Risk assessment is the process of identifying, quantifying, evaluating, and managing potential risks and uncertainties that may impact the performance of investments, projects, or other activities. It plays a crucial role in wealth management by helping investors and financial advisors make informed decisions about their investment portfolios. In wealth management, risk assessment is essential to protect clients' assets, optimize returns, and maintain financial stability. A thorough risk assessment helps wealth managers identify potential threats to their clients' investments, develop strategies to mitigate those risks, and make informed decisions to achieve clients' financial goals. The first step in the risk assessment process is to gather relevant information about the investment portfolio, financial markets, economic conditions, and other factors that may impact investment performance. This information is essential to identify and analyze potential risks accurately. Risk identification involves recognizing potential risks that may impact the investment portfolio. This step includes considering market risk, credit risk, operational risk, and other sources of uncertainty that could affect investment performance. Once potential risks have been identified, the next step is to quantify their likelihood and potential impact. Risk quantification involves using statistical models, historical data, and expert judgment to estimate the probability and severity of each risk. Risk evaluation involves prioritizing risks based on their likelihood and potential impact. This process helps wealth managers focus their attention and resources on the most significant risks, allowing for more effective risk management. After evaluating risks, wealth managers develop strategies to mitigate or manage the prioritized risks. This may involve adjusting investment portfolios, implementing risk management tools, or developing contingency plans to address potential risk events. Risk assessment is an ongoing process that requires regular monitoring and review to ensure that risk management strategies remain effective and that new risks are identified and addressed in a timely manner. Historical data analysis involves examining past data and events to identify patterns and trends that may help predict future risks. This technique can provide valuable insights into the potential impact of similar events or conditions on current investments and financial plans. Statistical models are widely used in risk assessment to estimate the probability and potential impact of risks. These models often rely on historical data and statistical techniques to identify patterns and trends that can help predict future risks. Stress testing is a technique used to evaluate the resilience of an investment or financial plan under extreme or adverse conditions. By simulating these conditions and assessing the potential impact on the investment or plan, stress testing can provide valuable insights into the robustness of risk management strategies and the overall financial stability of the portfolio. Scenario analysis is a tool used in risk assessment to evaluate the potential impact of different hypothetical scenarios. This technique can help investors and wealth managers understand the range of possible outcomes and develop strategies to manage the associated risks. Risk rating systems are tools used to assess and prioritize risks based on factors such as probability, impact, and potential mitigation strategies. These systems can help wealth managers make more informed decisions about risk management and resource allocation. Risk assessment provides investors and wealth managers with crucial information about potential risks associated with investment decisions. By considering the potential risks and their impact on investment performance, risk assessment enables more informed decision-making. It allows investors to evaluate the risk-reward tradeoff and make investment choices that align with their risk tolerance and financial goals. One of the primary objectives of risk assessment is capital preservation. By identifying and managing risks, risk assessment helps mitigate potential losses and safeguard clients' capital. Through a systematic analysis of potential risks, wealth managers can develop risk mitigation strategies tailored to the specific needs and goals of their clients. Effective risk management ensures that clients' capital is protected against adverse events, market downturns, and unexpected risks. A comprehensive risk assessment process allows investors and wealth managers to identify and evaluate potential risks that could negatively impact investment performance. By proactively identifying these risks, appropriate risk mitigation strategies can be implemented to reduce the probability and potential impact of adverse events. Risk assessment helps investors anticipate and prepare for potential risks, ensuring they are better positioned to manage and mitigate those risks effectively. Effective risk assessment and management contribute to improved portfolio performance. By understanding and addressing potential risks, wealth managers can optimize the risk-return tradeoff. A thorough risk assessment process helps identify opportunities to enhance returns while managing potential downside risks. By incorporating risk analysis into portfolio construction and management, wealth managers can design portfolios that are aligned with clients' risk preferences and financial goals. One of the drawbacks of risk assessment is the inherent uncertainty and volatility in financial markets. Despite careful analysis, unforeseen events or changes in market conditions can still impact investment performance, making it challenging to accurately assess and manage all risks. Financial markets are complex and interconnected, making it difficult to identify and evaluate all potential risks. The interconnectedness of global markets and the rapid pace of financial innovation further complicate the risk assessment process. Risk assessment relies heavily on data, and limitations in data quality, availability, and reliability can impact the accuracy of risk assessments. Inaccurate or incomplete data can lead to flawed risk estimates and suboptimal decision-making. Human biases can influence risk assessment and lead to suboptimal decisions. Biases such as overconfidence, anchoring, and herding behavior can cloud judgment and affect the accuracy of risk assessments. Wealth managers should conduct regular and comprehensive risk assessments to ensure that potential risks are continually monitored and evaluated. This practice allows for timely identification and mitigation of risks. Risk assessment should involve experienced professionals with deep knowledge of financial markets and risk management techniques. Their expertise can help identify and evaluate risks more accurately, leading to more effective risk management strategies. A robust risk management framework should be in place to support the risk assessment process. This framework includes well-defined policies, procedures, and controls to identify, assess, and mitigate risks effectively. The use of advanced technology tools and analytics can enhance risk assessment capabilities. Automated risk assessment systems, data analytics, and artificial intelligence can help identify patterns, trends, and potential risks more efficiently. Risk assessment is an ongoing process that requires regular monitoring and review. Wealth managers should continuously evaluate the effectiveness of risk management strategies, update risk assessments as needed, and adapt to changes in market conditions and risk profiles. Risk assessment is the process of identifying, quantifying, evaluating, and managing potential risks and uncertainties that may impact investment performance. The risk assessment process involves gathering relevant information, identifying risks, quantifying risks, evaluating risks, implementing risk mitigation strategies, and ongoing monitoring and review. Effective risk assessment is crucial in wealth management as it enables informed decision-making, preserves capital, protects against losses, and improves portfolio performance. Proper risk assessment enhances decision-making, preserves capital, protects against losses, and improves the overall performance of the investment portfolio.What Is Risk Assessment?

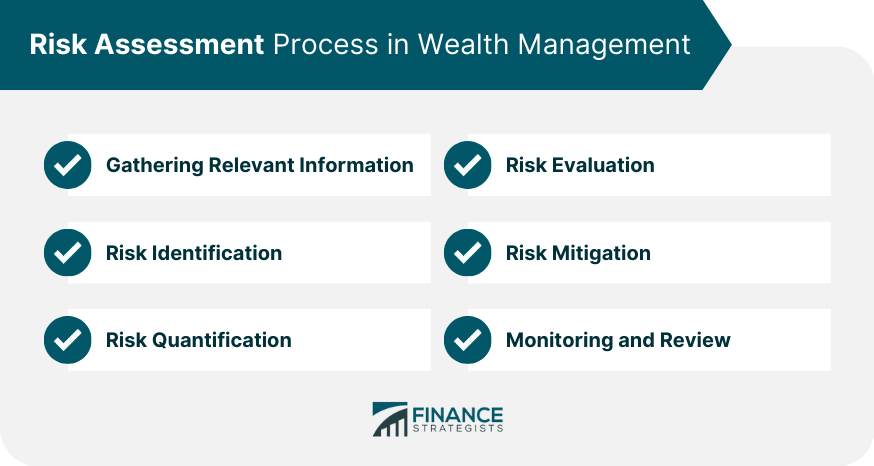

Risk Assessment Process in Wealth Management

Gathering Relevant Information

Risk Identification

Risk Quantification

Risk Evaluation

Risk Mitigation

Monitoring and Review

Tools and Techniques for Risk Assessment

Historical Data Analysis

Statistical Modeling

Stress Testing

Scenario Analysis

Risk Rating Systems

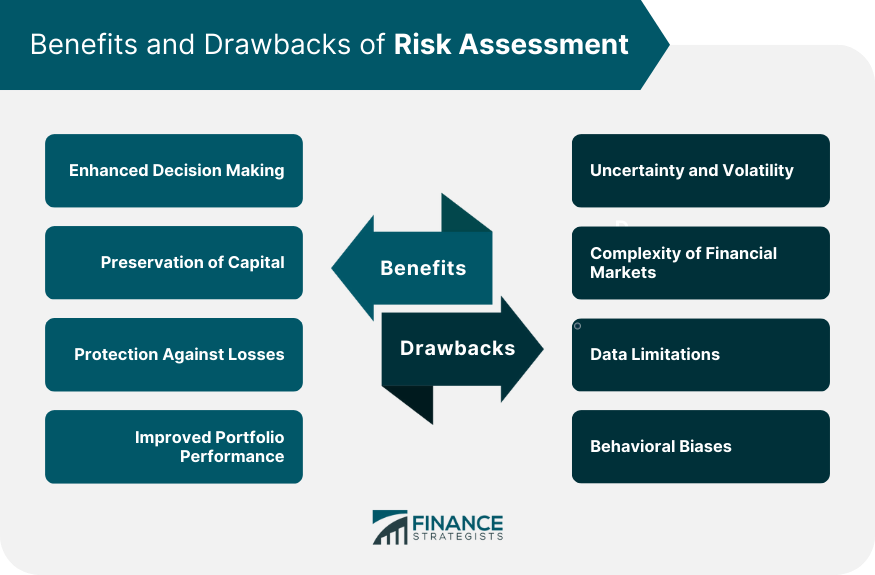

Benefits of Risk Assessment

Enhanced Decision Making

Preservation of Capital

Protection Against Losses

Improved Portfolio Performance

Drawbacks in Risk Assessment

Uncertainty and Volatility

Complexity of Financial Markets

Data Limitations

Behavioral Biases

Best Practices in Risk Assessment

Regular and Comprehensive Risk Assessments

Involvement of Experienced Professionals

Robust Risk Management Framework

Integration of Technology

Ongoing Monitoring and Review

Bottom Line

Risk Assessment FAQs

Risk assessment in wealth management is the process of identifying, evaluating, and managing potential risks that may impact the performance of investment portfolios. It helps investors and wealth managers make informed decisions and implement strategies to protect clients' wealth.

Risk assessment is important in wealth management because it allows investors and wealth managers to understand and manage the risks associated with investments. It helps preserve capital, protect against losses, and improve portfolio performance.

Some common tools and techniques used in risk assessment include historical data analysis, statistical modeling, stress testing, scenario analysis, and risk rating systems.

The benefits of risk assessment in wealth management include enhanced decision-making by considering potential risks, preservation of capital through effective risk mitigation, protection against losses by identifying and managing risks, and improved portfolio performance by optimizing the risk-return tradeoff.

Best practices for conducting risk assessments in wealth management include regular and comprehensive assessments, involvement of experienced professionals with deep market knowledge, a robust risk management framework, integration of technology tools and analytics, and ongoing monitoring and review of risk management strategies.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.