle of consent is of paramount importance in this context. As a child, you cannot secretly take out a life insurance policy on your parent. They must be aware of the policy, agree to it, and typically participate in the process, particularly if the policy requires a medical examination. Term life insurance offers coverage for a specific period, usually between 10 to 30 years. It is typically the most affordable type of life insurance and might be suitable if your parent has specific financial obligations that will disappear over time, such as a mortgage. Whole life insurance provides lifelong coverage and has a cash value component that grows over time. It is usually more expensive than term insurance but might be appropriate if your parent wants to leave a guaranteed death benefit, regardless of when they pass away. Universal life insurance offers more flexibility than whole life insurance. It provides a death benefit and cash value component but allows the policyholder to adjust the premium and death benefit amounts. This might be suitable for parents with fluctuating income or financial needs. Also known as burial insurance or funeral insurance, final expense insurance is a policy specifically designed to cover end-of-life expenses. This could be the right choice if your parent has substantial savings or other life insurance coverage but wants to ensure funeral and other related costs are covered. Buying a life insurance policy for a parent is similar to purchasing one for yourself. However, your parent will need to be actively involved in the process. Firstly, an open discussion with your parent is vital. This will allow you to explain why you think it’s necessary and ensure they’re comfortable with the process. It's important to be sensitive and respectful during this conversation. Next, you must decide which type of policy is most suitable based on your parent's health, age, financial situation, and financial goals. It's advisable to consult with a financial advisor or insurance broker at this stage. Your parent will likely need to undergo the underwriting process, which involves assessing their risk profile based on medical history, lifestyle factors, and, in some cases, a medical examination. The outcome of the underwriting process will determine the premiums payable for the policy. Once the policy is approved, regular premium payments need to be made to keep the policy in force. It's crucial to discuss who will be responsible for these payments. Life insurance can provide financial protection, covering loss of income, outstanding debts, or other expenses that might arise after a parent's death. Policies like final expense insurance can help cover funeral and burial costs, relieving families from the financial burden during an emotionally challenging time. Certain types of policies, like whole and universal life insurance, can accumulate cash value over time, which could be borrowed against if necessary. Life insurance premiums for older individuals can be high. It's essential to evaluate whether the cost of the premiums outweighs the potential benefits. Some parents might not qualify for certain types of policies due to their health status. Moreover, those who do qualify might face steep premiums. Choosing the right policy and managing it effectively can be complex. Misunderstandings and mismanagement can lead to lapses in coverage or financial losses. Annuities can provide a steady stream of income during retirement and can be an alternative or supplement to life insurance. Long-term care insurance can help cover the costs of nursing homes, assisted living facilities, or home health care. This can be beneficial if there's concern about these costs impacting the family's finances. A dedicated savings or investment account could provide a fund to draw on in the event of a parent's death. However, it would need to be set up and managed correctly, with a clear understanding of the relevant tax implications. Acquiring a life insurance policy for a parent is indeed feasible, given the existence of an insurable interest and the requisite consent. This arrangement offers financial security, with policy types like term, whole, universal, and final expense insurance each catering to different needs and situations. Open dialogue with your parent, understanding the policy options, and engaging in the underwriting process are crucial steps. Despite potential challenges like high costs and health-related barriers, the benefits of financial protection, funeral expense coverage, and cash value accumulation often outweigh the drawbacks. Additionally, alternative financial mechanisms like annuities, long-term care insurance, or creating a dedicated savings or investment account could also be viable strategies. Careful evaluation of all options is essential to make the most appropriate decision for your specific circumstances.Getting a Life Insurance Policy on a Parent

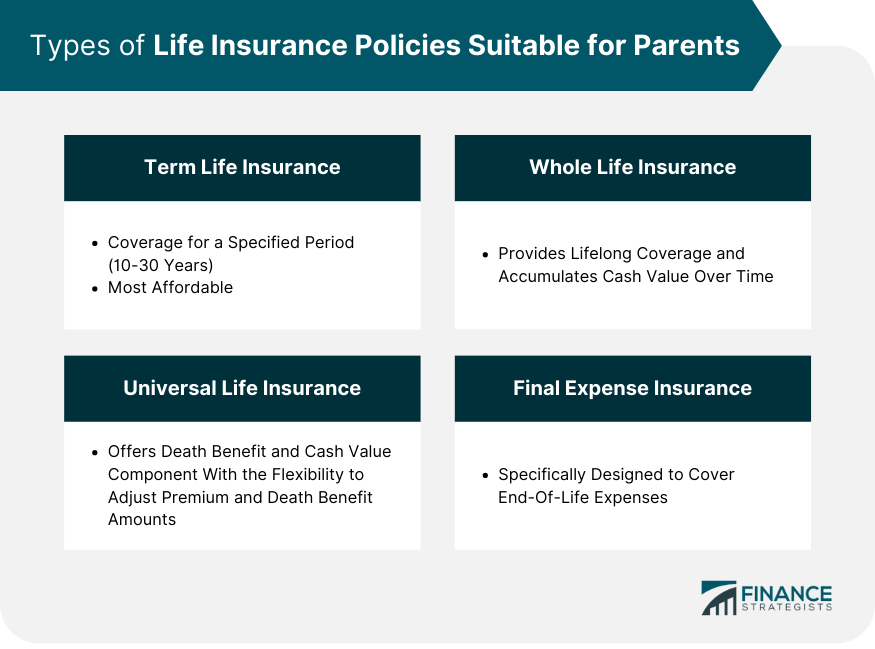

Types of Life Insurance Policies Suitable for Parents

Term Life Insurance

Whole Life Insurance

Universal Life Insurance

Final Expense Insurance

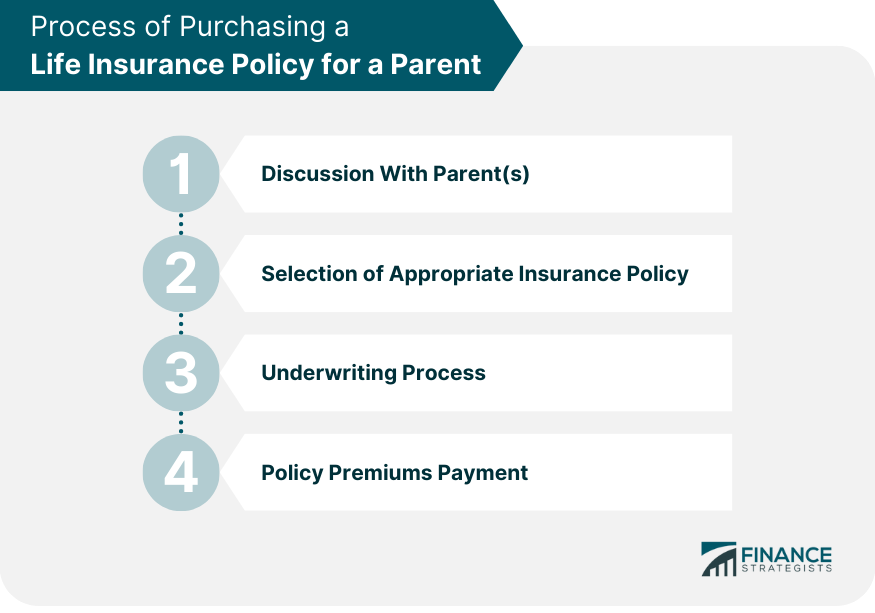

Process of Purchasing a Life Insurance Policy for a Parent

Discussion With Parent(s)

Selection of Appropriate Insurance Policy

Underwriting Process

Policy Premiums Payment

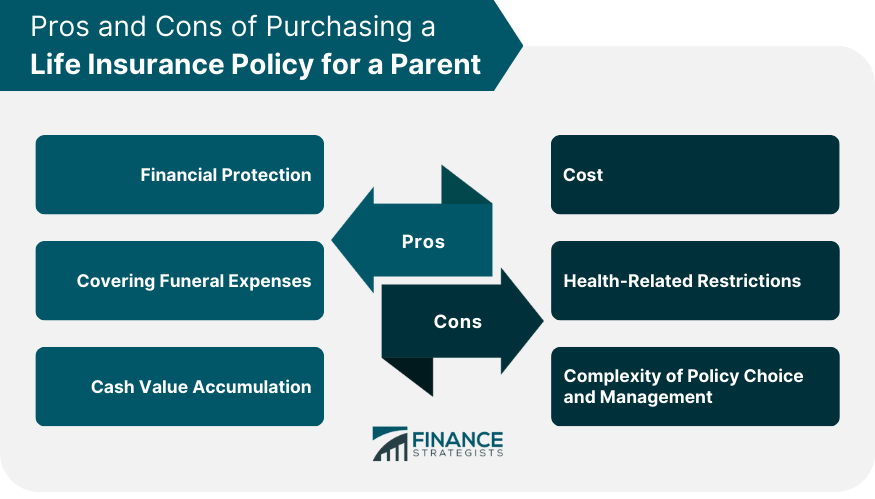

Pros and Cons of Purchasing a Life Insurance Policy for a Parent

Advantages

Financial Protection

Covering Funeral Expenses

Cash Value Accumulation

Disadvantages

Cost

Health-Related Restrictions

Complexity of Policy Choice and Management

Alternative Insurance Policies or Financial Arrangements

Annuities

Long-Term Care Insurance

Setting Up a Savings or Investment Account

Conclusion

Can You Get a Life Insurance Policy on a Parent? FAQs

No, you cannot get a life insurance policy on a parent without their knowledge or consent. It's a legal requirement that the insured person is aware of and consents to the policy.

There are several types of policies you can get for a parent, including term life, whole life, universal life, and final expense insurance. The choice depends on your parent's needs, health status, and financial situation.

Yes, you can still get a life insurance policy on a parent with health issues, but it might be more challenging. Certain types of policies, like guaranteed issue life insurance or final expense insurance, are often available to individuals with health issues, albeit at higher premium rates.

The person responsible for paying the premiums should be determined before finalizing the policy. It can be either the child who initiates the policy, the parent, or a shared responsibility.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.