An annuity exchange refers to the process of transferring an existing annuity contract or life insurance policy to a new contract without incurring any tax consequences. This tax-free exchange is commonly known as a "1035 exchange”. Section 1035 of the Internal Revenue Code (IRC) provides the legal basis for annuity exchanges. It stipulates that policyholders can transfer the cash value of an existing annuity contract or life insurance policy to a new contract without recognizing any gain or loss for tax purposes. 1035 exchanges allow policyholders to update their annuity contracts to take advantage of improved contract features, lower fees, or better investment options. The policyholder can defer taxes on any gains by exchanging the contract rather than liquidating it, providing a significant tax advantage. Policyholders can choose to execute a partial or full 1035 exchange, depending on their needs and preferences. A partial exchange allows the policyholder to maintain a portion of the original contract while transferring some of the cash value to a new contract. Traditional fixed annuities provide a guaranteed interest rate over a specified period. These contracts can be exchanged for another fixed annuity or a different type of annuity, such as a variable or indexed annuity. Fixed-indexed annuities link the interest credited to the performance of a market index, such as the S&P 500. These annuities can also be exchanged for other types of annuities, depending on the policyholder's needs and preferences. Variable annuities allow policyholders to invest their premiums in a variety of investment options, such as mutual funds. These annuities can be exchanged for other variable annuities or a different type of annuity. Immediate annuities provide income payments that begin immediately or within a short period after the premium payment. These annuities can be exchanged for other immediate annuities or deferred annuities. Deferred annuities are contracts where the policyholder's premiums accumulate interest, and income payments begin at a later date. These annuities can be exchanged for other deferred annuities or immediate annuities. Policyholders may want to exchange their annuity for a new contract with a higher guaranteed interest rate, which can lead to increased income payments over time. Some annuity contracts offer living benefits, such as guaranteed lifetime withdrawal benefits (GLWB) or long-term care riders. Policyholders may want to exchange their contract for one that offers these enhanced features. Some annuity contracts include a death benefit, which can be paid to beneficiaries upon the policyholder's death. An exchange may allow policyholders to secure a more attractive death benefit. Policyholders might consider an annuity exchange to take advantage of lower fees and expenses, which can lead to increased investment returns and income payments. Annuity exchanges can provide policyholders with access to updated or more diverse investment options, enabling them to align their contracts with their financial objectives better. As policyholders' financial goals and risk tolerance evolve over time, they may want to exchange their annuity for a contract that better aligns with their current objectives and preferences. Before initiating a 1035 exchange, policyholders should carefully review their existing contract to understand its features, benefits, and any potential penalties or fees associated with an exchange. Policyholders should research and compare various annuity contracts, considering factors such as fees, guarantees, investment options, and contract features to determine which new annuity best meets their needs. While 1035 exchanges are generally tax-free, consulting with a tax professional to understand any potential tax implications or consequences associated with the exchange is essential. Policyholders must complete the necessary paperwork with both the current and new insurance companies to initiate the exchange process. This includes providing personal information, existing contract details, and the desired new contract. After the exchange is complete, policyholders should regularly monitor their new annuity contract to ensure it continues to meet their financial objectives and adjust as needed. Many annuities have surrender charges, which are fees assessed if the contract is terminated or exchanged within a certain period. Policyholders should consider these charges when deciding whether a 1035 exchange is financially beneficial. While 1035 exchanges are generally tax-free, certain circumstances may trigger tax consequences, such as exchanging a non-qualified annuity for a qualified annuity. Consulting a tax professional is crucial in these situations. Some annuity contracts offer unique benefits or guarantees that may not be available in a new contract. Policyholders should carefully consider whether they are willing to forfeit these features when executing a 1035 exchange. Some fixed annuities may have a market value adjustment provision, which can impact the contract's cash value if interest rates change. This should be taken into account when evaluating the potential benefits of a 1035 exchange. Annuity exchanges can offer policyholders significant benefits, such as improved contract features, lower fees, and updated investment options. However, it's crucial to carefully evaluate the potential benefits and drawbacks of a 1035 exchange in the context of your unique financial situation. Consulting with a financial professional can provide valuable guidance and help you make informed decisions. Before executing a 1035 exchange, policyholders should weigh the potential benefits, such as improved guarantees, lower fees, and updated investment options, against the possible drawbacks, such as surrender charges, loss of benefits, and tax consequences. This evaluation will help ensure that the exchange is in the policyholder's best interest. Ultimately, the decision to pursue a 1035 exchange should be based on a comprehensive analysis of the existing annuity contract, the potential benefits of a new contract, and the policyholder's unique financial objectives. Policyholders can make informed decisions about annuity exchanges and optimize their financial planning strategies by carefully considering these factors and seeking professional guidance from an insurance broker.What Are Annuity Exchange (1035 Exchange) Options?

Types of Annuities Eligible for 1035 Exchange

Fixed Annuities

Traditional Fixed Annuities

Fixed Indexed Annuities

Variable Annuities

Immediate Annuities

Deferred Annuities

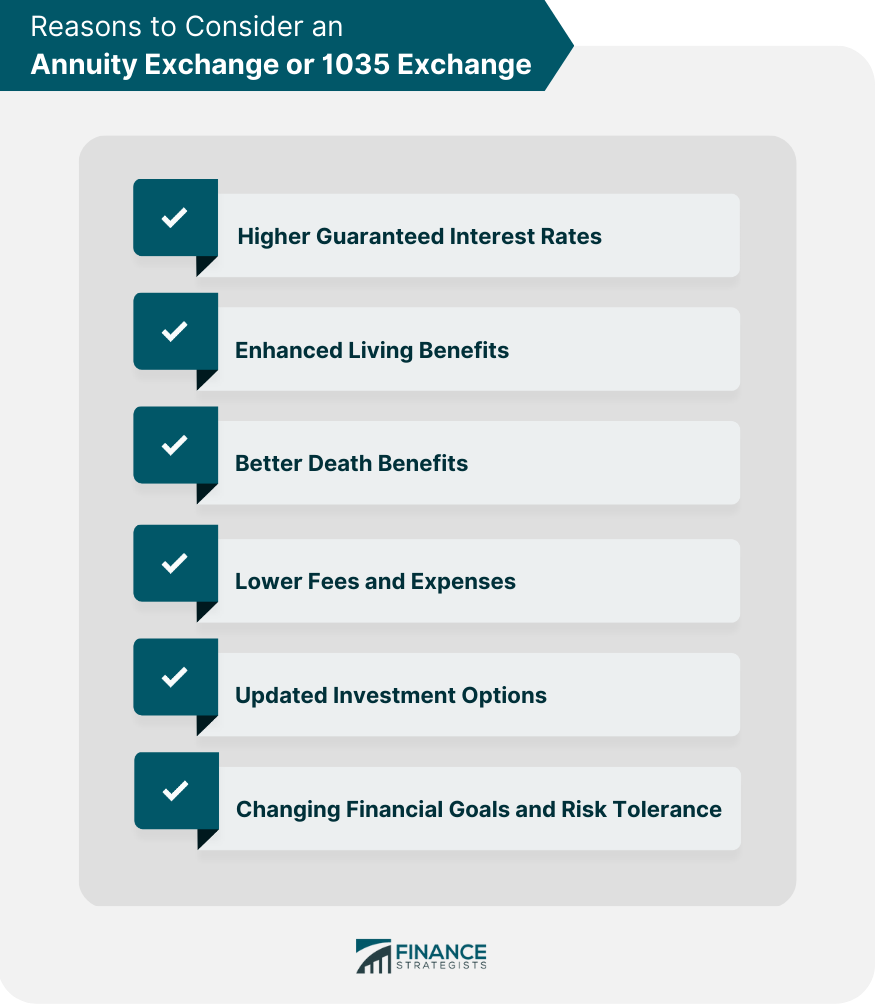

Reasons to Consider an Annuity Exchange or 1035 Exchange

Higher Guaranteed Interest Rates

Enhanced Living Benefits

Better Death Benefits

Lower Fees and Expenses

Updated Investment Options

Changing Financial Goals and Risk Tolerance

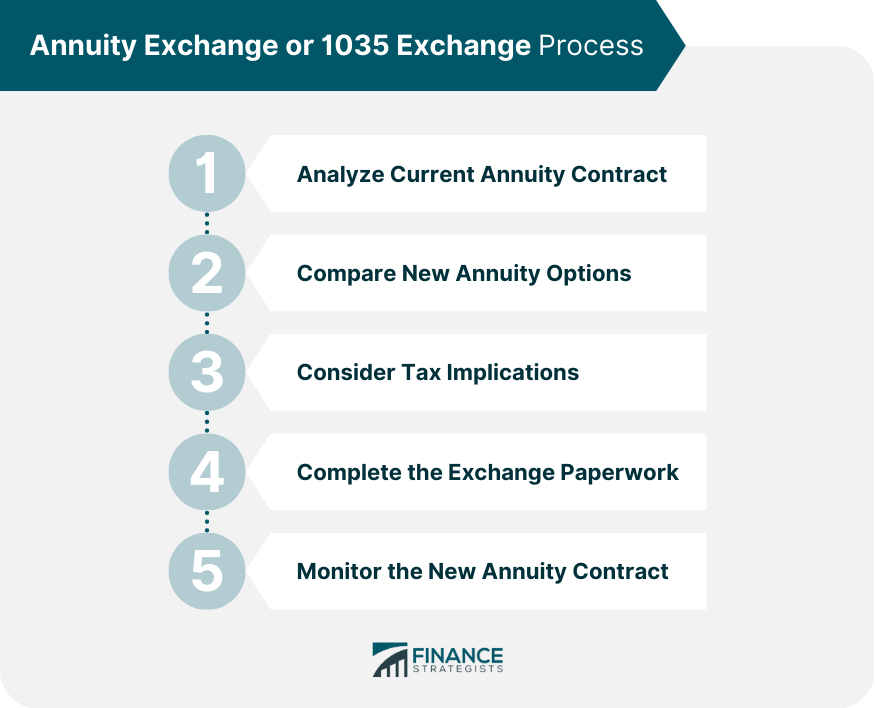

Annuity Exchange or 1035 Exchange Process

Analyze Current Annuity Contract

Compare New Annuity Options

Consider Tax Implications

Complete the Exchange Paperwork

Monitor the New Annuity Contract

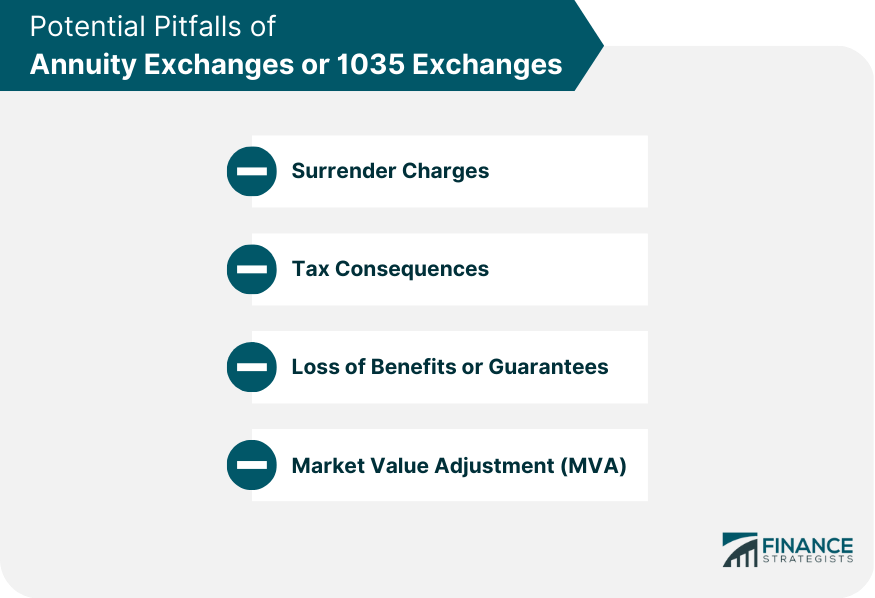

Potential Pitfalls of Annuity Exchanges or 1035 Exchanges

Surrender Charges

Tax Consequences

Loss of Benefits or Guarantees

Market Value Adjustment (MVA)

Final Thoughts

Annuity Exchange (1035 Exchange) Options FAQs

The key benefits of considering annuity exchange (1035 exchange) options include the ability to access improved annuity features, lower fees and expenses, updated investment options, and aligning the annuity contract with changing financial goals and risk tolerance, all while deferring taxes on any gains.

Potential drawbacks and risks associated with annuity exchange (1035 exchange) options include surrender charges, tax consequences, loss of benefits or guarantees, market value adjustments (MVA), and the possibility of not finding a suitable replacement contract that meets the policyholder's objectives.

You can perform a partial annuity exchange (1035 exchange) instead of the entire contract. This allows you to maintain a portion of the original contract while transferring some cash value to a new one. However, it's essential to consult a financial professional to determine if a partial exchange is suitable for your situation.

To determine if an annuity exchange (1035 exchange) option is the right choice for your financial situation, it's essential to evaluate your current annuity contract, compare new annuity options, consider potential benefits and drawbacks, and consult with a financial professional for personalized guidance.

Most annuities are eligible for annuity exchange (1035 exchange) options, including traditional fixed, fixed indexed, variable, immediate, and deferred annuities. However, specific requirements and limitations may apply, so it's crucial to consult a financial professional before initiating an exchange.

True Tamplin is a published author, public speaker, CEO of UpDigital, and founder of Finance Strategists.

True is a Certified Educator in Personal Finance (CEPF®), author of The Handy Financial Ratios Guide, a member of the Society for Advancing Business Editing and Writing, contributes to his financial education site, Finance Strategists, and has spoken to various financial communities such as the CFA Institute, as well as university students like his Alma mater, Biola University, where he received a bachelor of science in business and data analytics.

To learn more about True, visit his personal website or view his author profiles on Amazon, Nasdaq and Forbes.