The term "discharged" refers to the elimination of a debtor's obligation to pay certain types of debts. Bankruptcy offers an avenue for individuals and businesses to manage overwhelming debt. It's a legal procedure that provides debtors relief by discharging specific debts, reorganizing debt, or liquidating assets to pay creditors. Gaining a clear understanding of the tax implications associated with discharged debt is crucial when seeking a fresh financial start through bankruptcy. The tax code offers some respite. In general, discharged bankruptcy debt is not considered taxable income. This exclusion from gross income is stipulated in section 108 of the Internal Revenue Code. Nonetheless, there are caveats and conditions that can complicate this broad rule, making it necessary to delve deeper into the factors determining the taxability of discharged bankruptcy debt. There are different types of bankruptcy filings, the most common being Chapter 7, Chapter 11, and Chapter 13. Each type follows a different process and has unique tax implications. For instance, under Chapter 7 and Chapter 11, debts discharged are generally excluded from taxable income, while in a Chapter 13 case, only debts discharged through the completion of a court-approved payment plan may qualify for this exclusion. After a Chapter 7 bankruptcy, individuals are responsible for filing their taxes, while in a Chapter 11 reorganization, the responsibility lies with the bankruptcy estate until the case is dismissed or converted. The type of debt discharged also determines its taxability. Certain debts, like student loans, child support, and some taxes, are not dischargeable in bankruptcy. Therefore, if these debts are later forgiven, the forgiven amount could be considered taxable income. Contrarily, dischargeable debts like credit card debt or medical bills, if forgiven in a bankruptcy proceeding, are generally excluded from taxable income. However, the application of these rules may vary, underscoring the importance of understanding the tax implications of your specific situation. The timing of the bankruptcy discharge is also an important consideration. If the discharge happens within a tax year, the debtor is usually not liable for tax on the discharged amount. However, if the discharge occurs across multiple tax years (like in a Chapter 13 repayment plan), then the timing of when the debts are discharged could have different tax consequences. The timing factor becomes more complex if you consider the potential impact of the cancellation of debt income, potential tax liability, and available tax exclusions and deductions, which we will discuss next. Under IRS regulations, canceled debt is generally considered income and is, therefore, taxable. This is referred to as "Cancellation of Debt Income" (CODI). When a creditor forgives a debt, the debtor typically receives a Form 1099-C that reports the amount of the canceled debt. This amount is considered income unless it falls under specific exclusions, like debts discharged in bankruptcy. However, debtors should be mindful that the exclusion of discharged debts from income is not automatic. In fact, there is a process to follow that involves completing and submitting IRS Form 982 with your tax return. Though bankruptcy discharge can exclude debts from taxable income, it doesn't necessarily mean you're off the hook when it comes to taxes. In certain situations, there may still be potential tax liabilities associated with the bankruptcy process. For instance, if the bankruptcy estate sells assets to repay creditors, it may incur capital gains, which could be taxable. Furthermore, while the discharged debt may not be taxable, the bankruptcy could reduce certain tax benefits, known as "tax attributes," like net operating losses, general business credits, or basis in property. Various tax exclusions and deductions are available to individuals who have had their debts discharged in bankruptcy. Debtors can exclude discharged debts from gross income if the discharge occurred in a Title 11 bankruptcy case. Also, if they were insolvent immediately before the discharge, or if the debt was qualified farm indebtedness or qualified real property business indebtedness. The insolvency exclusion allows debtors to exclude discharged debts from income to the extent they were insolvent immediately before the discharge. It's important to note, however, that these exclusions have specific qualifications and limitations, and they require certain reporting on your tax return. The IRS allows for an insolvency exception where discharged debts can be excluded from gross income if the taxpayer is insolvent immediately before the discharge. Insolvency, in this context, means your total debts exceed the fair market value of your total assets. However, it's crucial to document this carefully, as you may need to prove your insolvency status to the IRS. While this exception can significantly alleviate potential tax burdens, it's worth noting that the excluded amount is limited to the amount by which you were insolvent. If the discharged debt exceeds this amount, the excess could still be taxable. For bankruptcy filings under Chapters 7 or 11, the IRS considers a separate taxable entity known as the bankruptcy estate. Essentially, the estate becomes the temporary owner of the debtor's assets, and any income generated by these assets is taxable to the estate rather than the debtor. This effectively shields the debtor from any tax liability that might arise from the estate’s management of the assets during the bankruptcy proceedings. This bankruptcy estate exception applies only to individual debtors and not to partnerships or corporations. It underscores the complexity of the tax treatment of bankruptcy and the importance of understanding how these rules might apply to your specific situation. The IRS offers an exception for qualified real property business indebtedness (QRPBI). If a taxpayer can prove the discharged debt was QRPBI, it may be excluded from gross income. For instance, the indebtedness must be incurred or assumed in connection with real property used in a trade or business, and the debt must be secured by such real property. While this exception could potentially offer significant tax savings, it is complex and often requires the assistance of a tax professional to ensure the conditions are met. Reporting discharged bankruptcy debt requires a certain level of diligence and accuracy. Form 982, "Reduction of Tax Attributes Due to Discharge of Indebtedness," is used to report the exclusion of discharged debt from gross income. This form is complex and requires you to detail the amount of discharged debt, the bankruptcy chapter under which the debt was discharged, and how you plan to reduce your tax attributes. The reduction of tax attributes is a mechanism to prevent taxpayers from double-dipping—excluding discharged debt from income while also maintaining certain tax benefits. Essentially, taxpayers must reduce certain "tax attributes" (like net operating losses or basis in property) by the amount of discharged debt they're excluding from income. As part of your tax filing, it is crucial to retain proof of bankruptcy discharge. This usually comes in the form of a court order, demonstrating that your debts were indeed discharged as part of a bankruptcy proceeding. This document may be necessary to prove the validity of your exclusion should the IRS question your tax return. Retaining this document and other pertinent records can save you from potential disputes down the line. Remember, the IRS can audit tax returns up to three years from the date of filing (or up to six years if substantial underreporting is suspected), so it's a good practice to keep these records for at least that long. The IRS requires detailed documentation about the nature and amount of the discharged debts. Lenders usually issue a Form 1099-C for canceled debts of $600 or more. Even though the debt was discharged in bankruptcy and is not taxable, you may still receive this form. It's essential to keep this and reconcile it with your records, ensuring the amount reported matches the discharged amount. Keeping accurate records of your debts before and after the bankruptcy will make this process smoother. It will also be helpful if the IRS or any other party questions the discharge later. When filing your taxes after a bankruptcy discharge, be prepared to provide supporting financial statements and other documentation. These might include statements showing your financial position before the bankruptcy filing, proof of your insolvency if you're claiming the insolvency exception, and records related to your bankruptcy estate if you filed under Chapter 7 or 11. Given the complexity of tax laws and regulations, working with a tax professional or a Certified Public Accountant (CPA) can be beneficial in ensuring you correctly navigate your post-bankruptcy tax responsibilities. Discharged debt is generally not considered taxable income, it's important to consider various factors that can complicate this rule. Factors such as the type of bankruptcy filing, the nature of the discharged debt, and timing of the discharge can affect the taxability of the debt. Additionally, debtors should be aware of potential tax liabilities related to the bankruptcy process, including cancellation of debt income and reduced tax benefits. There are exceptions to taxability, such as the insolvency exception and bankruptcy estate exception, as well as available tax exclusions and deductions. Reporting discharged bankruptcy debt accurately on tax returns, including using Form 982 and maintaining proof of bankruptcy discharge and documentation of discharged debts, is essential. Consulting with a tax professional can provide valuable guidance in navigating these complex tax obligations post-bankruptcy.Overview of Taxes on Discharged Bankruptcy Debt

Do You Have to Pay Taxes on Discharged Bankruptcy Debt?

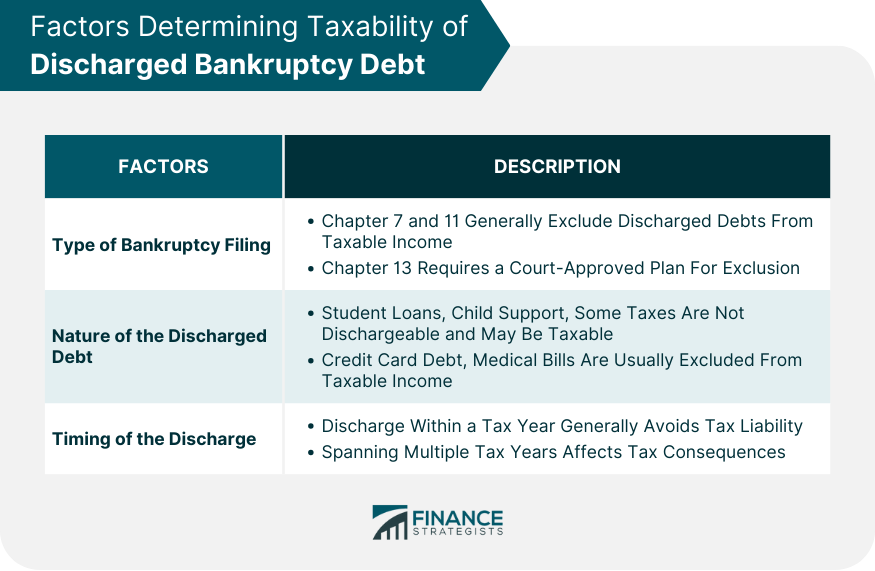

Factors Determining Taxability of Discharged Bankruptcy Debt

Type of Bankruptcy Filing

Nature of the Discharged Debt

Timing of the Discharge

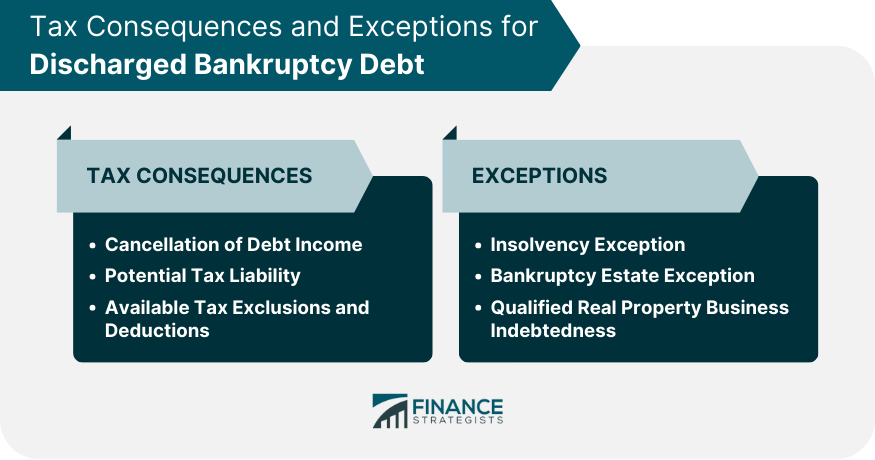

Tax Consequences of Discharged Bankruptcy Debt

Cancellation of Debt Income

Potential Tax Liability

Available Tax Exclusions and Deductions

Exceptions to Taxability

Insolvency Exception

Bankruptcy Estate Exception

Qualified Real Property Business Indebtedness

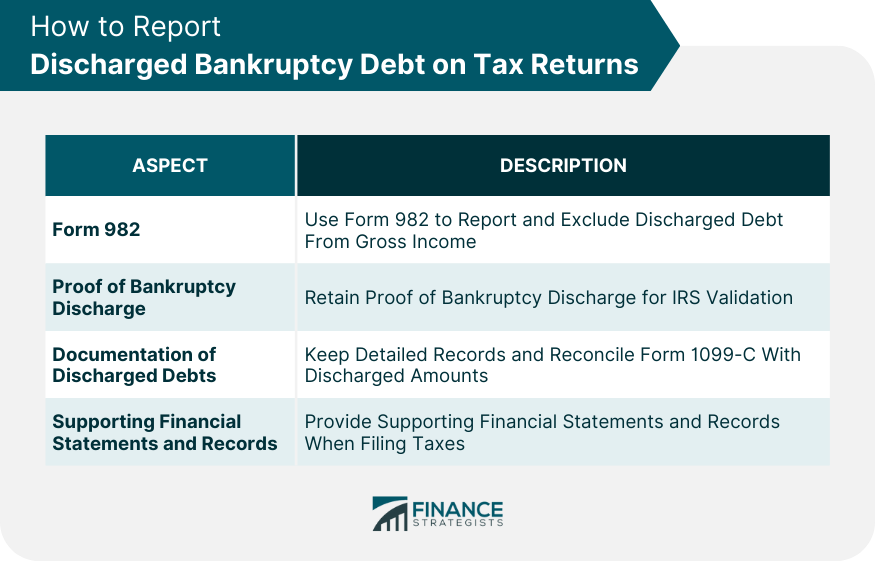

How to Report Discharged Bankruptcy Debt on Tax Returns

Form 982

Proof of Bankruptcy Discharge

Documentation of Discharged Debts

Supporting Financial Statements and Records

Conclusion

Do You Have to Pay Taxes on Discharged Bankruptcy Debt? FAQs

No, discharged bankruptcy debt is generally not considered taxable income. However, there are exceptions and specific circumstances that can affect this.

The insolvency exception allows taxpayers to exclude discharged debts from income to the extent they were insolvent immediately before the discharge. Insolvency means your total debts exceed the fair market value of your total assets.

Keep the court order of discharge, Form 1099-C from your lenders, IRS Form 982, and any other supporting documents like financial statements, records of assets and liabilities, and records related to your bankruptcy estate.

You report the discharged bankruptcy debt and its exclusion from income on IRS Form 982 and attach it to your federal income tax return.

Given the complexity of tax laws related to bankruptcy, consulting a tax professional is highly recommended. They can ensure you're accurately reporting discharged debts and correctly applying tax laws.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.