Gross income refers to the total revenue earned by an individual or a business before any deductions, taxes, or expenses are taken into account. It serves as the starting point for various financial evaluations, from determining taxation to assessing creditworthiness. For an individual, it might encompass salaries, hourly wages, bonuses, and any other forms of compensation. For businesses, gross income reflects the total revenue minus the cost of goods sold. When considering personal finance, gross income stands in contrast to net income, which is what remains after deductions like taxes, insurance, and retirement contributions have been subtracted. The gross income of an individual or business is a primary metric used by tax authorities to determine tax liability. Depending on the tax jurisdiction and specific regulations, various deductions or credits are allowed based on gross income levels. A higher gross income typically equates to a higher tax bracket, although actual tax obligations will depend on allowable deductions and credits. For businesses, gross income can affect the rate of corporate tax. It is also pivotal in determining eligibility for certain tax credits or incentives. Lenders and financial institutions assess an individual's or business's gross income to evaluate their creditworthiness. A higher gross income indicates a better capacity to manage and repay debts, making it a crucial factor in decisions about loan approvals, credit limits, and interest rates. Consistent and high gross income often leads to favorable loan terms and higher credit limits. It reassures lenders of the borrower's financial stability and capability to meet obligations. Gross income provides a ceiling for potential expenditures and investments. Financial planners and individuals use it to outline savings goals, investment strategies, and budgetary constraints. For businesses, gross income provides a foundation for operational budgeting, forecasting future revenues, and planning for expansions or contractions. For most individuals, wages and salaries make up a significant portion of their gross income. This includes regular hourly pay, monthly or annual salaries, overtime pay, bonuses, commissions, and tips. For entrepreneurs and business owners, the profit from business operations contributes to their personal gross income. This is typically calculated by subtracting business expenses from total business revenues. Income derived from renting out properties, whether residential, commercial, or land, counts towards gross income. This includes regular rent payments and any associated fees or charges levied on tenants. This encompasses earnings from various investments. Dividends from stocks, interest from bonds, and returns from mutual funds or other investment vehicles all contribute to an individual's or entity's gross income. Apart from the typical avenues mentioned, other sources might include royalties from intellectual properties, earnings from freelance or consulting work, and even lottery winnings. Most tax jurisdictions exclude gifts and inheritances from gross income. These are typically not considered earned income and, thus, aren't subject to regular income tax. However, there may be other taxes, like gift taxes or estate taxes, that apply separately. In many cases, life insurance proceeds, especially those received upon the death of the insured, are not considered part of the beneficiary's gross income. As such, they are usually not taxable. Certain scholarships awarded to students, especially those specifically intended for tuition, fees, books, and related academic expenses, might be excluded from gross income. However, funds meant for room and board might be taxable. Interest earned from certain municipal bonds, especially those used for public projects, is often tax-free and excluded from gross income. The exclusion of municipal bond interest from gross income effectively enhances the after-tax return for investors. This tax exemption makes municipal bonds particularly appealing to individuals in higher tax brackets who seek tax-efficient investment opportunities. Calculating gross income for an individual entails summing up all earnings before any deductions. For salaried employees, this would be their annual salary plus any additional compensation like bonuses or overtime. For those with varied income sources, it's a matter of adding together earnings from each source. For businesses, the gross income or gross profit calculation is slightly different. It's determined by subtracting the cost of goods sold (COGS) from total revenues. This gives a snapshot of the company's profitability at a basic operational level, excluding overheads and other indirect costs. The distinction between gross and net income lies in their respective scopes and implications. Gross income refers to the total earnings an individual or entity receives before any deductions, such as taxes, expenses, and contributions. It represents the raw income generated. On the other hand, net income reflects the actual amount remaining after all deductions have been subtracted from the gross income. These deductions typically include taxes, operating costs, interest payments, and other expenditures. Net income provides a clearer picture of the actual profit or take-home earnings, as it factors in the impact of various financial obligations. Understanding the difference between gross and net income is crucial for evaluating financial health, making informed financial decisions, and assessing the overall profitability of an endeavor. Gross income is the total revenue earned before deductions, serving as a foundational metric for financial evaluations. It impacts taxation, with higher gross income often leading to higher tax liability and influencing eligibility for credits. For loans and credit applications, higher gross income reflects better creditworthiness, impacting loan terms. Gross income guides financial planning, budgeting, and investment strategies. Its components encompass wages, business profits, rental income, investments, and more. Exclusions, like gifts and inheritances, affect taxable income. Calculating gross income involves summing earnings pre-deductions. Contrasting gross and net income, the former signifies raw earnings, while the latter deducts expenses. Understanding this distinction is vital for financial decisions, assessing profitability, and evaluating overall fiscal health.What Is Gross Income?

Significance of Gross Income

Taxation Purposes

Loan and Credit Applications

Financial Planning and Budgeting

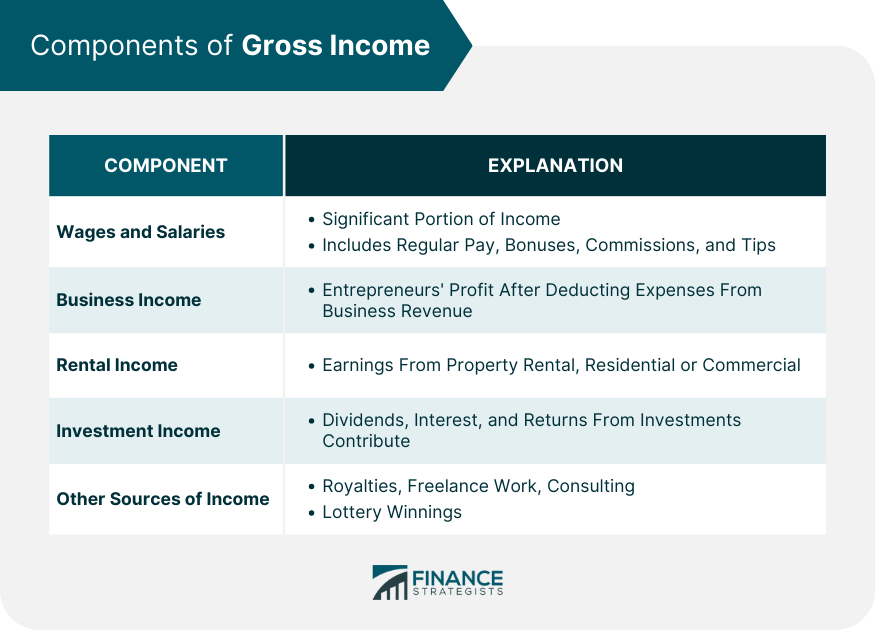

Components of Gross Income

Wages and Salaries

Business Income

Rental Income

Investment Income

Other Sources of Income

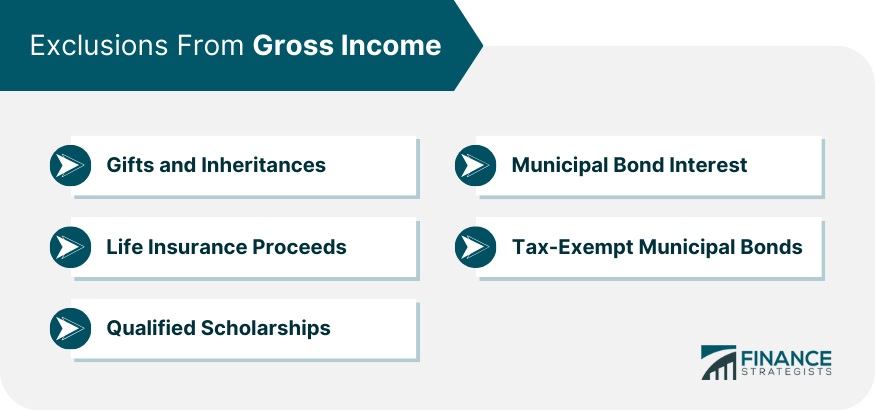

Exclusions From Gross Income

Gifts and Inheritances

Life Insurance Proceeds

Qualified Scholarships

Municipal Bond Interest

How to Calculate Gross Income

Difference Between Gross and Net Income

Conclusion

Gross Income FAQs

Net income is what remains after all deductions, taxes, and expenses are subtracted from gross income. Essentially, net income reflects what an individual or business actually takes home.

No, certain income types, like specific gifts, inheritances, and qualified scholarships, might be excluded, depending on the tax jurisdiction.

Regularly reviewing and updating your gross income, especially when there are significant changes like a job switch, new investments, or changes in business revenue, is advisable. It ensures accurate financial planning and tax calculations.

Yes, businesses first determine their gross income by subtracting COGS from total revenues. After accounting for operational expenses, overheads, taxes, and other costs, what remains is the net income or profit.

Typically, financial gifts are not considered earned income and are thus excluded from gross income. However, depending on the amount and jurisdiction, there might be separate gift taxes or reporting requirements.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.